WLAN Controller Market Size worth over $3bn by 2025

Published Date: May 2019

WLAN Controller Market size is set to exceed USD 3 billion by 2025; according to a new research report by Global Market Insights Inc.

The WLAN controller market growth is driven by the rising deployments of indoor & outdoor access points by enterprises to meet coverage requirements. As enterprises are expanding their businesses, they need a reliable wireless infrastructure, which can support a wide range of network resources & applications. This has resulted in an increase in the usage of devices that provide integrated connectivity and security for mobile clients as well as IoT devices. The growing usage of such devices will increase the demand for WLAN controllers that will provide centralized management for all access points and other devices used in the enterprise network. The rising popularity of BYOD and the IoT to quickly expand coverage across the enterprise will also increase the need to deploy more controllers, which can simplify the network management and improve efficiency.

The standalone WLAN controller market will exhibit a growth rate of over 5% from 2019 to 2025. As enterprises are focusing on improving their network coverage by deploying several standalone APs, they need to configure each AP individually, which is a tedious task. This will increase the complexity of managing multiple APs and make it very difficult for them to monitor their network in a centralized manner; thus, the demand for WLAN controllers increases, enabling them to manage all their access points centrally.

Get more details on this report - Request Free Sample PDF

Large enterprises will hold the WLAN controller market share of over 55% in 2025. They are experiencing a strain on their network infrastructure due to the increasing connectivity requirements and the growing amount of corporate information resources. To improve a network’s security & resiliency, they are deploying wireless networking solutions, such as LAN controllers, which will help them in managing their networks for massive mobile use or accommodating new resources.

Browse key industry insights spread across 260 pages with 266 market data tables & 24 figures & charts from the report, “WLAN Controller Market Size By Type (Standalone, Integrated), By Enterprise Size (Large Enterprises, SMEs/Small Office/Home Office (SOHO)), By Application (IT & Telecom, BFSI, Healthcare, Government & Public Sector, Retail, Manufacturing, Transportation & Logistics), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2019 - 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/wireless-lan-controller-market

The IT & telecom segment held a dominant position in the WLAN controller market in 2018 and will hold a market share of over 24% in 2025. The IT enterprise challenges are rapidly growing with the adoption of new network devices & technologies, augmenting the need for comprehensive WLAN controllers, and enabling IT firms to extend their network flexibility and centralize WLAN management to reduce additional hardware maintenance costs. The rising internet penetration due to a surge in smartphones has also laid an immense pressure on telecom companies to transform their legacy network architectures. This has increased the need for WLAN controllers, which will offer complete visibility of the entire network environment and allow customers to monitor the data traffic consumed by mobile devices & applications.

North America is projected to hold a WLAN controller market share of 40% in 2025 as enterprises in the region are moving toward wireless LAN infrastructure to reduce IT costs. An increase in the number of wireless devices is enabling enterprises to adopt WLAN controllers to provide uninterrupted connectivity to devices connected to enterprise WLAN. The growing trend of BYOD and the adoption of cloud-enabled WLAN by enterprises to ease network management will also spur the WLAN controller market growth. Major network solution providers in the region are introducing new access points that comply with the latest wireless standards. For instance, in April 2019, Cisco introduced Wi-Fi 6 access points, Catalyst 9100, Meraki MR 45/55 access points, and Catalyst 9600 switch. By introducing these products, the company will enable its customers to reap the benefits of superior network connectivity to meet its business requirements.

The companies present in the WLAN controller market are introducing new products to meet specific business needs. For instance, in September 2018, DIGISOL, a leading Indian network equipment provider, launched 1,200 Mbps high power Outdoor Wireless Access Point. This product enabled enterprises in India to access seamless wireless connectivity for network security and high bandwidth intensive tasks. Some of the leading network solution providers are focusing on strategic collaborations to deliver high-performance connectivity for enterprise networks. For instance, in July 2017, Net One Partners, an information platform solution & services provider in Japan, partnered with Mist, a leading wireless platform provider, to bring the first AI-driven WLAN platform to Japan. The new partnership helped Japanese enterprises in simplifying WLAN operations and increasing network reliability.

The WLAN controller market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2014 to 2025 for the following segments:

WLAN Controller Market, By Type

- Integrated

- Standalone

WLAN Controller Market, By Enterprise Size

- SMEs

- Small Office/Home Office (SOHO)

WLAN Controller Market, By Application

- IT & Telcom

- BFSI

- Government & Public Sector

- Healthcare

- Retail

- Manufacturing

- Transportation & logistics

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

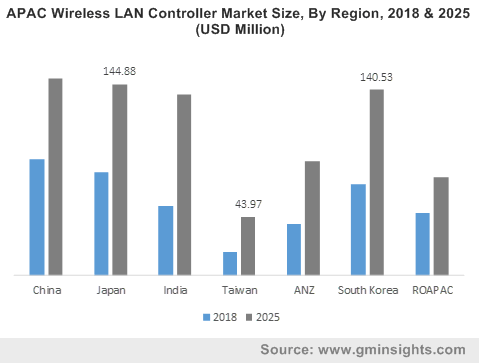

- APAC

- China

- Japan

- Taiwan

- ANZ

- South Korea

- India

- LAMEA

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- MEA

- South Africa

- Saudi Arabia

- Israel

- UAE