Display Market worth over $20bn by 2024

Published Date: September 2019

Display Market size is set to surpass USD 20 billion by 2024, according to a new research report by Global Market Insights Inc.

Growing adoption of touch-enabled screens in retail applications is expected to drive the market growth. The brick-and-mortar retailers are increasingly adopting touch-screen systems to enhance customer interaction to remain competitive in the industry. The touch-enabled kiosks are being adopted to a large extent as these systems allow the customers browse through different product offerings easily. This is encouraging the retailers to increasingly implement these systems.

Furthermore, the self-service technology is penetrating at a fast pace and is being adopted by retailers, restaurant owners, and warehouses & distribution centers to enhance the operational efficiency. This will propel the adoption of several types of kiosks such as self-checkout kiosks, ticketing kiosks, and food-ordering kiosks.Growing penetration of e-commerce, online payments, and mobile payments is anticipated to bode well for the POS applications. Several economies including China, India, Japan are shifting toward cashless economies. Initiatives such as demonetization and digitization in India have resulted in the large-scale adoption of POS systems. POS system manufacturers are investing increasingly in providing end-to-end encryption solutions to process payments safely and securely. This is encouraging the end users to use POS systems.

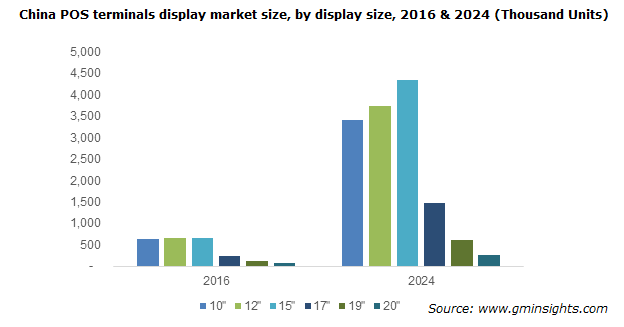

Browse key industry insights spread across 550 pages with 924 market data tables & 30 figures & charts from the report, “Display Market Size By Application (ATM [By Display Size {7”, 8”, 10”, Above 10”}, By Resolution {700x340 pixels, 800x600 pixels}], POS Terminals [By Display Size {10”, 12”, 15”, 17”, 19”, 20”}, By Resolution {1024x768 pixels, 1366x768 pixels, 1280x800 pixels}], Kiosks [By Display Size {15” – 17”, 17” – 32”, 32” – 65”, Above 65”}, By Resolution {1024x768 pixels, 1280x1024 pixels, 1920x1080 pixels}]), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2017 – 2024” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/display-market

Lack of standardization in the manufacture of displays is expected to challenge the industry growth. The offerings by the vendors differ according to the size, resolution, and costs. This refrains the device manufacturers from switching to different screen vendors, making it difficult for the small vendors to expand their reach in the industry. Moreover, the replacement of these components become difficult and costly due to the lack of standardized products.

Get more details on this report - Request Free Sample PDF

The 10” ATM display segment is predicted to grow at a rapid pace during the forecast timeline led by increasing deployment of multi-function ATMs. The banks and financial service providers are focusing on the deployment of multi-function ATMs to decrease the number of branches and enhance the functionality of the existing ATMs. 17” – 32” kiosk display is poised to grow significantly owing to the high quality offered by these devices and lower space requirements in small places such as retail stores.

The 1024x768 pixels display is expected to witness significant growth over the coming years on account of the high degree of vision comfort offered by the devices with this resolution. The system operators are exposed to high-brightness screens throughout the day and it becomes very important to ease their vision while operating these systems. 1024x768 pixels resolution provides high clarity and visibility.

South Korea display market will observe substantial growth through 2024 impelled by increasing number of manufacturers and the ability of these companies to manufacture components at a low cost. The semiconductor and display vendors in the region are rapidly expanding their manufacturing capabilities to cater to the rapidly increasing demand for these components.

Key players operating in the market include Fujitsu Limited, Displax S.A., Aplus Display Technology, Co., Ltd., Advantech Co., Ltd., and Ingenico Group. Vendors such as Ingenico Group, NCR Corporation, and NEC Corporation, undergo stringent quality control standards to manufacture high-quality components. With the steadily growing industry, the market players are investing in R&D to gain a competitive advantage.