Summary

Table of Content

Private LTE Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Private LTE Market Size

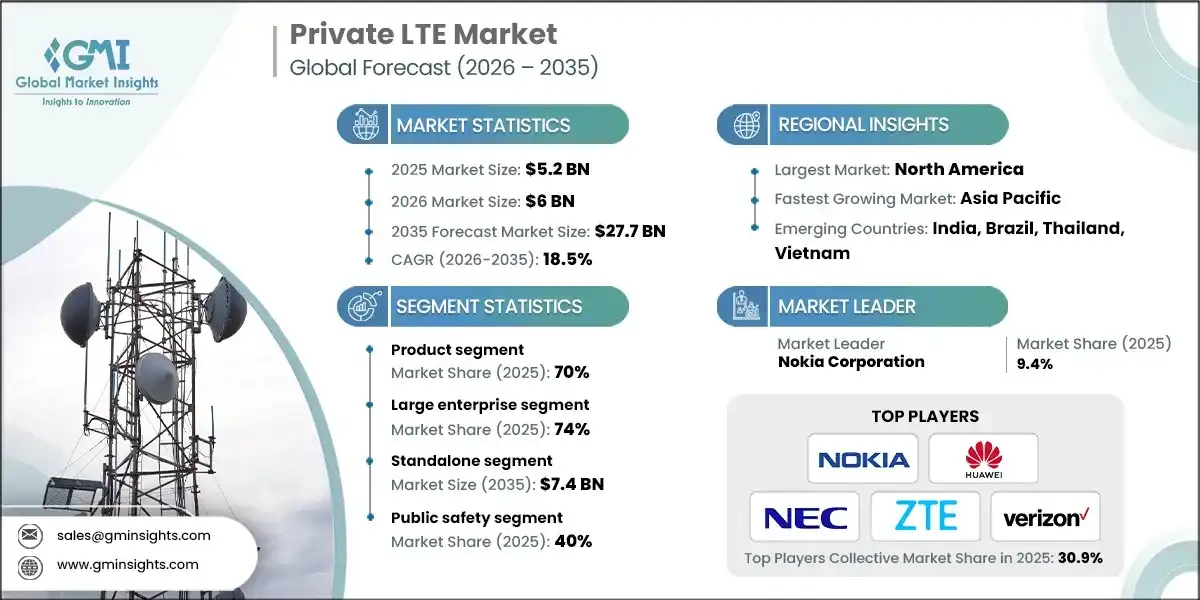

The global private LTE market was estimated at USD 5.2 billion in 2025. The market is expected to grow from USD 6 billion in 2026 to USD 27.7 billion in 2035, at a CAGR of 18.5% according to latest report published by Global Market Insights Inc.

To get key market trends

Industrial automation, robotics & real-time monitoring continue to advance towards deterministic and high-reliability wireless networks. The demand for scalable networks will continue to increase with the ongoing massive iot growth in factories, utilities, logistics and energy. Private LTE has an established infrastructure-world of work will provide high quality of service (QoS) and mobility management.

The availability of shared spectrum frameworks and localized licensing will continue to lower barriers to entry for enterprises, particularly small and midsize enterprises (sme) who will be enabled to deploy affordable private lte without having to depend solely on traditional mobile network operators.

Industry 4.0 initiatives are accelerating investment in connectivity - private lte is quickly becoming the technology of choice to support automation, predictive maintenance, proven mobile workforce enabling and edge driven operational intelligence.

Enterprise consideration and concerns related to cyber security, sovereignty and data protection, private LTE will provide the complete management and control of network traffic, access policies and data processing on the premises to meet regulatory compliance requirements.

Global private LTE deployment across 47 factories by the world's leading automotive manufacturer, which will enable automatic vehicle operation, robotic operation, and real-time quality assurance and augmented reality-based maintenance applications for digital industrial operations.

Huawei has launched its Mining Intelligence platform, which combines private LTE, edge computing, and AI to provide solutions for autonomous haulage, remote control of equipment, and predictive maintenance in underground and open-pit mining environments.

Private LTE Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.2 Billion |

| Market Size in 2026 | USD 6 Billion |

| Forecast Period 2026-2035 CAGR | 18.5% |

| Market Size in 2035 | USD 27.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Industrial Automation Demand | Industries adopting robotics, sensors, and digital workflows require reliable, low-latency connectivity. Private LTE enables deterministic performance, boosting productivity, reducing downtime, and accelerating Industry 4.0 modernization across manufacturing, utilities, and logistics. |

| Expansion of IoT and Connected Assets | Rising IoT device density increases the need for scalable, secure wireless networks. Private LTE supports high-capacity, mobility-rich environments, enabling efficient asset tracking, monitoring, and real-time decision-making across complex industrial operations. |

| Increasing Data Security and Sovereignty Requirements | Organizations seek greater control over data flows and network policies. Private LTE offers on-premises management and strong encryption, enhancing cybersecurity compliance and reducing risks associated with public network exposure. |

| Growing Adoption of Shared and Localized Spectrum | Shared and lightly licensed spectrum models lower cost barriers and simplify deployments. This expands private LTE accessibility for SMEs and accelerates adoption in regions with flexible regulatory frameworks. |

| Rising Need for Reliable Connectivity in Remote Sites | Mining, oil & gas, utilities, and transport sectors require resilient communication in hard-to-connect areas. Private LTE delivers wide coverage and mission-critical reliability, enabling safer, more efficient remote operations. |

| Pitfalls & Challenges | Impact |

| High Initial Deployment and Integration Costs | Infrastructure, integration, and spectrum planning can be costly. These upfront investments slow adoption, particularly among SMEs, limiting near-term scalability of private LTE deployments despite long-term operational benefits. |

| Spectrum Availability and Regulatory Complexity | Access to licensed or shared spectrum varies widely across regions. Regulatory limitations and fragmented policies hinder deployment flexibility, delaying projects and restricting market growth in spectrum-constrained geographies. |

| Opportunities: | Impact |

| Expansion Across Industrial IoT Ecosystems | As industries scale connected devices, private LTE becomes central for reliable, secure IoT operations. This creates significant opportunities for vendors offering optimized hardware, platforms, and integrated connectivity solutions. |

| Growth of Managed and Hosted Network Models | Operators and integrators offering turnkey, subscription-based private LTE reduce complexity and cost. This enables broader adoption, especially among SMEs lacking technical expertise or CapEx capacity. |

| Operators and integrators offering turnkey, subscription-based private LTE reduce complexity and cost. This enables broader adoption, especially among SMEs lacking technical expertise or CapEx capacity. | Private LTE combined with edge platforms supports real-time analytics, automation, and intelligent control systems. This accelerates advanced use cases such as predictive maintenance, autonomous vehicles, and smart manufacturing. |

| Adoption in Smart Cities and Public Infrastructure | Smart lighting, surveillance, transport, and emergency response systems require secure, high-reliability networks. Private LTE provides consistent performance, creating substantial growth opportunities in public-sector modernization initiatives. |

| Market Leaders (2025) | |

| Market Leaders |

9.4% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Thailand, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Private LTE Market Trends

Private LTE is also being combined with public networks to create a hybrid model for Mission-Critical areas. The hybrid model offers improved redundancy, coverage flexibility and seamless roaming.

More organizations deploy LTE networks with architecture that enable upgrades for future 5G technologies. Equipment manufacturers are developing LTE networks with a smooth transition path to 5G technology and spectrum.

Global businesses are moving towards a model of using managed private lte through telecommunications providers and cloud partners rather than owning their networks. This allows companies to decrease the complexity of network deployment, while providing a connectivity model that is opex-driven and scalable.

More companies and service providers are offering a complete, subscription-based, private LTE solution which is easier to install, and allows many small and non-technical companies or groups to buy them.

Companies are implementing private LTE in conjunction with either an on-premises or cloud-based service to allow for low latency applications that provide services like Industrial Automation, AI analytics and RealTime video intelligence.

With the integration of private LTE and edge computing, as well as artificial intelligence (ai), organizations can automate low latency industrial processes, predictive maintenance, and real-time analytics, thus driving digital transformation in manufacturing, transportation and logistics, utility management.

In many cases organizations are combining private lte (for mission critical sites) with public networks, to have a unified mobility solution. By employing hybrid architectures organizations have increased resiliency, reduced costs, and provided unified connectivity strategies across distributed locations.

The U.S. Federal Communications Commission (FCC) has updated its rules with respect to Citizens Broadband Radio Service (CBRS) to further simplify private lte deployment for industrial users through greater spectrum flexibility and fewer administrative barriers, while maintaining the shared-spectrum model.

Private LTE Market Analysis

Learn more about the key segments shaping this market

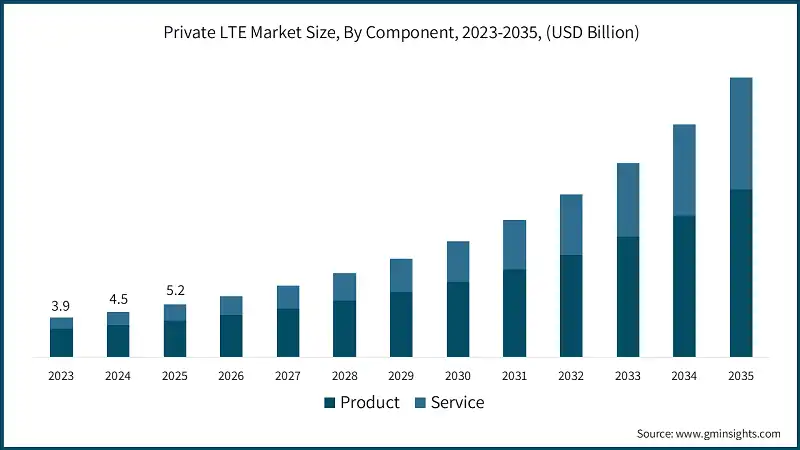

Based on component, market is segmented into product and service. The product segment dominates the market with 70% share in 2025, and the segment is expected to reach USD 16.6 billion in 2035.

- Private LTE is being adopted by a growing number of organizations around the world due to the need for secure, high-performance wireless networks that support automation, IoT, and mission-critical operations. Private LTE provides reliable coverage and controlled data environments; thus, it is generating significant interest across many industries.

- Deployment of private LTE is being driven by an increase in the availability of shared spectrum, as well as the rise of digital transformation initiatives and an increasing reliance upon mobile workflows within industrial settings. As a result, both large enterprises and small and medium-sized businesses are using private LTE solutions that are scalable and cost effective.

- The ecosystem is moving towards managed and hosted private LTE, hybrid models, as well as integration of edge computing and artificial intelligence. These developments create a greater level of flexibility, reduce complexity, and create an environment for advanced industrial intelligence and automation.

- As a growing number of global service providers and vendors enter the enterprise market for private LTE solutions, competition for market share is increasing. Vendors such as Nokia, Huawei, NEC, ZTE, and Verizon are enhancing their capabilities through partnerships, industry specific products, and comprehensive portfolios of private wireless solutions.

Learn more about the key segments shaping this market

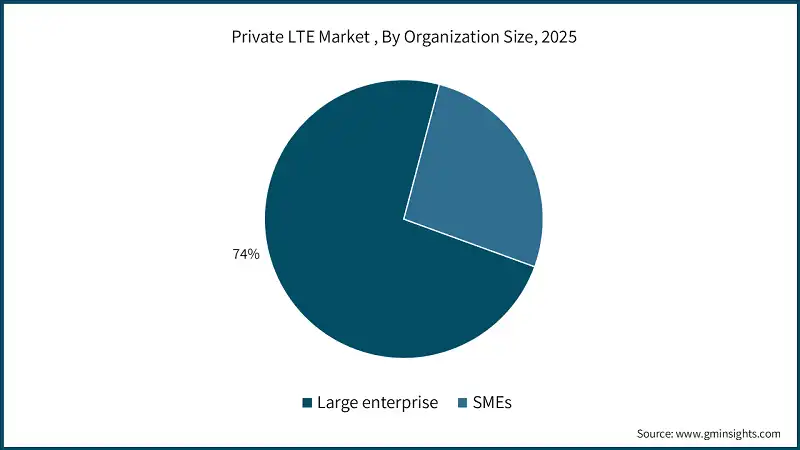

Based on organization size, the market is bifurcated into large enterprise and SMEs. The large enterprise segment dominates with 74% market share in 2025 and is estimated to reach USD 15.7 Billion by 2035.

- Larger businesses base most Private LTE rollouts due to scale and sophistication within Technology (IT/IS), extensive multi-site use of Private LTE, and the financial capability to purchase and utilize a Licensed Spectrum to build large-scale Private LTE infrastructure around the world.

- SMEs have experienced rapid growth of it because new spectrum-sharing initiatives to purchase equipment with affordable prices and the availability of managed services now allow for potentially lower barriers of entry into the world of Private LTE.

- The rise of shared spectrum enables the end-user to deploy LTE for cheaper purposes, such as automating business processes and monitoring the physical security of facilities and organizational connectivity of targeted applications in specific industries.

Based on network model, the market is segmented into standalone, hybrid, and managed/hosted architectures, each addressing different organizational requirements, operational contexts, and business preferences. The standalone segment dominates with 44% market share in 2025 and is anticipated to reach USD 7.4 billion by 2035.

- Enterprises are increasingly opting for standalone private LTE networks due to their ability to provide complete control, customization and data sovereignty; however, adoption is still limited to the larger organizations and mission-critical sectors (for example, military, health, etc.) who can afford the high capital, spectrum and operational expertise required.

- Hybrid networks are growing rapidly as they combine the best of both the dedicated private infrastructure and public networks; thus, allowing distributed industries access to relatively inexpensive wide-area coverage via advances in network slicing and seamless mobility between private and public domains.

- Managed private LTE networks are the fastest growing segment as Enterprises shift to service-based models, which offer a lower-cost, less complex deployment option. Managed providers have the expertise, resources, infrastructure and experience to successfully deploy and scale private LTE networks; therefore, they are ideal for small to medium sized enterprises who are unable to invest in the capital cost or operational complexity associated with building their own network.

Based on application, the private LTE market is divided into public safety, defense, mining, transportation, energy, manufacturing and others. Public safety segment held a market share of 40% in 2025 and is projected to grow at a CAGR of 15.3% from 2026 to 2035.

- Private LTE adoption is being led by the public safety sector's demand for mission-critical and highly dependent communication services that require high reliability and high availability.

- Because of the growth of public safety agencies looking to improve their ability to monitor and react to emergencies and recover from disasters has led many government entities to deploy LTE networks supporting the delivery of video, real-time data, and the facilitation of the coordinated response to an emergency. These agencies are modernizing their capabilities to replace their outdated (and often inefficient) radio systems and use private LTE to create new emergency operating procedures.

- Because of increased demand by defense organizations for secure, sovereign communications to support military missions, military bases, and training, they are starting to utilize Private networks to accomplish these objectives. The combination of using Private LTE, which provides an extremely high level of security, will provide defense organizations with the ability to deploy within a short time frame and be independent of commercial (i.e., public) networks, therefore creating a sustainable solution to maintain resilient military connectivity.

- Mining companies have adopted LTE networks to create automated environments, including automating the use of autonomous vehicles and providing the ability to control remote mine equipment and monitoring safety systems. This increased interest in implementing in mining is reflective of the industry's desire to modernize how they operate, improve productivity, and have access to reliable communication capabilities in remote areas where they do not have access to public telecommunication services.

- Transportation encompasses multiple industries (i.e., ports, railways, and logistics), but all of these transportation industries use LTE for automation, coordination, and safety of operations. The increase in these transportation applications is representative of how industries are modernizing and digitizing their operations and introducing autonomous systems into their operations and transportation infrastructures globally.

Looking for region specific data?

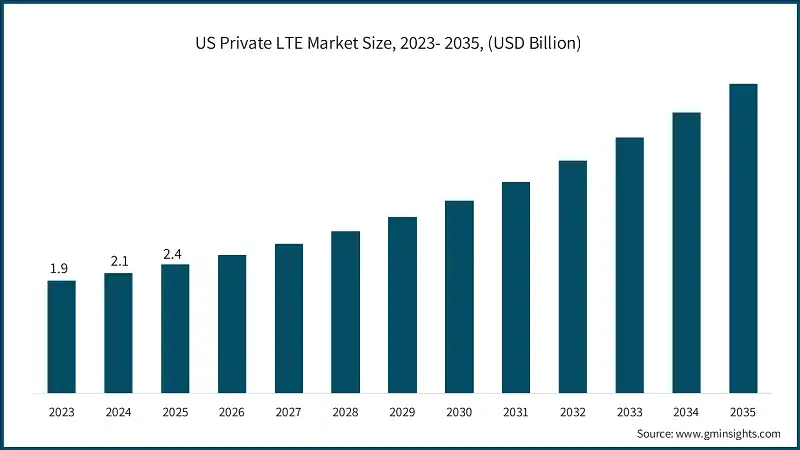

The private LTE market in US is valued at USD 2.4 billion in 2025 and is expected to experience significant and promising growth from 2026 to 2035.

- The adoption of private LTE is an ongoing effort to accelerate through new access to spectrum via CBRS (Citizens Broadband Radio Service), making it easier for businesses to create customized networks without going through the spectrum auction process. Shared-spectrum access allows for the increased participation of small and medium-sized enterprises (SMEs), along with innovation within the manufacturing, logistics, healthcare and utility sectors.

- The integration of Private LTE has also been increased within industrial automation platforms as companies are looking for resilient connectivity with their robots; automated guided vehicles; digital twins; and real-time monitoring products. The convergence of private LTE and edge computing creates a more viable solution by providing lower latency, secure on-premises processing.

- A significant increase in public–private partnerships will also contribute to the growth of investment in the modernization of Mission Critical Communications through the transition of legacy LMR (Land Mobile Radio) Systems to broadband-capable Private LTE systems that can provide Video, Situational Awareness and Emergency Response Coordination between State and Local Agencies.

- Mobile operators are expanding their offerings in the enterprise segment by offering Hybrid Model offerings that combine the use of licensed spectrum performance as well as CBRS deployable technology. There is a large demand for Managed Private LTE services that provide a predictable cost structure and simplified deployment process for organizations that do not have technical capabilities.

North America region in the private LTE market held a market revenue USD 2.7 Billion in 2025 and is anticipated to grow at a CAGR of 15.9% during 2026 to 2035.

- Various industrial sectors within North America have adopted private LTE for the purpose of increasing the resiliency of their operations, particularly those sectors involved in the energy, utility, and mining industries. Rugged environments are creating demand for highly reliable wireless solutions that support automation, remote operation, and worker safety.

- Regulators in Canada are encouraging experimentation with private networks through flexible spectrum access frameworks. Flexible spectrum access frameworks are particularly beneficial to projects in rural/industrial/public sector areas that have no reliable commercial coverage, or in those projects that are using legacy radio systems.

- Transportation facilities and cross-border logistics are increasingly investing in private LTE for asset tracking, terminal automation, and fleet coordination. Harmonized standards will allow for greater efficiency and interoperability of multi-sites across a wide area.

- There is a growing push towards cybersecurity in the enterprise, leading companies to invest in dedicated Private LTE, to segregate their operational technology environments from the internet, reducing the potential for ransomware and supply-chain threats.

Europe private LTE market accounted for USD 1.5 billion in 2025 and is anticipated to show growth of 19.7% CAGR over the forecast period.

- Local spectrum band licensing is available widely, enabling EU organizations to access private LTE technology and develop a secure means of managing their data through Private LTE networks. Industrial 4.0 is fast-tracking the adoption of Private LTE technology within industrial sectors such as manufacturing, automotive, and process industry (e.g., petrochemical).

- Legislative support for campus networks has fostered innovative development and a growing use of LTE technologies with respect to localized wireless networks within factories, ports, and research facilities that require deterministic wireless performance for industrial applications such as robotics, automation, and safety critical applications.

- Enterprise users integrate their Private LTE networks with their Energy Efficiency and Sustainability objectives, which allow them to optimize their Asset Usage, implement Predictive Maintenance and minimize Downtime, as part of their Decarbonization Strategic Investigations.

- The growing collaboration between network operators, equipment vendors and industrial customers will continue to strengthen the Ecosystem Maturity of Private LTE, leading to an increase in plug-and-play solutions designed specifically for mid-sized industrial enterprises, with simple deployment and lifecycle management capabilities.

Germany dominates the Europe private LTE market, showcasing strong growth potential, with a CAGR of 20.2% from 2026 to 2035.

- Germany has implemented a campus license framework in the frequency range of 3.7–3.8 GHz that has been essential to the growth of networks and has enabled manufacturers to create completely managed industrial networks that support the development of smart factories, robotics, and advanced automated solutions that align with the goals set forth by Industrie 4.0.

- The automotive and mechanical engineering sectors are using private LTE for the synchronization of production lines, autonomous transport systems, and high-precision machine coordination requiring ultra-reliable wireless capabilities, tight latency requirements, thus making them a target sector for LTE networks.

- They also being utilized by heavy industry (e.g., Manufacturing, Oil & Gas, Mining) and logistics facilities to improve the visibility of their supply chains by using technologically advanced methods to combine wireless equipment, digital twins, and real-time analytics to create greater stability and improve productivity.

- The increasing integration of these networks with edge computing will accelerate on-premise processing through secure data transfer that meets Germany’s stringent requirements regarding privacy, cybersecurity, and industrial compliance.

Asia Pacific region leads the private LTE market, exhibiting remarkable growth of 22.7% during the forecast period of 2026 to 2035.

- Numerous countries in the Asia/Pacific (APAC) region have recently seen a significant increase in the deployment of private LTE networks to support manufacturing automation, the use of robotics, and the evolution of "smart factories." This trend is especially visible in South Korea and Japan, as well as various industrial hubs located in Southeast Asia.

- Governments throughout the APAC region are working to stimulate the growth of private wireless usage by implementing a variety of programs that promote the use of private LTE networks. These initiatives include spectrum liberalization and the establishment of various incentive programs for "smart industry" and national digital economic growth, thereby providing a foundation for a rich participation of enterprise investment with ports, airports, and various transportation corridors.

- The expanding size of the mining, energy, and agricultural sectors has created demand for private LTE to provide reliable coverage in remote, rugged areas where the availability of public networks is limited or non-existent. To address this need, telecom operators are partnering with cloud service providers to deliver managed networks that offer SMEs a low-complexity solution with subscription-based pricing options and seamless integration into their current digital platforms and enterprise applications.

China to experience substantial growth in the Asia Pacific private LTE market in 2025. The market in China is expected to reach USD 3.1 billion by 2035.

- Government actions have significantly boosted the use of private lte in large deployments, such as manufacturing, ports, utilities and transport. The priority of the government to support national transformation while building a high-performance wireless infrastructure is driving many companies to adopt this technology.

- As state-owned enterprises continue to implement LTE to secure their operations, process data on-premises, and maintain local control, the reliance on commercial networks will continue to decrease, helping to ensure critical workloads operate without interruption.

- Integrating these networks with AI-driven automation will be a major drive for factories to adopt and grow applications such as predictive maintenance, autonomous coordination of equipment, and real-time quality inspections. Vendors are also developing integrated edge solutions optimized for rapid deployment, allowing for large-scale deployment of dense device environments, digital twins, and industrial analytics on large-scale production ecosystems.

Latin America private LTE market is valued at USD 309.1 million in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- Companies are adopting private LTE as a viable alternative to public networks with limited reliability. This is particularly true for large industries (such as mining and energy) that require secure wireless access across remote areas or where there is no existing infrastructure.

- The government is considering shared spectrum frameworks to reduce the obstacles associated with deploying this technology so that more small-medium enterprises can use LTE as a means of transforming their digital capabilities across the industrial cluster.

- Transportation Hubs (Ports/Airports) are turning to LTE as a means of automating processes, providing better insight into operations, tracking cargo, and facilitating mission-critical communications as the volume of trade continues to increase in the region.

- Managed services are on the rise, as companies are looking for ways to minimize their up-front investment and create predictable ongoing operational costs by delivering them through a vendor-managed connectivity model, as well as having limited access to technical resources within their company.

MEA is valued at USD 241.7 million in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- Government institutions from across the MEA region are making high priority investments into the rollout of LTE networks, which will modernize and increase reliability and safety in utility, oil & gas public safety & Industrial Programs at a National level.

- Industries in energy and extraction are deploying them to provide remote access to operations, secure their workers, and continuously collect, monitor and improve the status of their operations, replacing older radio systems that have been utilized in deserts, offshore drilling, and extremely harsh environments such as mining.

- Mega-projects and smart-city initiatives in major Gulf area economies are developing and implementing private deployments. These networks will provide connected infrastructure, enable testing of autonomous mobility and support IoT scale deployment for National digital transformation goals.

- The improved availability of managed/unmanaged and hybrid private LTE alternatives are enabling organizations with limited skill sets to quickly adopt and implement reliable enterprise grade wireless solutions, creating interest from logistics, manufacturing and education.

Private LTE Market Share

The top 7 companies in the private LTE industry are Nokia Corporation, Huawei Technologies Co., Ltd., ZTE Corporation, Cisco Systems, Inc., Samsung Electronics Co. Ltd., Verizon and NEC Corporation contributed around 36.9% of the market in 2025.

- Nokia corporation has established a dominant position within the private lte sector thanks to its extensive experience and knowledge base in infrastructure, an emphasis on industrial needs, and a complete solution offering for the entire ecosystem of ran, core, management platforms, and turn-key services to meet the mission critical needs of enterprise clients.

- Huawei technologies offers comprehensive private lte solutions with strong research and development capabilities and cost competitive pricing. In addition, huawei maintains its leadership position within the apac region and developing markets despite being hindered from accessing certain western markets due to regulatory restrictions.

- NEC corporation offers distinctive capabilities through its system integration expertise, significant experience with public safety projects, and custom-built private LTE solutions. The company's focus is primarily on mission critical networks and solutions used for transportation systems, health services, and government communications, as well as networks that need high levels of reliability and customized design.

- ZTE corporation significant growth in popularity across the Asia-pacific region and developing markets can be attributed to providing affordable private LTE packages. The company targets the industrial and transportation industries and governmental users with its ready-made (turnkey) solutions that highlight efficiency, reliability, and speed to deployment.

- Cisco systems Is well-positioned to provide private LTE services because of its existing enterprise networking platform, its leading-edge cloud-native core platform, and its strength in security by leveraging these capabilities and its expertise in integration. The company is focused on being the provider of choice for customers in the industrial digitalization and managed private wireless deployment space globally across enterprise and public sector markets.

- Samsung electronics is well-positioned to provide LTE services because of its state-of-the-art technology, its position as a 4g and 5g infrastructure provider, and its strong partnerships with operators to provide end-to-end solutions specifically designed to meet the needs of customers that are undergoing manufacturing, transportation, and large-scale enterprise digital transformation initiatives.

- Verizon wireless is a leading provider of these solutions due to its experience as a wireless operator, its extensive licensed spectrum holdings, and its management private wireless offering. Verizon serves customers with end-to-end solutions for industrial automation, campus networks, logistics operations, and mission critical enterprise environments throughout north America.

Private LTE Market Companies

Major players operating in the private LTE industry are:

- Affirmed Networks

- Boingo

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Mavenir Systems, Inc.

- NEC Corporation

- Nokia Corporation

- Samsung Electronics Co. Ltd.

- Verizon

- ZTE Corporation

- Nokia has an extensive industrial portfolio of products and services designed specifically for private LTE networks, along with an extensive global service footprint and the DAC platform that integrates all elements of the ran, core, management, application enablement into a single solution for mission-critical enterprises.

- Huawei also has a significant presence in the private LTE segment, primarily in Asia. This presence is supported by their broad range of infrastructure capabilities, competitive pricing, and extensive investment in R&D, although Huawei has limited access in some western markets due to regulatory restrictions and geopolitical factors.

- ZTE provides cost-effective solutions throughout Asia and developing markets and provides turnkey solutions to their customers and flexible ran and core architecture designs along with vertical solutions for manufacturing and transportation/agriculture as well as to customers in the public sector.

- Cisco utilizes its leadership in enterprise networking to incorporate private LTE into its existing solutions to provide secure connectivity, ease of management, OT-IT convergence along with partnerships with OEMs and software development partners to provide a complete solution for industrial and campus environments.

- Samsung has made private LTE a priority through the creation of a complete 5g ready infrastructure ecosystem, by actively integrating their devices, semiconductors and their targeted vertical solutions to provide customers with the tools needed to support industrial automation, logistics, smart cities along with mission critical enterprise applications.

Private LTE Industry News

- In December 2024, Nokia extended the Digital Administration Cloud, by adding new functionalities and AI-assisted analytics, which will enhance private LTE performance automatically; create predictive capacity planning; and improve the overall performance of industrials from machine learning-based allocation of resources.

- In November 2024, Nationwide launched Private 5G product from Verizon, including compatibility with LTE. They also offer standardized pricing and packaged kits for small and medium enterprises (SMEs); as well as being able to provide CBRS accountable managed networks, without requiring an enterprise's spectrum purchase.

- In October 2024, The European Union has developed a harmonized spectrum which will allow enterprises to obtain a dedicated 3.7–3.8 GHz frequency spectrum. This will simplify licensing to allow for a more rapid deployment of industrial private networks throughout member states due to regulatory alignment across members.

- In September 2024, Samsung announced its new, smaller, compact Industrial Base Stations which allow for simplified installations, reduced footprint size, and integration with Building Management and Industrial Control Systems (BMS & ICS) to provide better indoor private LTE coverage for more advanced automation types.

- In August 2024, The Chinese Government announces a new national Investment Programme to promote LTE/5G deployment via both Industrial Private LTE Network subsidization and reduced spectrum fees to accelerate Intelligent Manufacturing objectives as part of their overall Industrial Modernization Strategy.

- In July 2024, Cisco has added a new level of private cellular management to their IoT Operations Dashboard that allows for unified management of private LTE/Wi-Fi and wired networks from one enterprise focused, Operations-based platform.

The private LTE market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) and number of nodes from 2022 to 2035, for the following segments:

Market, By Component

- Product

- Infrastructure

- Evolved Packet Core (EPC)

- Backhaul

- eNodeB

- Device

- Smartphones

- Handheld Terminals

- Vehicular Routers

- IoT Modules

- Infrastructure

- Service

- Consulting & Training

- Integration & Maintenance

- Managed Service

Market, By Network Model

- Standalone

- Hybrid

- Managed/Hosted

Market, By Organization Size

- Large enterprises

- SMEs

Market, By Application

- Public safety

- Defense

- Mining

- Transportation

- Energy

- Manufacturing

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Portugal

- Croatia

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

- Turkey

Frequently Asked Question(FAQ) :

What are the upcoming trends in the private LTE industry?

Key trends include hybrid private–public wireless models, integration with edge computing and AI, CBRS-driven enterprise deployments, subscription-based managed private LTE, and advancements enabling smooth migration toward 5G.

What was the valuation of the standalone network model segment in 2025?

Standalone private LTE networks accounted for 44% share in 2025, driven by demand for complete data sovereignty, high customization, and secure on-premises control.

What is the growth outlook for the public safety segment from 2026–2035?

The public safety application segment is projected to grow at 15.3% CAGR through 2035. Increasing need for mission-critical video, real-time data, and reliable emergency communication systems is driving adoption.

What is the value of the U.S. private LTE market in 2025?

The U.S. market was valued at USD 2.4 billion in 2025, with strong growth expected through 2035 driven by CBRS adoption and rising industrial connectivity needs.

How much revenue did the product segment generate in 2025?

The product segment held 70% share in 2025, reflecting strong demand for eNodeB, EPC, devices, and backhaul components supporting industrial-grade private LTE deployments.

What is the projected value of the private LTE market by 2035?

The market is expected to reach USD 27.7 billion by 2035, expanding at a CAGR of 18.5%. Growth is driven by Industry 4.0, edge-AI integration, IoT scaling, and shared/localized spectrum models.

How much revenue did the product segment generate in 2025?

The product segment held 70% share in 2025, reflecting strong demand for eNodeB, EPC, devices, and backhaul components supporting industrial-grade private LTE deployments.

What is the private LTE market size in 2025?

The global market size for private LTE was valued at USD 5.2 billion in 2025. Growth is supported by rising industrial automation, expansion of IoT devices, and demand for secure, high-reliability wireless networks.

What is the market size of the private LTE industry in 2026?

The private LTE market reached USD 6 billion in 2026, reflecting accelerating adoption across manufacturing, utilities, logistics, and mission-critical operations.

Who are the key players in the private LTE market?

Major players include Nokia, Huawei, ZTE, Cisco, Samsung, Verizon, and NEC. These companies lead through extensive infrastructure portfolios, industrial partnerships, and turnkey private wireless solutions.

Private LTE Market Scope

Related Reports