Summary

Table of Content

Maternity Apparel Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Maternity Apparel Market Size

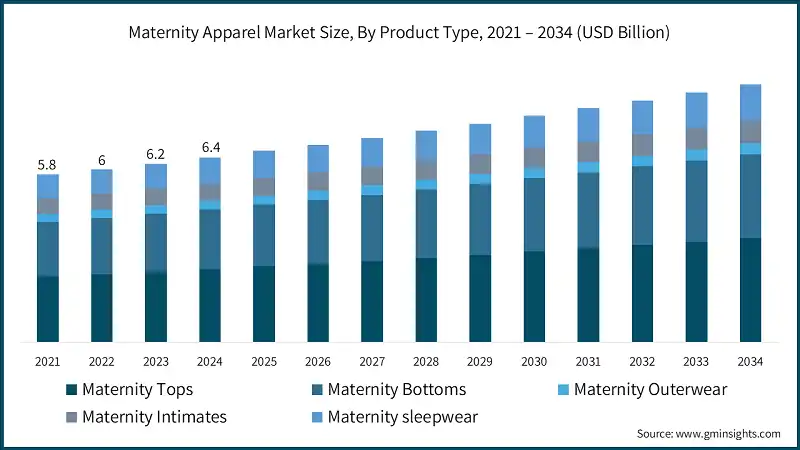

The global maternity apparel market was valued at USD 6.4 billion in 2024. The market is expected to grow from USD 6.6 billion in 2025 to USD 8.9 billion in 2034, at a CAGR of 3.4%.

To get key market trends

The increase in the number of working pregnant women globally has been the single most significant driver behind the expansion of the maternity wear apparel industry, and it's growth has been remarkable in recent years. The maternity apparel industry has expanded due to the increased participation of women in the workforce. As per the S. Bureau of Labor Statistics, women made up roughly a half (47%) of the total labor market in the year 2023, with a large number of them continuing to work throughout their pregnancy. This has resulted in the need for feminine, stylish, yet comfortable professional maternity apparel. Also, governments in countries like the US and Germany have implemented policies that allow for the supportive accommodation of maternity leave which encourages greater participation of women in the workforce during pregnancy. For example, pregnant employees in the US are protected under the Family and Medical Leave Act (FMLA) which has been predicted to increase the use of maternity apparel, fueling its demand. Further, the increase in disposable income and the fashion sense of expecting mothers has led to women striving towards finding clothing that suit their professional and personal life during pregnancy, adding to this trend.

Maternity Apparel Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 3.4% |

| Market Size in 2034 | USD 8.9 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Another driver for the growth of the maternity apparel market is the rise in awareness and popularity of maternity fashion. Nowadays pregnant women tend to purchase clothes that are appealing as well as comfortable because people tend to perceive pregnancy as an opportunity to showcase themselves. With this new mindset came the expansion of casual and formal styles of maternity clothing to suit different tastes and occasions. The growth of the industry has further been fueled by social media and the endorsement of celebrity and fashion models which has increased interest from the public. The development of new materials has made it possible to design more comfortable and practical maternity clothing which has increased the number of women willing to purchase them.

Maternity Apparel Market Trends

- New fabric technologies such as moisture-wicking and antimicrobial materials are changing maternity apparel. For example, Nike’s maternity activewear line includes Dri-FIT technology which meets the need for comfortable and practical clothing. The Smart and Interactive Textiles Market is anticipated to reach over USD 2.14 billion in 2021 with a CAGR growth of more than 25.6% between 2022 and 2030.

- Policies created with consumer protection in mind impact the maternity clothing industry. Adhering to textile safety claims and label regulations is crucial in maintaining the trust of the market, therefore, manufacturers’ credibility must be protected at all costs. Governments are implementing strategies to ensure materials used in maternity garments are safe and non-toxic. REACH legislation set forth by the European Union is an example of apparel makers facing stringent compliance policies.

- There is a rising trend for more personalized maternity clothes, including adjustable waistbands and hips, as well as modular clothing. Customizable products are offered by brands such as Seraphine to accommodate varying shapes and sizes. Fashion influencers alongside social media have a powerful influence on maternity fashion style changes. There has been an increase in expectant women seeking out these social platforms for ideas, thus increasing the demand for fashionable, modern, and trendy maternity clothes.

Maternity Apparel Market Analysis

Learn more about the key segments shaping this market

On the product basis, the market is segmented into maternity tops, maternity bottoms, maternity outerwear, maternity intimates, and maternity sleepwear. In 2024, maternity tops led the market, reaching to revenue of USD 2.5 billion in the year 2024 and expected to grow at a CAGR of 3.6% during the forecast period.

- The changes in the maternity tops segment are being driven by the heightened consumer interest in comfortable, functional, stylish products that accommodate the changing shape of the body of a pregnant woman. In July 2021, MORI launched its maternity line, Mama by MORI, incorporating sustainable practices with comfort with ruched sides and button openings for easy nursing and elasticated waistbands.

- A mother’s maternity wardrobe is very stylish because of updates in current fashions which come in various styles, colors, and patterns. This variety enables expectant mothers to dress in their preferred style whether casual, formal, or in a professional setting.

- During a woman’s pregnancy, there is a need for maternity tops due to their need for comfortable yet stylish clothing that matches their new body shape. They are available in numerous styles and designs to fit the unique needs of pregnant women.

Learn more about the key segments shaping this market

On a material basis, the maternity apparel market is segmented into cotton, polyester, spandex, modal, among others. In 2024, cotton held a share of 37.5% in the year 2024 and expected to reach around 3.5 billion by 2034.

- Globally cotton makes up around 40% of clothing material for the textile industry. It is a fundamental material in maternity clothing because it is soft, highly breathable, along with being non-irritating for the skin.

- In warmer regions, cotton also helps pregnant women stay dry and cool due to its natural moisture-wicking abilities. This improves comfort and overall health of expectant mothers.

- To ensure a constant supply of cotton for manufacturers, government programs like the Cotton Corporation of India are supporting its growth.

By distribution channel, the maternity apparel market is segmented into online and offline. The offline segmented the market in 2024 and is expected to maintain its position during the forecast period.

- Physical stores allow expectant mothers to “shop” for clothes by trying them on and getting assistance if needed. This is especially useful when purchasing maternity wear where clothing needs to be fit properly and be comfortable.

- Reputable brands have a physical presence in retail stores which adds value for consumers and increases confidence in brand options for maternity clothing. Brands like Seraphine and Thyme Maternity have strong offline presence, thus helping in escalating market growth.

- Stores like Macy’s and Target have increased the size of their maternity sections as a response to growing needs of customers.

Looking for region specific data?

The U.S. dominated the North America market with a revenue of USD 1.42 billion in 2024 and is expected to grow at a CAGR of 3.6% during the forecast period.

- The U.S. has a birthrate of 11.0 per 1,000, which is a positive indication for demographic changes. Coupled with a fertility rate of 56.3 births per 1,000 females aged 15-44, this shows how frequently maternity apparel, and other products, are bought.

- China is a world leader in the adoption of e-commerce, making it easier for maternity apparel vendors to market their goods through an extensive online marketplace. These channels have made it possible for convenience and ease of use, enabling brands to sell to a large number of expectant mothers located all over the country. Bolstered by an emerging fashion industry, Chinese consumers are paying more attention to fashion and look for available options to maternity attire, which encourages creativity and plurality of the market.

- The German maternity apparel market is characterized by a notable focus on sustainability because consumers are inclined to use more green materials and ethically produced goods. In Germany, expecting mothers are more concerned about the environmental effects of the clothing they buy.

- The rising number of female workers in Saudi Arabia is increasing the need for stylish yet practical maternity apparel as more women require these clothes for everyday and professional use.

Maternity Apparel Market Share

- In 2024, Top 5 players such as Inditex group, H&M, Nike Inc., Gap Inc., Maternity corporation held a share of about 15-20%.

- Nike, Inc.: Nike focus on activewear to include maternity activewear in response to the increasing interest in fitness among pregnant women.

- Gap Inc.: Gap aims its products toward the middle class, using its wide network of stores and website to make its clothing affordable and easily accessible.

- Maternity Corporation: Maternity Corporation provides tailored premium maternity apparel, specializing in meeting the different needs of individual consumers.

Maternity Apparel Market Companies

Some of the key players profiled in the maternity apparel industry report include:

- Adidas AG

- Gap Inc

- H&M

- Hatch Collection LLC

- Inditex-group

- Ingrid & Isabel, LLC

- Isabella Oliver Limited

- Maternal America, Inc.

- Maternity Corporation

- Nike, Inc.

The companies within the maternity apparel segment are focusing on product innovation, sustainability, and omnichannel retailing to gain competitive advantage. In response to consumer demand for multifunctional clothing, many brands are developing multifunctional maternity apparel that can be worn during and after pregnancy. Additionally, many companies are adopting sustainable practices to distinguish themselves from competitors by using organic materials and eco-friendly production methods.

Additionally, another strategy is the development of new distribution channels that attract new customers. Businesses are improving the online and offline retail experience to satisfy different consumers. Integrating AR technology into e-commerce enables shoppers to see how maternity clothing will fit, thus making shopping easier. Innovative brands like H&M have pioneered eco-friendly fashion with the Conscious Collection, which includes products made from organic cotton and recycled polyester, while Nike took a new approach in the style of maternity activewear by incorporating functionality into fashion.

Maternity Apparel Industry News

- In April 2024, celebrities’ favorite maternity clothing brand, Bumpsuit, known for its stylish and comfortable apparel for mothers, opened her first pop-up store at The Grove shopping mall in Los Angeles. Founded in March 2020 by model Nicole Trunfio, the brand is known for recently introducing the innovative Armadillo Baby Carrier.

- In March 2024, the H&M Group, together with Vargas Holding and TPG Rise Climate, launched Syre, a new venture aimed at scaling the production of recycled polyester from textiles. The project seeks to lessen the dependence on virgin polyester and help make the textile industry more sustainable by quickly scaling recycling technology and infrastructure.

- In May 2023, Destination Maternity launched their latest Spring/Summer collection, which includes stylish maternity apparel and basic intimates for pregnant and postpartum women. The collection was made available only at Walmart. This initiative was a calculated and brand-specific strategic change for the company under the parent Marquee Brands to fulfill consumer needs.

- In September 2022, Bollywood actress Alia Bhatt debuted her line of comfort focused maternity wear. Besides her renowned roles in acting, she also is an active businesswoman with a production house and a children’s apparel brand making her a fashion influencer to be reckoned with.

The maternity apparel market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2018 to 2034, for the following segments:

Market, By Product Type

- Maternity Tops

- T-shirts

- Blouses

- Others (Tunics, etc)

- Maternity Bottoms

- Pants

- leggings

- Skirts

- Shorts

- Maternity Outerwear

- Jackets

- Coats

- Others (Sweaters, etc)

- Maternity Intimates

- Nursing bras

- Lingerie

- Others (Camisoles, etc)

- Maternity sleepwear

- Nightgowns

- Sleep Shirts

- Lounge Pants

- Others (Pajama Sets, robes, etc)

Market, By Material

- Cotton

- Polyester

- Spandex

- Modal

- Others

Market, By Price Range

- Low (Upto $50)

- Medium ($50 - $100)

- High (Above $100)

Market, By Distribution Channel

- Online

- E-Commerce

- Company Website

- Offline

- Wholesales/Distributors

- Hypermarkets/Supermarkets

- Specialty Stores

- Multi-Brand Stores

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Indonesia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

Who are the key players in maternity apparel industry?

Some of the major players in the industry include Adidas AG, Gap Inc, H&M, Hatch Collection LLC, Inditex Group, Ingrid & Isabel, LLC, Isabella Oliver Limited, Maternal America, Inc., Maternity Corporation, Nike, Inc.

How big is the maternity apparel market?

The market size for maternity apparel was valued at USD 6.4 billion in 2024 and is expected to reach around USD 8.9 billion by 2034, growing at 3.4% CAGR through 2034.

How much is the U.S. maternity apparel market worth in 2024?

The U.S. market was worth over USD 1.42 billion in 2024.

What is the size of maternity tops segment in the maternity apparel industry?

The maternity tops segment generated over USD 2.5 billion in 2024.

Maternity Apparel Market Scope

Related Reports