Commercial Satellite Launch Services Market size worth $9bn by 2026

Published Date: June 2020

Commercial Satellite Launch Services Market size is set to surpass USD 9 billion by 2026, according to a new research report by Global Market Insights Inc.

The growing utilization of navigation features to locate destinations across the globe will drive the market demand. Rising adoption of Global Positioning System (GPS) and Global Navigation Satellite System (GLONASS) in various countries is increasing navigation utilization.

The rise in information technologies, cloud computing, and connected technologies will increase the demand a comprehensive global telecommunication network, generating market demand in the commercial industry. According to the Global Digital Report, in 2018, there were over four billion people using the internet. This number is expected to increase with the growing penetration of internet-enabled devices.

The establishment of international associations, including International Space Association (ISA), International Space Station (ISS) Program, and United Nations Office for Outer Space Affairs (UNOOSA), to promote the sharing of information and technologies will further support industry growth. Such initiatives taken by government entities and involvement of major regulatory bodies including U.S. FAA will fuel the market revenue.

The sudden outbreak of COVID-19 pandemic will moderately slow the market growth in 2020. The requirement of social distancing has generated a situation of limiting working staff and labor force. Temporary shutdown of various research, development, manufacturing, and educational facilities will impose a negative impact on the market size. The commercial satellite launch services market will witness a gradual revival post pandemic, owning to the rising demand in telecommunication sector.

Introduction of new telecommunication technologies influencing the LEO segment growth

The commercial satellite launch services market valuation from LEO segment was over USD 3 million in 2019 and is expected to reach USD 5 million by 2026, growing at more than 9%. The growth is attributed to significant number of satellites launches to strengthen global communication network. Ongoing project developments in 5G internet services in multiple countries will present potential growth prospects, for instance, in January 2020, China launched its first private 5G low orbit broad band satellite from Jiuquan Satellite Launch Center.

Browse key industry insights spread across 220 pages with 182 market data tables & 22 figures & charts from the report, “Commercial Satellite Launch Services Market Size By Orbit (LEO, MEO, GEO, HEO), By Size (Large, Medium, Small, Micro), By Application (Navigational, Communication, Reconnaissance, Weather Forecasting, Remote Sensing), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/commercial-satellite-launch-service-market

Increasing adoption of Cubesats to augment segment growth of small satellites

The small satellites segment is predicted to capture the market share of more than USD 2 billion by 2026 owing to rising adoption of small satellites for commercial services. The major opportunity pursued by micro-launching companies is to develop differentiating factors to capture a significant market share in satellite delivery. Moreover, the small size and weight of these satellites enable the deployment of multiple such satellites in a single launch.

The rising scope of application for remote sensing satellite

Get more details on this report - Request Free Sample PDF

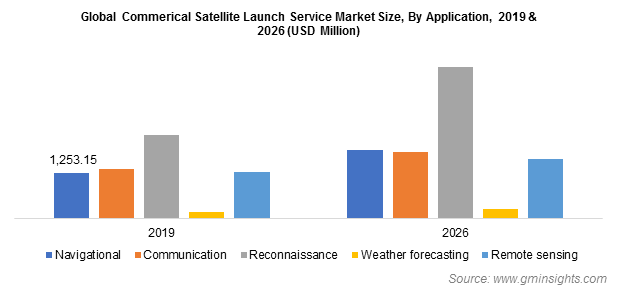

The remote sensing satellite segment is anticipated to capture a commercial satellite launch services market share of around 17% by 2026 due to its application on commercial front such as communication, navigation, research, and development. For instance, Commercial Remote Sensing Space Policy (CRSSP) provides guidance for the operation of commercial remote sensing space systems in the U.S. This will support economic growth and enable scientific & technological excellence.

Increasing efforts to develop ingenious manufacturing capabilities in Asia Pacific

The Asia Pacific commercial satellite launch services market will register a growth rate of 9% from 2020 to 2026 propelled by increasing efforts of Asia Pacific to establish indigenous manufacturing capabilities for increasing its global market share. For instance, in May 2020, Vestaspace Technology and Indian start-up announced their plans to develop and launch 35 cubesat satellites to facilitate 5G and IoT network application for the commercial sector.

Increasing market competitiveness through innovation

Major companies operating in the commercial satellite launch services market are Ariane Group, GK Launch Services, Lockheed Martin, United Launch Alliance, Commercial Space Technologies Ltd., ISRO, NASA, Antrix Corporation Limited, COSMOS International, Sea Launch, Boeing, Orbital Sciences Corporation, SpaceX, Eurockot Launch Services, and Mitsubishi Heavy Industries Launch Services.

These players are significantly investing in research & development to reduce the overall operational cost of satellite launch. The government bodies are increasingly funding to support these efforts. Companies showing assurance toward reducing the operational cost are establishing market dominance. For instance, in 2016, SpaceX received a funding worth USD 33.6 million from the U.S. Air Force, followed by another investment of USD 67.3 million for the development of reusable methane-fueled Raptor engine for the upper-stage development project.