U.S. Off-Road Vehicles (ORVs) Market Size to hit $13.5bn by 2024

Published Date: January 2019

U.S. Off-Road Vehicles Market size is estimated to surpass USD 13.5 billion by 2024; according to a new research report by Global Market Insights Inc.

Rising discretionary spending in conjunction with the improving economic conditions is increasing the participation in outdoor activities, expanding the U.S. off-road vehicles (ORVs) market size. According to the Bureau of Economic Analysis in 2017, the U.S. GDP increased by over 4% as compared to 2016. The growing participation in adventure activities will propel industry growth over the study timeframe.

Changing lifestyle with increasing participation in outdoor activities will positively influence the U.S. ORVs market share over the forecast period. Government is taking initiatives to enhance participation in recreational activities. For instance, the U.S. Recreation Government in partnership with the Bureau of Land Management, National Park Service, and the U.S. Forest Service provides around 3,000 facilities for activities including camping, hunting, and trailing.

Get more details on this report - Request Free Sample PDF

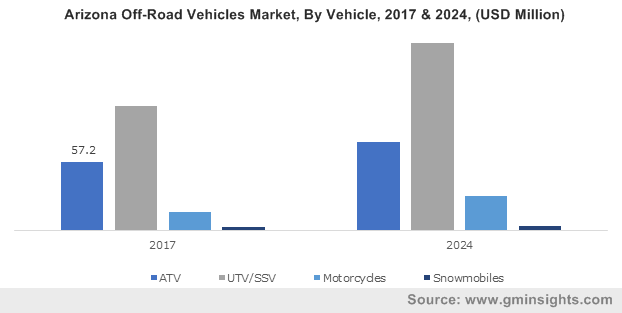

In 2017, California accounts for over 10% share in the U.S. off-road vehicles (ORVs) market with the presence of state parks and recreational areas driving the product demand. Organizations such as California State Parks are launching Grants & Cooperative Agreements Program to promote OHV adaption. Arizona will witness steady growth owing to flexible regulations. For instance, Arizona allows the usage of California-registered vehicles in its state parks.

Texas will witness strong growth with the increasing youth population participating in ORV activities. According to the U.S. Census Bureau, in 2017, the under-18 population rose to 7.37 million with as increase of over 4.5% as compared to 2013. The growing youth population will propel industry share over the forecast period. Moreover, the Texas law allows the under-14 to drive ATVs under supervision, positively influencing the product demand.

Browse key industry insights spread across 220 pages with 248 market data tables & 13 figures & charts from the report, “U.S. Off-Road Vehicles Market Size By Vehicle (ATV, SSV/UTV, Off-Road Motorcycles, Snowmobiles), By Application (Utility, Sports, Recreation, Military), Industry Analysis Report, State Outlook (Arizona, California, Colorado, Florida, Kentucky, Minnesota, New Mexico, Nevada, Ohio, Oregon, Pennsylvania, Tennessee, Texas, Utah, Washington, West Virginia, Wisconsin), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/us-off-road-vehicles-market

The presence of various facilities is scaling up the ORV demand. For instance, Trans American Trail offers a 5,000-mile adventurous route with dense forests, dirt, gravels, and roads for off-roading activities. The availability of off-road trail guides and travel communities are assisting events by providing easily accessible route data and plans. Moreover, the emergence of grants and funding for the development of trails will expand the U.S. ORVs market size from 2018 to 2024.

Increasing utility activities, such as construction, agriculture, and mining, will propel the industry growth. ORVs are capable of operation on variable natural terrains and carrying heavy weights. High torque generation, superior traction, and stability further advocate its usage in non-conventional terrains. However, rising accidents and injuries arising from off-roading will restrict the U.S. off-road vehicles market size.

Ongoing regulatory initiatives to enhance driver and passenger safety will boost product adoption. For instance, the Consumer Product Safety Commission (CPSC) has launched the Consumer Product Safety Act and the Federal Hazardous Substances Act to ensure the correct handling of OHVs. Moreover, organizations such as ATV Safety Institute are training young riders and providing education regarding safety gears. The rising adoption of safety gears will induce a significant potential in the U.S. off-road vehicles (ORVs) market share in the next six years.

SSV leads the industry size owing to its applications in sports, utility, and recreational activities. Industry players are upgrading their product portfolio for multiple functionalities and more affordability. For instance, in June 2018, BRP announced to launch Can-Am SXS for recreation and utility purposes. Moreover, easy finance availability will escalate the U.S. ORVs market growth over the forecast timeline.

Off-road motorcycles will witness around 6% CAGR in the U.S. off-road vehicle (ORVs) market size over forecast period. According to the OIO, in 2017, the U.S. outdoor participants spent over USD 50 million in off roading. Industry participants are expanding their product portfolio to serve larger consumer base. For instance, in October 2017, KTM launched Freeride E-XC dirt bike for trail racing.

Military application will witness a steady growth in the U.S. off-road vehicles market share with the adoption of ORVs to carry artillery and soldiers in tough terrains. Rising product demand in tactical & combat missions, search & rescue, and security & patrol activities will enhance segment penetration. Organizations, such as AMA, are conducting off-roading events, such as Amateur Championship, supporting the segment growth.

Major U.S. ORVs market participants include Polaris Industries, Textron, BRP, and Yamaha Motors. Industry players are expanding their product portfolio to serve a larger consumer base. For instance, in June 2018, Textron introduced Prowler Pro with whisper-quiet technology for noise-restricted areas. Further, industry players are adopting advanced technologies such as mobile tracking and Bluetooth connectivity to enhance the consumer experience.

(ORVs) Off-road vehicles market research report in the U.S. includes in-depth coverage of the industry with estimates & forecast in terms of volume in units and revenue in USD million from 2013 to 2024, for the following segments:

U.S. Off-Road Vehicles (ORVs) Market, By Vehicle

- All-Terrain Vehicles (ATV)

- Side by Side Vehicles (SSV)

- Off-Road Motorcycles

- Snowmobiles

U.S. Off-Road Vehicles (ORVs) Market, By Application

- Utility

- Sports

- Recreation

- Military

The above information is provided on state basis for the following:

- U.S.

- Arizona

- California

- Colorado

- Florida

- Kentucky

- Minnesota

- New Mexico

- Nevada

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Utah

- Washington

- West Virginia

- Wisconsin