Bleached Linter Cellulose Market Size worth $1.3bn by 2025

Published Date: July 2019

Bleached Linter Cellulose Market size will reach USD 1.3 billion by 2025; according to a new research report by Global Market Insights.

Bleached linter cellulose market is anticipated to achieve growth from rapidly growing food industry and massive textile business in Asia Pacific. Increasing product demand from North America pharmaceutical sector will further complement industry growth by 2025. For instance, it is widely used in the CMC manufacturing, which has various applications across food industry due to its ability to act as a thickening agent, adhesion agent and as a stabilizer. Moreover, in pharmaceutical applications, the product is used as emulsion stabilizer of injections, and in film-forming agents for tablets.

Despite of having various applications, product demand is likely to be restrained by the presence of various substitutes in the bleached linter cellulose market. Also, the product is used in the production of CMC, acetate, viscose etc., and production for all aforementioned compounds can also be executed by choosing wood as a raw material. Several companies are engaged in producing cellulose from wood pulp. For instance, Bracell is engaged in the production of special soluble cellulose derived from wood having high alpha rates and purity of about 98.5%.

Get more details on this report - Request Free Sample PDF

As per the grade, bleached linter cellulose market has been split into technical grade & high grade. High grade possesses a higher growth rate as compared to technical grade due to growing CMC applications across food and pharmaceutical applications. Moreover, technical grade grabs market shares close to 80% of the total industry share, as viscose being a major application segment and is widely used in the production of textiles, non-woven fabrics, etc. which retains the dominant demand share of technical grade in the overall market size.

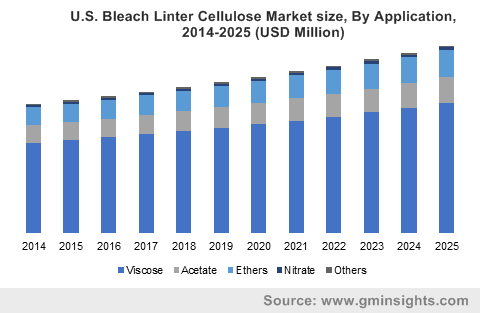

In terms of applications, viscose segment captured close to 65% of the global bleached linter cellulose market in 2018. Product is broadly used to produce acetate, viscose, cellulose ethers and several other compounds. CMC, a cellulose ether type which is extensively used across various end users including food, pharmaceutical, cosmetics, construction, paper & textile industry. For instance, in construction industry CMC is used in most of the cement and other building materials compositions owing to its stabilizing and hydrophilic properties.

Browse key industry insights spread across 154 pages with 267 market data tables & 23 figures & charts from the report, Bleached Linter Cellulose Market Size By Grade (High, Technical), By Application (Viscose, Acetate, Ethers, Nitrate), By End-user (Food & Beverage, Pharmaceutical, Textile, Pulp & Paper, Personal Care, Paints & Coatings, Packaging), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Spain, Italy, Greece, The Netherland, Turkey, China, India, Japan, Australia, Thailand, South Korea, Indonesia, Malaysia, Brazil, Mexico, Argentina, South Africa, Egypt, Saudi Arabia, UAE), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019-2025.”in detail along with the table of contents: https://www.gminsights.com/industry-analysis/bleached-linter-cellulose-market

Product has marked its presence in a wide range of industries. In personal care industry, the product is used to thicken and stabilize cosmetics and to improve moisturizing effects. Growing personal care products demand from young population and willingness to invest in grooming products is the major reason likely to positively influence the market growth by 2025. In the U.S., increasing demand for luxury personal care brands is expected to support the demand for cosmetics. Europe, on the other hand has been witnessing high demand for skin care and toiletries, which in turn will drive CMC demand and thus making a significant impact on the total bleached linter cellulose market in the near future. Personal care industry is also highly influenced by growing old age population in countries such as Japan, which in turn will drive anti-aging creams demand and thereby drive the market size in the forthcoming years.

Asia Pacific accounted for the largest share in bleached linter cellulose market in 2018 and is likely to witness gains more than 3.5% in the forecast timeframe. This is due to easy availability of raw materials along with its lower prices mainly in India and China, as they are the key cotton linters producers. Apart from this, end-user industries in Asia Pacific including food, pharmaceutical and personal care industry is growing rapidly due to improving socio-economic factors and will thereby propel the market demand by 2025.

Bleached linter cellulose has a diversified end user segment, as a result there are several players engaged in production to tap more markets to gain profit margins. The bleached linter cellulose market is highly fragmented by the presence of various small and medium scale players. Some of the product manufactures are GRN Cellulose Pvt. Ltd., Shandong Silver Hawk Chemical Fibre, Linter Pak Co, among several others.

Bleached linter cellulose market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Kilo Tons & revenue in USD Million from 2014 to 2025, for the following segments:

Bleached Linter Cellulose Market, By Grade

- High Grade

- Technical Grade

Bleached Linter Cellulose Market, By Application

- Viscose

- Acetate

- Ethers

- Nitrate

- Others

Bleached Linter Cellulose Market, By End-user

- Food & beverage

- Pharmaceutical

- Textile

- Pulp & paper

- Personal Care

- Paints & coatings

- Packaging

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Greece

- The Netherlands

- Turkey

- Asia Pacific

- China

- India

- Japan

- Australia

- Thailand

- Indonesia

- Malaysia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Egypt

- Saudi Arabia