Summary

Table of Content

Sports Protective Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sports Protective Equipment Market

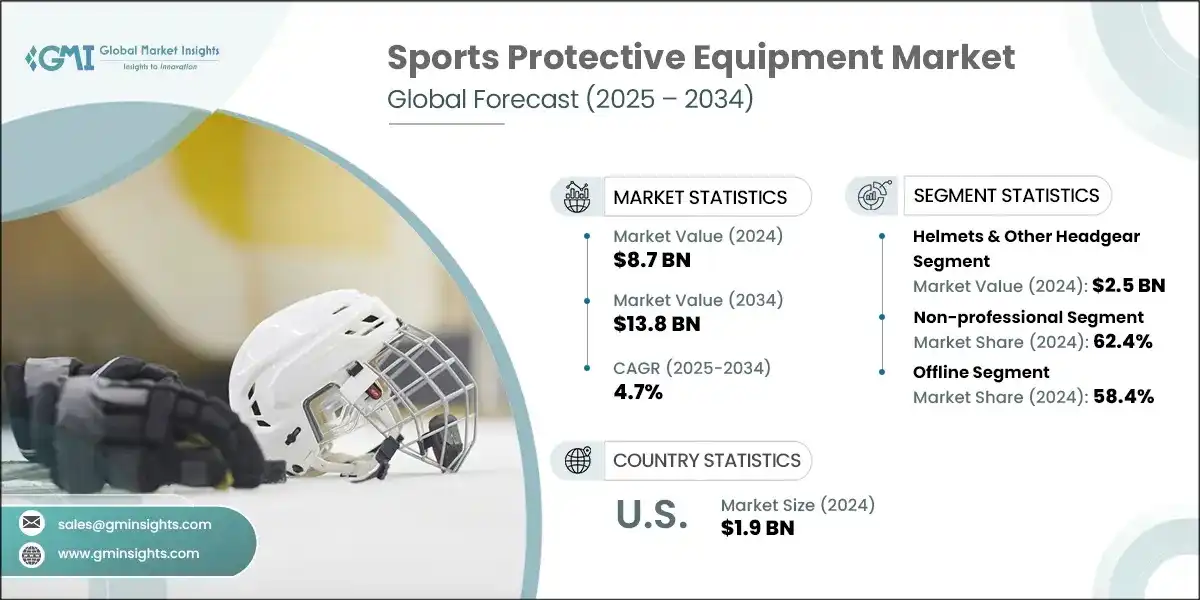

The global sports protective equipment market was valued at USD 8.7 billion in 2024 and is projected to grow from USD 9.1 billion in 2025 to USD 13.8 billion by 2034, registering a CAGR of 4.7%, according to Global Market Insights Inc.

To get key market trends

- Sports protective equipment are essential gears and devices that aid in safeguarding individuals from injuries during sports and recreational activities. Some protectors include goggles, cups, helmets, as well as pads and guards. Athletes should always participate in their specific sport with well-fitted protective equipment. As well, they should avoid gear which is worn out or damaged since such items could expose an athlete to aggravate injuries.

- The increasing national and international popularity of some sports have heightened the need for awareness regarding safety which significantly increased the quality of protective gear used by athletes and athletic enthusiasts alike. According to data from the U.S. Consumer Product Safety Commission (CPSC), there were over 3.2 million sports-related injuries treated in emergency rooms in 2022, highlighting the critical need for effective protective equipment. The development of online retailing has improved market reach thus widening access to sporting goods no matter where consumers are located.

- Furthermore, there was an increase in spending on sporting activities coupled with change in attitude towards personal fitness which boosted the demand towards advanced protective gear as much specialized equipment was required for people who renewed focus towards keeping fit through rigorous exercises. Greater demand for fitness has aided growth the market requires at this point to protect users from aggressive sports as using worn out items would lead to more injuries than not using protective gear at all.

- Furthermore, the growing involvement in sports at all levels has led to a consistent market for safety equipment as both recreational and competitive athletes increasingly seek to safeguard their health and wellbeing while engaging in physical activities. Moreover, in some instances, the governing bodies of certain sports insisting on compliance with policies concerning sporting safety equipment has significantly advanced market growth by making it obligatory for players to adhere to safety regulations issued by relevant authorities.

- Another primary reason for growth in the sports protective equipment market is the increasing consumer expenditure on sports gear, reflecting a significant shift in lifestyle and health priorities. As individuals place greater emphasis on fitness, wellness, and recreational activities, their willingness to invest in premium-quality sports equipment, including protective gear, has grown substantially. For instance, disposable income in countries like India and China has grown by over 10% annually in recent years, further fueling this trend.

- This trend is particularly evident in urban regions and among younger, health-conscious, and tech-savvy demographics. Additionally, the expansion of organized sports leagues, fitness centers, and adventure sports activities has consistently driven the demand for safety-oriented gear that delivers high performance. In emerging economies, rising disposable incomes have further enabled consumers to purchase branded, technologically advanced, and premium protective equipment. This shift not only contributes to increased market revenues but also fosters innovation and intensifies competition among manufacturers striving to meet the evolving expectations of consumers.

Sports Protective Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.7% |

| Market Size in 2034 | USD 13.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing popularity of national and international sports events | Drives demand innovative, safety-certified protective gear. |

| Increase in the trend of online sales | Boosts accessibility and personalized product offerings |

| Rise in consumer spending on sports equipment | Encourages premium, advanced protective gear development |

| Increase in growth of consumer awareness regarding health and fitness | Expands protective gear use in sports and recreation. |

| Increase in participation in sports activities | Prompts diverse, affordable, sport-specific gear solutions |

| Pitfalls & Challenges | Impact |

| Increase in number of counterfeit products | Counterfeit goods harm consumer trust, brand reputation, and safety while causing revenue losses and regulatory challenges for manufacturers. |

| Growing cost of raw materials | Higher prices for materials like carbon fiber and Kevlar increase production costs, reducing margins and potentially slowing market growth. |

| Opportunities: | Impact |

| Rising Youth Participation in Sports | Youth sports participation boosts demand for entry-level protective gear |

| Innovation in Lightweight and Smart Materials | Lightweight, smart materials attract tech-savvy athletes. |

| Market Leaders (2024) | |

| Market Leaders |

12% Market share |

| Top Players |

The collective market share in 2024 is 25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America & Europe |

| Emerging Country | U.S., China, Germany |

| Future Outlook |

|

What are the growth opportunities in this market?

Sports Protective Equipment Market Trends

- A noteworthy trend impacting the market for protective equipment in sports is the use of smart technologies. Specifically, this includes the addition of sensors, impact monitoring systems, and other analytics devices to traditional forms of protective equipment. For example, in 2024, Hexoskin unveiled its Smart Shirt Gen 3, boasting improved sensor precision, extended battery longevity, and cloud-driven analytics.

- The shirt monitors heart rate, respiration, and movement, serving athletes, astronauts, and researchers alike in their quest for ongoing health oversight and performance enhancement. These advancements relay critical information pertaining to performance and injury risks in real-time, enhancing evaluation processes for athletes involved, their coaches, and healthcare professionals.

- The increasing focus on sustainability is influencing the sports protective equipment market, with a growing demand for products made from eco-friendly materials. Athletic apparel manufacturers are now addressing eco-friendly options by incorporating recycled or even biodegradable materials into gear. This shift embodies growing consumer demand for environmentally friendly products that resonate with their core values while upholding responsible social practices from a broader perspective.

- An additional focus area is the collaboration between professional athletes and manufacturers involving the design concepts of sports protective gear as advanced teamwork strategies towards comprehensive branding initiatives. Collaborations extend far beyond conventional endorsement contracts because participating athletes contribute interactive design input while incorporating vital industry knowledge stemming from personal experience which accelerates innovation tailored towards universal challenges across diverse sporting disciplines.

Sports Protective Equipment Market Analysis

Learn more about the key segments shaping this market

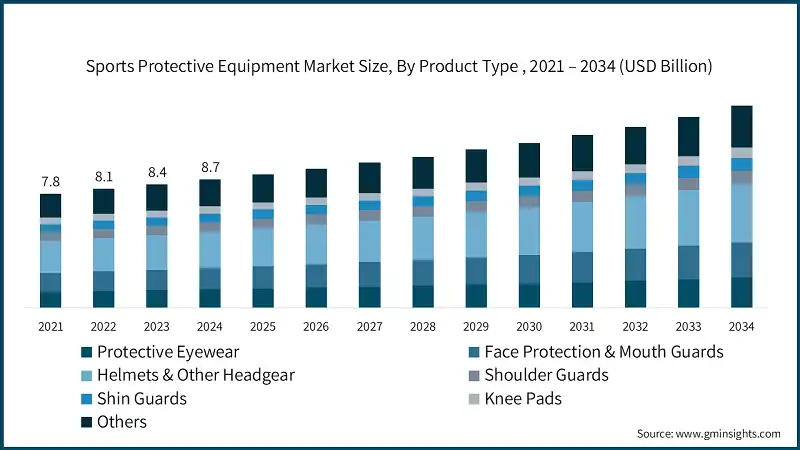

Based on product type, the market of sports protective equipment is categorized into protective eyewear, face protection and mouth guards, helmets and other headgear, shoulder guards, shin guards, knee pads, and other specialized protective gear. The helmets & other headgear accounted for revenue of around USD 2.5 billion in the year 2024 and is estimated to grow at a CAGR of 4.7% from 2025 to 2034.

- The expansion of the sub-segment helmets and other headgear in the sports protective equipment market stems from greater concern regarding head injuries, specifically concussions, alongside stricter safety policies in both professional and amateur sports leagues. The growing interest and participation in high impact sports including football, hockey, cycling, and motorsports have created a need for new helmets with improved impact absorption as well as better comfort and ventilation. Smart helmets that incorporate sensors for real-time injury assessment are also driving an increase in adoption along with advanced materials like carbon fiber and multi-density foam used to improve the helmet's structural integrity. Stronger parental supervision driven by national injury prevention initiatives along with safety campaigns has markedly influenced and helped sustain market growth.

- However, face protection & mouth guards is expected to grow at a highest CAGR of 5.1% during the forecast period, driven by the increasing awareness of orofacial injuries, advancements in technology, and stringent regulatory mandates. Research indicates that athletes are nearly 60 times more likely to sustain facial or dental injuries without a mouthguard, emphasizing the critical role these devices play in high-contact sports such as boxing, rugby, and hockey. Modern mouthguards have undergone a significant transformation, evolving from simple protective barriers to sophisticated devices equipped with smart sensors. These sensors monitor impact forces, jaw movements, and biometric data such as heart rate and hydration levels, making them indispensable in sports like football, boxing, hockey, and rugby, where the risk of facial injuries and concussions is notably high.

Based on usage, sports protective equipment market is segmented into professional users and non-professional users. The non-professional emerged as leader and held 62.4% from the total market share in 2024 and is anticipated to grow at a CAGR of 4.6% from 2025 to 2034.

- Due to increased engagement in recreational activities, the non-professional segment has now become the leading user group and main driver of demand for sports protective equipment. Aerobic fitness clubs and casual exercise centers have been increasingly popular recently, which is also expanding the amateur athletic programs at schools, colleges, and universities. With these developments, there is a substantial increase in non-professionals purchasing apparel and protective gear because it keeps them safe from injury.

- Furthermore, athletes at all levels now have access to inexpensive protective equipment that is multifunctional or multi-style and visually appealing. Through social media platforms and government efforts endorsing active living, more people are adopting riskier forms of physical activity thus boosting supplementary demand for non-elite sports protection equipment.

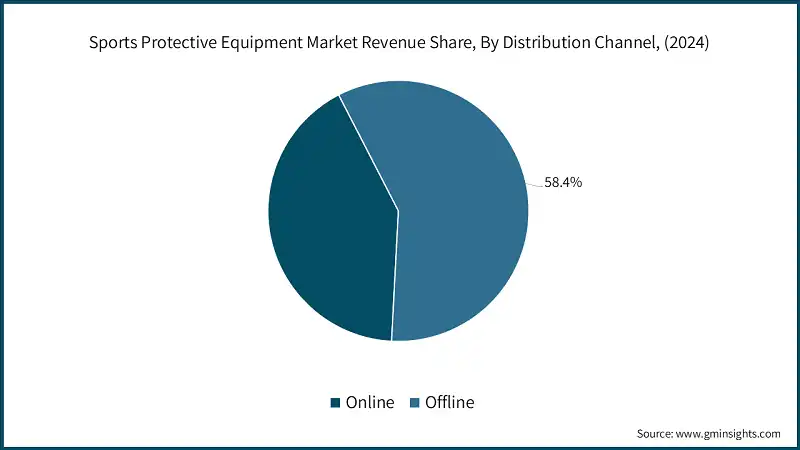

Learn more about the key segments shaping this market

Based on distribution channels the sports protective equipment market is separated into online channels and offline channels. The offline segment holds the largest share of 58.4% in 2024 and is anticipated to grow at a CAGR of 4.6% from 2025 to 2034.

- Offline distribution channel relies fundamentally on proper evaluation prior to purchase due to items such as helmets, guards or pads requiring specific fitting as well as comfort factors. Specialist shops alongside larger chain stores ensure almost instantly accessible product inspection coupled with professionally backed consultations addressed during sale-process safeguards authenticity demanded by patrons shopping for sport protective gear furthermore driving purchase interest through significant brand recognition paired with in-store advertising reinforces immediate possession needs deepening footfall volume into outlets.

- Furthermore, the online channel is expected to grow at a CAGR of 4.9% during the forecast period driven by evolving consumer preferences and the ongoing digital transformation in the retail landscape. The convenience of exploring an extensive range of products, accessing comprehensive specifications, and comparing prices seamlessly from the comfort of home has significantly fueled the growth of online sales. Moreover, the rapid expansion of e-commerce platforms, the implementation of direct-to-consumer brand strategies, and the integration of augmented reality (AR) technology for virtual try-ons have further elevated the online shopping experience, making it increasingly personalized, interactive, and efficient.

Looking for region specific data?

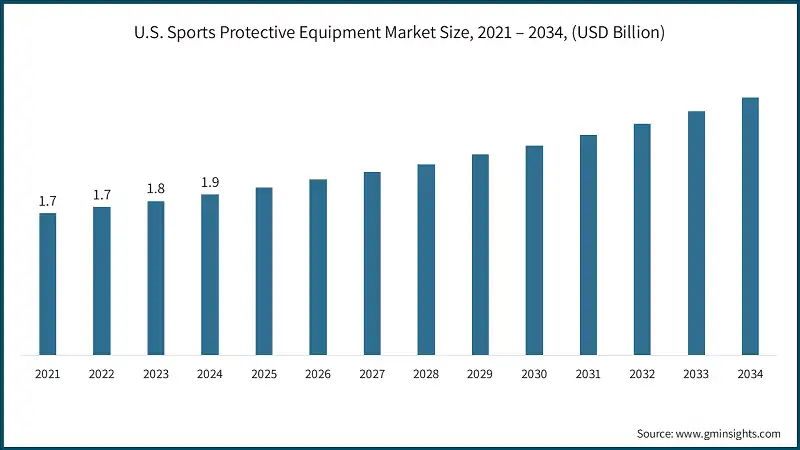

The U.S. dominates an overall North America sports protective equipment market and valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 4.7% from 2025 to 2034.

- The U.S. market for protective equipment in sports dominates North America due to the country’s vigorous sporting culture, high rates of organized and recreational participation, and strict safety enforcement at the school, collegiate, and professional levels. The active youth and amateur sports programs as well as major leagues NFL, NHL, and MLB create a continual need for quality sport-specific protective equipment. Increased sophistication of retail outlets makes protective sports gear readily available. Considerable awareness of safety issues associated with the sporting activities alongside continuous innovations also advances the market offer.

The sports protective equipment market in Europe, Germany is expected to experience significant and promising growth from 2025 to 2034.

- The market in Germany is anticipated to grow significantly with demand driven by higher participation in organized sports and fitness as well as outdoor activities. The German sporting heritage in football, cycling, winter sports, and handball continues to drive the need for more sophisticated protective equipment. There are increasing efforts regarding injury prevention among youth and amateur athletes along with improving sports facilities and school-level sports programs which further expands opportunities for the market. In addition, stringent requirements of Germany on quality and safety of products coupled with presence of international and local manufacturers of sport goods enhance Germany's mounting role within European market for sports protective equipment.

The Asia Pacific dominated the sports protective equipment market, with China accounting for 42% market share in 2024 and is anticipated to grow at a CAGR of 4.5% from 2025 to 2034.

- The expansion is fueled by its large and increasingly health-conscious population. In China, the market growth is supplemented by rising participation in sports, accelerating urbanization, expanding government policies aimed at physical education and sports infrastructure development like the “Healthy China 2030” initiative. Moreover, growing disposable incomes, expansion of protective gear among school and youth athletic programs, and an emerging enthusiasm for Western sports such as basketball, football, and cycling are heightened. A robust domestic manufacturing backbone along with expanding retail infrastructure both e-commerce and brick-and-mortar further strengthens China’s dominance as well as projected growth.

In the Middle East and Africa sports protective equipment market, South Africa held 32% market share in 2024 and is anticipated to grow at a CAGR of 3.1% from 2025 to 2034.

- The country’s active participation in high-impact sports such as rugby, football, cricket, and hockey that require protective equipment is the major driver of this growth. Increased concern over injuries related to sporting activities alongside investment at the community level, as well as expanding school and university sports programs are supporting heightened demand. In addition, an emerging middle class with increased discretionary spending along with a growing focus on health is driving youth sports participation which is further fueling demand for quality protective equipment in urban and semi-urban centers.

Sports Protective Equipment Market Share

- In 2024, dominant market players, including Adidas AG, Nike, Inc., Amer Sports, BRG Sports and Under Armour Inc., collectively hold around 25% market share. These firms focus their efforts on research and development which allows them to introduce protective gears that smartly incorporate advanced technologies and sustainable materials while simultaneously offering top tier performance, safety, endurance, and comfort.

- Mergers and acquisitions, global facility expansions, sponsorships, as well as innovative partnerships are all aggressive strategic initiatives these companies pursue to diversify their products and penetrate new markets.

- The strong brand equity, global distribution channels, marketing campaigns that this industry leaders possess are not only sufficient for maintaining a competitive advantage but also allow the companies to shape consumer preferences and set market benchmarks in sports protective equipment.

- Amer Sports business areas include manufacturing and marketing protective equipment for skiing, snowboarding, cycling, running, hiking, climbing, watersports as well as team sports.

- Nike Inc. also produces and sells sports protective equipment such as helmets and guards, braces, compression garments as well as pads and sleeves of varying complexity for all age groups. These products are engineered using advanced technologies and materials to ensure full protection while preserving ease of movement.

Sports Protective Equipment Market Companies

Major players operating in the sports protective equipment industry include:

- Adidas

- Amer Sports

- Bauer Hockey

- BRG Sports

- McDavid

- Mizuno

- Nike

- Puma

- Harrow Sports

- Rawlings Sporting Goods

- Schutt Sports

- Shock Doctor

- Under Armour

- Warrior Sports

- Warrix

BRG Sports has built a strong reputation in the sports industry with well-known brands like Riddell and Bell. The company is at the forefront of football and cycling safety, due to its commitment to integrating advanced impact monitoring systems and innovative smart helmet technologies. By prioritizing athlete safety and adhering to league standards, BRG Sports positions itself as a trusted partner in high-impact sports. Their continuous focus on technological advancements keeps them ahead in the market.

McDavid, Inc. focuses on enhancing athlete performance through its range of compression and support gear. Drawing on insights from biomechanical research, McDavid designs braces and sleeves that not only prevent injuries but also aid in recovery. This emphasis on injury prevention and rehabilitation has made McDavid a popular brand for athletes who prioritize optimizing their performance while ensuring their safety.

Sports Protective Equipment Industry News

- In April 2025, Riddell significantly strengthened its foothold in the football equipment market by acquiring assets from Xenith, a prominent competitor. This strategic move not only enhances Riddell's technological capabilities but also diversifies its product portfolio, reinforcing its leadership in protective equipment innovation within the competitive football segment.

- In January 2025, The Denver Broncos launched the groundbreaking "All In. All Covered." initiative, providing over 15,000 Riddell Axiom smart helmets to 277 high schools across Colorado at no cost. This USD 12 million investment represents the largest community-focused contribution in the franchise's history, highlighting their unwavering commitment to advancing youth sports safety.

- In 2024, Bauer Hockey expanded its partnership with Hockey Canada by becoming the official team apparel partner while continuing to supply critical protective equipment, including helmets, visors, face masks, neck guards, and gloves, for national teams. This enhanced three-year agreement extends through the 2026 Olympic and Paralympic Winter Games, further solidifying Bauer Hockey's role in supporting elite athletes.

- In June 2024, Under Armour, Inc. entered a partnership with the USA Football Team as the official and exclusive outfitter for its national teams. The company will provide premium performance gear and protective equipment, focusing on improving player safety and performance. This collaboration ensures athletes are equipped with advanced protective gear for training and competitions.

- In October 2023, FORM released Smart Swim Goggles which are allowed in the World Triathlon Competition after review from the World Triathlon Technical Committee.

- In April 2023, Vicis released a new line of football helmet, the Zero2 Matrix QB Helmet which is designed to reduce the risk of concussions.

The sports protective equipment market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Protective eyewear

- Goggles

- Eye shield

- Face protection & mouth guards

- Helmets & other headgear

- Shoulder guards

- Shin guards

- Knee pads

- Others (chest protector, arm guard, spinal vest, gloves, jockstrap, neck guards, etc.)

Market, By Usage

- Professional

- Non-professional

Market, By Price Range

- Low (<25$)

- Mid (25$-50$)

- High (>50$)

Market, By Consumer Group

- Men

- Women

- Kids

Market, By Sport

- Ball based sports

- Volleyball

- Football

- Handball

- Basketball

- Others (rugby, baseball, etc.)

- Racing sports

- Horse riding

- Auto racing

- Bike racing

- Cycling

- Others (formula racing, bull racing, etc.)

- Water based sports

- Swimming

- Diving

- Surfing

- Sailing

- Others (kayaking, snorkeling, etc.)

- Skating

- Skiing

- Cricket

- Hockey

- Others (tennis, martial arts, fencing, baseball, horse racing, etc.)

Market, By Distribution channel

- Online channels

- E-commerce

- Company websites

- Offline channels

- Specialty stores

- Mega retail stores

- Others (departmental stores, individual stores, club stores. etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the sports protective equipment market?

Key players include Adidas, Amer Sports, Bauer Hockey, BRG Sports, McDavid, Mizuno, Nike, Puma, Harrow Sports, Rawlings Sporting Goods, Schutt Sports, and Shock Doctor.

What is the growth outlook for the offline distribution channel from 2025 to 2034?

The offline distribution channel is projected to grow at a CAGR of 4.6% from 2025 to 2034, maintaining its dominance in the market.

Which region leads the sports protective equipment market?

The U.S. leads the North American market, valued at USD 1.9 billion in 2024, with a projected CAGR of 4.7% from 2025 to 2034.

What are the upcoming trends in the sports protective equipment industry?

Trends include the adoption of smart technologies such as sensors and impact monitoring systems, real-time analytics for injury prevention, and the development of cloud-based performance evaluation tools.

What was the market share of the non-professional user segment in 2024?

The non-professional user segment held a 62.4% market share in 2024 and is anticipated to grow at a CAGR of 4.6% from 2025 to 2034.

How much revenue did the helmets and headgear segment generate in 2024?

The helmets and headgear segment generated approximately USD 2.5 billion in revenue in 2024, dominating the product type category.

What is the market size of the sports protective equipment in 2024?

The market size was valued at USD 8.7 billion in 2024, with a CAGR of 4.7% expected through 2034. The growth is driven by increasing awareness of sports safety and the integration of smart technologies into protective gear.

What is the projected value of the sports protective equipment market by 2034?

The market is projected to reach USD 13.8 billion by 2034, fueled by advancements in smart protective equipment and rising participation in sports activities globally.

What is the projected size of the sports protective equipment market in 2025?

The market is expected to reach USD 9.1 billion in 2025.

Sports Protective Equipment Market Scope

Related Reports