Boom Trucks Market size worth over $3.5bn by 2025

Published Date: January 2025

Boom Trucks Market size is set to exceed USD 3.5 billion by 2025; according to a new research report by Global Market Insights Inc.

The rapidly developing utility industry across the globe due to the increasing demand for energy in various industry verticals is anticipated to drive the boom trucks market growth. The new power generation companies and governments are expected to invest substantially in the development of new power projects and the replacement of aging plants. This will surge the demand for construction machines across the globe, providing ample growth opportunities to companies operating in the truck cranes market. The increasing government investments in mining and construction projects in several countries, such as Brazil, China, and India, are driving the boom trucks market demand. Additionally, the rising exploration of new mines across Saudi Arabia and the UAE will create huge demand for these machines. A major factor hampering industry growth is the high costs associated with the maintenance of these machines.

The demand for heavy-duty truck cranes including class 7 and class 8 trucks is increasing across the globe due to their long-haul traveling and higher load carrying capacities. These trucks are majorly used at the construction and oil & gas sites to lift heavy equipment safely and reliably. The increasing investments in the mining and construction industries are contributing to the growth of the class 8 boom trucks. Additionally, these machines are increasingly used in rough terrains, high-rise installations, and in wind farm repairing, further supporting industry expansion.

Get more details on this report - Request Free Sample PDF

The demand for boom truck cranes with a lifting capacity of above 50 metric tons is increasing in the construction of high-rise buildings across the globe. The increasing utilization of these trucks in the oil & gas industry for various applications, such as handling pipes and lines for setting up oil & gas extraction plants, is contributing to the boom trucks market size. Additionally, these cranes offer a wider center of gravity and stable & reliable operations. The fast-growing industrialization and urbanization in countries such as China, India, Indonesia, Vietnam, and Thailand have led to expansion in power generation plants and transmission & distribution (T&D) networks, thereby driving the demand for bucket trucks market.

Browse key industry insights spread across 180 pages with 207 market data tables & 24 figures & charts from the report, “Boom Trucks Market Size, By Product (Boom Truck Crane [Below 10 Metric Tons, 10 to 20 Metric Tons, 20 to 30 Metric Tons, 30 to 40 Metric Tons, 40 to Metric Tons, Above 50 Metric Tons], Bucket Truck), By Vehicle Class (Class 4, Class 5, Class 6, Class 7, Class 8), By Application (Rental, Construction, Utility), Industry Analysis Report, Regional Outlook, Application Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/boom-trucks-market

The rapidly growing construction industry across the globe is driving the truck-mounted cranes market growth. The rising necessity for houses and the increasing investments in the infrastructure development, particularly in the economically stable countries, are expected to elevate the industry growth over the forecast timeline. The North American and European governments are making significant investments in building huge infrastructures, such as the construction of high-rise buildings, airports, railway stations, and metro stations, providing lucrative opportunities for industry development.

The Asia Pacific boom trucks market share is expected to grow at over 4% CAGR from 2019 to 2025 due to the ongoing & upcoming infrastructure projects across China, Japan, India, and Malaysia. According to the Asian Development Bank, Asian countries will need to invest around USD 26 trillion in the infrastructure sector by the end of 2030 to maintain optimum growth momentum. The governments of China, India, and Australia are making huge investments for the development of smart cities, thus supporting the adoption of the construction equipment across the region.

The South Korean construction industry is witnessing a high growth due to the rising government investments in the development of building infrastructure. These machines find applications in the construction of bridges, dams, and other infrastructure facilities. The increasing government focus on enhancing the country’s energy production is expected to create a high demand for these trucks in the utility sector. Additionally, the rising numbers of new construction projects and the renovation of the existing infrastructures in Japan result in the adding up of the truck-mounted crane market demand.

Key companies in the boom trucks market share include Manitowoc Cranes, Manitex International Inc., Altec Inc., Aichi Corporation, Link Belt, Versalift, Elliott Equipment Company, Tadano Ltd. and Palfinger AG, etc. Manufacturers are investing heftily in product innovation strategies and constantly integrating new features in the truck models. Due to the increasing need for high-capacity equipment, the companies are developing new machinery with heavy load lifting capacities. The companies are also focusing on offering total lifecycle support for each machine to enhance the equipment performance and gain high ROI.

The boom trucks market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2015 to 2025, for the following segments:

Boom Trucks Market, By Product

- Boom truck cranes

- By lifting capacity

- Below 10 metric tons

- 10 to 20 metric tons

- 20 to 30 metric tons

- 30 to 40 metric tons

- 40 to 50 metric tons

- Above 50 metric tons

- By lifting capacity

- Bucket trucks

Boom Trucks Market, By Vehicle Class

- Class 4

- Class 5

- Class 6

- Class 7

- Class 8

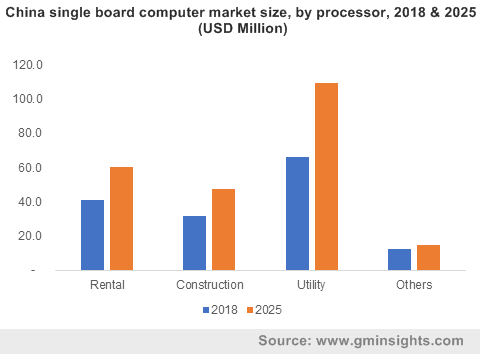

Boom trucks Market Share, By Application

- Rental

- Construction

- Utility

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa