Summary

Table of Content

Ophthalmic Sutures Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ophthalmic Sutures Market Size

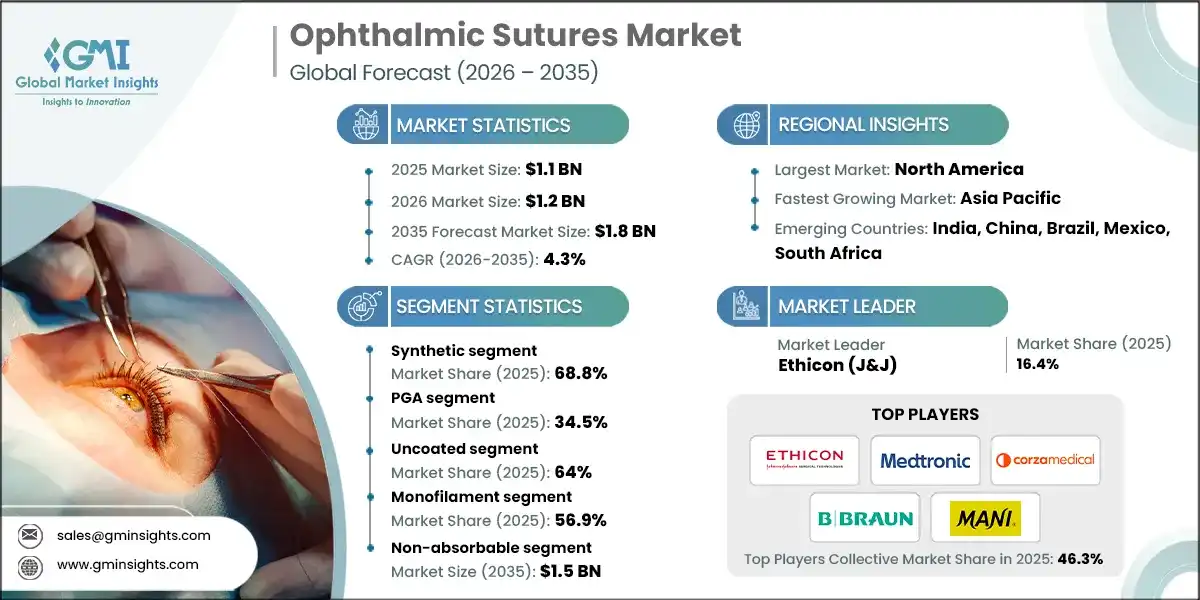

The global ophthalmic sutures market was valued at USD 1.1 billion in 2025. The market is expected to reach from USD 1.2 billion in 2026 to USD 1.8 billion in 2035, growing at a CAGR of 4.3% during the forecast period, according to the latest report published by Global Market Insights Inc. The continuous growth in the market is driven by rising ophthalmic surgeries, an aging population, continuous technological advancements and factors such as increased prevalence of eye disorders and expanded access to healthcare.

To get key market trends

The ophthalmic sutures industry delivers essential surgical solutions to hospitals, ambulatory surgical centers, and specialty eye clinics, supporting improved patient outcomes, precise wound management, and enhanced surgical efficiency across cataract, corneal, glaucoma, and retinal disorder treatment. Solutions include advanced absorbable and non-absorbable sutures engineered for superior handling, minimal tissue trauma, and reliable postoperative healing, enabling ophthalmologists to perform high-precision interventions with greater safety and consistency.

The market is a tight oligopoly, and key players such as Ethicon (J&J), Medtronic, Corza Medical, B. Braun, and Mani maintain their competitive edge through continuous product innovation, strong global distribution networks, strategic collaborations, and significant R&D investments, meeting the growing demand for safe, high-performance ophthalmic suturing systems while expanding their presence across international eye care markets and advanced surgical care segments.

The market has increased from USD 791.9 million in 2022 and to USD 1 billion in 2024. The ophthalmic sutures market is propelled by a range of structural, demographic, and technological forces that continue to strengthen surgical demand worldwide. A major driver is the growing global burden of refractive errors, cataracts, glaucoma, and corneal injuries, which is increasing the volume of both routine and complex ophthalmic procedures. Rising awareness and early diagnosis of eye conditions, supported by national screening programs and broader access to vision care are further expanding the surgical pipeline.

Advancements in microsurgical techniques, including femtosecond-assisted cataract surgery and minimally invasive glaucoma surgeries, are also fueling the need for high-performance sutures that enable precise manipulation of delicate ocular tissues. Additionally, the widespread shift toward outpatient and ambulatory ophthalmic procedures has created demand for sutures offering faster healing, reduced inflammation risk, and predictable postoperative outcomes.

Improving healthcare infrastructure in emerging economies, along with rising healthcare expenditure, is enabling more patients to access corrective eye surgeries, driving consistent market growth. The rising prevalence of lifestyle-linked disorders such as hypertension and myopia in younger populations is also contributing to higher surgical intervention rates. At the same time, training programs for ophthalmic surgeons, supported by global health organizations and private companies, are reinforcing the adoption of advanced suturing materials across diverse care settings.

Ophthalmic sutures are specialized surgical threads used to close incisions or repair delicate ocular tissues during eye surgeries such as cataract, corneal, glaucoma, and retinal disorder treatment. Designed for precision and minimal tissue trauma, they ensure proper wound healing, maintain ocular integrity, and support safe, effective postoperative recovery.

Ophthalmic Sutures Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.1 Billion |

| Market Size in 2026 | USD 1.2 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.3% |

| Market Size in 2035 | USD 1.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing prevalence of eye diseases | Rising incidence of cataracts, glaucoma, and corneal disorders increases surgical volumes, driving sustained demand for high-quality ophthalmic sutures across global healthcare settings. |

| Technological advancements | Innovations in suture materials and microsurgical techniques enhance precision, reduce tissue trauma, and improve outcomes, accelerating surgeon adoption and strengthening market growth. |

| Rising prevalence of diabetes leading to ophthalmic disorders | Increasing diabetic retinopathy and related complications elevate surgical interventions, expanding the need for reliable sutures supporting delicate ocular repairs. |

| Favorable government initiatives | Public health programs promoting eye screenings, subsidized surgeries, and improved ophthalmic care infrastructure boost procedure rates, positively influencing suture consumption. |

| Surging demand and preference for minimally invasive surgeries | Preference for safer, faster-recovery procedures increases reliance on advanced sutures designed for precision and minimal tissue disruption. |

| Pitfalls & Challenges | Impact |

| Postoperative complications associated with ophthalmic procedures | Risks like infection, inflammation, and suture-related irritation may limit adoption or require premium solutions, adding cost and restraining widespread use. |

| Lack of skilled ophthalmologist | Limited surgical expertise in many regions restricts procedure volumes, slowing suture demand despite growing disease prevalence. |

| Opportunities: | Impact |

| Rising adoption of specialty and premium sutures | Future growth will benefit from expanding use of antimicrobial, absorbable, and high-precision sutures that improve outcomes and reduce postoperative risks. |

| Expansion in emerging markets with improving eye care infrastructure | Growing healthcare investment, increasing surgical capacity, and improved access to eye care in developing regions will significantly widen the customer base for ophthalmic sutures. |

| Market Leaders (2025) | |

| Market Leaders |

16.4% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Ophthalmic Sutures Market Trends

The major factor contributing to the growth of the market is the growing prevalence of eye diseases that influence surgical demand and total market growth. Cataract, glaucoma, diabetic retinopathy, macular degeneration, and corneal injuries have emerged as the most common ocular disorders in most parts of the world due to the combined effect of aging, lifestyle changes, and rising prevalence of chronic diseases.

- According to epidemiological studies, the global incidence of cataracts alone is projected to increase substantially in the coming decade, creating higher demand for corrective surgical interventions. Similarly, the rise in diabetes, particularly in developing regions, has resulted in increased cases of diabetic retinopathy, necessitating frequent ophthalmic surgeries that rely on high-quality sutures for optimal outcomes.

- Technological advancements in ophthalmic sutures have further reinforced this growth driver. Innovations in suture materials, including absorbable and antimicrobial threads, as well as improved monofilament designs, enable surgeons to achieve greater precision, minimize tissue trauma, and reduce postoperative complications.

- Integration of microsurgical techniques and femtosecond laser-assisted procedures has elevated the need for sutures that are reliable, easy to handle, and compatible with minimally invasive interventions. These innovations enhance patient outcomes, encouraging wider adoption among healthcare providers.

- Macro and microeconomic factors also support market expansion. Rising healthcare expenditure, increased insurance coverage, and government initiatives promoting eye care facilitate access to surgical procedures. On a microeconomic level, growing awareness among patients, urbanization, and higher disposable incomes in emerging economies enable greater access to corrective eye surgeries. Simultaneously, hospitals and specialty clinics are investing in advanced surgical infrastructure and surgeon training, boosting procedural volumes.

- Collectively, these factors rising disease prevalence, technological improvements, and favorable economic conditions underscore the strong influence of growing eye diseases on the market, ensuring sustained growth in both developed and emerging regions.

Ophthalmic Sutures Market Analysis

Learn more about the key segments shaping this market

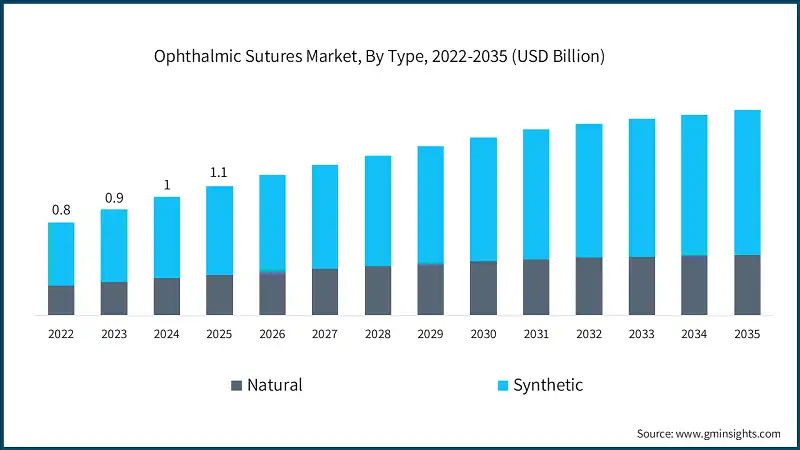

Based on the type, the ophthalmic sutures market is bifurcated into natural and synthetic. The synthetic segment has asserted its dominance in the market by securing a significant market share of 68.8% in 2025, driven by high tensile strength, predictable absorption rates, and widespread clinical adoption propel the growth of synthetic ophthalmic sutures segment worldwide. The segment is expected to exceed USD 1.2 billion by 2035, growing at a CAGR of 4.6% during the forecast period.

On the other hand, the natural segment is expected to grow with a CAGR of 3.7%. The growing preference for biodegradable, biocompatible materials in delicate ocular surgeries drives demand for natural ophthalmic sutures globally.

- The synthetic segment growth is primarily driven by their superior performance characteristics compared to natural sutures. Synthetic sutures, made from materials such as polyglactin, polyglycolic acid, and polydioxanone, offer predictable absorption rates, high tensile strength, and reduced tissue reactivity. These properties minimize the risk of infection, inflammation, or tissue rejection, making them highly preferable in delicate ophthalmic surgeries such as corneal transplants, cataract procedures, and glaucoma surgeries.

- Furthermore, synthetic sutures ensure consistent quality and reliability, which is critical for ophthalmologists performing microsurgeries. Advances in polymer science have enabled the development of sutures with enhanced biocompatibility and optimized absorption profiles, improving post-surgical healing and patient outcomes.

- Additionally, the growing preference for synthetic sutures is influenced by increasing regulatory approvals and standardization in ophthalmic surgical procedures worldwide.

- The natural segment recorded revenue of USD 345.2 million in 2025, with projections indicating a steady expansion at 3.7% CAGR from 2026 to 2035.

- The segment continues to hold relevance due to its unique biocompatibility and tissue integration properties, driving steady growth in the market. Natural sutures, primarily composed of materials like silk and catgut, are highly favorable in ophthalmic procedures where tissue healing and minimal foreign-body reaction are critical.

- Silk sutures, for example, offer excellent handling, knot security, and tensile strength, making them suitable for delicate eye surgeries such as eyelid reconstruction or pterygium removal. The absorbable nature of catgut sutures ensures they gradually dissolve, reducing the need for suture removal and improving patient comfort, particularly in pediatric ophthalmic surgeries.

- Moreover, the segment benefits from increased preference in regions where cost-effective surgical solutions are a priority, as natural sutures are generally more affordable than advanced synthetic options.

Based on material, the ophthalmic sutures market is classified into PGA, nylon, silk, polypropylene, and other materials. The PGA segment dominated the market with a revenue share of 34.5% in 2025 and is expected to reach USD 607 million within the forecast period.

- PGA is dominating segment due to its biodegradable nature and excellent tensile strength; hence, it is perfect for sensitive ocular surgeries. PGA sutures degrade hydrolytically in the body at a slow pace, thereby avoiding suture removal post-surgery and thus minimizing patient discomfort and number of follow-up visits. It is particularly useful for ophthalmic surgeries in pediatric and geriatric populations where compliance with post-operative care may be difficult to manage.

- Additionally, PGA’s predictable absorption rate ensures consistent wound support during critical healing periods, minimizing the risk of post-surgical complications such as wound dehiscence or infection.

- Technological advancements have further improved the manufacturing processes of PGA sutures, enhancing their uniformity, knot security, and tissue compatibility. Surgeons increasingly prefer PGA for procedures like cataract extraction, corneal transplantation, and glaucoma surgeries, driving adoption across global markets.

- The nylon segment recorded revenue of USD 318.5 million in 2025, with projections indicating a steady expansion at 4.5% CAGR from 2026 to 2035.

- Nylon sutures are non-absorbable synthetic materials widely used in ophthalmic procedures because of their exceptional tensile strength, elasticity, and minimal tissue reactivity. These properties make nylon sutures highly suitable for delicate eye surgeries, including corneal and conjunctival repairs, where precision and sustained support are critical.

- Nylon’s low tissue drag ensures minimal trauma during insertion, promoting faster wound healing and reducing inflammation. Furthermore, nylon sutures retain their strength over extended periods, which is essential for procedures requiring prolonged mechanical support.

- Technological improvements, such as the development of monofilament nylon sutures, have enhanced surgeon control and reduced knot slippage, further boosting clinical preference.

- The silk segment held a revenue of USD 169.9 million in 2025, with projections indicating a steady expansion at 4.1% CAGR from 2026 to 2035.

- Silk sutures, derived from natural fibers, remain popular in ophthalmic surgeries due to their exceptional biocompatibility and superior handling characteristics. Surgeons value silk for its ease of knotting, smooth passage through tissues, and flexibility, which ensures precise wound approximation in delicate ocular procedures.

- Although non-absorbable, silk sutures are associated with minimal inflammatory response, making them suitable for sensitive ocular tissues. This segment benefits from applications in corneal, conjunctival, and eyelid surgeries, where both cosmetic and functional outcomes are critical.

- The rising number of ophthalmic procedures globally, driven by aging populations and increasing prevalence of eye disorders, has led to sustained demand for high-quality silk sutures. Furthermore, the growth of specialized ophthalmic surgery centers in developed regions supports increased usage, as surgeons often prefer silk for its handling and predictable performance.

Based on coating, the ophthalmic sutures market is classified into coated and uncoated. The uncoated segment dominated the market with a revenue share of 64% in 2025 and is expected to reach USD 708.6 million within the forecast period.

- The uncoated segment dominates the market due to its affordability, widespread availability, and consistent clinical performance across a range of ocular procedures. Uncoated sutures, typically made from natural or synthetic materials like silk, polyglactin, or nylon, offer reliable tensile strength and predictable absorption, making them a preferred choice in routine ophthalmic surgeries such as cataract extraction, pterygium excision, and corneal repair.

- Their simpler manufacturing process and lower cost compared to coated sutures make them highly accessible, particularly in emerging markets where cost-effectiveness drives procurement decisions.

- Additionally, uncoated sutures cause minimal chemical interaction with ocular tissues, reducing the risk of adverse reactions in certain patient populations.

- The coated segment generated revenue of USD 397.9 million in 2025, with projections indicating a steady expansion at 5.7% CAGR from 2026 to 2035. The segment is driven primarily by the enhanced functional and clinical benefits offered by the coating.

- Coatings, such as silicone, polybutylate, or antimicrobial layers, improve the suture's handling, reduce tissue drag, and provide a smoother passage through delicate ocular tissues. This reduces intraoperative trauma, postoperative inflammation, and complications, making coated sutures particularly favored in microsurgeries and complex ophthalmic procedures like corneal transplants and cataract surgeries.

Based on material structure, the ophthalmic sutures market is bifurcated into monofilament and multifilament/braided. The monofilament segment dominated the market with a revenue share of 56.9% in 2025 and is expected to reach USD 1 billion within the forecast period.

- The monofilament segment has emerged as a preferred choice due to its unique structural and clinical advantages. Monofilament sutures consist of a single, smooth strand, which minimizes tissue drag and reduces trauma during ophthalmic surgeries.

- This low tissue reactivity significantly decreases the risk of postoperative inflammation and infection, making it highly suitable for delicate procedures like corneal transplants, cataract surgeries, and glaucoma interventions.

- Additionally, the smooth surface allows for easier passage through ocular tissue, reducing operative time and improving surgical outcomes.

- The multifilament/braided segment generated revenue of USD 476.8 million in 2025, with projections indicating a steady expansion at 5.9% CAGR from 2026 to 2035. The multifilament or braided segment is driven by its superior handling characteristics and knot security. Composed of multiple intertwined filaments, these sutures offer high flexibility, ease of tying, and excellent knot stability, which is crucial in complex ophthalmic procedures such as retinal surgeries, scleral repairs, and corneal grafting.

- Surgeons often prefer braided sutures for procedures requiring precise tissue approximation and secure closure, reducing the risk of wound dehiscence or leakage.

Based on absorption, the ophthalmic sutures market is classified into absorbable and non-absorbable. The non-absorbable segment dominated the market with a revenue share of 83.4% in 2025 and is expected to reach USD 1.5 billion within the forecast period.

- The non-absorbable segment dominates the market due to its durability, precision, and wide-ranging clinical applications. These sutures maintain tensile strength over prolonged periods, ensuring reliable wound closure in complex ocular surgeries, such as corneal transplants, glaucoma procedures, and retinal repairs, where long-term tissue support is critical.

- Surgeons often prefer non-absorbable sutures in high-tension areas to prevent dehiscence, making them indispensable in ophthalmic surgery. The segment’s dominance is also supported by the availability of diverse suture materials, including nylon, polypropylene, and silk, which offer excellent handling characteristics, knot security, and biocompatibility.

- The absorbable segment recorded revenue of USD 183.8 million in 2025, with projections indicating a steady expansion at 5.5% CAGR from 2026 to 2035. The absorbable ophthalmic sutures segment is primarily driven its inherent clinical advantages, particularly in procedures requiring minimal post-operative care.

- These sutures gradually break down within the body, eliminating the need for suture removal, which reduces patient discomfort and the risk of post-surgical complications such as infections or tissue trauma. This feature makes them especially preferred in pediatric ophthalmic surgeries and delicate ocular procedures where patient compliance may be challenging.

Based on application, the ophthalmic sutures market is classified into cataract surgery, corneal transplantation surgery, glaucoma surgery, vitrectomy, oculoplastic surgery, and other applications. The cataract surgery segment dominated the market with a revenue share of 46% in 2025 and is expected to reach USD 832.2 million within the forecast period.

- The cataract surgery segment dominates the market due to the rising global prevalence of cataracts, particularly among the aging population. According to the WHO, cataracts remain the leading cause of blindness worldwide, with millions requiring surgical intervention each year. The increasing geriatric population is directly driving demand for high-quality ophthalmic sutures that ensure precise wound closure, reduce postoperative complications, and promote faster recovery.

- Additionally, advancements in surgical techniques, such as phacoemulsification and femtosecond laser-assisted cataract surgery, require specialized sutures that can handle delicate ocular tissues.

- Surgeons increasingly prefer sutures with superior tensile strength, minimal tissue reactivity, and absorbable properties, which enhance patient outcomes.

- The corneal transplantation surgery segment held a revenue of USD 208.7 million in 2025, with projections indicating a steady expansion at 6.5% CAGR from 2026 to 2035. Corneal transplantation surgery, also known as keratoplasty, is witnessing steady growth in ophthalmic suture demand due to rising corneal disorders and ocular trauma incidents.

- Conditions such as keratoconus, corneal dystrophies, scarring, and infections often necessitate full-thickness or partial-thickness corneal transplants, which require precise suturing techniques for optimal visual outcomes. The success of corneal grafts heavily depends on the quality and type of sutures used, as improper wound closure can lead to astigmatism, graft rejection, or infection.

- The glaucoma surgery segment held a revenue of USD 176.5 million in 2025, with projections indicating a steady expansion at 6.2% CAGR from 2026 to 2035. Glaucoma surgery represents a significant driver of ophthalmic suture usage due to the increasing global prevalence of glaucoma, a leading cause of irreversible blindness.

- Procedures such as trabeculectomy, drainage implant surgery, and minimally invasive glaucoma surgeries (MIGS) require precise suturing to regulate intraocular pressure, prevent fluid leakage, and ensure successful postoperative outcomes. Rising awareness and early diagnosis of glaucoma, particularly in aging populations, are increasing surgical interventions, boosting demand for high-quality sutures.

Learn more about the key segments shaping this market

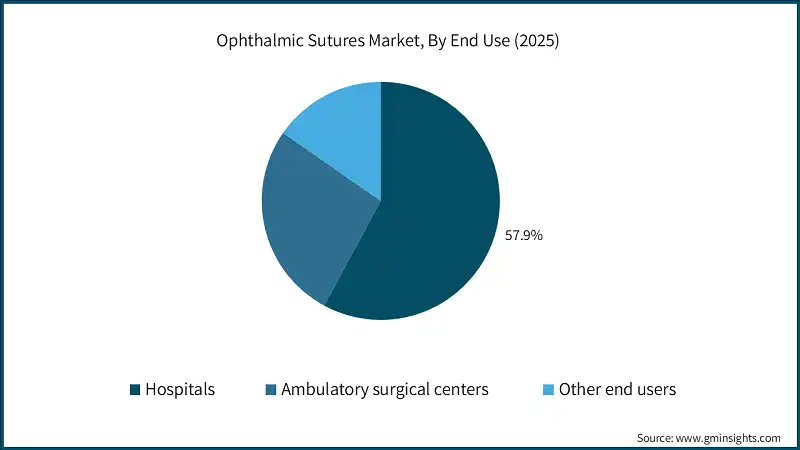

Based on end use, the ophthalmic sutures market is classified into hospitals, ambulatory surgical centers, and other end users. The hospitals segment dominated the market with a revenue share of 57.9% in 2025 and is expected to reach USD 1 billion within the forecast period.

- The two largest segments account for over 84.7% of the total market value. The hospitals segment dominates the market primarily due to the rising number of ophthalmic surgeries performed globally. Hospitals are often the preferred choice for patients requiring complex eye surgeries, such as cataract, glaucoma, retinal, and corneal procedures.

- These surgeries require high-precision suturing techniques and premium-quality ophthalmic sutures, which are widely available in hospital settings. Moreover, hospitals are equipped with advanced surgical instruments, operating theaters, and skilled ophthalmologists, which further drives demand. The aging population and increasing prevalence of age-related eye disorders, particularly cataracts, have led to a surge in surgical interventions.

- The ambulatory surgical centers segment held a revenue of USD 296.4 million in 2025, with projections indicating a steady expansion at 5.7% CAGR from 2026 to 2035.

- Ambulatory surgical centers are witnessing increasing demand for ophthalmic sutures due to the rising preference for cost-effective, outpatient eye procedures. ASCs provide a convenient and efficient alternative to hospitals for elective surgeries, including cataract and refractive procedures, as they reduce hospital stays and associated healthcare costs.

- The growing adoption of minimally invasive ophthalmic surgeries, such as phacoemulsification and small incision cataract surgery, supports the use of precise, high-quality sutures in ASC settings.

- These centers are also increasingly equipped with modern surgical instruments and skilled ophthalmologists capable of performing advanced procedures.

Looking for region specific data?

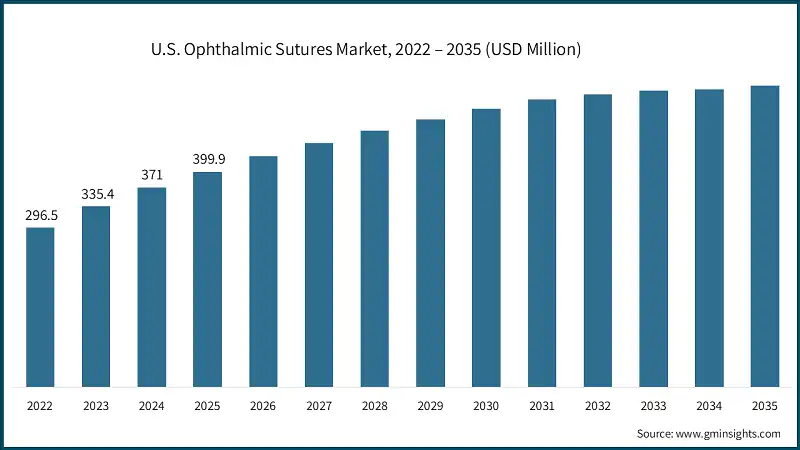

North America Ophthalmic Sutures Market

North America dominated the market with the highest market share of 38.1% in 2025.

- North America dominates the global ophthalmic sutures market due to a combination of advanced healthcare infrastructure, high healthcare expenditure, and increasing prevalence of ophthalmic disorders. The region has a well-established network of hospitals, specialty eye clinics, and ambulatory surgical centers that perform a large volume of cataract, glaucoma, and retinal surgeries annually, creating sustained demand for ophthalmic sutures.

- Technological advancements in ophthalmic surgery, including minimally invasive procedures and robotic-assisted surgeries, require precise and high-quality sutures, further boosting market growth.

- Additionally, the growing geriatric population in North America has led to a rise in age-related ocular disorders, such as cataracts and macular degeneration, driving surgical interventions.

- The presence of leading global players, including Johnson & Johnson, B. Braun, and Medtronic, has facilitated the adoption of advanced suture materials and bioabsorbable options in the region.

- Furthermore, government initiatives promoting eye care, screening programs for diabetic retinopathy, and increased awareness about vision health contribute to higher surgical rates and suture usage.

The U.S. ophthalmic sutures market was valued at USD 296.5 million and USD 335.4 million in 2022 and 2023, respectively. In 2025, the market size grew to USD 399.9 million from USD 371 million in 2024.

- The U.S. market is driven by the increasing prevalence of ocular disorders, rising number of outpatient ophthalmic procedures, and strong adoption of innovative surgical solutions. The U.S. benefits specifically from a combination of high patient awareness, accessibility to cutting-edge surgical technologies, and a robust regulatory framework ensuring safety and quality of ophthalmic sutures.

- The country has one of the highest rates of cataract and refractive surgeries globally, fueled by an aging population and lifestyle-related ocular conditions such as diabetes and myopia.

- Advanced surgical techniques, including femtosecond laser-assisted cataract surgery and corneal transplants, require specialized sutures that promote faster healing and reduce postoperative complications.

Europe Ophthalmic Sutures Market

Europe market accounted for USD 283.5 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Europe ophthalmic sutures market is primarily driven by the rising prevalence of ocular disorders and an increasing geriatric population across the region. Age-related eye conditions, such as cataracts, glaucoma, and macular degeneration, are becoming more common, leading to higher surgical intervention rates and, consequently, greater demand for ophthalmic sutures.

- Europe has a well-established healthcare infrastructure, with advanced hospitals and specialized ophthalmic centers that facilitate high volumes of eye surgeries. Technological advancements in suture materials, including bioabsorbable, synthetic, and ultra-thin sutures, improve surgical precision and outcomes, further fueling market growth.

- Additionally, increasing awareness among patients about the availability of minimally invasive and outpatient ophthalmic procedures is encouraging earlier intervention, which indirectly boosts suture consumption.

Germany dominates the European ophthalmic sutures market, showcasing strong growth potential.

- The Germany market is driven by a combination of technological adoption and strong healthcare expenditure. Germany is known for its advanced medical infrastructure, with high-quality hospitals and outpatient surgical centers performing a large number of ophthalmic procedures annually.

- The country has a strong focus on research and development in ophthalmology, including innovations in suture materials, such as ultra-fine, monofilament, and absorbable sutures, that enhance surgical outcomes.

- Rising prevalence of ocular disorders, including diabetic retinopathy and glaucoma, due to lifestyle changes and an aging population, further fuels demand for precise suturing solutions.

- Germany also benefits from favorable reimbursement policies and insurance coverage for ophthalmic surgeries, making high-quality surgical interventions accessible to a larger patient base.

Asia Pacific Ophthalmic Sutures Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 6.3% during the analysis timeframe.

- The Asia Pacific ophthalmic sutures market is witnessing rapid growth due to multiple interrelated factors. A key driver is the rising prevalence of eye disorders across the region, including cataracts, glaucoma, and diabetic retinopathy fueled by aging populations and lifestyle changes such as increased screen time and urbanization.

- Technological advancements in ophthalmic surgery, including phacoemulsification, micro-incision cataract surgery, and advanced microsurgical instruments, are driving higher adoption of high-quality sutures in hospitals and clinics. Healthcare infrastructure improvements across developing countries such as India, Indonesia, and Thailand enhance access to ophthalmic procedures, further increasing demand.

- Government initiatives aimed at reducing preventable blindness, coupled with health awareness campaigns, are encouraging more patients to seek surgical interventions, thus boosting the market.

China ophthalmic sutures market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- China’s ophthalmic sutures market is driven by a combination of demographic, technological, and policy-related factors distinct from the broader Asia Pacific region. The country’s rapidly aging population has led to a surge in age-related ocular conditions such as cataracts and glaucoma directly increasing the demand for surgical interventions requiring sutures.

- China is experiencing significant advancements in medical technology, with hospitals adopting minimally invasive ophthalmic procedures and premium suture materials, including absorbable and bioengineered options.

- Government healthcare reforms and initiatives such as the Healthy China 2030 plan emphasize early diagnosis and treatment of eye disorders, boosting surgical volumes in both public and private hospitals.

Latin America Ophthalmic Sutures Market

Brazil leads the Latin America market, exhibiting remarkable growth during the analysis period.

- Brazil leads the Latin America ophthalmic sutures market due to a combination of increasing prevalence of eye disorders and government initiatives to improve eye care accessibility. The country has a high incidence of cataracts, glaucoma, and diabetic retinopathy, which drives demand for surgical interventions requiring ophthalmic sutures.

- Public health campaigns, such as the National Cataract Program, focus on reducing preventable blindness by providing free or subsidized eye surgeries, resulting in higher surgical volumes in both public hospitals and private clinics.

- Brazil also has a growing network of modern ophthalmology centers equipped with advanced surgical instruments which supports the adoption of high-quality suture materials.

- Moreover, rising awareness among patients regarding eye health and early surgical interventions encourages timely procedures, further boosting demand. The expansion of private healthcare services and insurance coverage increases access to specialized eye care, particularly in urban centers.

Middle East and Africa Ophthalmic Sutures Market

Saudi Arabia market to experience substantial growth in the Middle East and Africa ophthalmic sutures market in 2025.

- The market is driven by the government’s heavy investment in healthcare infrastructure and modernization of ophthalmic services. Vision-related disorders, including cataracts, glaucoma, and diabetic retinopathy, are increasingly prevalent due to a growing aging population and high incidence of diabetes, creating a strong demand for surgical interventions.

- The Saudi government’s Vision 2030 initiative emphasizes advanced healthcare services and encourages the adoption of cutting-edge medical technologies, including microsurgical ophthalmic procedures that rely on high-quality sutures.

- Increasing private sector participation in healthcare and expansion of specialized eye centers provide patients with access to sophisticated surgical treatments. Additionally, rising patient awareness and preference for minimally invasive and cosmetic ophthalmic surgeries, such as refractive and corneal procedures, drive demand for precise and bio-compatible sutures.

Ophthalmic Sutures Market Share

The market operates as a moderately concentrated oligopoly, with Ethicon (J&J), Medtronic, Corza Medical, B. Braun, and Mani collectively accounting for 46.3% of the global market share. This market structure fosters competition centered on product quality, suture material innovation, surgical precision, and patient safety. These leading companies maintain their positions through extensive product portfolios that include absorbable, non-absorbable, monofilament, and braided sutures, catering to cataract, glaucoma, corneal, and retinal surgeries. Strong global distribution networks, strategic hospital partnerships, and collaborations with ophthalmic clinics reinforce their market presence and enable timely delivery of advanced suture solutions.

Market growth is driven by the rising prevalence of ocular disorders, including cataracts, glaucoma, and diabetic retinopathy, which are increasing surgical volumes worldwide. Companies are investing in R&D to develop biocompatible, minimally reactive suture materials that enhance healing, reduce post-surgical complications, and improve patient outcomes. Technological advancements such as pre-loaded suture kits, precision-engineered needle-suture combinations, and bioabsorbable options are shaping surgeon preference.

Furthermore, partnerships with specialty eye hospitals, ambulatory surgical centers, and research institutions enhance product adoption and drive innovation in ophthalmic suturing techniques. The growing trend toward minimally invasive ocular surgeries, combined with rising patient awareness and government-supported eye care programs, is encouraging continuous product development. Differentiation within this competitive environment increasingly depends on delivering high-quality, patient-centric, and technologically advanced suture solutions suitable for both hospital and outpatient surgical settings.

Ophthalmic Sutures Market Companies

Few of the prominent players operating in the ophthalmic sutures industry include:

- Alcon

- Assut Medical

- Aurolab

- Accutome

- B Braun

- Corza Medical

- DemeTECH

- Ethicon

- FCI Ophthalmics

- Geuder AG

- Mani

- Medtronic

- Teleflex Incorporated

- Unilene

- Ethicon (J&J)

Ethicon leverages its global reputation and extensive R&D capabilities to offer high-quality, biocompatible ophthalmic sutures. Its product portfolio includes absorbable and non-absorbable options, precision-engineered needles, and preloaded kits, ensuring surgical efficiency, reduced complications, and enhanced patient outcomes. Strong hospital partnerships reinforce widespread adoption.

Medtronic distinguishes itself through innovative suture technologies and integrated solutions for complex ocular surgeries. The company emphasizes precision, safety, and reliability, supported by advanced material science and surgeon-focused design. Global distribution and training programs enhance adoption in hospitals and specialty centers, ensuring consistent quality and improved surgical outcomes across diverse ophthalmic procedures.

Ophthalmic Sutures Industry News:

- In October 2024, Corza Medical introduced its Onatec ophthalmic microsurgical sutures at the American Academy of Ophthalmology conference in Chicago. This launch underscores Corza’s focus on innovation, providing precise, high-quality solutions for advanced ophthalmic procedures, and reinforcing its presence in the global ophthalmic surgery market.

- In November 2022, Alcon finalized the acquisition of Aerie Pharmaceuticals, Inc., enhancing its footprint in the ophthalmic pharmaceutical sector. The acquisition aims to broaden Alcon’s commercial product portfolio, strengthen its market position, and support the development and delivery of innovative therapies for eye care patients worldwide.

- In June 2022, Corza Medical acquired Barron Precision Instruments, LLC (BPI), a founder-owned medical device company focused on ophthalmic surgery products. This acquisition improved the company’s product portfolio and enabled them with increased customer base.

The ophthalmic sutures market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Type

- Natural

- Synthetic

Market, By Material

- PGA

- Nylon

- Silk

- Polypropylene

- Other materials

Market, By Coating

- Coated

- Uncoated

Market, By Material Structure

- Monofilament

- Multifilament/Braided

Market, By Absorption

- Absorbable

- Non-absorbable

Market, By Application

- Cataract surgery

- Corneal transplantation surgery

- Glaucoma surgery

- Vitrectomy

- Oculoplastic surgery

- Other applications

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the ophthalmic sutures market?

Key players include Alcon, Assut Medical, Aurolab, Accutome, B Braun, Corza Medical, DemeTECH, Ethicon, FCI Ophthalmics, Geuder AG, Mani, and Medtronic.

How much revenue did the PGA segment generate in 2025?

The PGA segment accounting for a 34.5% revenue share, and is expected to reach USD 607 million by 2035.

What was the valuation of the uncoated segment in 2025?

The uncoated segment held a 64% market share in 2025, with projections to reach USD 708.6 million by 2035.

Which region leads the ophthalmic sutures market?

North America dominated the market with a 38.1% share in 2025, driven by advanced healthcare infrastructure and high adoption of innovative surgical techniques.

What are the upcoming trends in the ophthalmic sutures industry?

Key trends include advancements in suture materials such as absorbable and antimicrobial threads, improved monofilament designs, and rising demand for precision in ophthalmic surgeries.

How much revenue did the PGA segment generate in 2025?

The PGA segment accounting for a 34.5% revenue share, and is expected to reach USD 607 million by 2035.

What was the market share of the synthetic segment in 2025?

The synthetic segment held a 68.8% market share in 2025 and is projected to exceed USD 1.2 billion by 2035, growing at a CAGR of 4.6% during the forecast period.

What is the projected value of the ophthalmic sutures market by 2035?

The market is expected to reach USD 1.8 billion by 2035, fueled by increased prevalence of eye disorders and expanded access to healthcare.

What was the market size of the ophthalmic sutures market in 2025?

The market size was USD 1.1 billion in 2025, with a CAGR of 4.3% expected through 2035, driven by rising ophthalmic surgeries, an aging population, and technological advancements.

Ophthalmic Sutures Market Scope

Related Reports