Apheresis Equipment Market size to exceed USD 5bn by 2025

Published Date: August 2019

Apheresis Equipment Market size is set to exceed USD 5.0 billion by 2025; according to a new research report by Global Market Insights Inc.

Favorable regulatory scenario in developed economies is expected to boost the apheresis devices business growth. The European commission have encouraged numerous initiatives related to the quality and safety for collecting, processing, storing and distributing blood along with blood components. These directives are undertaken in response to the rising need of blood and plasma for patients requiring plasma transfusions and derived products for their survival, thereby fostering industry demand. Additionally, the European commission has developed directives such as 2001/83/EC and 2002/98/EC to encourage blood collection through voluntary unpaid donations. Hence, above mentioned factors prove beneficial for apheresis equipment market growth.

The growing awareness for healthy lifestyle coupled with rising R&D investments by various biopharmaceutical companies will render optimistic impact on the apheresis equipment industry growth. Numerous initiatives undertaken by several other organizations in order to reduce incidence of blood-related disorders should accelerate the equipment demand. Also, rising usage rates of apheresis kits and machines for better patient management is projected to further accelerate business growth. However, complications associated with apheresis may hinder apheresis equipment market growth over the coming years.

Get more details on this report - Request Free Sample PDF

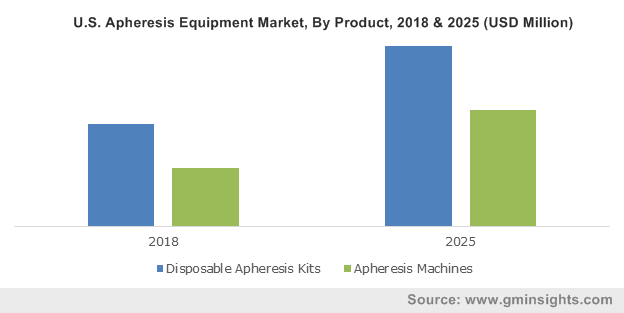

Disposable apheresis kit segment was valued around 1.6 billion in 2018 and will show momentous growth during the forthcoming years. This is majorly due to the increasing need for blood components including platelets amongst patient base. Additionally, availability of apheresis kit at lower prices with large volume procurement for platelet transfusions may propel apheresis equipment market growth.

Neurology segment accounted for over 50% revenue share in 2018 and should witness substantial growth by 2025. Rising prevalence of neurological ailments such as multiple sclerosis globally, enhances the demand for apheresis devices. Moreover, increasing R&D and favorable government initiatives for neurological disorders to ease patient’s convenience will accelerate the segmental growth.

Plasmapheresis segment was valued around 1.2 billion in 2018 and is predictable to experience profitable growth during the analysis period. Plasmapheresis is an extracorporeal technique of blood purification which involves removal of plasma from patient’s blood and replaces it with suitable intravenous fluid, to treat several autoimmune diseases. Hence, above mentioned factors thereby accelerates huge demand for apheresis devices.

Membrane filtration segment accounted for more than 55% revenue share in 2018 owing to increasing demand for plasma and platelets used in the treatment of various blood related diseases. Moreover, benefits such as flexibility, effective functioning at low temperatures, efficient sieves, and uniformity proves beneficial for the segmental growth.

Browse key industry insights spread across 200 pages with 222 market data tables & 9 figures & charts from the report, “Apheresis Equipment Market Size By Product (Disposable Apheresis Kits, Apheresis Machines), By Application (Renal Disease, Neurology, Hematology), By Procedure (Photopheresis, Plasmapheresis, LDL Apheresis, Plateletpheresis, Leukapheresis, Erythrocytapheresis), By Technology (Membrane filtration, Centrifugation), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Spain, Japan, China, India, Australia, Brazil, Mexico, South Africa, GCC Countries, Turkey), Application Potential, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/apheresis-equipment-market

North American market was valued around USD 1.0 billion in 2018. Rising health concerns and presence of sophisticated healthcare infrastructure will drive the regional growth. Furthermore, high patient awareness along with relatively better healthcare spending should foster the business growth.

Few of the notable business players operational in apheresis equipment market include Asahi Kasei Kuraray Medical, Terumo BCT, Fenwal, Haemonetics, Therakos, B. Braun, Hemacare, Kawasumi Laboratories and Fresenius. Several strategies undertaken by business players including mergers and collaborations to withstand industry competition will prove advantageous for market growth. For instance, in December 2017, Asahi Kasei Medical planned to construct a novel plant for Planova virus, a spinning of cellulose hollow-fiber membranes removal filters in Japan. Virus removal filters are used to enhance safety in the production process. This strategy has enhanced the customer base for the firm. Furthermore, in October 2016, Fenwal received FDA clearance for the Aurora Xi Plasmapheresis System. A separation method that enabled faster collection of source plasma. This strategy helped to improve plasma center efficiency and the overall experience for operators and donors.

Apheresis Equipment market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2014 to 2025, for the following segments:

Apheresis Equipment Market By Product, 2014-2025 (USD Million)

- Disposable Apheresis Kit

- Apheresis Machines

By Application, 2014-2025 (USD Million)

- Renal Disease

- Neurology

- Hematology

- Others

By Procedure, 2014-2025 (USD Million)

- Photopheresis

- Plasmapheresis

- LDL Apheresis

- Plateletpheresis

- Leukapheresis

- Erythrocytapheresis

- Others

By Technology, 2014-2025 (USD Million)

- Membrane Filtration

- Centrifugation

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- Australia

- Latin America

- Brazil

- Mexico

- Middle East Asia & Africa

- South Africa

- GCC Countries

- Turkey