Summary

Table of Content

Veterinary Hospital Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Veterinary Hospital Market Size

The global veterinary hospital market was valued at USD 65.9 billion in 2024. The market is estimated to grow from USD 69.2 billion in 2025 to USD 124.4 billion in 2034, growing at a CAGR of 6.7% from 2025 to 2034. The market is experiencing considerable growth driven by increasing animal population globally, high adoption of pet animals for companionship, high demand for medical veterinary services, and rising expenditure on veterinary care. As per the 2024 Global Pet Parent Study, the global pet population is around 1 billion. Similarly, the worldwide population of livestock is also rising to meet the increasing demand for meat, milk, and eggs. For example, the global live cattle population was approximately 1.57 billion heads in 2023. Further, the global poultry population reached 27.22 billion. Such a high volume of animals increases the demand for various animal healthcare services including veterinary hospital services, thereby boosting market growth.

To get key market trends

Availability of advanced medical facilities for pets, cutting-edge medical devices, drugs, and pet insurance are set to positively impact industry growth. Several technological advancements in the field of veterinary medicine are set to positively influence the animal health industry. Recent developments such as enhanced imaging modalities for animals, telemedicine platforms, point-of-care diagnostics, along with ongoing research and development activities in veterinary field are set to bring rapid expansion in the veterinary hospital market.

Veterinary Hospital Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 65.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.7% |

| Market Size in 2034 | USD 124.4 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Veterinary hospitals are institutes with facilities for day-to-day treatment, immunization, vaccination, artificial insemination, surgical intervention, etc. of livestock, pets, small animals and bird. These facilities are like specialized hospitals tailored for animals. Veterinary hospitals are essential for diagnosing and treating complex medical conditions, providing advanced treatments, and ensuring that pets receive the highest level of care during critical situations.

Veterinary Hospital Market Trends

- The increasing number of veterinary hospitals and rapidly developing veterinary infrastructure in both developed and emerging markets is a key factor driving the market.

- As per the American Veterinary Medical Association, the number of veterinary practices in the U.S. is estimated to be between 28,000 and 32,000. Similarly, in India, the number of veterinary institutions has seen a significant increase in recent years. During financial year 2022, over 12,000 veterinary hospitals and polyclinics were found across India.

- Such rapid growth in veterinary infrastructure increases the adoption of specialized veterinary services for both pet and farm animals, thereby driving the veterinary hospital market growth.

- Also, a rise in pet adoption for companionship has led to increased spending on pet care. High disposable income has further augmented the spending on animals. As households increase their spending on pets, there is a higher demand for various pet care services, thereby fueling market growth.

- Growing adoption of pet insurance is expected to be an instrumental factor in driving the market expansion. According to the North American Pet Health Insurance Association, there has been an increase of about 18% in the number of insured pets during 2017-2018, in the U.S.

- Similarly, the number of pets insured in 2021 was 26% higher than in 2020 and 63% higher than in 2018. Thus, surging adoption of pet insurance coupled with the growing number of insured animals will drive the market expansion by increasing the adoption of various animal healthcare services.

- Moreover, the rising incidence of chronic diseases in pets and increase in the number of surgeries also aids market growth. For instance, in the U.S., about 14 million adult dogs are affected with osteoarthritis, making it a top health concern for owners. One study estimated that over 1 million cranial cruciate ligament surgeries (CrCL) are performed in dogs each year.

- Spaying and neutering are very common surgical procedures performed in pet animals. Such rise in chronic diseases and surgeries increases the demand for effective treatment modalities, thereby fostering market growth.

Veterinary Hospital Market Analysis

Learn more about the key segments shaping this market

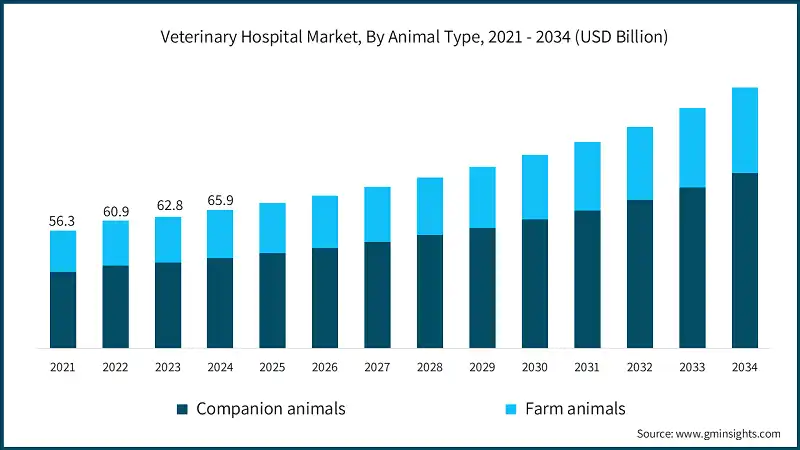

The market was valued at USD 56.3 billion in 2021. The following year, it saw a slight increase to USD 60.9 billion, and by 2023, the market further climbed to USD 62.8 billion.

Based on animal type, the veterinary hospital market is segmented into companion animals and farm animals. The companion animal segments include dogs, cats, horses, and other companion animals. The companion animals segment dominated the market in 2024 with a revenue of USD 43.1 billion.

- High growth can be attributed to the rising number of households adopting companion animals as beloved members of the family. More than half of the global population is estimated to have a pet at home. Globally, dogs are the most popular pet, present in around one in three homes. Almost a quarter of pet owners have a cat. Thus, the sheer number of companion animals along with increased spending is expected to propel the segmental growth.

- Also, pet owners are now more inclined than ever to invest in comprehensive medical care, preventive treatments, and wellness programs for their furry counterparts, leading to a surge in revenue within the veterinary hospitals market.

- There has been a significant increase in the incidence of various diseases among the companion animals. According to data published in the National Institute of Health (NIH), cancer is the leading cause of death in 47% of dogs, especially dogs over age ten, and 32% of cats.

- Further, it is estimated that nearly 30-50% of dogs and cats will be affected by osteoarthritis during their lifetime. Similarly, as per the results of the APPA 2017-2018 National Pet Owners Survey, nearly 8% of cats and 10% of dogs underwent surgical procedures.

- Thus, rising burden of chronic diseases in pets along with growing number of pets undergoing surgical procedures will spur the market growth of market.

Learn more about the key segments shaping this market

Based on the services, the market is segmented into general veterinary services, diagnostic services, surgical services, and other services. The general veterinary services segment held highest market share of 45.8% in 2024 dominating the veterinary hospital market.

- High demand for general veterinary services can be attributed to increasing pet ownership, heightened awareness of animal health and welfare, and advancements in veterinary medical practices.

- The rising prevalence of veterinary diseases also increases the demand. This has prompted veterinary hospitals to diversify and enhance their general veterinary offerings, encompassing preventive care, routine check-ups, and vaccinations.

- Moreover, the integration of technology into veterinary practices has streamlined processes, enabled efficient medical diagnostics, and facilitated remote consultations, thereby further boosting the market growth.

Based on ownership, the market is segmented into private and public. Private segment was valued at USD 40.3 billion in 2024 and is anticipated to witness high growth at a CAGR of 7.2% between 2025 - 2034.

- In the past few years, the improvement in socio-economic factors and rising disposable income have led individuals to spend more on high-quality veterinary services offered in the private sector. Therefore, the willingness of pet owners to provide premium services for their pets is supporting segment growth.

- The growing number of mobile pet care hospitals further enhances market growth. For instance, Premium Vet Care, Florida, U.S., is a mobile companion animal hospital that offers a wide range of services with the help of mobile veterinarians. Thus, the aforementioned factors collectively contribute to high market growth.

Looking for region specific data?

North America dominated the global veterinary hospital market with a market share of 39.6% in 2024. The U.S. market was valued at USD 20.2 billion and USD 21.9 billion in 2021 and 2022, respectively. The market size reached USD 23.8 billion in 2024, growing from USD 22.6 billion in 2023.

- High regional growth is fueled by factors such as heightened awareness of animal healthcare, increasing pet ownership in the region, and advancements in medical technology.

- According to the 2021–2022 National Pet Owners Survey by the American Pet Products Association (APPA), 70% of the U.S. households owned at least one type of pet. Similarly, almost 69 million of the U.S. households have at least one dog, and 45.3 million have at least one cat, about 9.9 million have birds, and 3.5 million have horses.

- Further, the country also boasts a high population of livestock animals. For instance, there were 87.2 million head of cattle and calves on the U.S. farms as of January 2024.

- Such high volume of companion and livestock animals in the country increases the demand for various animal healthcare services, thus boosting the growth of the U.S. market.

Europe veterinary hospital market was valued at USD 18.1 billion in 2024 and is anticipated to witness significant growth over the analysis period.

- Rising animal adoption in European region coupled with increasing initiatives by various governments to improve animal healthcare is anticipated to spur market growth.

- Advancements in veterinary services with frequent introduction of superior veterinary diagnostic products for accurate diagnosis will boost the adoption of veterinary services in the Europe region, thereby driving the market growth.

- The UK has reported outbreaks of various diseases, such as bird flu and West Nile virus. For example, UK has experienced a large outbreak of bird flu. The outbreak led to the death of 3.8 million birds in the UK, with significant consequences for agriculture and livestock industry. Such disease outbreaks increase the adoption of veterinary services for preventive measures, thereby boosting the veterinary hospital market.

- Further, the UK is home to a large pet population. Studies estimate that early 62% of UK households own at least one pet. Accessibility to modern care facilities for pets, advanced diagnostic modalities, and high adoption of pet insurance will propel the industry’s growth positively.

India veterinary hospital market is expected to witness growth at considerable rate in Asia Pacific market.

- India has a large pet population with over 31 million pet dogs and 2.44 million pet cats. The increasing pet ownership and rising disposable income in the country coupled with high expenditure on pet healthcare will offer market growth opportunities in the country.

- Also, rapidly expanding veterinary infrastructure in the country such as veterinary hospitals and services will further enhance market growth.

- Several government initiatives to support animal health and wellness also stimulate market growth. For instance, the National Animal Disease Control Program is a flagship scheme launched in 2019 that aims to control foot & mouth disease and brucellosis by vaccinating the animals. Such initiatives aid in high adoption of veterinary services, thus fostering market growth.

Brazil is anticipated to witness significant growth in the Latin America veterinary hospital market.

- Brazil dominates the Latin America industry. The country has the third-largest pet population in the world with 160 million pets, of which 60 million are dogs, 30 million cats, and 32 million pet-owning households.

- The country is also home to a large livestock population, with Brazil being the third-largest cattle producer and second-largest beef exporter in the world.

- Such high animal volume coupled with strong growth in veterinary expenditure is anticipated to foster market growth.

Veterinary Hospital Market Share

The competitive landscape of the veterinary hospital industry is increasingly dynamic, marked by the consolidation of veterinary practices and the growing presence of corporate veterinary groups. Large corporations acquire independent hospitals to build expansive networks that benefit from economies of scale, standardized care protocols, and advanced diagnostic technologies. Top 4 market players such as Mars, National Veterinary Associates (NVA), CVS Group, and Greencross Vets dominate the global market with a market share of ~15% - 20%. Key players are differentiating themselves through specialized services such as oncology, cardiology, and telemedicine, as well as through enhanced customer experience and digital health solutions.

The market also includes a mix of regional and local veterinary clinics that compete by offering personalized, community-based care. Technological innovation, quality of service, and strategic geographic expansion are critical factors driving competition in this evolving market.

Veterinary Hospital Market Companies

Major players operating in the veterinary hospital industry are:

- Animal Hospital

- All Pets Veterinary Hospital

- Blaine Central Veterinary Clinic

- Beijing Xintiandi International Animal Hospital

- Belltowne Veterinary Center

- CVS Group

- Greencross Vets

- Innovative Petcare

- Mars Incorporated

- MaxPetZ

- National Veterinary Associates (NVA)

- Pets at Home Group

- Royal Veterinary College (RVC)

- SASH Vets

- The Animal Medical Center

Mars Inc., through its Mars Petcare division, is a major player in the veterinary hospital market, operating a wide network of veterinary practices globally, including Banfield Pet Hospital, VCA Animal Hospitals, and BluePearl. The company leverages its integrated approach combining pet nutrition, veterinary care, diagnostics, and technology. The company continues to invest heavily in veterinary innovation and pet health services.

National Veterinary Associates (NVA) is a leading player in the market, operating one of the largest networks of veterinary hospitals worldwide. The company offers a wide range of medical, surgical, and preventive care services for companion animals.

Veterinary Hospital Industry News

- In August 2024, King Animal Hospital, a renowned veterinary institution, officially launched its new 60,000 square-foot tertiary care veterinary hospital in King City, Ontario.

- In July 2024, Daktari Animal Hospital, one of Japan's leading veterinary hospitals, announced that it had successfully maintained its accreditation from the American Animal Hospital Association (AAHA). This accreditation signifies that the hospital meets rigorous standards of veterinary care, including medical care, patient management, and organizational operations, evaluated through more than 900 criteria across 20 categories.

- In February 2024, the People's Dispensary for Sick Animals (PDSA) of Canada announced expansion plans for their new hospital building located at Brunswick Avenue, Hull. The plan involves constructing a larger, modern animal hospital next to the existing facility to enhance veterinary services for pet owners on low incomes in the Hull area.

- In May 2023, CVS acquired Top Vets Ltd., which trades as Riverside Veterinary Practice, also known as Riverside Vets. This helped the company to expand its local business.

- In March 2021, CVS Group acquired Market Hall Vets, a first opinion practice operating three sites across Carmarthenshire in southwest Wales. This helped the company to expand its business.

The veterinary hospital market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Animal Type

- Companion animals

- Dogs

- Cats

- Horses

- Other companion animals

- Farm animals

- Cattle

- Swine

- Poultry

- Other farm animals

Market, By Services

- General veterinary services

- Diagnostic services

- Surgical services

- Other services

Market, By Ownership

- Private

- Public

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the veterinary hospital industry?

Some of the major players in the industry include Animal Hospital, All Pets Veterinary Hospital, Blaine Central Veterinary Clinic, Beijing Xintiandi International Animal Hospital, Belltowne Veterinary Center, CVS Group, and MaxPetZ.

How much market share did North America capture in the veterinary hospital market in 2024?

North America dominated the global market with a market share of 39.6% in 2024.

How big is the veterinary hospital market?

The market size for veterinary hospital was valued at USD 65.9 billion in 2024 and is projected to reach around USD 124.4 billion by 2034, growing at a CAGR of 6.7% during the forecast period.

Which segment held the largest share in the veterinary hospital industry in 2024?

The general veterinary services segment held the highest market share of 45.8% in 2024, dominating the market.

Veterinary Hospital Market Scope

Related Reports