Summary

Table of Content

International Freight Forwarding Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

International Freight Forwarding Market Size

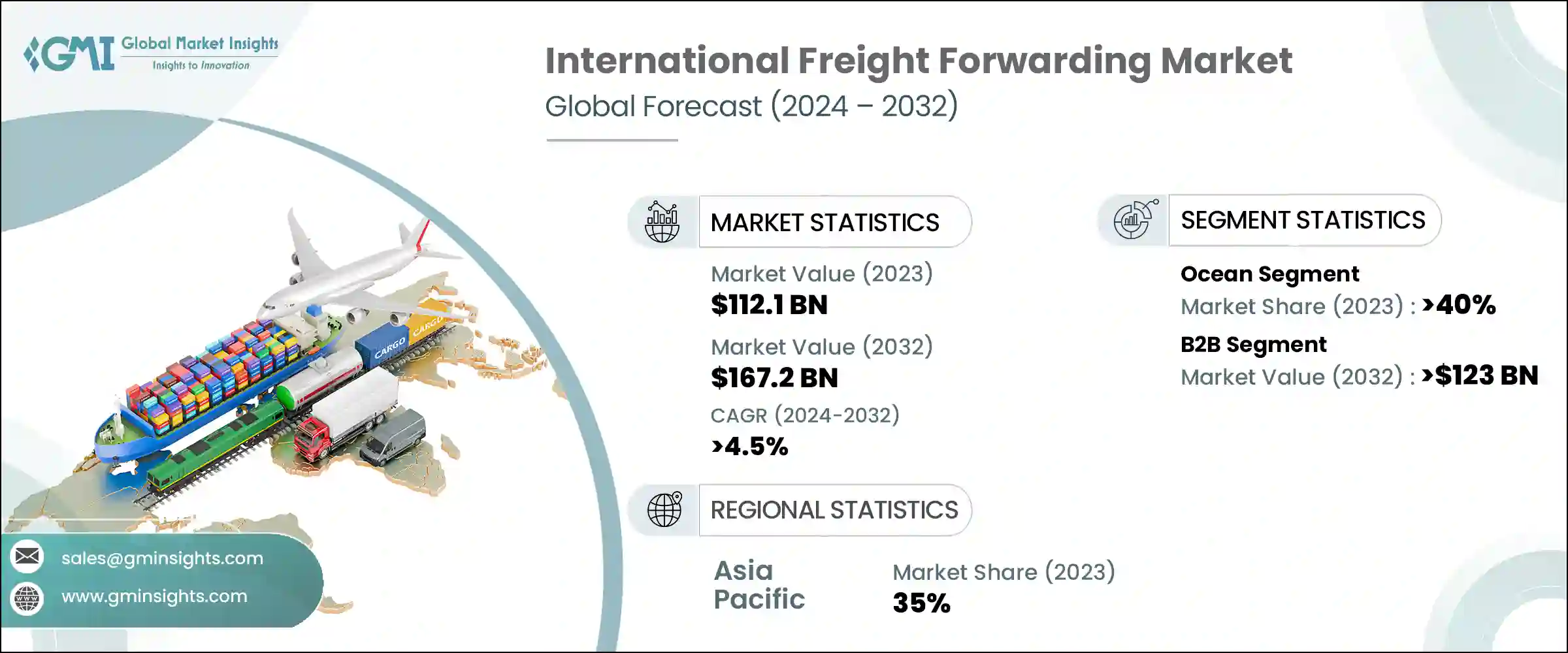

International Freight Forwarding Market size was valued at USD 112.1 billion in 2023 and is estimated to register a CAGR of over 4.5% between 2024 and 2032. The continuous expansion of global trade and the rapid growth of the economy in emerging markets are driving the market. In addition, companies increasingly rely on efficient logistics and freight forwarding services to navigate the complexities of international shipping.

To get key market trends

As countries become more economically interconnected, businesses are sourcing materials, manufacturing products, and selling goods overseas at an increasing rate. This surge in international trade creates a demand for efficient and reliable methods of transporting goods. Moreover, with the growth of the global economy and international trade, more goods are shipped around the world.

For example, in April 2023, the World Trade Organization reported a 4% increase in global trade volumes compared to the previous year. This surge was due to the easing of pandemic-related restrictions and subsequent rebounds in manufacturing and consumer spending. Consequently, the international freight forwarding market experienced heightened activity as companies expanded their logistics operations to manage the growing volume of goods transported across borders.

International Freight Forwarding Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 112.1 Billion |

| Forecast Period 2024 - 2032 CAGR | 4.5% |

| Market Size in 2032 | USD 167.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The rise of e-commerce has led to a substantial increase in demand for freight forwarding services. As consumers and businesses increasingly buy products online, there is a growing requirement for efficient logistics solutions that can manage the transportation and delivery of goods across borders. E-commerce depends heavily on swift and dependable delivery services. Customers now anticipate quick arrival times for their online purchases, often expecting options such as same-day or next-day delivery.

In response, freight forwarders have adjusted by offering expedited shipping choices like airfreight and express services to meet these expectations. For example, in November 2023, DHL made a significant investment in its e-commerce logistics infrastructure to handle the surge in online shopping during the holiday season. This initiative involved expanding fulfillment centers and improving last-mile delivery capabilities.

International trade requires navigating a complex set of regulations and customs procedures that vary between countries. In addition, several factors contribute to higher costs in the international freight forwarding market. Fluctuations in fuel prices, rising insurance premiums, and labor shortages can all result in higher transportation and operational expenses. Moreover, the global supply chain is vulnerable to disruptions caused by diverse factors such as severe weather events, political instability, labor strikes, and accidents. These disruptions can lead to delays, shipping shortages, and price fluctuations, posing challenges for freight forwarders in terms of predictability and effective planning. As a result, all these factors collectively hamper market growth.

International Freight Forwarding Market Trends

Innovations in logistics technology, such as blockchain for supply chain transparency, automation, and digital freight platforms, are focused on improving the efficiency and reliability of freight forwarding services. These advancements enable better tracking, management, and optimization of shipping processes. In addition, data analytics plays a crucial role in analyzing extensive data sets, including shipping routes, traffic patterns, and historical trends. This data-driven approach helps optimize transportation costs and ensures punctual deliveries.

Moreover, blockchain technology provides a secure and transparent method for tracking shipments across the supply chain, eliminating delays and potential errors associated with paperwork, thereby accelerating the entire process. AI and machine learning algorithms automate tasks, enhance decision-making capabilities, and forecast future demand. For instance, in April 2024, CEVA Logistics implemented a new AI-powered chat system allowing customers to track shipments, obtain quotes, and book services in real time. This 24/7 automated service offers customers a more convenient and personalized experience.

Investments in transportation infrastructure, such as ports, airports, and rail networks, propel the growth of the international freight forwarding market by enhancing the efficiency and capacity of freight transport. Projects that connect previously isolated regions can open new trade routes and markets. This expanded connectivity provides freight forwarders with more options, enabling them to offer clients competitive pricing and a wider range of transportation solutions.

For instance, in March 2024, the Panama Canal completed its expansion, with significant infrastructure development which allows for the passage of larger cargo ships, thus increasing the canal's capacity. It resulted in quicker and more efficient movement of goods between the Atlantic and Pacific Oceans. This development is particularly advantageous for international freight forwarders, which can now provide clients with faster and potentially more cost-effective shipping choices on this vital trade route.

International Freight Forwarding Market Analysis

Learn more about the key segments shaping this market

Based on the mode of transportation, the market is divided into ocean, road, air, and rail. In 2023, ocean segment accounted for a market share of over 40%. The adoption of containerization has significantly enhanced the efficiency and security of ocean freight forwarding by facilitating easier loading, unloading, and transportation of goods, thereby reducing shipping times and costs. In addition, there is a growing emphasis on sustainability within the shipping industry, with companies focused on investments in greener technologies such as cleaner fuels and more energy-efficient vessels to minimize their environmental footprint.

Investments in port infrastructure worldwide, particularly in emerging markets, are bolstering the capacity and efficiency of ocean freight operations. Further, improved port facilities and logistics hubs contribute to smoother and expedited cargo handling processes. Furthermore, digital platforms for booking and managing shipments are simplifying logistics for shippers and forwarders. For instance, in March 2024, CMA CGM launched its new digital solution, “eSolutions,” which provides end-to-end digital services for booking, tracking, and managing shipments, aiming to enhance customer experience and operational efficiency.

Learn more about the key segments shaping this market

Based on customer, the international freight forwarding market is categorized into B2B and B2C. The B2B is expected to hold over USD 123 billion by 2032. B2B customers are increasingly shifting towards digital solutions to manage their logistics and supply chain requirements. This trend includes utilizing digital freight platforms that provide improved visibility, tracking, and management of shipments. In addition, clients often request customized logistics solutions tailored to specific industry needs. Freight forwarders are responding to these requests by developing specialized services for industries such as automotive, pharmaceuticals, and retail, each with distinct shipping requirements.

Security measures and compliance with international trade regulations are critical factors for B2B customers when selecting freight forwarders. They seek integrated logistics solutions that seamlessly integrate with their broader supply chain management systems. For instance, in October 2023, DB Schenker announced a partnership with SAP to integrate its logistics services with SAP's supply chain management software. This collaboration offers B2B customers a streamlined solution for managing logistics and supply chain operations. The integration aims to optimize inventory management, reduce lead times, and enhance overall efficiency.

Looking for region specific data?

Asia Pacific had a significant share of the international freight forwarding market with around 35% in 2023. Various countries, such as China, India, and emerging nations in Southeast Asia, are undergoing rapid economic growth. This expansion has further fueled increased trade activities and driven up the demand for efficient freight forwarding services. Moreover, trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) are stimulating regional trade by lowering tariffs and simplifying customs procedures. Further, the adoption of advanced technologies is enhancing the efficiency and transparency of freight forwarding operations across the region.

Furthermore, a significant rise in e-commerce activities has also led to higher trade volumes. As a result, there is a rising emphasis on sustainability within the logistics industry in response to these growing environmental concerns, in this region. In addition, companies are investing in eco-friendly practices and technologies to mitigate their environmental impact. For example, in May 2024, Singapore's PSA International launched new green port initiatives, incorporating electric cranes and autonomous vehicles to reduce the carbon footprint of its logistics operations. These efforts align with regulatory mandates and respond to consumer demand for sustainable freight forwarding solutions.

The rapid growth of e-commerce in North America, particularly in the U.S., has heightened the demand for efficient freight forwarding services to manage the substantial volume of cross-border shipments. The United States-Mexico-Canada Agreement (USMCA), effective since July 2020, has catalyzed trade among these nations. This agreement has opened new opportunities for freight forwarders by optimizing cross-border logistics and reducing trade barriers.

For instance, in January 2023, the United States International Trade Commission (USITC) reported increased trade volumes among the U.S., Mexico, and Canada attributable to the USMCA. It reduces tariffs on a wide range of goods traded within the region and includes provisions to simplify customs procedures and facilitate the flow of goods across borders. This highlights its positive impact on cross-border logistics and freight forwarding services.

Europe is witnessing notable advancements in logistics technology, including automation, digital platforms, and real-time tracking systems. The European Union's trade agreements with various countries and regions, such as the EU-Japan Economic Partnership Agreement, are enhancing international trade and boosting demand for freight forwarding services. For instance, in January 2024, the European Commission reported a substantial rise in trade between the EU and Japan after the agreement's implementation. This agreement removes or greatly reduces tariffs on most goods traded between the EU and Japan and simplifies customs procedures, underscoring its positive effect on freight forwarding services.

International Freight Forwarding Market Share

DHL, Kuehne + Nagel, and DSV Global dominate the market with around 8% of the market share. DHL Supply Chain & Global Forwarding is a global leader in contract logistics and international freight forwarding. They provide a wide range of services, including warehousing, transportation, packaging, and value-added services such as customs brokerage and lead logistics management. They serve businesses of all sizes across diverse industries, from automotive and consumer goods to life sciences and retail.

Kuehne + Nagel specializes in contract logistics, air, ocean, and overland freight forwarding, along with tailored solutions for specific industries. The company is renowned for its expertise in sea freight and integrated logistics solutions, which seamlessly combine multiple services for clients. They prioritize innovation and technology adoption, investing in areas such as artificial intelligence and data analytics to enhance transportation and logistics efficiency.

International Freight Forwarding Market Companies

Major players operating in the international freight forwarding industry are:

- Kuehne + Nagel

- DB Schenker

- DHL Supply Chain & Global Forwarding

- UPS Supply Chain Solutions

- DHL Express

- Expeditors International

- C.H. Robinson

- CEVA Logistics

- Panalpina (part of DSV Panalpina)

- Nippon Express

- Expeditors International

- Sinotrans

International Freight Forwarding Industry News

- In February 2024, Kuehne + Nagel launched myKN, its new digital platform. This platform provides B2B customers with real-time tracking, online booking, and end-to-end visibility of their shipments. It enhances the digital logistics experience.

- In May 2023, Bolloré Logistics inaugurated K-HUB, its latest warehouse and distribution center located in South Korea. The site is located in Geomdan, and it benefits from its strategic location near the Seoul metropolitan area and other parts of the country. K-HUB represents a contemporary facility with a strong emphasis on sustainability and innovation.

The international freight forwarding market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Bn) and volume (000’ tons) from 2021 to 2032, for the following segments:

Market, By Services

- Freight transportation

- Warehousing and distribution

- Customs brokerage

- Freight consolidation

- Value-added services

Market, By Mode of Transportation

- Ocean

- Freight transportation

- Warehousing and distribution

- Customs brokerage

- Freight consolidation

- Value-added services

- Road

- Freight transportation

- Warehousing and distribution

- Customs brokerage

- Freight consolidation

- Value-added services

- Air

- Freight transportation

- Warehousing and distribution

- Customs brokerage

- Freight consolidation

- Value-added services

- Rail

- Freight transportation

- Warehousing and distribution

- Customs brokerage

- Freight consolidation

- Value-added services

Market, By Customer

- B2B

- B2C

Market, By End User

- Manufacturing

- E-commerce & retail

- Automotive

- Healthcare & pharmaceuticals

- Oil and gas

- Food and beverage

- Consumer goods

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- South Africa

- Saudi Arabia

- Rest of MEA

Frequently Asked Question(FAQ) :

How substantial is the international freight forwarding market in Asia Pacific?

Asia Pacific market held over 35% share in 2023, driven by the region's strategic location, extensive port infrastructure, robust economic growth and expanding manufacturing sector.

Which prominent players are operating in the international freight forwarding industry?

Kuehne + Nagel, DB Schenker, DHL Supply Chain & Global Forwarding, UPS Supply Chain Solutions, DHL Express, Expeditors International, C.H. Robinson, CEVA Logistics, Panalpina (part of DSV Panalpina), Nippon Express, Expeditors International, and Sinotrans, among others.

What is driving the demand for international freight forwarding in oceans?

The ocean segment recorded 40% of the international freight forwarding industry share in 2023, attributed to the cost-effectiveness and capacity of ocean freight, the growing global trade and the expansion of port infrastructure.

What is the size of the international freight forwarding market?

The market size of international freight forwarding reached USD 112.1 billion in 2023 and will witness 4.5% CAGR from 2024 to 2032, owing to increasing globalization and international trade agreements, the rise of e-commerce and just-in-time delivery practices.

International Freight Forwarding Market Scope

Related Reports