Summary

Table of Content

IoT Gateway Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

IoT Gateway Devices Market Size

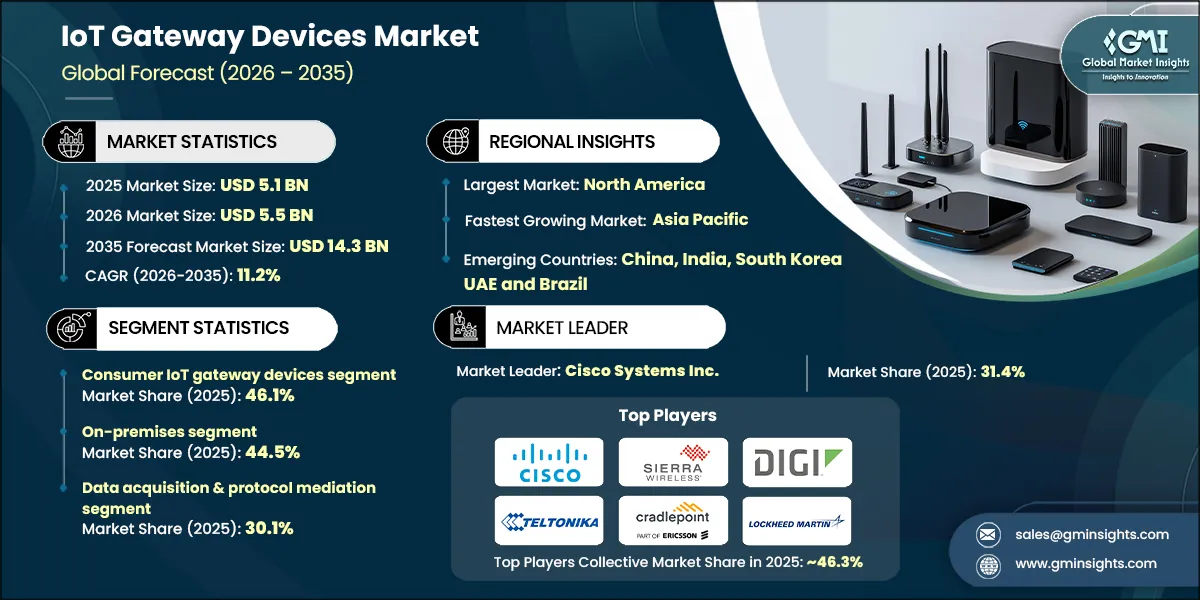

The global IoT gateway devices market was valued at USD 5.1 billion in 2025. The market is expected to grow from USD 5.5 billion in 2026 to USD 8.7 billion in 2031 and USD 14.3 billion in 2035, at a CAGR of 11.2% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

Several factors contribute to the growth of the IoT gateway devices market, such as the rapid growth in proliferation of connected devices across industrial, commercial, and consumer applications, rising need for reliable and secured data aggregation between cloud platforms and heterogeneous devices, and increasing focus on device management, cybersecurity, and scalable IoT deployments.

A considerable expansion of smart infrastructure initiatives such as smart cities, intelligent transportation systems, and smart grids is expected to strengthen the demand for IoT gateway devices market. For instance, in January 2026, Taiwanese government has introduced an initiative to expand its "Ten Major AI Infrastructure Projects," aiming on smart applications, critical technologies, and digital infrastructure. This initiative is likely to promote digital transformation and infrastructure modernization across industrial and urban domains with an objective to build a nationwide smart living ecosystem, supporting the adoption of IoT gateway device by creating the need for scalable and interoperable edge gateways that effectively connects IoT endpoints with cloud and AI systems. Such strategic steps are likely to promote the lucrative demand for market.

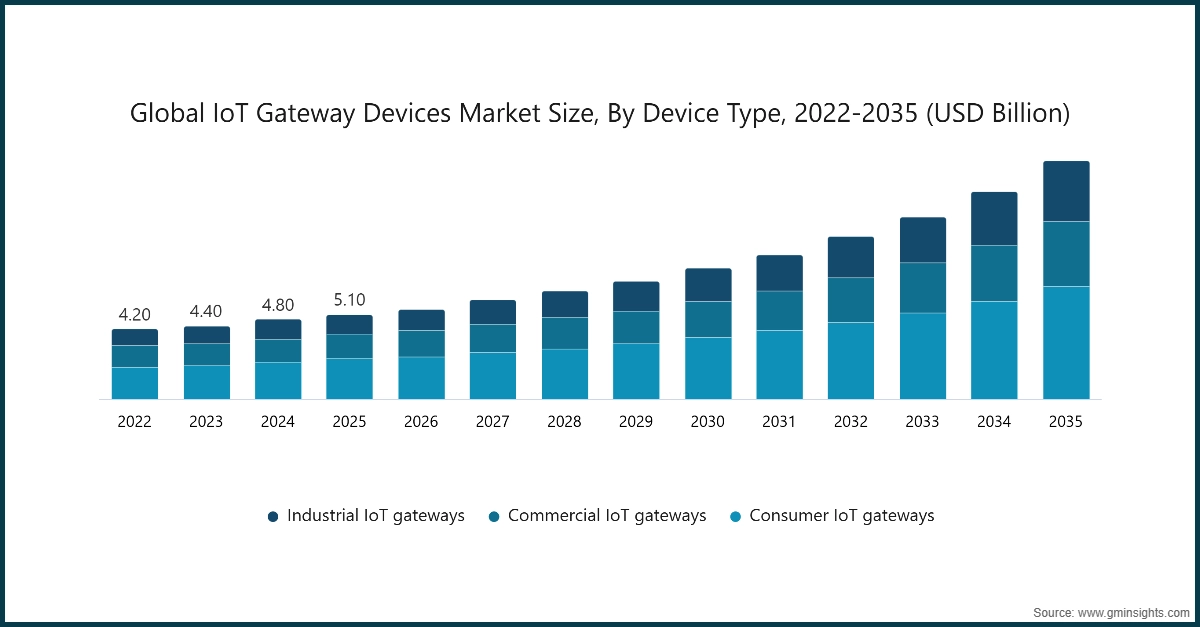

Between 2022 and 2024, the market witnessed considerable growth, increasing from USD 4.2 billion in 2022 to USD 4.8 billion in 2024. A considerable shift toward edge computing architectures to allow real-time data processing and low-latency decision-making is gradually stimulating the need for IoT gateway devices across urban mobility to energy management and public services. Meanwhile, rising public-private investments in 5G and LPWAN connectivity, along with increasing adoption of AI-driven analytics at the edge are strengthening the demand for IoT gateway devices as a critical connectivity and intelligence layer, allowing secure data aggregation and protocol translation between distributed IoT endpoints and centralized cloud platforms across urban, industrial, and public-sector applications. For instance, in May 2025, AccelerComm completed a funding of about USD 15 million to strengthen space-based 5G network technology, which is likely to boost the deployment of IoT gateway devices, as it has potential to aggregate data from distributed sensors and devices, translate protocols, and securely backhaul data between local IoT networks and satellite-5G links. Henceforth, this factor is likely to strengthen the growth for market.

IoT Gateway Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.1 Billion |

| Market Size in 2026 | USD 5.5 Billion |

| Forecast Period 2026-2035 CAGR | 11.2% |

| Market Size in 2035 | USD 14.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid expansion of IoT deployments across industries | Drives 28% growth due to rising adoption of IoT devices across manufacturing, healthcare, smart buildings, transportation, and consumer electronics, , requiring gateways for protocol translation, data aggregation, and secure connectivity. |

| Shift toward edge computing and real-time analytics | Contributing 22% growth as enterprises increasingly deploy edge-based architectures to allow low-latency decision-making, localized processing, and reduced cloud bandwidth dependence, thereby strengthening demand for intelligent IoT gateway devices. |

| Government-led smart infrastructure and digital transformation initiatives | Accounts for 20% growth driven by large-scale investments in smart cities, intelligent transportation systems, smart grids, and public services, all of which depend on IoT gateways to integrate heterogeneous sensors and platforms. |

| Advancements in connectivity technologies | Fuels 18% growth, supported by the rollout of 5G, LPWAN (LoRaWAN, NB-IoT), and emerging satellite-enabled IoT networks that require gateways to bridge local device networks with wide-area communication infrastructure. |

| Pitfalls & Challenges | Impact |

| Data security & privacy concerns | Restrains 23% of market growth, as IoT gateways serve as critical attack surfaces on account of their role in handling sensitive data, making them vulnerable to cyber intrusions, malware, and unauthorized access. |

| High initial deployment and lifecycle management costs | Limits 16% growth, especially among public-sector and SMEs projects, as hardware procurement, software integration, security updates, and maintenance raise total cost of ownership. |

| Opportunities: | Impact |

| Integration of AI, machine learning, and advanced edge intelligence | Accounts for 19% growth, as AI-enabled gateways support predictive maintenance, anomaly detection, and autonomous decision-making, improving operational efficiency across industrial and infrastructure applications. |

| Expansion of remote, rural, and non-terrestrial IoT connectivity | Increasing adoption of satellite IoT and space-based 5G networks for smart agriculture, energy asset management, and disaster response, and maritime monitoring is likely to accelerate the demand for rugged, satellite-compatible IoT gateway devices. |

| Market Leaders (2025) | |

| Market Leader |

31.4% market share in 2025 |

| Top Players |

Collective market share is ~46.3% in 2025 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia-Pacific |

| Emerging countries | China, India, South Korea, UAE, and Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

IoT Gateway Devices Market Trends

- The integration of AI analytics, 5G connectivity, and edge computing considerably transforming the functional competences of IoT gateway devices, enabling real-time data processing, autonomous decision-making, and predictive analytics at the network edge. Enterprises across transportation, industrial automation, defense-critical infrastructure, and smart cities are progressively deploying AI-driven gateways to minimize latency, enhance bandwidth deployment, and foster operational resilience.In order to expand cybersecurity and network intelligence initiatives, Cradlepoint and Cisco are often actively incorporating secure SD-WAN, edge AI, and private 5G reinforcement into their gateway portfolios. Therefore, the growing adoption of AI-enabled and edge-optimized IoT gateway devices is likely to prosper the overall market growth.

- Furthermore, the growing requirement of connectivity requirements across public safety, industrial IoT, defense, and remote asset monitoring applications has expanded the demand for ruggedized and secure IoT gateway devices. Ongoing critical infrastructure modernization, geopolitical uncertainties, and increased dependance on real-time situational awareness have boosted deployments of robust communication gateways capable of operating in harsh environments. Key vendors like Sierra Wireless, Teltonika Networks, and Digi International are observing escalated demand for cellular IoT gateways supporting LTE, 5G, multi-network failover, and advanced encryption. This trend is likely to play an integral role in expanding the growth outlook of the IoT gateway devices market worldwide, particularly in energy, transportation, and defense communication networks.

- The growing need for cloud-managed IoT gateway platforms is likely to grow substantially on account of distributed and large-scale networked device ecosystems and IoT architectures become more prevalent. Enterprises are heavily spending on scalable gateway solutions that enable centralized network orchestration across endpoints, remote device management, and over-the-air updates. Managed connectivity platforms offered by key players, such as Cisco IoT Operations Dashboard and Cradlepoint NetCloud, are supporting multi-site deployments and allowing seamless integration with enterprise IT and cloud systems. As organizations tend to toward highly connected, software-defined, and automated IoT ecosystems, thereby this factor is likely to reinforce sustained demand for advanced IoT gateway devices globally.

IoT Gateway Devices Market Analysis

The global IoT gateway devices industry was valued at USD 4.2 billion and USD 4.5 billion in 2022 and 2023, respectively. The market size reached USD 5.1 billion in 2025, growing from USD 4.8 billion in 2024.

Learn more about the key segments shaping this market

Based on the device type, the global IoT gateway devices market is divided into consumer IoT gateways, commercial IoT gateways, and industrial IoT gateways. The consumer IoT gateway devices segment accounted for 46.1% of the market in 2025.

- Consumer IoT gateway devices continue to have a huge impact on this trend due to their exceptional benefits, such as ease of deployment, cost efficiency, and better compatibility with multiple wireless communication protocols, such as Zigbee, Wi-Fi, Bluetooth, and Z-Wave, which stimulates the adoption of consumer IoT gateways. Furthermore, the rising proliferation of smart homes, connected consumer electronics, and broadband penetration is likely to strengthen the growth of consumer IoT gateway devices market.

- The industrial IoT gateway devices segment was valued at USD 1.2 billion in 2025 and is anticipated to grow at a CAGR of 11.8% over the forecast years. The development of industrial IoT gateway devices has been significantly accelerated by the expansion of digital transformation initiatives in manufacturing, energy & utilities, oil & gas, and transportation sectors.

- Manufacturers should focus on creating industrial IoT gateway devices with robust edge computing features, real-time data acquisition capabilities, and secure connectivity between cloud or enterprise IoT systems and legacy industrial equipment.

Based on deployment mode, the IoT gateway devices market is classified into cloud, on-premises, and hybrid. The on-premises segment dominated the market in 2025 with a market share of 44.5%.

- The on-premises segment growth is driven by the high-security industrial users and defense sector that need exclusive control over system access, data pathways, and hardware-level security. Organizations prioritizing mission assurance in critical environments depending on on‑premises infrastructure to preserve deterministic performance, complete data sovereignty, and low‑latency processing.

- Manufacturers should focus on developing hardened, cyber‑resilient on‑premises gateway architectures capable of operating independently of external networks. Developments such as redundant compute modules, zero‑trust security layers, and tamper‑resistant designs helps in ensuring operational continuity in environments where data exposure or downtime is unacceptable.

- The cloud segment is expected to witness growth at a CAGR of 12.0% during the forecast period. The growing adoption of distributed IoT architecture, multi-domain operations, and enterprise-wide digital transformation initiatives supports the demand for cloud-based IoT gateway devices.

- As such, manufacturers must make it a priority to create cloud-native integration frameworks that supports remote configuration and seamless data synchronization across the IoT gateway devices.

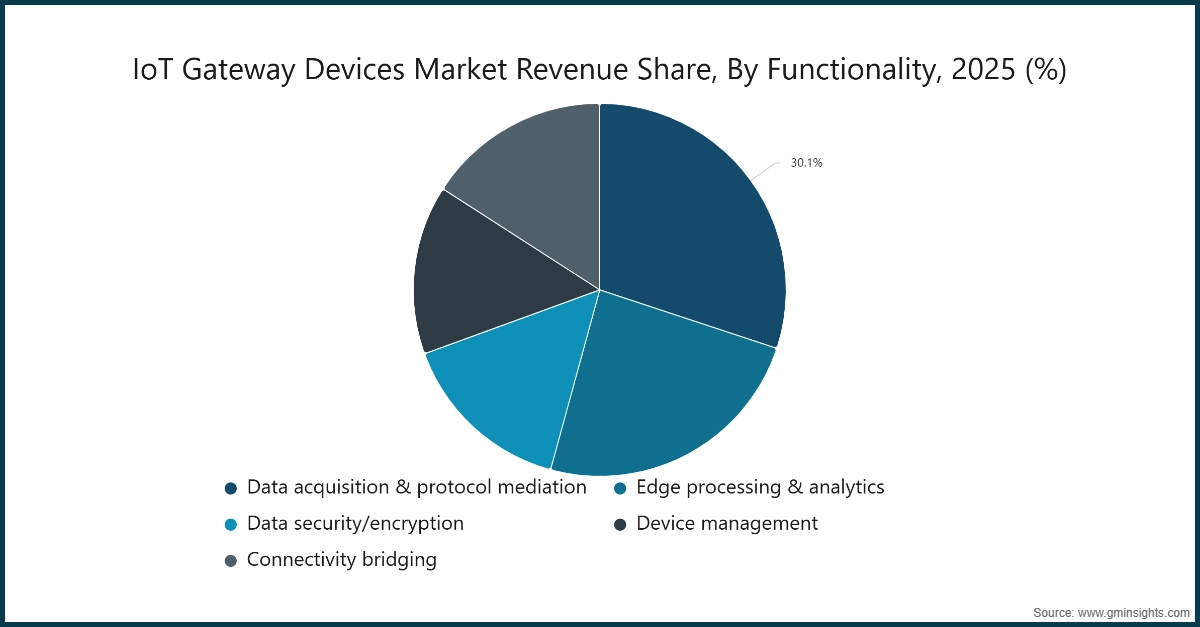

Learn more about the key segments shaping this market

Based on functionality, the IoT gateway devices market is classified into data acquisition & protocol mediation, edge processing & analytics, data security/encryption, device management, and connectivity bridging. The data acquisition & protocol mediation segment dominated the market in 2025 with a market share of 30.1%.

- The data acquisition & protocol mediation segment is driven by seamless integration of modern digital platforms, legacy equipment, and heterogeneous sensors, as well as the spread of unified command architectures in infrastructure, defense, and industrial settings, are driving the data acquisition and protocol mediation market.

- In order to ensure backend compatibility and continuity, manufacturers should concentrate on advancing highly interoperable IoT gateway devices that support deterministic connectivity, wide protocol libraries, and real-time data normalization.

- The edge processing & analytics segment is expected to witness growth at a CAGR of 12.7% during the forecast period, due to the growing use of real-time decision engineers, onboard intelligence, and AI-driven field operations. In addition, the rapid shift toward sensor-rich platforms and distributed operations, such as remote infrastructure, autonomous systems, and tactical networks, is likely to pave the need for advanced edge analytics functions, thereby driving the market growth.

- As such, manufacturers must develop high-performance computer architectures at the edge, ruggedized processors, and integrating AI/ML accelerators that supports in autonomous threat detection and real-time operational insights.

North America IoT Gateway Devices Market

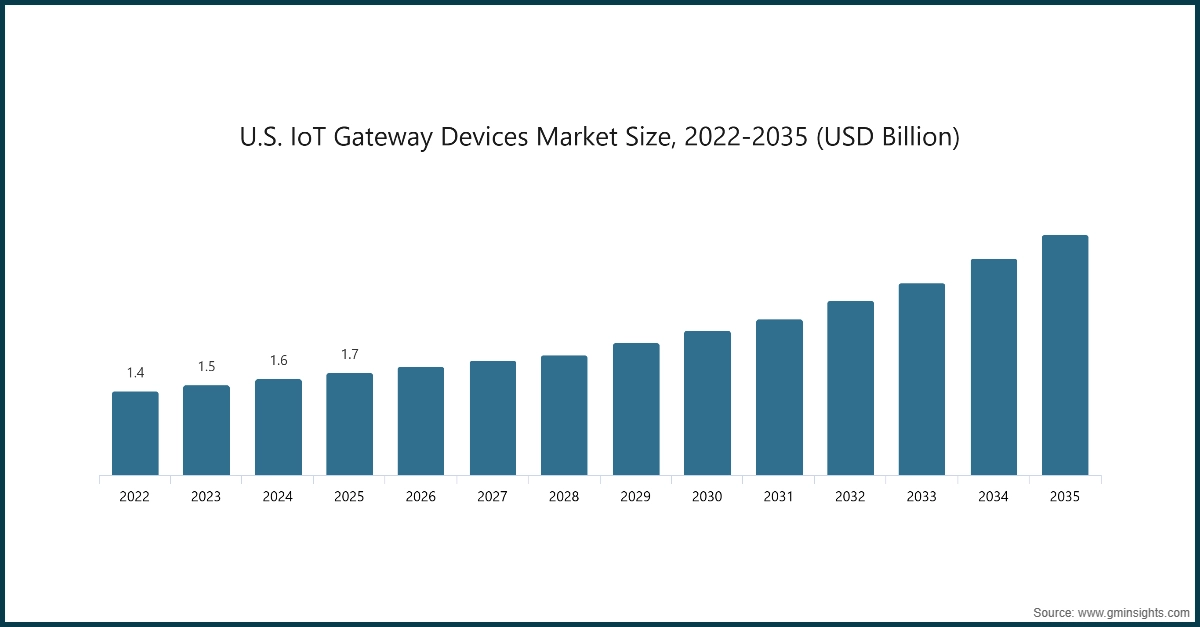

North America dominated the global IoT gateway devices industry with a share of 38% in 2025.

- In the North American market, growing IoT budget, increasing penetration of connected vehicle technologies and smart manufacturing, and the rapid growth of home automation & security system are driving the growth of the market.

- In addition, the market growth is further fueled by growing adoption of cloud technology, edge computing & 5G rollout for improving connectivity and device management, along with the presence of major vendors of IoT gateway devices.

Looking for region specific data?

The U.S. IoT gateway devices market was valued at USD 1.4 billion and USD 1.5 billion in 2022 and 2023, respectively. The market size reached USD 1.7 billion in 2025, growing from USD 1.6 billion in 2024.

- The growth of the IoT gateway devices industry in the U.S. is being driven by robust growth trajectory in smart factories, along with growing initiatives in smart healthcare and grid modernization.

- Companies addressing U.S. market demand must prioritize on advanced edge‑processing capabilities, robust framework for cybersecurity frameworks, and seamless integration with industrial automation ecosystem that meet operational need of manufacturers across varied industrial applications.

Europe IoT Gateway Devices Market

Europe market accounted for USD 1.1 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The European market is expected to grow due to the significant growth in automation capabilities of industrial manufacturers, along with the growing government-led digitalization initiatives.

- In addition, the growing initiatives to focus on demand for interoperability, security, and real-time processing features are likely to drive this market throughout Europe.

Germany dominates the Europe IoT gateway devices market, showcasing robust growth potential.

- Germany's market is likely to driven by the increased footprint of industrial and manufacturing sectors, along with the rising adoption of sensors and edge devices.

- Companies should focus on developing precision engineering, robust interoperability within Industry 4.0 production systems, and industrial-grade reliability, which helps to better align with the sensor‑dense environments, predictive maintenance workflows, and highly secure data exchanges.

Asia Pacific IoT Gateway Devices Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 13% during the analysis timeframe.

- The Asia Pacific market continues to see rapid growth from an expanding investment in smart building and smart cities projects, along with the constant growth in adoption of connected devices in the region.

- Further, the market is driven by the automation capabilities in Industry 4.0 and the shift towards edge AI, low latency IoT, and energy-efficient gateway hardware.

China IoT gateway devices market is estimated to grow with a significant CAGR of 13.7% in the Asia-Pacific.

- China's market influenced by a range of factors, including the government incentives for IoT development, robust ecosystem led by tech giants such as Huawei and Tencent, and growing adoption of edge devices and sensors.

- Companies operating in the Chinese market must prioritize and invest in multi‑protocol connectivity, high‑capacity edge computing, and flexible device management frameworks to aid fast data aggregation and large-scale device ecosystem.

Latin American IoT Gateway Devices Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil's market is being driven by growing adoption of gateways to manage the need for real-time decision-making, along with rising investments in IoT deployment.

- Manufacturers must emphasize strong interoperability, competent data handling at the edge, and adaptable connectivity options well-suited to the nation’s diverse smart city and industrial applications.

Middle East and Africa IoT Gateway Devices Market

Saudi Arabia market to experience substantial growth in the Middle East and Africa in 2025.

In the Middle East & Africa Region, growing 5G rollouts for low-latency IoT gateway connection, along with the meeting the targets of Vision 2030 initiatives facilitate the greater adoption of IoT gateway devices is driving Saudi Arbia market growth.

- Companies targeting the region should deliver scalable, secure, and analytics‑driven gateway platforms that facilitates energy‑efficient architectures, high‑reliability connectivity, and smooth integration into infrastructure and enterprise environments.

IoT Gateway Devices Market Share

Major vendors such as Cisco Systems Inc., Sierra Wireless Inc., Digi International Inc., Teltonika Networks, and Cradlepoint, Inc. (Ericsson) control more than half of the IoT gateway devices industry, accounting for around 46% of total market share in 2025. These important contributors are leading the way in data acquisition and protocol mediation, edge processing and analytics, and data security and encryption, with applications in manufacturing, smart infrastructure, energy and utilities, healthcare, and other industries.

Leading suppliers of IoT gateway devices are able to provide dependable and high-throughput connectivity by utilizing cutting-edge computing architecture and enterprise-grade cybersecurity frameworks. The continuous focus on improving scalability, seamless IT-OT integration, and cloud-native device management allow these solutions to operate effectively in high-risk and latency-sensitive deployment scenarios such as public safety, industrial automation, critical infrastructure networks, and defense communications. Moreover, the focus on zero-trust security, resilient network failover, and multi-domain interoperability across mobile, fixed, and remote assets is bolstering vendor dominance across commercial, industrial, and government IoT ecosystems.

Several small niche players are often entering in the marketplace of IoT gateway devices. These companies facilitate increased competition and eventually drive technological advancements to meet the evolving needs of hybrid connectivity along with the integration of brownfield industrial equipment with modern cloud platforms.

IoT Gateway Devices Market Companies

Prominent players operating in the IoT gateway devices industry are as mentioned below:

- ADLINK Technology Inc.

- Advantech Co., Ltd.

- Cisco Systems, Inc.

- Cradlepoint, Inc. (Ericsson)

- Digi International Inc.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Moxa Technologies

- MultiTech Systems, Inc.

- Siemens AG

- Sierra Wireless, Inc.

- Teltonika Networks

- Toshiba Corporation

- Winmate, Inc.

Cisco Systems remains to lead in industrial and enterprise-grade IoT gateway solutions, using it extensive expertise in edge computing, cloud-managed architectures, and secure networking. To enable mission-critical connectivity across smart infrastructure, industrial automation, defense, and transportation communication networks, the company integrates SD-WAN, advanced routing, edge analytics, and zero-trust security frameworks into its portfolio of IoT gateway devices.

Cradlepoint, an Ericsson company, is major provider in 5G-enabled IoT gateways and wireless edge solutions, highlighting cloud-managed connectivity, enterprise-class security, and software-defined networking. The company’s gateways are optimized for high-performance, low-latency applications across defense, public safety, transportation, and mission-critical enterprise networks.

Digi International is specialized in providing secured industrial-grade IoT gateway solutions, integrating long product lifecycles, reinforced cybersecurity features, and robust device management. The company’s gateways are extensively implemented across utilities, transportation, manufacturing, and public sector applications where long-term support and reliability are utmost important. Digi’s strong capabilities in protocol translation, edge intelligence, and remote monitoring allow seamless integration of legacy systems with modern cloud and IoT gateway platforms.

Sierra Wireless offers a wide range of cellular IoT gateways, which are distinguished by ruggedized designs, global carrier certifications, and flexible connectivity options. The company also provides dependable communication platforms tailored for industrial operations, mission-critical field deployments, and remote asset monitoring applications.

Teltonika Networks is well known for its feature-rich and reasonably priced industrial IoT gateways, which offer flexible hardware configurations, cellular redundancy, and wide protocol support. The company stands out for its quick product customization, widespread use of 5G and LTE technologies, and robust presence in use cases related to fleet management, industrial connectivity, and smart mobility. Rapid deployment of strong IoT networks in industrial and commercial settings is made possible by Teltonika's modular design approach and emphasis on scalable deployments.

IoT Gateway Devices Industry News

- In July 2025, LORIOT completed a strategic partnership with Minew Technologies to provide integrated IoT solutions, addressing the increasing demand for wide-ranging and secured solutions in massive IoT deployments by integrating hardware innovation with strong network infrastructure.

- In May 2025, Kontron strengthened its automation and connectivity offerings by introducing a new IoT gateway featuring LTE Cat-1 connectivity, targeting cost-efficient and reliable industrial IoT deployments.

- In January 2024, Teltonika Networks introduced TRB256, a versatile NB-IoT gateway designed to offer dependable connectivity across a range of networking solutions. The TRB256 supports 4G LTE Cat M1 mobile connectivity, along with compatibility with NB1, NB2, and LTE-M IoT technologies, enhancing its applicability and performance in various IoT applications.

The IoT gateway devices market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Device Type

- Consumer IoT gateways

- Commercial IoT gateways

- Industrial IoT gateways

Market, By Functionality

- Data acquisition & protocol mediation

- Edge processing & analytics

- Data security/encryption

- Device management

- Connectivity bridging

Market, By Deployment Mode

- Cloud

- On-Premises

- Hybrid

Market, By Connectivity Technology

- Wi-Fi

- Bluetooth

- ZigBee

- Ethernet

- Cellular

- Others

Market, By End-User

- Industrial & Manufacturing

- Smart Infrastructure

- Smart Cities

- Smart Buildings

- Energy & Utilities

- Healthcare

- Automotive & Transportation

- Consumer Electronics

- Retail & BFSI

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the market share of the consumer IoT gateway devices segment in 2025?

The consumer IoT gateway devices segment accounted for 46.1% of the market in 2025, driven by the proliferation of smart home devices and consumer electronics.

What is the projected value of the IoT gateway devices market by 2035?

The market size for IoT gateway devices is expected to reach USD 14.3 billion by 2035, growing at a CAGR of 11.2% during the forecast period. This growth is attributed to increasing IoT adoption in industrial automation, smart cities, and connected healthcare applications.

What is the market size of the IoT gateway devices industry in 2026?

The market size for IoT gateway devices reached USD 5.5 billion in 2026, reflecting steady growth fueled by rising demand for edge computing and real-time data processing capabilities.

What is the IoT gateway devices market size in 2025?

The market size for IoT gateway devices was valued at USD 5.1 billion in 2025. The market's growth is driven by increasing adoption of IoT-enabled devices across various industries and advancements in connectivity technologies.

What was the market share of the on-premises deployment mode in 2025?

The on-premises deployment mode dominated the market in 2025 with a 44.5% share. Its leadership is supported by demand for secure and localized data processing solutions, particularly in industries with stringent data privacy requirements.

What was the market share of the data acquisition & protocol mediation segment in 2025?

The data acquisition & protocol mediation segment held a 30.1% market share in 2025, driven by the need for seamless integration of diverse IoT devices and efficient data collection.

Which region led the IoT gateway devices market in 2025?

North America dominated the market with a 38% share in 2025. The region's leadership is attributed to widespread IoT adoption, advancements in connectivity infrastructure, and strong presence of key market players.

What are the upcoming trends in the IoT gateway devices industry?

Key trends include the integration of AI and machine learning for edge analytics, adoption of 5G for enhanced connectivity, increased focus on cybersecurity in IoT ecosystems, and the rise of hybrid deployment models. Additionally, advancements in low-power IoT devices and edge computing are expected to drive market innovation.

Who are the key players in the IoT gateway devices market?

Prominent players in the market include ADLINK Technology Inc., Advantech Co., Ltd., Cisco Systems, Inc., Cradlepoint, Inc. (Ericsson), Digi International Inc., Fujitsu Limited, Huawei Technologies Co., Ltd., Intel Corporation, Moxa Technologies, and MultiTech Systems, Inc.

IoT Gateway Devices Market Scope

Related Reports