Summary

Table of Content

Intrauterine Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Intrauterine Devices Market Size

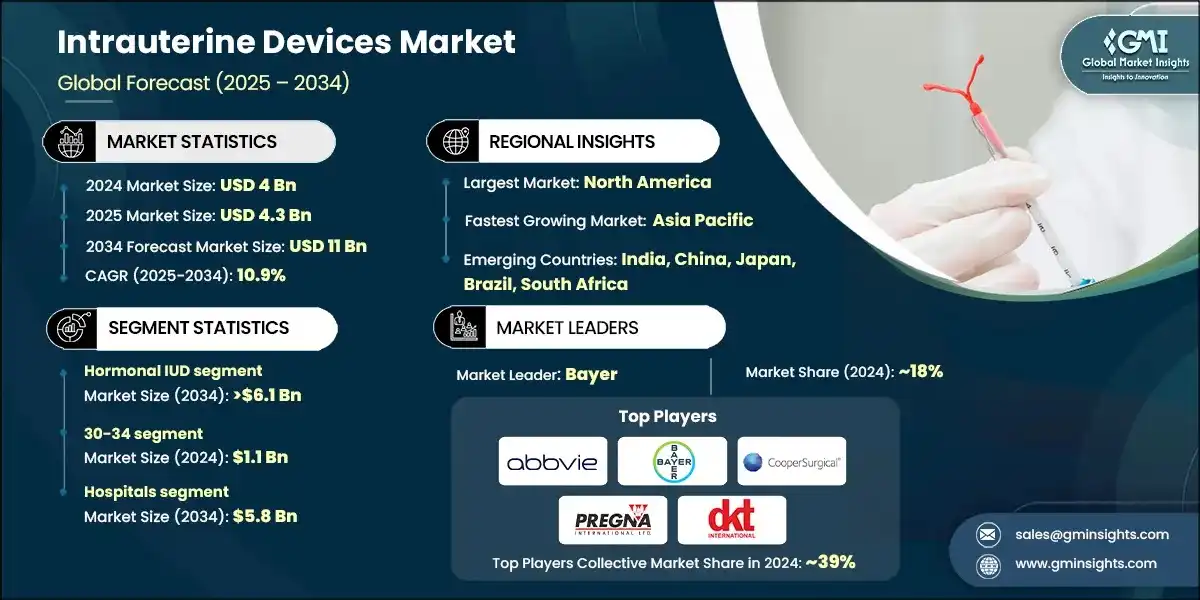

According to a recent study by Global Market Insights Inc., the global intrauterine devices (IUDs) market was valued at USD 4 billion in 2024. The market is expected to grow from USD 4.3 billion in 2025 to USD 11 billion in 2034, at a CAGR of 10.9% during the forecast period,

To get key market trends

The high market growth is attributed to the favorable regulatory scenario, rising awareness among women regarding various IUD applications, and a high number of unintended pregnancies, among others.

IUDs are vital contraceptives, offering a highly effective, long-term, and reversible solution for birth control. Key players of the industry are AbbVie, CooperSurgical, Contrel Europe, and Bayer, among others. These devices are valued for their minimal maintenance, convenience, and ability to provide protection for up to 10 years, depending on the type.

The market has increased from USD 3.3 billion in 2021 and reached USD 3.8 billion in 2023, with a historic growth rate of 6.7%. This growth was primarily driven by the rising demand for long-term, reversible contraceptive solutions, increased awareness about family planning, and supportive government initiatives across both developed and emerging economies.

IUDs are now increasingly recognized for their broader health benefits, including the management of heavy menstrual bleeding, endometriosis, and even perimenopausal symptoms. Educational campaigns, digital health platforms, and improved access to reproductive health information have empowered women to make informed choices about long-term birth control options. This shift in perception is encouraging more women to consider IUDs not just for pregnancy prevention, but as a proactive tool for overall reproductive health management. Additionally, the growing involvement of healthcare providers in counseling women about the safety, efficacy, and non-contraceptive benefits of IUDs has further fueled adoption.

Intrauterine devices (IUDs) are small, flexible, T-shaped contraceptive tools placed inside the uterus to prevent pregnancy. Designed for long-term use, they offer a reversible and highly effective method of birth control.

Intrauterine Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 4 Billion |

| Market Size in 2025 | USD 4.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 10.9% |

| Market Size in 2034 | USD 11 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Favorable regulatory scenario | Streamlined approval processes and supportive policies accelerate market entry and adoption of IUDs. |

| Rising awareness among women regarding various IUD applications | Increased education empowers women to choose long-term, effective contraceptive options. |

| High number of unintended pregnancies | Growing rates of unplanned pregnancies drive demand for reliable birth control methods like IUDs. |

| Government initiatives for the prevention of unwanted abortions and pregnancies | Public health programs promote IUDs as a preventive solution, boosting market growth. |

| Growing inclination towards planned delayed pregnancy | Lifestyle shifts and career planning encourage women to opt for long-term contraception. |

| Technological advancements | Innovations in IUD design and materials enhance comfort, safety, and effectiveness, attracting more users. |

| Pitfalls & Challenges | Impact |

| High cost of the device | Elevated upfront costs can deter adoption, especially among uninsured or low-income populations. |

| Risk of several health issues | Concerns over side effects like cramping, bleeding, or infections may limit patient acceptance. |

| Variability in insurance coverage and access | Inconsistent reimbursement policies create disparities in IUD availability and affordability. |

| Opportunities: | Impact |

| Rising demand for long-term contraception | Growing preference for hassle-free, durable birth control methods is expanding the IUD user base. |

| Market Leaders (2024) | |

| Market Leaders |

~18% market share |

| Top Players |

Collective market share in 2024 is ~39% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Japan, Brazil, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Intrauterine Devices Market Trends

The intrauterine devices industry is experiencing rapid growth, driven by innovations in device design, materials, and insertion techniques.

- For instance, the use of shape memory alloys in newer IUDs helps prevent malposition and uterine wall perforation, enhancing both user experience and clinical outcomes. Additionally, the development of smaller, low-dose, and hormone-free IUDs with up to 99% efficacy over three years is expanding the market by addressing concerns related to traditional devices.

- Furthermore, advancements include ergonomic applicators and pre-loaded insertion kits, which simplify the insertion process and reduce discomfort, making IUDs more accessible to a broader demographic. Research is also underway for smart IUDs capable of monitoring hormone levels and uterine conditions, offering personalized reproductive health insights. These innovations not only improve patient satisfaction but also support the growing demand for long-acting reversible contraception (LARC).

- Moreover, new materials like iron-based IUDs are being explored to offer non-hormonal alternatives with fewer side effects, catering to women seeking hormone-free options. Thus, these technological advancements are reshaping the IUD industry and fueling sustained market expansion.

Intrauterine Devices Market Analysis

Learn more about the key segments shaping this market

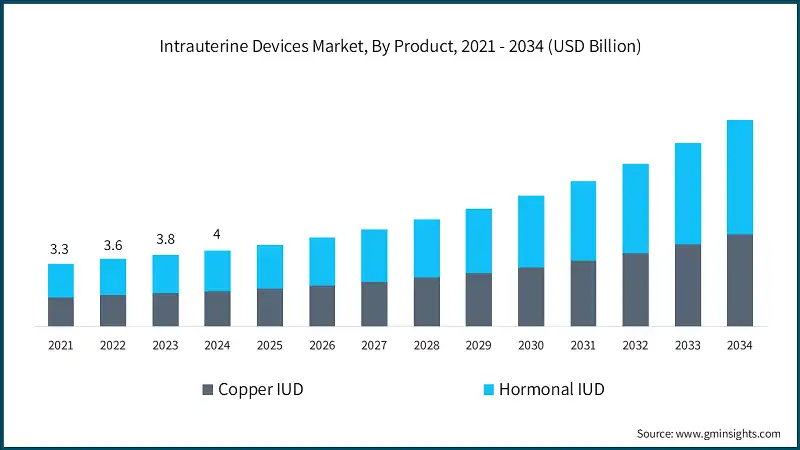

The global market for intrauterine devices was valued at USD 3.3 billion in 2021. The market size reached USD 3.8 billion in 2023, from USD 3.6 billion in 2022.

Based on the product, the market is segmented into copper IUD and hormonal IUD. The hormonal IUD segment accounted for 53.8% of the market in 2024 due to its dual benefits of long-term contraception and menstrual health management, high efficacy, low maintenance, and growing awareness among women and healthcare providers. The segment is expected to exceed USD 6.1 billion by 2034, growing at a CAGR of 11.2% during the forecast period.

On the other hand, the copper IUD segment held a market share of 46.2% in 2024. The growth of this segment can be attributed to its long-term effectiveness, hormone-free nature, affordability, and increasing consumer preference for non-hormonal contraceptive options.

- This dominance of hormonal IUDs in the market is driven by their high efficacy, long-acting protection, and additional health benefits such as reduced menstrual bleeding and relief from symptoms of endometriosis. Hormonal IUDs, particularly those releasing levonorgestrel, are favored by healthcare providers and patients alike for their dual role in contraception and menstrual health management.

- The popularity of hormonal IUDs is further supported by ongoing product innovations, such as slimmer designs for easier insertion and improved comfort, and regulatory approvals from agencies like the FDA and EMA. These devices offer 3 to 5 years of protection, making them ideal for women seeking low-maintenance, reversible birth control.

Based on age group, the intrauterine devices market is segmented into 15-19, 20-24, 25-29, 30-34, 35-39, 40-44, and 45+. The 30-34 segment dominated the market in 2024, accounting for USD 1.1 billion, and is anticipated to grow at a CAGR of 11.1% during the forecast period.

- The 15-19 segment held a revenue of USD 268.1 million in 2024, with projections indicating a steady expansion at 9.9% CAGR from 2025 to 2034.

- The 20-24 segment was valued at USD 550 million in 2024.

- The 25-29 segment held a revenue of USD 934.9 million in 2024, with projections indicating a steady expansion at 11.4% CAGR from 2025 to 2034.

- The 35-39 segment is expected to grow with a CAGR of 10.9%.

- The 40-44 segment held a market share of 10.5% in 2024.

- The 45+ segment was valued at USD 210.6 million in 2024.

Learn more about the key segments shaping this market

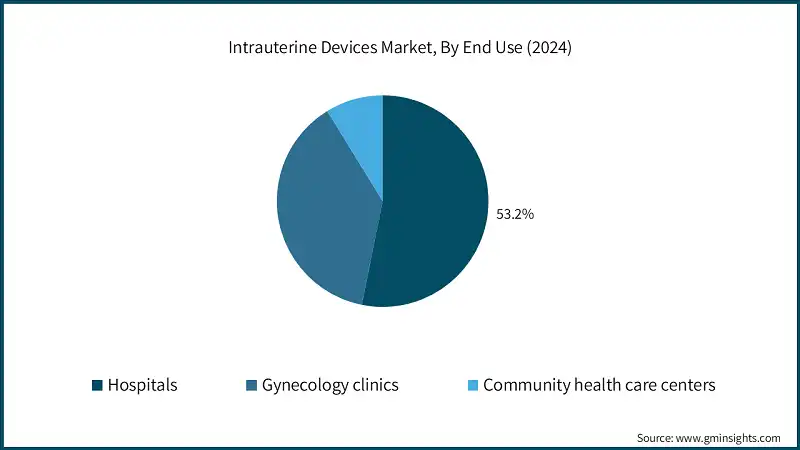

Based on end use, the intrauterine devices market is classified into hospitals, gynecology clinics, and community health care centers. The hospitals segment dominated the market with a revenue share of 53.2% in 2024 and is expected to reach USD 5.8 billion within the forecast period.

- Hospitals across the globe play a central role in delivering long-acting reversible contraception (LARC), including IUDs. Their importance is amplified by the availability of skilled gynecologists and obstetricians who ensure safe and effective insertion procedures. In many countries, hospitals are increasingly adopting protocols for immediate postpartum IUD insertion, which not only enhances access but also contributes to reducing unintended pregnancies. This trend is particularly evident in regions with strong maternal health programs and integrated reproductive care services.

- Gynecology clinics are witnessing steady growth worldwide, driven by rising demand for specialized reproductive care and personalized contraceptive counseling. With advanced IUD insertion technologies and growing awareness of long-term contraceptive options, these clinics are becoming preferred access points, especially in urban and semi-urban areas.

- The community health care centers segment was valued at USD 354.4 million in 2024, driven by increasing access to affordable reproductive health services and growing adoption of IUDs in underserved and rural populations.

Looking for region specific data?

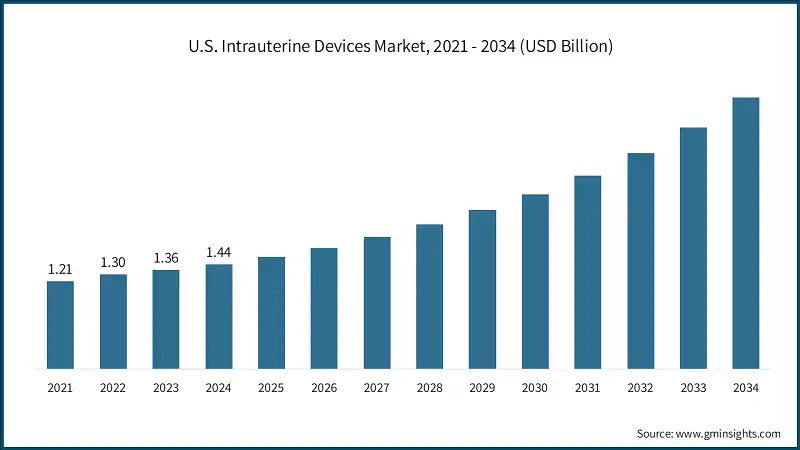

North America Intrauterine Devices Market North America dominated the global intrauterine devices industry with the revenue share of 37.3% in 2024. European market for intrauterine devices accounted for USD 727.5 million in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 11.5% during 2025 to 2034. The Latin America market is expected to experience robust growth over 2025 to 2034. The Middle East and Africa (MEA) market is expected to experience robust growth over the analysis timeframe. Leading industry players such as AbbVie, Bayer, DKT, PREGNA, and CooperSurgical hold around 39% of the market share in the competitive intrauterine devices industry. These companies maintain their leading position by combining strong product lines, business collaborations with healthcare providers, regulatory clearances, and consistent product innovation. Major companies in the intrauterine devices market are reinforcing their competitive positions by focusing on innovation, including the development of frameless and biodegradable IUDs, user-friendly insertion systems, and hormone-free alternatives like copper-based spherical designs. Bayer AG continues to lead with its robust hormonal IUD portfolio, including the widely used Mirena and Kyleena systems. The company recently received FDA approval for an extended-duration Mirena IUD, now offering up to 8 years of protection. Similarly, CooperSurgical is advancing its position through its hormone-free IUD, Paragard, which provides up to 10 years of contraception. The company has launched consumer engagement initiatives and digital tools to improve patient education and access. Its focus on hormone-free solutions appeals to a growing segment of women seeking non-hormonal options. Meanwhile, other key players, such as AbbVie, DKT, PREGNA, and Sebela Pharmaceuticals, are investing in next-generation IUDs with customizable hormone release, longer duration, and improved biocompatibility. These companies are also exploring biodegradable materials and frameless designs to enhance comfort and reduce side effects. A few of the prominent players operating in the intrauterine devices industry include: AbbVie has made significant strides in democratizing access to hormonal IUDs with Liletta, a cost-effective levonorgestrel-releasing system. Designed for up to 8 years of use, Liletta is FDA-approved and widely adopted in public health clinics across the globe. AbbVie’s strategy emphasizes affordability, clinical efficacy, and broad accessibility, particularly for underserved populations. Bayer leads the intrauterine devices market with a share of 18% in 2024. Bayer leads the IUD market with its flagship hormonal IUDs, which are known for their long duration, high efficacy, and additional therapeutic benefits such as reduced menstrual bleeding. Bayer’s commitment to innovation, sustainability, and expanded access is reflected in its efforts to improve device design and broaden contraceptive availability. CooperSurgical distinguishes itself with Paragard, an FDA-approved, hormone-free copper IUD, offering up to 10 years of protection. The company is investing in consumer engagement platforms and digital education tools to raise awareness about non-hormonal options. CooperSurgical’s focus on reusability, patient comfort, and sustainability aligns with the growing demand for personalized and eco-conscious contraceptive solutions.Europe Intrauterine Devices Market

Asia Pacific Intrauterine Devices Market

Latin America Intrauterine Devices Market

Middle East and Africa Intrauterine Devices Market

Intrauterine Devices Market Share

Intrauterine Devices Market Companies

Intrauterine Devices Industry News:

The intrauterine devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Copper IUD

- Hormonal IUD

Market, By Age Group

- 15-19

- 20-24

- 25-29

- 30-34

- 35-39

- 40-44

- 45+

Market, By End Use

- Hospitals

- Gynecology clinics

- Community health care centers

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the intrauterine devices market?

North America held around 37.3% share of the intrauterine devices market in 2024. Strong healthcare infrastructure, insurance coverage improvements, and government family planning initiatives fuel the region's dominance.

What are the upcoming trends in the intrauterine devices market?

Key trends include development of frameless and biodegradable IUDs, smart IUDs for monitoring hormone levels, iron-based non-hormonal alternatives, and ergonomic insertion systems for improved patient comfort.

What was the valuation of the hospitals segment in 2024?

Hospitals held 53.2% share in 2024 and are projected to reach USD 5.8 billion by 2034.

What is the growth outlook for the Asia Pacific intrauterine devices market from 2025 to 2034?

Asia Pacific market for intrauterine devices is projected to grow at the highest CAGR of 11.5% till 2034, due to government family planning policies, improved healthcare infrastructure, and affordable product availability.

Who are the key players in the intrauterine devices market?

Key players include AbbVie, Bayer, CooperSurgical, DKT, PREGNA, GIMA, GYNO CARE, HLL Lifecare Limited, Medicines360, Meril, MONA LISA, Prosan, Sebela Pharmaceuticals, and SMB.

How much revenue did the hormonal IUD segment generate in 2024?

Hormonal IUDs generated revenue with 53.8% market share in 2024, due to dual benefits of contraception and menstrual health management.

What is the market size of the intrauterine devices in 2024?

The market size was USD 4 billion in 2024, with a CAGR of 10.9% expected through 2034 driven by favorable regulatory scenarios, rising awareness among women, and high numbers of unintended pregnancies.

What is the projected value of the intrauterine devices market by 2034?

The intrauterine devices market is expected to reach USD 11 billion by 2034, propelled by technological advancements, government initiatives, and growing inclination towards long-term contraception.

What is the current intrauterine devices market size in 2025?

The market size is projected to reach USD 4.3 billion in 2025.

Intrauterine Devices Market Scope

Related Reports