Summary

Table of Content

Xylitol Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Xylitol Market Size

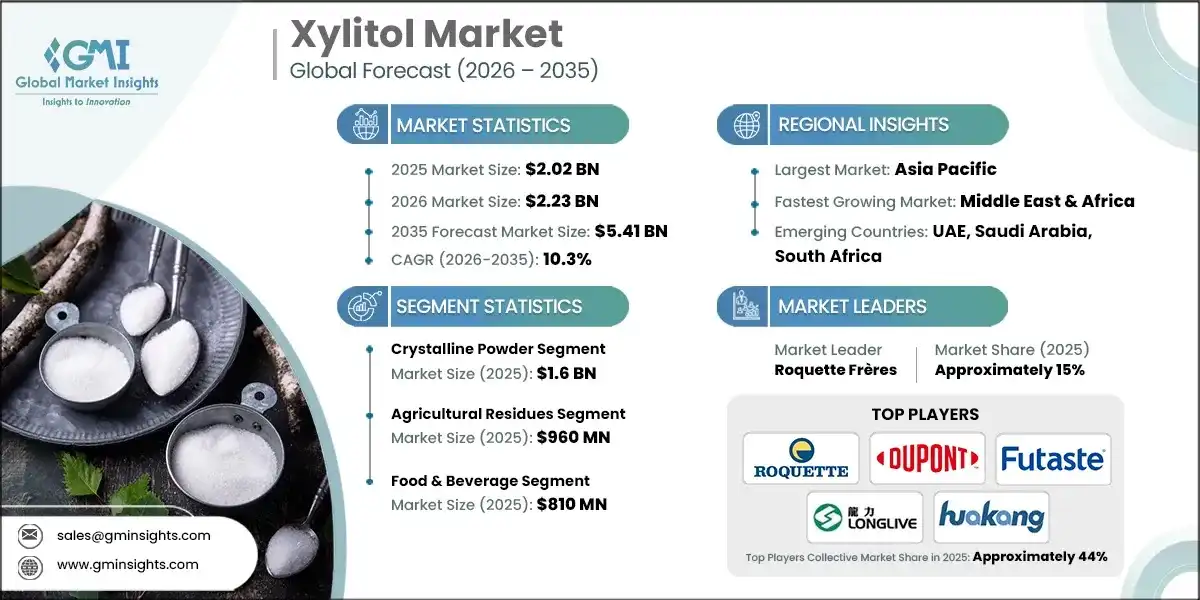

The global xylitol market was valued at USD 2.02 billion in 2025. The market is projected to grow from USD 2.23 billion in 2026 to USD 5.41 billion by 2035, representing 10.3% CAGR from 2026 to 2035, according to latest report published by Global Market Insights Inc.

To get key market trends

- Xylitol market is recording a gradual growth due to the increased demand for sugar-free and low calorie sweeteners in food and beverage products. The shift towards the use of other sweeteners such as xylitol instead of sugar is growing faster due to increasing consumer attention to healthier foods and the use of less sugar. The fact that it can provide the sweetness of sugar without raising blood glucose levels is also enhancing its application. This is most common in the developed and urban consumer markets.

- The increasing incidences of diabetes and obesity is also facilitating the market growth since the consumption of xylitol is largely prescribed in diabetic friendly preparations. Confectionery and bakery products, as well as functional foods, are also being used by food manufacturers in increasing numbers as a way of targeting health-conscious consumers who consume xylitol. Political encouragement of sugar cut programs in various states is also strengthening demand. Consequently, xylitol is becoming popular as a preventative-health based ingredient.

- Another important growth factor is high usage of xylitol in oral care products. Its anti-cariogenic effects have proven to be effective thus it is a common ingredient in toothpaste, mouthwashes and chewing gums. The sustained consumption is being propelled by the increased awareness of oral hygiene and preventive dental care particularly among the younger and the aging generations. This has made oral care one of the most consistent end-use markets of xylitol.

- Moreover, the trend of clean-label and natural ingredient preferences is also improving the market of xylitol. Xylitol is of vegetable origin; it is in line with the demand by consumers of clear, non-artificial formulations of products. Food, pharmaceutical and nutraceutical companies are cashing in on this position to position their products differently. This is change to natural and functional ingredients that is still helping the market to grow in the long run.

Xylitol Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.02 Billion |

| Market Size in 2026 | USD 2.23 Billion |

| Forecast Period 2026-2035 CAGR | 10.3% |

| Market Size in 2035 | USD 5.41 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for sugar-free and low-calorie sweeteners | Boosts xylitol adoption in food and beverage formulations |

| Increasing prevalence of diabetes and obesity | Expands consumer base for xylitol as a safe sugar alternative |

| Strong adoption in oral care products (toothpaste, chewing gum) | Sustains steady demand from dental health-focused segments |

| Growing clean-label and natural ingredient preference | Enhances xylitols appeal as a plant-derived sweetener |

| Pitfalls & Challenges | Impact |

| High production and processing costs | Limits price competitiveness against other sweeteners |

| Volatility in raw material prices (corn, birch, hardwood) | Creates uncertainty in supply chain and profit margins |

| Gastrointestinal side effects at high consumption levels | Restricts usage in certain food categories and consumer groups |

| Opportunities: | Impact |

| Expansion in pharmaceutical and nutraceutical applications | Opens new revenue streams beyond food and oral care |

| Growing demand in diabetic and functional food segments | Strengthens positioning in health-focused product lines |

| Increasing use in pet food and dental care products | Diversifies applications into animal health and wellness |

| Capacity expansion and cost optimization through bio-based technologies | Improves scalability and reduces production costs |

| Market Leaders (2025) | |

| Market Leaders |

Market Share Approximately 15% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Country | UAE, Saudi Arabia, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Xylitol Market Trends

- The xylitol industry is experiencing a trend of diversified portfolio of application in other areas other than conventional confection and chewing gum. Producers are incorporating xylitol into functional foods, nutraceuticals, pharmaceuticals and in medical nutrition products. This is indicative of an industry trend in general of ingredient multifunctionality, in which sweeteners are supposed to provide both flavor and utility. This diversification is decreasing overreliance on one end-use segment.

- The next trend that is occurring is the slow movement towards sustainable and alternative sources of raw materials. Manufacturers are also seeking alternative feedstocks other than wood and agricultural by-products to enhance supply security and environmental safety. This is a change that is in line with other sustainability objectives in the food and ingredient sector. This leads to the development of production models towards more circular and resource-efficient processes.

- Formulation innovation is also being witnessed in the market in order to enhance taste profile, digestive tolerance, and compatibility to blend. Xylitol is also being used more and more together with other polyols or natural sweeteners in order to make the sweetness levels as high as possible and reduce the side effects. This is a trend that demonstrates the industry preference for customized sweetener systems instead of single-ingredient solutions. There is an increase in the application of xylitol in complex formulations due to such innovations.

- Also, the shift towards premiumization and value added positioning of xylitol based products is easily noticed. Companies are also focusing on purity grades, pharmaceutical complaints and application specific variants to approach high-margin segments. This is in line with the general ingredient market trend which is shifting towards specialization instead of volume growth. As such, xylitol is changing to a functional ingredient that is more differentiated than a commodity sweetener.

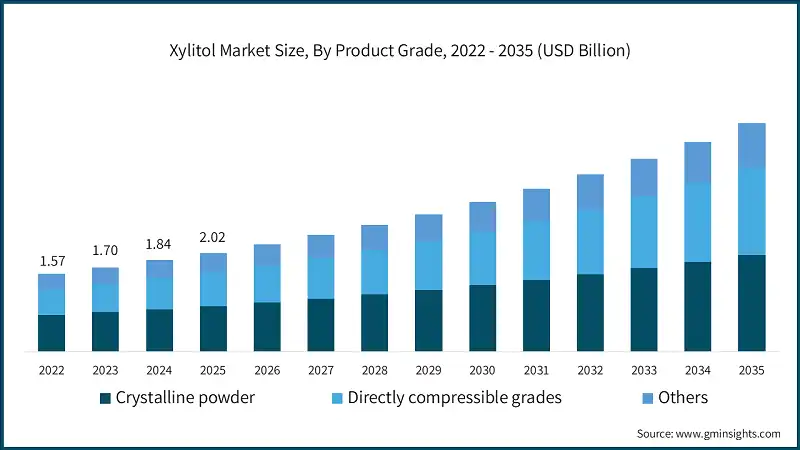

Xylitol Market Analysis

Learn more about the key segments shaping this market

Xylitol market based on product grade is segmented into crystalline powder, directly compressible grades, and others. The crystalline powder segment was valued at USD 1.6 billion in 2025, and it is anticipated to expand at 10.1% CAGR during 2026 to 2035.

- Expansion in the grades of xylitol products is influenced by the rising customization in the final product formulations. The steady increase in food and beverage usages of crystalline powder is due to its stability, handling comfort, and its usability with the conventional sugar-processing systems. The trend of increased demand of sugar free confectionery and bakery products is contributing to the growth in volume. Producers are increasing their scale of output to fit in the quality and cost expectations that are standardized.

- Other specialty grades like direct compressibility are positively contributing to market growth by new uses of higher value. Pharmaceutical companies are turning to direct compressible grades in tablet, lozenge, and medicated gum processing due to their effectiveness in providing the company with processing efficiency and excellent product performance. The grades of pharma, food and cosmetic are facilitating compliance-based adoption in regulated industries. This diversification founded on grades reinforced wider penetration in a variety of industries.

Xylitol market based on source is segmented into agricultural residues, wood-based sources, cereal by-products, and others. The agricultural residues segment was valued at USD 960 million in 2025, and it is anticipated to expand at 10% CAGR during 2026 to 2035.

- The by-products of agriculture are focusing on agricultural waste and cereals where producers are concerned about their sustainability and cost-effectiveness. Use of these sources is in line with the principles of circular economy and reduces the reliance on traditional feedstocks. New technologies of fermentation and extraction are enhancing the consistency of yields of these inputs. This is slowly transforming the sourcing strategies into the value chain.

- The wood based sources are still in use, as there are established supply chains and established processing procedures. Nevertheless, increasing attention to environmental effects is stimulating selective and efficient utilization. The other alternative sources are coming up as niche inputs into regional specific production models. All in all, the sourcing diversification is enhancing the resilience of supply and scalability of the market in the long run.

Learn more about the key segments shaping this market

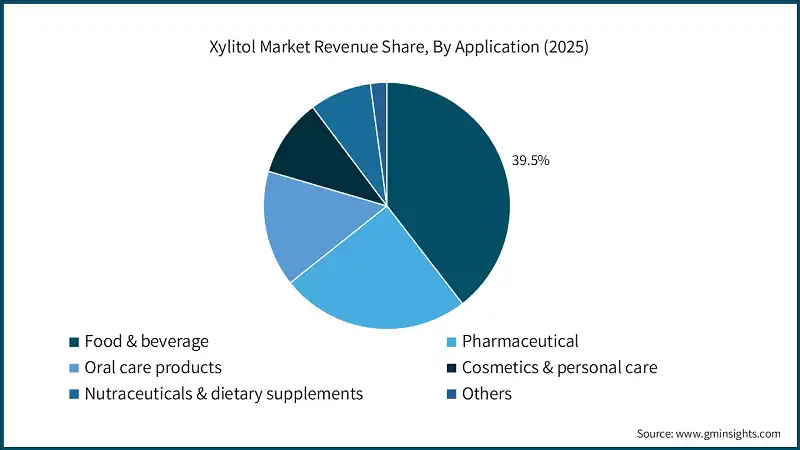

Xylitol market based on application is segmented into food & beverage, pharmaceutical, oral care products, cosmetics & personal care, nutraceuticals & dietary supplements, and others. The food & beverage segment was valued at USD 810 million with a market share of 39.5% in 2025, and it is anticipated to expand at 9.9% of CAGR during 2026 to 2035.

- The food and beverage sectors are propelling market growth steadily since the manufacturers are reformulating the food products to minimize the sugar content without affecting the flavor. Xylitol is currently looking for application in confectionery, bakery and beverages that are targeted at health-conscious clients. The range of pharmaceutical and nutraceutical use is growing because of the xylitol compatibility within the diabetic-friendly and oral health related formulations. This approves superior consumption tendencies.

- The xylitol has remained a consistent ingredient in oral care products because of its functional characteristics in dental hygiene preparations. Personal care and cosmetics are also increasing with the demands in mild, non-irritative and naturally occurring ingredients. The application base is expanding as new applications are being sought in dietary supplements and other functional products. This is a multi-application growth that is enhancing the overall stability and upward growth momentum in the markets.

Looking for region specific data?

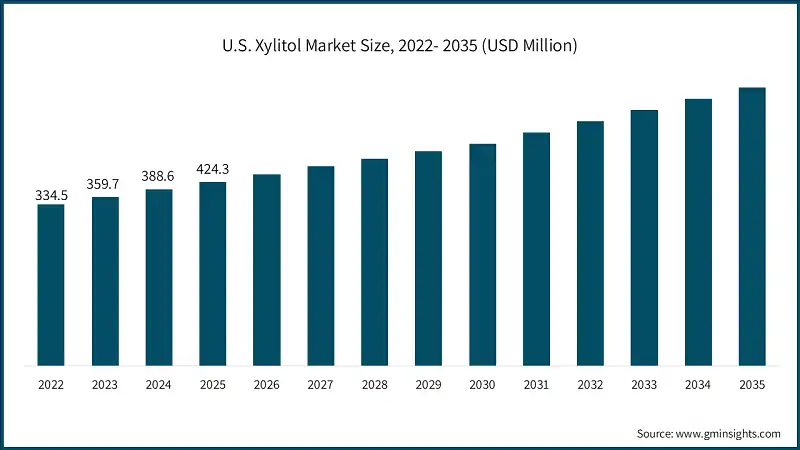

The North America xylitol market accounted for USD 480 million in 2025 and is anticipated to show lucrative growth over the forecast period. The North American market is actively growing, grounded on the high level of consumer awareness regarding the reduction of sugar and prophylactic health.

Manufacturers of food and beverage are busy re-formulating products to conform to clean-label and low-glycemic demands to facilitate broader application of xylitol. Oral care, nutraceuticals and functional foods growth is strengthening demand in various areas of applications. A mature pharmaceutical industry in the region is also incorporating xylitol into chewable tablets, syrups and oral-dissolving formulations.

U.S. dominates the North America xylitol market, showcasing strong growth potential of USD 424.3 million in 2025.

The growth of the U.S. is accelerating because of the increasing lifestyle-related diseases and growing popularity of sugar substitutes. The use of Xylitol is increasing in confectionery, chewing gum, and oral care products, which are promoted through good marketing of the benefits of dental health. Directly compressible and high-purity grades are becoming more common with pharmaceutical and nutraceutical manufacturers to enhance products in terms of functionality. Demand is further driven by innovation in functional food and supplements.

The Europe xylitol market accounted for USD 0.41 billion in 2025 and is anticipated to show lucrative growth over the forecast period. The markets in Europe have been encouraged by strict regulations on sugar reduction and high demand for natural sweeteners which have helped the market to grow in the region. Manufacturers of food in the region are putting more emphasis on reformulation approaches to fit the policies of the population health, which is contributing to more and more xylitol consumption. The demand is also stable through oral care and pharmaceutical uses especially in preventive healthcare products. The issue of sustainability is affecting sourcing and production choices, which promote investment in effective and green processes.

Germany dominates the Europe market, showcasing strong growth potential. Germany has been enjoying a stable xylitol market due to a large consumer awareness of health and wellness products. The well-established pharmaceutical and nutraceutical industries in the country are incorporating xylitol into the oral care, nutritional confectionery, and diet supplements. There is also a growing demand for food manufacturers who invest in sugar-free and reduced-sugar products. The focus on xylitol in high-purity, pharma-grade and food-grade is consistent with the strictness of quality standards in Germany.

Asia Pacific xylitol market accounted for 47.5% market share in 2025 and is anticipated to show lucrative growth over the forecast period. Asia Pacific market has been experiencing rapid growth as a result of increased populations in cities, changes in dietary habits and increased health awareness.

Packaged food, confectionery and oral care products are getting more and more opportunities for increasing consumption, and it also poses new demand. The xylitol is being used in more often in diabetic-friendly and preventative medical formulations by pharmaceutical and nutraceutical industries. The demand is increasing the supply through the increase in local production capacity and better processing technologies.

China xylitol market is estimated to grow with a significant CAGR, in the Asia Pacific market. China is also developing as a high growth market due to the increased frequency of diabetes as well as the growing attention to oral health care. The consumption of xylitol is increasing in chewing gum, functional foods and pharmaceutical. Local manufacturers are increasing capacities to satisfy the local and export markets. The increasing investment in consumer products that are health oriented is driving rapid adoption in various end use markets.

Latin America xylitol market is anticipated to grow at a CAGR of 8.5% during the analysis timeframe. The market in Latin America is growing consistently because of the increased awareness of consumers of the health risks of sugar consumption. Manufacturers of food and beverages are slowly launching sugar-free and reduced sugar-sugar food, which contributes to a slow shift in the adoption. Market is expanding with growth in the oral care and pharmaceutical usage especially in urban centers. The market is becoming more accessible due to the improvement of retail penetration and availability of functional products.

Brazil leads the Latin America xylitol market, exhibiting remarkable growth during the analysis period. The increasing health awareness and the growing number of middle-income populations in the country are causing Brazil to experience an increase in the demand of xylitol. Sugar substitutes are being more and more introduced in food and beverage industry in confectionery, beverages, and bakery products. Consumption is also being facilitated by oral care products because of increased focus on dental health. It is also being added to by the local production of pharmaceuticals and nutraceuticals.

Middle East & Africa xylitol market is expected to grow at a CAGR of 12.1% during the analysis timeframe. The market in Middle East and Africa is expanding at an average rate, owing to the rise in health awareness and change in diet. The increase in the consumption of packaged foods and oral care products is establishing new demand.

The use of drugs is increasingly being used in preventive healthcare, and this will facilitate the use of drugs. Market dynamics are being influenced by reliance on imports and low production in the local market. Nevertheless, the ability to invest more in healthcare infrastructure and functional food products is enhancing long-term growth opportunities in most of the major countries in the region.

Saudi Arabia xylitol market to experience substantial growth in the Middle East and Africa market in 2025. The increasing demand of xylitol is being driven by the increased health-related problems that are on the rise in Saudi Arabia and its emphasis on the improvement of its populace health through government initiatives. The manufacturers of food and beverages are launching products that have low sugar content to suit shifting consumer tastes.

Oral care and pharmaceutical applications are on a growing trend with increased health care expenditure. Supplies of imports are still predominant, yet the increasing demand for high quality and functional ingredient is fortifying the market expansion. There is a growing momentum of acceptance of health-oriented consumer products.

Xylitol Market Share

Roquette Frères, DuPont, Shandong Futaste Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd., and Zhejiang Huakang Pharmaceutical Co., Ltd. are a significant part of the xylitol industry and with further standing of being slightly consolidated with the top five players steadily holding 44% market share in the year 2025.

- Firms in the xylitol market segment place a lot of emphasis on product grade diversification to serve food, pharmaceutical, oral health and cosmetic markets to enable them to capture the demand in the volume and value added segment. This would enhance the stability of revenue and lessen reliance on one-end use industry.

- Improved efficiency in the processes and production is a competitive strategy that requires continuous investments in process optimization and production efficiency that allow manufacturers to control high costs of production and secure margins. Increased fermentation, hydrogenation, and purification technologies have enhanced reliability and scaled supply.

- Backward integration and the use of diversified feedstock to source raw materials is another form of strategic control over sourcing of raw materials that helps companies to reduce the effects of price volatility and guarantees their quality. This has increased the security of supply in the long run and also helped stable prices in the market.

- High focus on regulatory compliance and quality certifications have facilitated increased usage in pharmaceutical, nutraceutical and oral care applications. Agreement to high-value, high-purity and safety requirements has increased access to the controlled and premium end markets.

- The application-driven innovation applies in companies and is the development of customized grades that can be applied to certain formulation requirements. This has made switching costs higher for the customer and enhanced long-term supply contracts with food and healthcare manufacturers.

- The ability to expand geographically by capacity additions and regional distribution relationships has enhanced proximity to the end users. The strategy has assisted quicker response, lowering the cost of logistics, and enhanced market penetration in the emerging markets.

- The ability to educate customers about their functional benefits is done through marketing and technical support capabilities, especially in oral care and formulations that are diabetic friendly. This has contributed to the increase in downstream adoption and enhanced positioning of the brands.

- Partnerships with food, pharmaceutical and personal care brands have boosted the integration and co-development of products. These alliances have shaped the trend of formulation and strengthened the use of xylitol as a functional sweetener, as opposed to a commodity ingredient.

- Emphasis on sustainability efforts, such as efficient use of resources and the exploration of alternatives to feedstock, has harmonized the strategies of the company with changing customer and regulatory requirements. This has enhanced the long term competitiveness and strengthened the credibility in the market.

Xylitol Market Companies

The major players operating in xylitol industry include:

- Roquette Frères

- DuPont

- Shandong Futaste Co., Ltd.

- Shandong Longlive Bio-Technology Co., Ltd.

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Ingredion Incorporated

- ZuChem Inc.

- Merck KGaA

- Foodchem International Corporation

- Yusweet Xylitol Technology Co., Ltd.

- Others

Roquette Frères is specialized in the production of xylitol and polyol solutions, which are of high quality and packaged to suit the food, oral care, as well as pharmaceutical market. The company focuses on sustainable sourcing and innovation in processes to maintain a steady supply and respond to clean-label requirements, which makes it relevant in the market.

DuPont capitalizes on high-quality standards and new technology in the production of xylitol in a high purity state in order to supply this product with various uses. It has significant regulatory compliance and research and development which condition its formulation expertise, contributing to the preservation of long-term customer relationships in the food and healthcare segments.

Shandong Futaste is focusing on the expansion of volumes using high production capacities and low costs. The company focuses on the wide range of products and lower prices, which make xylitol available to a wide area of usage in both regional and international supply chains.

Shandong Longlive is interested in introducing xylitol to functional foods and nutraceuticals development by specific products. It also conforms with the changing consumer preferences of health-conscious ingredients, which will help to maintain the demand in major markets.

Zhejiang Huakang focuses on pharma-grade and food-grade xylitol that is carefully controlled with the best quality control that would be able to fit sensitive formulations. Its focus on compliant and high purity variants enhances its market performance in regulated oral care and in drug use.

Xylitol Industry News

- In October 2025, Roquette presented its further excipient and formulation portfolio in CPHI 2025 following integration acquisitions, demonstrating its high-growth technologies in delivery; this impacted the xylitol market as it indicated a greater involvement in high-growth pharmaceutical and nutraceutical formulations where xylitol is commonly co-formulated.

- In May 2025, Roquette Freres acquired IFF Pharma Solutions which combines a wide range of pharmaceutical excipients and increases its formulation capacities. This increased the competitiveness of Roquette in high-value excipients associated with the use of xylitol in oral care and health segments.

The xylitol market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product Grade

- Crystalline powder

- Fine grade

- Coarse grade

- Extra coarse grade

- Directly compressible grades

- Co-processed with dextrin

- Co-processed with CMC

- Others

- Pharmaceutical grade

- Food grade

- Cosmetic grade

Market, By Source

- Agricultural residues

- Corncob

- Corn husk

- Sugarcane bagasse

- Wood-based sources

- Hardwood

- Birch wood

- Cereal by-products

- Oat hulls

- Wheat straw

- Rice straw

- Others

Market, By Application

- Food & beverage

- Chewing gum

- Confectionery (candies, marshmallow)

- Sugar-free foods

- Bakery products

- Pharmaceutical

- Oral dosage forms

- Medicated confectionery

- Coating applications

- Drug formulations

- Oral care products

- Toothpaste

- Mouthwash

- Dental health claims & regulatory status

- Cosmetics & personal care

- Moisturizing products

- Face & neck products

- Skincare

- Bath products

- Nutraceuticals & dietary supplements

- Diabetic foods

- Weight management foods

- Dietary supplements

- Others

- Anti-quorum sensing / anti-biofilm agent

- Veterinary products

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the xylitol industry?

Major players include Roquette Frères, DuPont, Shandong Futaste Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd., Ingredion Incorporated, ZuChem Inc., Merck KGaA, Foodchem International Corporation, and Yusweet Xylitol Technology Co., Ltd.

What are the upcoming trends in the xylitol market?

Diversification into functional foods and nutraceuticals, sustainable raw materials, improved formulations for taste and blending, and premium high-purity, application-specific products.

What is the growth outlook for the food & beverage segment from 2026 to 2035?

The food & beverage segment, valued at USD 810 million in 2025 with a 39.5% market share, is set to observe around 9.9% CAGR through 2035.

Which region leads the xylitol sector?

North America leads the market, accounting for USD 480 million in 2025. Growth is driven by consumer awareness of sugar reduction, clean-label demands.

What was the valuation of the agricultural residues segment in 2025?

The agricultural residues segment was valued at USD 960 million in 2025 and is expected to grow at a CAGR of 10% up to 2035.

How much revenue did the crystalline powder segment generate in 2025?

The crystalline powder segment was valued at USD 1.6 billion in 2025 and is anticipated to expand at a CAGR of 10.1% till 2035.

What is the expected size of the xylitol industry in 2026?

The market size is projected to reach USD 2.23 billion in 2026.

What was the market size of the xylitol in 2025?

The market was valued at USD 2.02 billion in 2025, growing at a CAGR of 10.3% from 2026 to 2035, driven by increasing demand for sugar-free and low-calorie sweeteners.

What is the projected value of the xylitol market by 2035?

The market is poised to reach USD 5.41 billion by 2035, fueled by its adoption in food, beverages, and pharmaceutical applications.

Xylitol Market Scope

Related Reports