Automotive Transmission Market size worth $281.3 Bn by 2026

Published Date: September 2020

Automotive Transmission Market size will likely reach USD 281.3 billion by 2026; according to a new research report by Global Market Insights Inc.

Increasing automotive sales due to increasing socio-economic factors of consumers in APAC and LATAM countries will positively impact the industry growth. The growth will be further driven by increasing electric vehicle sales due to increasing government initiatives to reduce carbon emissions.

COVID-19 has impacted almost evert industry across the world. The global automotive transmission market is also highly impacted by this ongoing pandemic. As the product has indispensable application in the automotive industry, a dip in the automotive sector is negatively influencing the transmission demand. Nationwide lockdowns in major economies disrupted automotive production and demand all over the world. Many manufacturing facilities are closed due to the pandemic, which has created severe impact on the industry.

Get more details on this report - Request Free Sample PDF

Increasing demand for continuously variable transmission (CVT) will augment industry growth

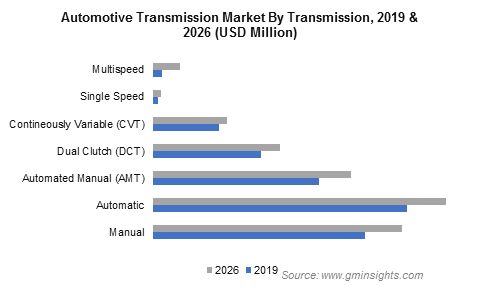

Continuously variable transmission (CVT) demand is projected to grow at a CAGR around 3.5% during the forecast timespan. CVT is said to be smoother than traditional transmission systems, although some users find it slow on shifting. It also helps to improve car’s fuel efficiency owing to which its demand in hybrid vehicles is increasing rapidly from past several years.

Browse key industry insights spread across 300 pages with 327 market data tables & 21 figures & charts from the report, “Automotive Transmission Market Size By Transmission (IC {Manual Transmission, Automatic Transmission, Automated Manual Transmission, Dual Clutch Transmission, Continuous Variable Transmission}, EV {Single Speed Transmission, Multi Speed Transmission}), By Engine (IC, EV), By Vehicle (Passenger Cars, LCV, HCV), By Gear (Less Than 5, 5 to 6, 7 to 8, Above 8), By Distribution (OEM, After Market), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-transmission-market

IC engine will dominate automotive transmission market

Transmission demand for IC engines generated for over USD 230 billion in 2019 and is forecast to grow at a CAGR of over 4% in coming years. IC engine, being the traditionally largest demand generating segment, is expected to dominate the market over the forecast period. However, IC is losing some market to electrical vehicles as transmission demand for EV is forecast to grow at a CAGR of over 14% by 2026. Introduction of new and innovative vehicles coupled with affordable price is projected to drive the transmission demand for EV in next few years.

Rapidly growing e-commerce industry across the globe will fuel the LCV demand

The e-commerce industry across the globe has been growing rapidly owing to the increased penetration of internet connectivity and smartphones coupled with discounts offered by e-commerce sites. This growth in the e-commerce industry is expected to result in increased purchase of LCVs for facilitating the timely delivery of items to buyers. Moreover, many small vendors in emerging economies prefer LCVs due to low price and fuel efficiency, in turn, boosting the transmission demand for LCV in emerging economies such as India, Brazil, and South Africa. Therefore, the automotive transmission market size for LCV segment will exceed USD 39 billion in 2026.

7 to 8 gear speed transmission expected to gain some market share by 2026

7 to 8 speed transmission is the latest craze amongst manufacturers owing to high fuel efficiency. Audi, BMW, Porsche, and Lexus offer 8 geared automatic transmissions with planetary gearsets and traditional torque converters. Ford is also using its own in-house 8 speed transmission. Furthermore, some manufacturers are opting for above 8 speed transmission. For instance, Fiat/ Chrysler is using ZF’s 9 speed transmission. Mercedes Benz is also using 9 speed transmission system. Traditionally, above 8 gears speed transmission was used for racing cars but now many companies are offering it in their sports variants.

Asia Pacific will remain the largest region due to high automotive production

Asia Pacific is expected to dominate the automotive transmission market and will hold a substantial share of over 55% in 2026. The region will register the highest demand for single speed and multispeed transmission. This can be attributed to high EV production in China. Industry rivalry in the market is moderate due to the presence of various regional and domestic manufacturers in the value chain. High brand loyalty is shown by most of the automakers due to high switching cost. Major companies working in the industry include Magna International, ZF Friedrichshafen AG, GKN PLC, BorgWarner Inc., Aisin Seiki Co., Allison Transmission Inc., and Eaton.