Summary

Table of Content

Road Haulage Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Road Haulage Market Size

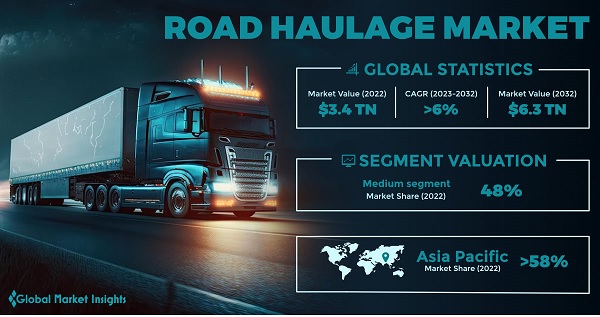

Road Haulage Market size was valued at USD 3.4 trillion in 2022 and is anticipated to register a CAGR of over 6% between 2023 and 2032, propelled by freight transportation, which serves as the backbone of the supply chain. The need for the efficient movement of goods, driven by e-commerce, manufacturing, and global trade, has led to increased reliance on trucking services. Innovations in technology, logistics optimization, and the need for just-in-time deliveries are further boosting industry growth. As a result, road haulage remains a pivotal force in the transportation of goods as it sustains economic activity and trade around the globe.

To get key market trends

The road haulage market growth is being led by the expansion in logistics & distribution networks. Efficient transportation will be crucial as supply chains become increasingly complex. The rise in e-commerce, rapid urbanization, and globalization are necessitating timely & widespread deliveries, elevating the importance of trucking services. To meet these demands, the industry is adopting advanced technologies, route optimization, and warehousing solutions. These developments make road haulage integral to modern logistics, underpinning the global movement of goods and facilitating economic growth.

Road Haulage Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 3.4 Trillion |

| Forecast Period 2023 to 2032 CAGR | 6% |

| Market Size in 2032 | USD 6.3 Trillion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

A critical challenge facing the road haulage market is the shortage of qualified truck drivers. Factors contributing to this shortage include an aging workforce, limited interest among younger individuals in pursuing trucking careers, and stringent regulatory requirements for obtaining commercial driver licenses. As the demand for freight transportation grows, the shortage will exert upward pressure on driver wages and lead to capacity constraints, potentially hindering the industry's ability to meet the increasing demand for transportation services.

COVID-19 Impact

The COVID-19 pandemic had significant impacts on the road haulage market. Lockdowns, supply chain disruptions, and reduced economic activities led to the initial decrease in demand for transportation services. However, as the pandemic evolved, the industry played a critical role in delivering essential goods such as medical supplies and food. It also faced challenges such as driver safety concerns and changing regulations. The pandemic highlighted the industry’s resilience and adaptability in responding to unforeseen challenges.

Road Haulage Market Trends

Technological advancements in telematics are providing lucrative growth opportunities in the road haulage industry. Telematics innovations, such as GPS tracking, real-time data analytics, and IoT integration, are enhancing efficient route planning, vehicle maintenance, and driver management.

For instance, in March 2023, Trimble launched a groundbreaking addition to its mobility telematics portfolio, Trimble Fleet Manager. It is an inaugural back-office fleet management solution that can introduce industry-specific average dwell time metrics. This invaluable data equips fleet operators with the means to enhance their planning processes, bolster adherence to the Service Level Agreements (SLAs) and optimize the utilization of their assets & drivers for greater efficiency. As the road haulage market adopts these technologies, it will gain a competitive edge, attract new opportunities, and witness sustained growth in an increasingly digitalized & data-driven landscape.

Road Haulage Market Analysis

Learn more about the key segments shaping this market

Based on type, the domestic segment held major road haulage market share in 2022. The substantial volume of goods transported nationwide is a crucial factor driving the domestic segment growth. Domestic road haulage services are poised to play a pivotal role as the demand for the movement of goods within a country continues to surge.

According to the Domestic Road Freight Statistics Report of the UK government, 1.65 billion tons of goods were lifted, 178 billion tons of goods were moved, and 19.7 billion kilometers were covered by heavy goods vehicles between 2021 Q3 to 2022 Q2. Furthermore, this segment benefits from the need for efficient & reliable transportation solutions by businesses and consumers alike, propelling segment growth and augmenting its prominence in meeting the ever-expanding logistical requirements of a nation.

Learn more about the key segments shaping this market

The medium segment accounted for 48% of the road haulage market share in 2022. The escalating volume of global trade is a major catalyst propelling the use of heavy vehicles in the market. These vehicles are instrumental in the transportation of goods to & from ports, airports, and distribution centers, thereby facilitating international trade flows. As global trade continues to expand, the demand for the efficient movement of cargo across vast distances will grow, driving the utilization of heavy vehicles. Their capacity, adaptability, and ability to connect various modes of transportation make them indispensable in supporting the global supply chain.

Looking for region specific data?

Asia Pacific road haulage market recorded around 58% of revenue share in 2022. Collaborative initiatives among Asian countries to improve road networks are bolstering the market growth. These partnerships focus on enhancing remote area connectivity & infrastructure, thereby facilitating the efficient movement of goods within the region.

For instance, in July 2023, the Ministry of Road Transport & Highways (MoRTH), in association with the Japan International Cooperation Agency (JICA), took a significant stride in enhancing the infrastructure of mountainous roads in India. The objective is to establish a foundation for top-notch & enduring road initiatives in hilly areas. As part of this effort, five comprehensive guidelines have been finalized to ensure the quality & sustainability of road projects in these challenging terrains.

Road Haulage Market Share

Major companies operating in the road haulage market are:

- UPS Freight

- FedEx Freight

- DHL Freight

- XPO Logistics

- C.H. Robinson

- J.B. Hunt Transport Services

- Schneider National

These companies are focused on strategic partnerships, new product launches, and commercialization efforts for market expansion. They are also heavily investing in research to introduce innovative products and garner the maximum market revenue.

Road Haulage Industry News

- In June 2021, Volvo Trucks India, a subsidiary of VE Commercial Vehicles Ltd (VECV), launched six heavy-duty trucks in the FM & FMX series for the Indian market. These newly launched trucks can be purchased nationwide and are produced at the Volvo Trucks manufacturing facility, located in Hoskote, near Bengaluru (India).

The road haulage market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) from 2018 to 2032, for the following segments:

Market, By Type

- Domestic

- International

Market, By Vehicle

- Heavy

- Medium

- Light

Market, By End-user

- Automotive

- Manufacturing

- Healthcare

- Retail

- Food Beverages

- Mining & Construction

- Oil & Gas

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Russia

- Netherlands

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Question(FAQ) :

Who are the key road haulage industry players?

UPS Freight, FedEx Freight, DHL Freight, XPO Logistics, C.H. Robinson, J.B. Hunt Transport Services, and Schneider National are some of the major road haulage companies worldwide.

What factors are influencing road haulage market growth in Asia Pacific?

Asia Pacific recorded more than 58% of the market share in 2022, owing to the growing number of partnerships focusing on enhancing the remote area connectivity & infrastructure in the region.

How big is the road haulage market?

The market size of road haulage reached USD 3.4 trillion in 2022 and is set to register over 6% CAGR from 2023 to 2032, due to the increasing need for the efficient movement of goods, driven by rising e-commerce, manufacturers, and international trades worldwide.

How are medium vehicles contributing to road haulage industry growth?

The medium vehicle segment held over 48% of the market share in 2022, owing to the need for facilitating international trade flows through transportation of goods to & from ports, airports, and distribution centers.

Road Haulage Market Scope

Related Reports