Online Grocery Market revenue worth over $1 trillion by 2026

Published Date: December 2020

Online Grocery Market size is slated to surpass USD 1 trillion by 2026, according to a new research report by Global Market Insights Inc.

Advancements in internet infrastructure coupled with the penetration of affordable network connectivity across emerging economies have led to a significant shift in consumer shopping behavior. High-income earners and millennials have significantly increased online shopping, positively impacting the online grocery industry growth. To capitalize on this rapidly changing behavior, companies are expanding their reach across various countries to process a large number of orders per day.

The emergence of card-based and digital wallet payment methods with a significant increase in smartphone users globally is driving the online grocery market demand. In 2019, the number of Apple Pay users reached 30 million in the U.S., representing around 48% of all mobile payment users. With the increased popularity of contactless payments among consumers, market leaders are focusing on providing a wide range of payment options to users.

Get more details on this report - Request Free Sample PDF

The ongoing coronavirus (COVID-19) pandemic has positively impacted the online grocery industry growth on account of the shutdown of physical retail stores in several countries globally. The pandemic has led to an increase in the number of consumers buying groceries online to limit social interaction and prevent the spread of the virus. The increasing frequency of grocery orders on online channels from active households is anticipated to observe market growth.

Availability of fresh & safe meat & seafood in online grocery stores at an affordable price to accelerate market growth

The meat & seafood is set to register of over 35% CAGR through 2026. The demand for fresh meat & seafood continues to grow with the global production of meat estimated to reach 465 million metric tonnes by 2050. Consumers prefer online stores for purchasing perishable goods due to the benefits offered including a wide range of products, convenience, and low prices. In the wake of the COVID-19 pandemic, consumers are increasingly shifting to buy meat & fish online. Uncertainties over hygiene and large crowds in conventional meat & fish markets have resulted in fueling the trend.

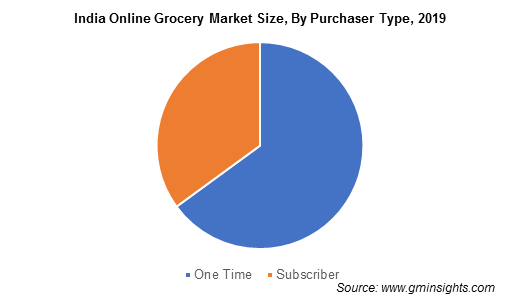

Browse key industry insights spread across 300 pages with 268 market data tables and 30 figures & charts from the report, “Online Grocery Market Size By Category (Dairy & Breakfast Products, Fresh Produce, Snacks & Beverages, Meat & Seafood, Staple & Cooking Essentials), By Purchaser Type (One Time, Subscriber), By Delivery Type (Home Delivery, Click & Collect), By End-Use (Individual, Distributors), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/online-grocery-market

High renewal cost and less opportunity to explore other online grocery retailers associated with the subscription-based purchase model are limiting its adoption among consumers

The one-time payment model enables consumers to purchase groceries at a low-cost compared to a subscription-based model. Market participants charge a high subscription fee and require consumers to place a minimum order to access the service. The financial risks and less flexibility to switch to other retailers in subscription services will also encourage consumers to opt for the one-time purchase model. The model is mainly beneficial for consumers, who are not frequent in purchasing groceries online.

Benefits of low-cost, convenience, and comfort to drive the demand for the home delivery services

The demand for saving costs and convenience is forecast to propel the adoption of home delivery services in the online grocery market. The services allow consumers to order online and manage the account from the comfort of their homes. Several online retail chains rely on delivery partners to strengthen their product supply capability. For instance, in May 2020, Nature's Basket, an Indian grocery delivery store, partnered with Uber to provide consumers access to essential supplies at their doorsteps, amid the COVID-19 pandemic.

Distributors buying bulk grocery from online stores to serve the growing needs of consumers

Distributors are facing unique challenges to serve the growing needs of different customers owing to the COVID-19 crisis. This has encouraged them to purchase bulk items from online stores to maintain stock and quickly deliver a wide range of products to customers. Additionally, distributors are signing agreements and partnerships with grocery retailers to increase their product offerings.

The expanding e-commerce sector in the MEA will fuel market expansion

The MEA online grocery market size is estimated to see 20% CAGR through 2026 impelled by the flourishing e-commerce sector. Improving economic conditions and a rise in disposable incomes are primary growth drivers of the regional retail market. According to PayFort, an online payment gateway, the MEA e-commerce market will reach USD 69 billion by 2020.

Companies are increasingly adopting automated technologies to reduce the delivery time of orders and serve customers quickly. Increasing investments by players in the region will positively impact market revenue.

Focus on business acquisition strategies by market players

Key online grocery market players include Safeway, Inc., ShopFoodEx, LLC, Alibaba Group, mySupermarket Limited, Koninklijke Ahold Delhaize N.V, Tesco PLC, The Kroger Company, NetGrocer.com, Inc., Schwan Food Company, BigBasket, My Brands Inc., AmazonFresh, LLC, Walmart Stores, Inc., Carrefour S.A., and Honestbee. These players are adopting various strategic initiatives, such as mergers, acquisitions, and collaborations, to accelerate their market position.