Global IP Camera Market Size worth $20bn by 2025

Published Date: July 2019

IP Camera Market size is set to exceed USD 20 billion by 2025; according to a new research report by Global Market Insights Inc. The global shipments are expected to grow at a CAGR of over 20% from 2019 to 2025.

The rise in demand for modern security technologies in industrial facilities to ensure the safety & security of workers will drive the IP camera market demand. The industries are concerned for the health & safety of their employees due to rise in industrial accidents & injuries. IP surveillance solutions allow manufacturing industries to monitor crucial areas, such as assembly sections, boilers, and condensers, where high chances of accidents are being witnessed. Additionally, it helps operators to monitor the production process and optimize business operations. Thermal imaging technologies are being widely used to highlight potential issues including machine failure and overheating. Manufacturers in the IP camera market are developing rugged and long-lasting solutions specifically designed for industrial environment. For instance, Matrix Comsec is offering camera solutions for manufacturing, warehouse, and construction applications.

The increasing adoption of PTZ cameras for 360o visibility & security of large facilities is augmenting the IP camera market growth. These solutions are being widely adopted for outdoor applications such as garages, parking lots, construction sites, airports, railways, and bus stands. They allow operators to monitor the facility by capturing the footage at multiple angles or directions, enhancing the security & safety of the premises. Major advantages such as ease in installation, high-quality & tamper resistant image production, and wide coverage area are propelling the demand for PTZ solutions in the IP camera market. Manufacturers are engaged in providing infrared technology in PTZ cameras for enhancing the image quality in different light conditions. For instance, in March 2019, Axis Communications AB, a subsidiary of Canon, Inc., announced the launch of AXIS Q6215-LE PTZ Network Camera with built-in IR illumination to meet the demand for heavy-duty solutions.

Get more details on this report - Request Free Sample PDF

With the increasing adoption of centralized security solutions in large enterprises, the IP camera market is expected to witness a high growth over the coming years. These solutions are being widely installed in facilities with multi IP camera platforms. They store recorded data on a separate Digital Video Recorder (DVR) or Network Video Recorder (NVR) devices, making it more expensive in comparison to the decentralized technologies. However, centralized solutions allow businesses to manage and store the recorded data from all the installed cameras in a single platform, increasing accessibility & flexibility in data management and analysis. Additionally, the increased adoption of centralized systems for home surveillance applications is also a major factor augmenting the market growth.

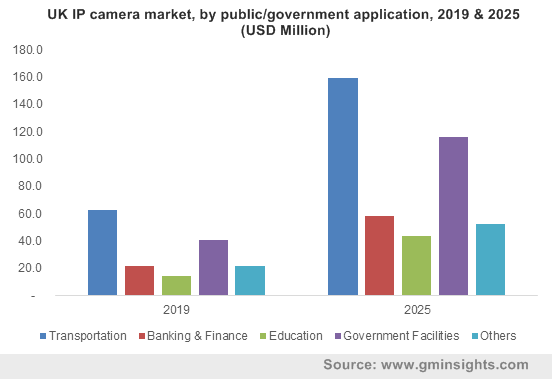

Browse key industry insights spread across 400 pages with 629 market data tables & 36 figures & charts from the report, “IP Camera Market Size By Product (Fixed, PTZ, Infrared), By Connection (Centralized, Decentralized), By Application (Residential [Home Security, Smart Home], Commercial [Retail, Industrial, Healthcare, Real Estate], Public/Government [Transportation, BFSI, Education, Government Facilities]), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Spain, Italy, Russia, China, India, Japan, South Korea, Taiwan, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa), Application Potential, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/ip-camera-market

Increasing crime rates, thefts, and burglaries in several countries including Uganda, Sweden, Italy, and Tanzania are encouraging the adoption of home security solutions, propelling the IP camera market growth. The residential sectors are investing highly to integrate advanced security systems in their homes. Countries including the U.S. and China are the major economies with high installation of network cameras. According to a report by People’s Daily, Beijing has around 470,000 cameras installed across the city. This increase in the installation of security solutions is due to increased government efforts toward smart city mission, propelling the IP camera market growth. With the increasing focus on the development of smart homes in these countries, the demand for IP security solutions is predicted to grow rapidly.

In 2018, the North America IP camera market accounted for around 35% of the industry share and with the rising digitization and industrialization is witnessing substantial growth. With the ongoing expansion of several SMEs and large enterprises in the U.S., the demand for security solutions is growing rapidly. A large number of retail players, such as Walmart, Costco Corporation, and Kroger Company are expanding their business establishments in the region leading to increased installation of surveillance solutions. Additionally, these retail businesses are continuously engaged in developing automated retail outlets, propelling the adoption of modern network camera solutions. For instance, in January 2018, Amazon Go announced the opening of a new automated convenience store in the U.S., where shoppers are being monitored by hundreds of cameras. Such factors are anticipated to positively impact the IP camera market growth over the coming years.

The major players operating in the IP camera market are Tyco International, VideoIQ Inc., Pelco by Schneider Electric, Panasonic Corporation, March Networks, Guangzhou Juan Intelligent, Dahua Technology, Hangzhou Hikvision Digital Technology Co., Ltd., Bosch Security Systems, Axis Communications AB, Avigilon, and Shenzhen Apexis Electronic Co., Ltd. The manufacturers in the market are introducing innovative solutions to attract a large customer base. For instance, in July 2019, Matrix Comsec announced the launch of its professional series solution Sataya MIDR20FL36CWP, which is an audio-enabled system and ideal for low light conditions. Moreover, market players are offering their solutions in different models and price ranges to cater to customers from SMBs to large enterprises.

The IP camera market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD and shipment in units from 2015 to 2025 for the following segments:

By Product

- Fixed

- PTZ

- Infrared

By Connection

- Centralized

- Decentralized

By Application

- Residential

- Home security

- Smart home

- Commercial

- Retail

- Industrial

- Healthcare

- Real Estate

- Others

- Public/Government

- Transportation

- Banking & finance

- Education

- Government facilities

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- Saudi Arabia

- UAE

- South Africa