Get a free sample of MEA Utility Terrain Vehicles Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Get a free sample of MEA Utility Terrain Vehicles Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MEA Utility Terrain Vehicles Market Size

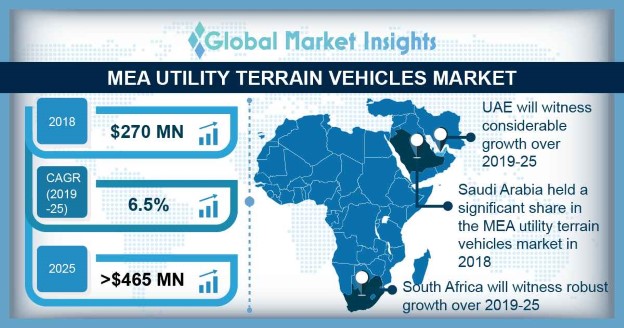

MEA Utility Terrain Vehicles Market size valued at around USD 270 million in 2018 and is estimated to exhibit over 6.5% CAGR from 2019 to 2025.

Increasing preferences of infrastructure contractors and planners for deploying easily operable vehicles on construction sites will propel the MEA utility terrain vehicles (UTV) market size over the study timeframe. Rising investments for infrastructure development and modernization of agricultural transportation are prominently supporting the industry share. For instance, in 2016, Egypt implemented investments in construction and building sector rose to USD 1.4 billion with an increase of over 3% as compared with 2015.

Rising demand for innovative green buildings and modern amenities will support the infrastructure expansion till 2025. Increasing adoption of green revolution technologies is prominently contributing towards developing agricultural sector, further supporting the MEA utility terrain vehicles market share. Significant growth in the agriculture productivity is attributed to increasing utilization of modernized farming equipment and transportation vehicles. For instance, in 2017, Saudi Arabia agricultural output rose to USD 17.5 billion with an increase of over 1.05% as compared with 2016.

Growing demand for utilizing advanced side by side vehicles equipped with comfortable seating arrangements and improved passenger capacities are significantly expanding the MEA utility terrain vehicles market size. Incorporation of advanced interior cockpits and air conditioning systems are primarily improving the passenger comfort and vehicle handling efficiency. Side by side vehicles offering enhanced durability and safety are gaining a higher visibility in construction sector.

Increasing disposable income along with proliferating economic conditions are providing potential opportunities for recreation activities, further strengthening the market size. For instance, in 2017, disposable income in UAE rose to 329.14 billion with an increase of over 7.8% as compared with 2016. Moreover, rising recreational spending is significantly inducing the increased youth participation in outdoor leisure activities.

Provision of finance assistance policies and promotional deals offered will escalate the product penetration over the study timeframe. Rising tourism industry is positively impacting the GDP, further enhancing the MEA utility terrain vehicles market size. For instance, in 2018, travel industry in UAE rose to USD 44.8 billion with an increase of over 2.4% as compared with 2017.

What are the key factors accelerating 400cc-800cc utility terrain vehicles demand?

Need for vehicular features like improved stability and high torque as well as surging demand for UTVs offering larger storage and multiple seating configurations are supporting the demand for 400cc-800cc UTVs.

What is the expected growth rate for MEA utility terrain vehicles industry share during the forecast timespan?

The industry share of MEA utility terrain vehicles is estimated to exhibit around 6.5% CAGR from 2019 to 2025.

What was the size of the global MEA utility terrain vehicles market in 2018?

The market size of MEA utility terrain vehicles was valued at over USD 870 million in 2018.

Which aspects are propelling UAE utility terrain vehicles industry size?

Robust economic growth and surging spending on recreational activities are driving UAE industry size.

Why are UTVs gaining traction in the defense sector?

The defense sector of MEA is significantly leveraging UTVs to offer better transportability and multi-mission capabilities across rough terrains.

How are UTV manufacturers expanding their business reach in MEA?

Companies such as Yamaha Motor, John Deere, Polaris Industries Inc, Kubota Corporation, and Bombardier Recreational Products are delivering superior quality UTVs in MEA at cost-effective price through innovative manufacturing techniques.