Network as a Service (NaaS) Market Size to exceed $50bn by 2025

Published Date: May 2019

Network as a Service (NaaS) Market size is set to exceed USD 50 billion by 2025; according to a new research report by Global Market Insights Inc.

The network as a service market is expected to witness a significant growth rate from 2019 to 2025 due to the rising demand for network virtualization technologies among enterprises to minimize CAPEX & OPEX costs. These technologies are gaining immense popularity among network operators due to cost-effectiveness. The rise in the number of mobile applications and network endpoints has put tremendous pressure on the traditional network infrastructure. To meet the enterprise mobility demands and ensure a long network uptime, enterprises are switching toward SDN-enabled NaaS, which help in providing on-demand network services to customers. The rising trend of pay-per-use business model will enable customers to pay only for the network or services they avail, leading to NaaS market growth. Large as well as small organizations are using this pricing model to benefit from on-demand network resource provisioning to increase the application throughput.

WAN as a service segment is expected to hold a major share of the network as a service market share of around 30% by 2025 as the enterprises are largely dependent on the WAN infrastructure for connecting their remote employees & devices. To minimize the costs associated with the management of WAN networks, enterprises are using NaaS offerings. The NaaS model enables them to use or provide network services on a subscription-based pricing model, eliminating the need to rearchitect their networks. As they are continuously looking for new ways to reduce their networking costs, the demand for cloud network services will increase over the forecast timespan.

Get more details on this report - Request Free Sample PDF

The SME market is projected to exhibit an excellent CAGR of over 35% during the forecast timeline. SMEs use the NaaS model as it provides them with the flexibility to scale up or down the network resources as per their requirements and also promise greater efficiency through an on-demand provisioning model. The growing needs among SMEs to increase the return on investment and focus on other priorities to generate more revenue will also facilitate NaaS adoption.

Browse key industry insights spread across 240 pages with 286 market data tables & 30 figures & charts from the report, “Network as a Service (NaaS) Market Size By Type (LAN as a Service, WAN as a Service, Bandwidth on Demand (BoD), VPN as a Service, Managed Services), By Enterprise Size (Large Enterprises, SMEs), By Application (IT & Telecom, BFSI, Manufacturing, Healthcare, Government & Public Sector, Retail), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2019 - 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/network-as-a-service-naas-market

The BFSI vertical is estimated to hold the network as a service market share of around 15% by 2025. Driven by the need to manage remote branch sites and deliver better services to customers, the banking & other financial institutions are modernizing their IT infrastructure by investing a huge sum in cloud and networking technologies. These technologies are enabling them to increase the network performance and improve resource availability. To manage multi-channel digital platforms and services and handle vast amount of financial data, they are using NaaS and cloud-NFV to deliver uninterrupted services.

The Asia Pacific NaaS market is projected to witness the fastest growth rate of over 40% from 2019 to 2025. The market growth is attributed to the increasing deployment of cloud & network virtualization solutions to meet the rising network traffic demands. In this region, the telecom sector has witnessed an extensive usage of NaaS model due to the growing trend of workforce mobility. The countries including Japan, China, and South Korea will lead other countries in terms of market share due to the widespread deployment of NaaS platforms driven by technologies such as SDN and NFV.

The companies present in the network as a service market are focusing on offering new products & services to gain more market share. In November 2018, Amazon introduced the Global Accelerator networking service, which will help to improve the performance of applications running on AWS cloud. In November 2018, Telstra introduced the NaaS platform across its business networks. By introducing a new platform, the company has been able to improve its product offering through refinement. The new platform accelerated the rate of delivery for the firm’s network innovations. The telecom companies in the country are partnering with technology companies to provide the NaaS platform. For instance, in July 2017, Telus, a Canadian telecommunication company partnered with Nuage Networks, a software-defined networking solutions provider to imitate its NaaS and SD-WAN platforms. This partnership helped the company in minimizing the network infrastructure cost, boosting business agility and providing the scalability needed to meet cloud-driven requirements.

The (NaaS) network as a service market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2014 to 2025 for the following segments:

Network as a Service (NaaS) Market, By Type

- LAN as a Service

- WAN as a Service

- Bandwidth on Demand (BoD)

- VPN as a Service

- Managed Services

Network as a Service (NaaS) Market, By Enterprise Size

- Large enterprises

- SMEs

Network as a Service (NaaS) Market, By Application

- IT & Telcom

- BFSI

- Government & Public Sector

- Healthcare

- Manufacturing

- Retail

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

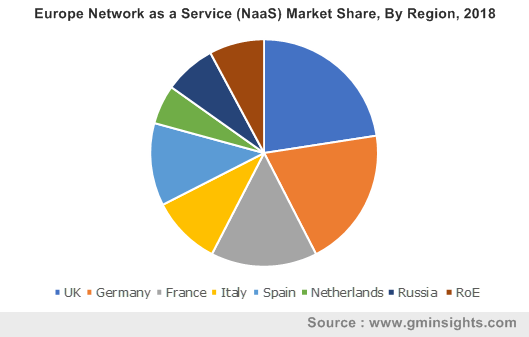

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- APAC

- China

- Japan

- ANZ

- South Korea

- India

- Southeast Asia

- LAMEA

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- MEA

- South Africa

- Saudi Arabia

- UAE

- Qatar

- Bahrain