Wax Market Size worth around USD 10 Bn by 2024

Published Date: August 2019

Wax Market size is forecast to exceed 10 billion US$ by 2024; according to a new research report by Global Market Insights Inc.

The global wax market share is driven by the expanding base of end-user industries. Packaging, and candles were the fastest-growing end-user industries in 2016 and shall experience the same growth number over the forecast period. These industries will drive the overall growth of the market. Product application in the adhesive industry is driven by expanding construction and automotive industries across the globe. This trend is likely to drive the global product demand over the forecast duration.

Candles application segment led the global product demand, accounting for over 40% of the total demand in 2016. Increasing demand for scented and luxury candles is driving the global candles market. Adhesive was the second-largest application segment in the global wax market in 2016. Cosmetics is forecast to grow with a significant CAGR in coming years. This can be attributed to the changing lifestyle and increasing disposable income of the people. Consumer patterns of product in application industries differ significantly in different end-use industries.

Get more details on this report - Request Free Sample PDF

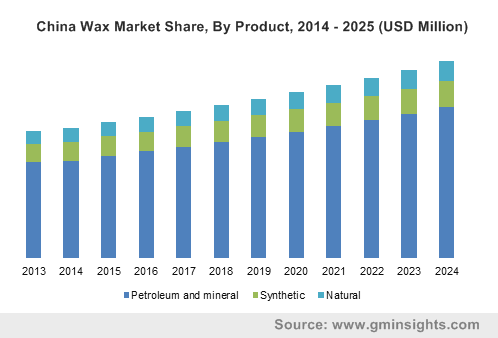

Browse key industry insights spread across 327 pages with 716 market data tables & 23 figures & charts from the report, “Wax Market Size By Product (Petroleum And Mineral [Paraffin, Microcrystalline], Synthetic [GTL Waxes, Polymer Waxes], Natural [Bees Wax, Vegetable Wax]), By Application (Candles, Packaging, Wood & Fire-Logs, Rubber, Adhesive, Cosmetics) Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, Australia, Malaysia, Indonesia, Brazil, Mexico, South Africa, GCC), Application Potential, Price Trends, Competitive Market Share & Forecast, 2017 – 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/wax-market

Natural wax is used in a wide range of applications. Increasing consumer awareness is also affecting petroleum wax demand. Increasing environmental awareness along with government legislations against crude derived products drive the natural product demand growth over the forecast period, as product is environment friendly in the nature. However, high price of natural product type affects its overall demand, as petroleum product can be used for same applications.

Medical & pharmaceutical was the one of the fastest growing application segments in 2018. Increasing health awareness and medical tourism will have positive impact on industry growth in next few years. Global healthcare expenditure is expected to growth with a CAGR over 5% from approximately USD 7 trillion in 2016 to over USD 11 trillion in 2024. Growing healthcare expenditure owing to the increasing medical tourism and aging population in developed countries is likely boost the product demand over the forecast period.

Asia Pacific led the global wax market size, accounting close to 35% share in terms of volume and revenue in 2016. Asia Pacific product demand is expected to grow with a highest CAGR during the forecast timespan. This is due to the high demand in end-user industries, as Asia Pacific is considered as a manufacturing hub of the world. Product demand in the North America and Middle East and Africa are likely to expand at moderate rates in the next few years. Cosmetics and packaging industry in these regions are attributed to propel the product demand over the forecast period.

Global wax market share is highly consolidated with a few multinational giants are having major market. Some prominent players operating in the industry includes Sasol, Exxon Mobil Corporation, The International Group, Inc., China National Petroleum Corporation (CNPC), Total S.A., Lukoil Company, Sinopec Limited, Petroleo Brasileiro S.A. (Petrobras) and Royal Dutch Shell Plc. Companies operating in the industry are large multinational giants and has strong distribution network. Many companies operating in the industry are expanding their production facility to cater the increasing product demand. For instance, Sasol is expanding its wax production facility in Johannesburg in South Africa.

Wax research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in kilo tons and revenue in USD million from 2013 to 2024, for the following segments:

Wax Market, Product by Application

- Petroleum and mineral

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Paraffin

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Microcrystalline

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Others

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Synthetic

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- GTL waxes

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Polymer waxes

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Others

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Natural

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Bees wax

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Vegetable wax

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

- Others

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

Wax Market By Application

- Candles

- Packaging

- Wood & fire-logs

- Rubber

- Adhesive

- Cosmetics

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- GCC