Summary

Table of Content

Industry 4.0 Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industry 4.0 Market Size

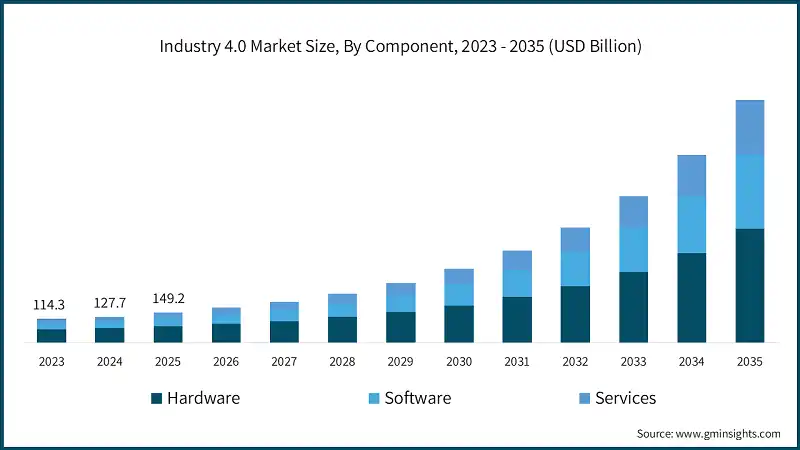

The global industry 4.0 market size was estimated at USD 149.2 billion in 2025. The market is expected to grow from USD 172.5 billion in 2026 to USD 1.2 trillion in 2035, at a CAGR of 24% according to latest report published by Global Market Insights Inc.

To get key market trends

The market's substantial growth is underpinned by several quantifiable factors. Connected IoT devices in manufacturing environments have experienced tremendous expansion, growing from 237 million devices in 2015 to 923 million in 2020, with projections indicating further growth to 21.1 billion globally by 2025.

Investment trends underscore the market's promising trajectory. Enterprises are set to allocate a whopping USD 2.5 trillion towards digital transformation in 2024. Narrowing the focus, spending on automation alone is anticipated to soar to USD 232 billion in the same year.

In manufacturing settings, the number of connected IoT devices surged from 237 million in 2015 to 923 million in 2020. Projections indicate the global IIoT market could hit 21.1 billion devices by 2025.

The manufacturing executives surveyed, 92% of them, believe that smart factory solutions will be the main drivers of competitiveness, highlighting the transformative impact of artificial intelligence on industrial operations. Furthermore, AI-driven predictive maintenance has the potential to enhance labor productivity by 5% to 20% and cut downtime by up to 15%.

National Industry 4.0 policies are fueling significant market expansion. Germany's Industrie 4.0 initiative seeks to cement its technological dominance in industrial production. Meanwhile, China's "Made in China 2025" plan sets a goal of achieving 70% domestic content by 2025. In the U.S., the "Manufacturing USA" initiative has established 16 collaborative R&D institutes since 2014.

By 2025, government spending on Industry 4.0 is expected to generate nearly USD 1 trillion in economic value, with Korea, Japan, and Singapore leading digital manufacturing programs. The EU allocated EUR 20 billion under Horizon 2020 for AI competitiveness, while the U.S. funds 51 technology adoption centers through the NIST Manufacturing Extension Partnership.

Industry 4.0 Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 149.2 Billion |

| Market Size in 2026 | USD 172.5 Billion |

| Forecast Period 2026-2035 CAGR | 24% |

| Market Size in 2035 | USD 1.2 Trillion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing adoption of industrial IoT (IIoT) and smart factory solutions | Enables real-time monitoring, data exchange, and smarter manufacturing decisions. |

| Rising demand for automation and robotics across manufacturing sectors | Manufacturers improve efficiency, reduce errors, and ensure quality. |

| Growing need for real-time data analytics and predictive maintenance | Manufacturers can optimize performance and reduce downtime by anticipating equipment failures. |

| Expansion of cloud computing, AI, and edge computing in industrial operations | Enables swift decision-making, scalable data processing, and smart process optimization in intricate industrial networks. |

| Government initiatives and investments supporting digital manufacturing and smart industries | It promotes Industry 4.0 adoption through funding, incentives, and infrastructure support. |

| Pitfalls & Challenges | Impact |

| High implementation costs for SMEs | Limits adoption of Industry 4.0 technologies among small and medium enterprises due to budget constraints. |

| Cybersecurity and data privacy risks | Exposes industrial operations to potential cyberattacks and sensitive data breaches, affecting trust and compliance. |

| Opportunities: | Impact |

| Expansion of smart factories and automated production lines | Boosts manufacturing efficiency, reduces manual intervention, and enables scalable, flexible production. |

| Integration of AI and machine learning for predictive maintenance | Minimizes equipment downtime, extends machinery life, and optimizes maintenance schedules. |

| Growth in Industrial IoT (IIoT) adoption | Enhances connectivity, real-time monitoring, and data-driven decision-making across industrial operations. |

| Cloud and edge computing solutions for industrial operations | Enables faster data processing, seamless collaboration, and scalable digital manufacturing solutions. |

| Government incentives and initiatives promoting digital manufacturing | Encourages technology adoption, reduces investment barriers, and accelerates Industry 4.0 transformation. |

| Market Leaders (2025) | |

| Market Leaders |

4% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, South Korea |

| Future Outlook |

|

What are the growth opportunities in this market?

Industry 4.0 Market Trends

Transformative trends are reshaping the global landscape of the Industry 4.0 sector, particularly in manufacturing and industry. These trends highlight the merging of digital technologies, artificial intelligence, and operational technology, paving the way for unmatched opportunities in efficiency, sustainability, and innovation.

The AI market in manufacturing is rapidly growing as companies move from pilot projects to enterprise-wide adoption. Many manufacturers now use AI for production scheduling, monitoring, and control, leveraging smart factory solutions for a competitive edge.

AI integration yields measurable and substantial benefits. For instance, AI-driven predictive maintenance can enhance labor productivity by 5% to 20% and cut downtime by up to 15%. Additionally, a global manufacturer overseeing more than 10,000 machines reaped millions in savings, achieving ROI in just three months

Manufacturers are leveraging Generative AI (GenAI) to reduce AI application deployment time from month to week. For instance, Siemens' Engineering Copilot TIA converts natural language into automation codes, while Honeywell and Google Cloud use Vertex AI Search to deliver enterprise-wide insights.

Edge computing and next-gen connectivity are driving a pivotal shift in how industries operate, merging Information Technology with Operational Technology. By 2028, global investments in edge computing are set to hit USD 378 billion, spearheaded by the manufacturing sector.

Edge computing is rapidly gaining traction due to its significant operational benefits. This technology updates inventories 50 times quicker than traditional cloud systems and meets the crucial 3-5ms latency demands of robotic applications. According to Harbor Research, converged networks boost operational productivity by 15-35% and cut cybersecurity risks by 10-30%.

Collaborative robots (Cobots) are the fastest-growing robotics segment, offering affordability, safety, and ease of use. They enable SMEs to compete in applications like packaging and electronics assembly, supported by Robotics-as-a-Service (RaaS) models that reduce upfront costs.

The integration of robotics with digital twins and edge computing creates sophisticated operational capabilities. BMW uses NVIDIA Omniverse to create digital twins of robotic systems, enabling simulation of assembly lines, identification of bottlenecks, and reduction of waste and costs.

Industry 4.0 Market Analysis

Learn more about the key segments shaping this market

Based on component, the industry 4.0 market is segmented into hardware, software and services reflecting the evolving technological priorities and investment strategies of manufacturing organizations globally. The hardware segment dominated the market with 54% share in 2025, and the segment is expected to grow at a CAGR of 22.1% from 2026 to 2035.

- The hardware category includes sensors, actuators, industrial IoT devices, edge computing infrastructure, industrial PCs, robotic systems, and smart manufacturing equipment.

- Advancements in sensor miniaturization, processing capabilities, and power efficiency are driving hardware growth. GE Appliances now operates with over 250 robots at its Louisville plant, tripling its count from five years ago.

- As industrial networks upgrade to a 10 Gig capacity, edge computing hardware becomes vital, managing the surge in traffic driven by AI applications and enhancing PoE performance for cameras in AI-driven vision systems.

- Efforts like OPC UA over TSN are improving deterministic communication, while affordable and user-friendly collaborative robots are boosting SME adoption.

- Hardware's strong absolute growth contrasts with its lower CAGR, reflecting market maturation and a shift toward intelligent applications and analytics built on physical infrastructure.

- Software is surging ahead as the second fastest growing segment, boasting an impressive 25.5% CAGR from 2026 to 2035.

- This category includes Manufacturing Execution Systems (MES), Supervisory Control and Data Acquisition (SCADA), Enterprise Resource Planning (ERP), Product Lifecycle Management (PLM), analytics platforms, AI/ML applications, digital twin software, cybersecurity solutions, and cloud-based industrial platforms.

- The software segment's accelerated growth reflects the industry's transformation toward data-driven, intelligent operations.

- Generative AI is accelerating AI application deployment from months to weeks. Siemens' Engineering Copilot TIA automates code generation, while Honeywell and Google Cloud deliver AI agents via Vertex AI Search.

- The services segment, fastest growing at 26.7% CAGR from 2026 to 2035, includes system integration, consulting, managed services, cybersecurity, and digital transformation advisory.

- The growing complexity of Industry 4.0 implementations drives premium growth, as 98% of data remains unused due to limited analytics capabilities, necessitating professional data services.

Learn more about the key segments shaping this market

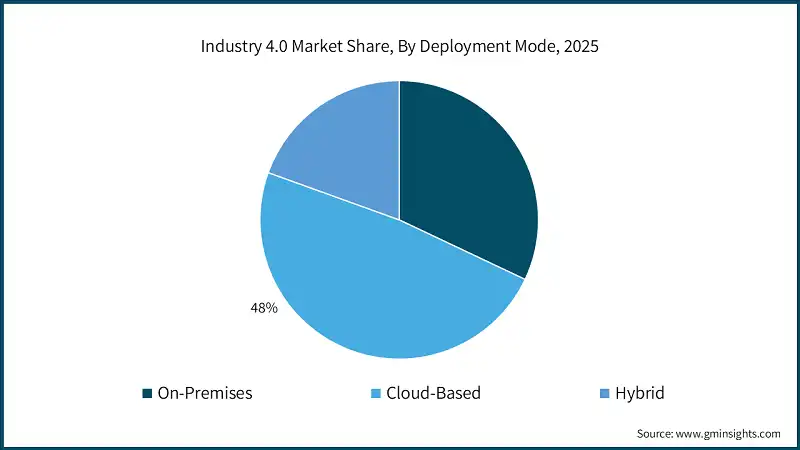

Based on deployment mode, the industry 4.0 market is divided into on-premises, cloud-based and hybrid. The cloud-based segment dominates with 48% market share in 2025 and is expected to grow at the fastest rate of 24.3% from 2026 to 2035.

- Cloud deployment offers scalability, cost efficiency, centralized data management, advanced analytics, global accessibility, and robust security with compliance support.

- IBM's Watson Supply Chain, powered by clouds, seamlessly integrates predictive maintenance data into inventory and logistics planning, enhancing both throughput and resilience.

- The cloud model's scalability allows small manufacturers to adopt Industry 4.0 technologies via platforms like Schneider Electric's EcoStruxure and Siemens Xcelerator without significant infrastructure costs.

- On-premises deployments cater to industries with strict data sovereignty, regulatory compliance needs, and mission-critical applications requiring low latency, supported by existing infrastructure investments.

- Industries like aerospace, defense, pharmaceuticals, and nuclear energy prefer on-premises deployments to manage classified data and meet regulatory requirements. This model ensures full control over data, infrastructure, and security protocols, removing external dependencies.

- On-premises edge infrastructure minimizes latency critical for robotics, ensures offline functionality during outages, improves bandwidth via local data filtering [A3.ORG], and enhances security with device-level processing.

- Organizations are retrofitting legacy equipment with sensors, software, and training despite high costs. On-premises deployment remains crucial for deterministic control, supported by industrial networks upgrading to 10 Gig capacity for reliable, low-latency control traffic delivery.

- Hybrid architectures blend on-premises and cloud deployments, tailoring performance, security, cost, and flexibility to meet specific workload demands.

- Organizations can now retain sensitive data and crucial applications on-premises, while harnessing the cloud for analytics, training machine learning models, coordinating across multiple sites, and utilizing scalable storage.

- Global operations find immense value in hybrid deployment, leveraging edge processing at factory sites for immediate control and utilizing the cloud to aggregate data across various locations, thereby training AI models on extensive datasets.

Based on organization size, the industry 4.0 market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominates with 66% market share in 2025.

- Large enterprises, with over 500 employees and annual revenues exceeding USD 500 million, leverage significant capital, specialized IT/OT teams, existing automation, global coordination, and vendor relationships to adopt industry 4.0 effectively.

- These organizations are leading digital transformation at scale, with 92% of manufacturing executives surveyed believing smart factory solutions will be primary drivers of competitiveness.

- 78% of large manufacturers allocate over 20% of their improvement budget to smart manufacturing, with 88% expecting investments to rise or remain steady next fiscal year.

- Since implementing smart manufacturing, large enterprises have reported operational improvements: production output has risen by 10% to 20%, employee productivity has increased by 7% to 20%, and capacity has been unlocked by 10% to 15%.

- With 40% integration of edge computing and 70% of tech leaders chasing digital twin initiatives, they spearhead advanced technology deployment.

- By 2025, SMEs are set to command a market share of 34%, translating to a valuation of USD 51.2 billion. Projections indicate that this figure will surge to USD 419.2 billion by 2035, marking a robust CAGR of 24.3%, outpacing the growth rate of larger enterprises.

- Globally, SMEs, defined as organizations with fewer than 500 employees, make up 90% of businesses and account for 50% of jobs. In developing countries, they contribute a significant 40% to the GDP.

- The SME segment's higher CAGR is driven by accessible cloud-based SaaS models, declining hardware costs, tailored solutions, and government support programs.

- Integrating with legacy equipment is challenging due to older machines lacking sensors, requiring costly investments. However, SMEs are increasingly adopting targeted strategies to overcome these barriers.

- Collaborative robots (cobots) are affordable, easy to program, and tailored for SMEs, with Robotics-as-a-Service (RaaS) enabling automation without large upfront costs.

Based on technology, the industry 4.0 market is divided into internet of things (IoT), digital twin, big data and AI analytics, cybersecurity, cloud computing, robotics and automation, augmented reality (AR) and others. The internet of things (IoT) dominates with 28% market share in 2025, and with a CAGR of 24.1% during forecast period.

- IoT connects sensors, actuators, and devices, turning physical measurements into data streams for real-time monitoring and control.

- IoT adoption has surged in industrial sectors, with manufacturing facilities leveraging connected devices for asset tracking, machine monitoring, and production optimization. By mid-2024, many factories transitioned to connected operational architectures.

- Industrial IoT gained momentum in 2023 as major manufacturers deployed connected devices, driving seamless data collection, better equipment utilization, and higher productivity.

- Digital Twin technology, accounting for 11% of the technology segment share, is poised to grow at a remarkable 25.0% CAGR, underscoring its pivotal role in seamlessly integrating virtual and physical systems.

- Digital twins, powered by AI and analytics, are virtual replicas that sync with real-world data via IoT sensors. They facilitate simulation, monitoring, and informed decision-making.

- For instance, as of October 2024, Siemens harnessed its Semantic Stack to craft over 400 million digital twins. Concurrently, 81% of companies are either utilizing, testing, or strategizing on metaverse applications.

- Big Data and AI Analytics, accounting for 12% of the technology sector, is witnessing a robust growth rate of 23.8% CAGR, underscoring the pivotal role of data-driven insights in the operations of Industry 4.0.

- This category encompasses data lakes, analytics platforms, machine learning models, and AI-powered decision systems that transform raw industrial data into actionable intelligence.

- Cybersecurity, holding an 8% share of the technology sector, is witnessing a robust 24.5% CAGR, underscoring rising threats and stringent compliance mandates.

- Network security, endpoint protection, threat intelligence, security information and event management (SIEM), identity and access management, and OT-specific security solutions all fall under this category.

- Blockchain for supply chain traceability, additive manufacturing/3D printing, advanced materials, and other emerging technologies fall under the "Others" category, projected to grow at a 15.7% CAGR during forecast period.

Looking for region specific data?

The US industry 4.0 market is expected to experience significant and promising growth of 30.4% from 2026 to 2035.

- The US leads the North American Industry 4.0 market, driven by advanced digital infrastructure, industrial IoT adoption, and a focus on automation and smart manufacturing.

- The U.S., supported by industrial tech vendors, cloud providers, and leading manufacturers, is swiftly adopting Industry 4.0 in sectors like automotive, aerospace, electronics, and heavy machinery.

- Federal initiatives and programs are driving industries to adopt digital technologies responsibly, focusing on cybersecurity, resilience, and scalability.

- Public and private-sector regulations on data integrity, cyber risks, and digital governance are driving secure and compliant adoption of Industry 4.0 technologies in critical industries.

- In the U.S., strong research, venture funding, and industry-academia partnerships are accelerating innovation and commercialization of advanced automation and AI-driven platforms.

- U.S. enterprises are adopting intelligent automation, digital twins, and connected factory systems to enhance productivity and supply-chain responsiveness. Manufacturers and logistics operators are leveraging smart factory solutions to meet growing demands for efficiency and quality.

North America region dominated the industry 4.0 market with a market share of 32% in 2025, which is anticipated to grow at a CAGR of 23.4% during the analysis timeframe. North America's leadership stems from widespread acceptance of AI-driven logistics solutions, advanced technology infrastructure, and concentration of leading technology companies.

- North America leads the market, bolstered by its vast addressable market, lenient regulatory landscape, and a tech-savvy culture that spans various industries. Additionally, there's a notable concentration of early-adopter SMEs across all key verticals.

- Global technology leaders like Siemens USA, Emerson Electric, and Honeywell International drive North America's advanced Industry 4.0 ecosystem with innovations in automation, IoT, and AI platforms.

- The U.S., driven by advanced digital infrastructure and technologies like IoT and AI, leads global digital industrial transformation as manufacturers modernize operations and increase smart manufacturing budgets.

- Government programs like Manufacturing USA and NIST Manufacturing Extension Partnership drive R&D, workforce development, and technology growth, while major industrial investments strengthen U.S. advanced manufacturing.

- North America is rapidly adopting digital twins, predictive maintenance, and cyber-physical systems to boost productivity and operational resilience. Aerospace, defense, and automotive sectors lead with AI-driven optimization and connected manufacturing systems.

- Reshoring initiatives, clean manufacturing investments, and sustainability mandates are transforming supply chains, positioning North America as a global leader in high-tech, automated manufacturing.

- Canada is strengthening its regional presence through government incentives, leadership in clean technology, and integration into North American supply chains. Its innovation-driven policies and industrial digitalization are accelerating Industry 4.0 adoption.

- The region faces challenges like a skills gap, cybersecurity threats, and labor shortages, which are driving faster adoption of robotics, autonomous systems, and AI-driven manufacturing to remain competitive.

The China is fastest growing country in Asia Pacific industry 4.0 market growing with a CAGR of 25.8% from 2026 to 2035.

- China's robust manufacturing base, coupled with its advanced digital infrastructure, is propelling the swift expansion of the Industry 4.0 market. This growth is further fueled by a surging demand for smart factories, interconnected production systems, and cutting-edge automation technologies.

- Government initiatives like "Made in China 2025" and AI strategies are driving the large-scale adoption of intelligent manufacturing, industrial IoT, and AI-driven production optimization.

- China's advanced industrial and digital infrastructure, including automated factories, robotics, industrial internet platforms, and 5G, drives real-time data integration and digital transformation across industries.

- Chinese cloud providers, telecom operators, and manufacturers are advancing Industry 4.0 by adopting digital twins, AI-driven systems, and IoT networks to modernize production and enhance competitiveness.

- China, backed by strong policies, innovation, and rapid tech advancements, leads Asia Pacific's Industry 4.0 in smart manufacturing and digital factory transformation.

Asia Pacific is the fastest growing industry 4.0 market, which is anticipated to grow at a CAGR of 25.7% during the analysis timeframe.

- Rapid industrialization, robust manufacturing growth, enhanced digital infrastructure, and extensive government-led digital transformation initiatives in major economies have positioned Asia Pacific as the leading regional market for Industry 4.0.

- China leads the region in Industry 4.0, driven by national strategies, large-scale IoT deployments, advanced robotics, and government-backed smart factory projects.

- Chinese industrial and technology giants are advancing digital manufacturing with AI platforms, industrial-internet systems, and automation, driving efficiency and smart factory growth in domestic and regional markets.

- India is emerging as a high-growth market, driven by expanding digital infrastructure, government-led modernization, and adoption of automation, IoT, and AI. Its global IT services hub status further supports Industry 4.0 implementation.

- Japan and South Korea lead intelligent manufacturing with advanced robotics ecosystems, precision-engineering expertise, and integrated strategies for automation and digital innovation.

- Southeast Asia, led by countries like Singapore, Malaysia, Thailand, and Vietnam, is rapidly advancing through investments in industrial parks, digital infrastructure, and Industry 4.0 technologies, supported by cross-border manufacturing supply chains.

- Australia drives regional growth through mining automation, research collaborations with Asia, and digital technology adoption in agriculture and services, strengthening Asia Pacific's Industry 4.0 ecosystem.

- Asia Pacific's young workforce, growing middle class, and major manufacturing clusters drive the rapid adoption of IoT, AI, robotics, and connected factory technologies.

- Public-private partnerships, industrial strategies, and investments in 5G, data centers, and automation drive Asia Pacific's position as a leading Industry 4.0 growth engine.

Germany dominates the Europe industry 4.0 market, showcasing strong growth potential, with a CAGR of 25% from 2026 to 2035.

- Technology providers and industrial firms in Germany are driving Industry 4.0 adoption by utilizing digital platforms, IoT solutions, and automation to transform manufacturing, logistics, and energy sectors.

- Government initiatives like Industrie 4.0 and Horizon 2020 are driving the adoption of smart factory solutions, AI-driven production, and real-time data monitoring in industrial sectors.

- German manufacturers and tech firms use digital twins, IoT, and AI analytics to enhance efficiency, predictive maintenance, and supply chain operations.

- Germany solidifies its status as Europe's epicenter for industrial digital transformation and smart manufacturing, as leading providers roll out scalable, modular, and interoperable Industry 4.0 platforms.

- For instance, in October 2025, Siemens bolstered its Xcelerator platform facilities in Germany, emphasizing digital twin integration, AI-driven industrial analytics, and connected automation solutions, thereby enhancing its prowess in smart factory deployments.

Europe industry 4.0 market accounted for USD 42 billion in 2025 and is anticipated to show growth of 24.6% CAGR over the forecast period.

- The Industry 4.0 market in Europe is growing steadily, driven by strong industrial output and digital transformation across supply chains. Germany, France, the Netherlands, and the UK lead this adoption.

- Germany leads the regional landscape with its strong manufacturing base, advanced factory modernization, and widespread industrial IoT deployment, driven by its role as the origin of Industry 4.0.

- Southern Europe is rapidly adopting Industry 4.0, driven by investments in automation, modernized logistics, and the growth of e-commerce and smart supply chains.

- The UK is rapidly adopting industry 4.0 technologies, driven by strong data governance, cloud adoption, and national programs supporting AI and automation. Public-private partnerships further aid manufacturers in implementing advanced digital tools.

- European regulations, including GDPR and AI governance frameworks, are driving responsible adoption of Industry 4.0 technologies, boosting enterprise confidence and secure automation deployment.

- Collaboration among technology providers, research institutions, and industrial players is driving scalable Industry 4.0 solutions. Innovation clusters in Europe are enhancing manufacturing resilience and intelligent automation in supply chains.

Brazil leads the Latin American industry 4.0 market, exhibiting remarkable growth of 22.2% during the forecast period of 2026 to 2035.

- Latin American countries like Brazil, Mexico, and Argentina are rapidly adopting Industry 4.0 technologies, driven by industrialization, manufacturing modernization, and demand for automation.

- In the region, government initiatives bolster adoption by channeling investments into industrial digital infrastructure, promoting industry 4.0 programs, and implementing innovation-centric policies to boost competitiveness.

- Global Industry 4.0 leaders are collaborating with firms in Brazil, Mexico, and Argentina to implement industrial IoT, digital twins, AI analytics, and automation for production optimization.

- The adoption of industry 4.0 in Latin America's manufacturing, logistics, and energy sectors is accelerating, driven by advancements in cloud computing, IoT networks, and smart factory platforms.

Saudi Arabia to experience substantial growth in the Middle East and Africa industry 4.0 market in 2025.

- In Riyadh, Jeddah, and Dammam, government initiatives are propelling Saudi Arabia's Industry 4.0 market, emphasizing smart manufacturing, digital transformation, and enhanced operational efficiency.

- Driven by Vision 2030 and industrial diversification, investments are increasingly focused on Industry 4.0 solutions like IoT, AI analytics, robotics, and automation.

- In Saudi Arabia, sectors like petrochemicals, manufacturing, and energy are witnessing a surge as industrial firms, technology providers, and system integrators roll out scalable, data-driven Industry 4.0 platforms.

- The country utilizes modular industrial IoT platforms, digital twins, and automation tools to enhance production and real-time monitoring, solidifying its role as a regional hub for smart industrial operations.

Industry 4.0 Market Share

- The top 7 companies in the market are Siemens, Emerson Electric, General Electric, Robert Bosch, Honeywell International, Cisco Systems, and Schneider Electric contributed around 22% of the market in 2025.

- Siemens, at the forefront of the industry, harnesses its extensive portfolio that encompasses industrial automation, digitalization, and electrification. Central to its strategy is the Siemens Xcelerator platform, an open digital business platform and pioneering digital ecosystem, facilitating swift and secure access to industrial AI.

- Emerson Electric launched its "Boundless Automation" vision to integrate software, data, and technology across plant, site, and enterprise levels in 2024. The company provides solutions ranging from sensors to control systems and project services for process industries.

- General Electric, harnessing its Predix platform and deep industrial know-how, leads the charge in the Industry 4.0 arena. Using Industrial IoT, digital twins, and AI analytics, GE's solutions not only optimize manufacturing processes but also facilitate predictive maintenance and boost operational efficiency in sectors ranging from energy and aviation to healthcare.

- Robert Bosch, focused on automotive and industrial technology, consumer goods, and energy solutions, has generated over four billion euros in Industry 4.0 sales since 2011, including 700 million euros in 2020 from connected manufacturing and logistics solutions.

- Honeywell leverages its Forge IoT platform and Accelerator operating system to integrate technology, software, and AI, aligning with trends in energy security, sustainability, digitalization, and AI.

- Cisco Systems is prioritizing industrial networking, cybersecurity, and connectivity for Industry 4.0. Its 2024 report highlights that 89% of organizations prioritize cybersecurity compliance, 92% value unified cybersecurity solutions, and 63% increased industrial infrastructure spending last year.

- Schneider Electric leads in digital energy management and automation, helping manufacturers cut costs and achieve sustainability through its EcoStruxure platform.

Industry 4.0 Market Companies

Major players operating in the industry 4.0 industry are:

- Cisco Systems

- Emerson Electric

- General Electric

- Honeywell International

- Microsoft

- Mitsubishi Electric

- Oracle

- Robert Bosch

- Schneider Electric

- Siemens

- Siemens, Emerson Electric, and General Electric lead the Industry 4.0 market by utilizing digital twins, IoT, AI analytics, and automation to optimize operations and enable predictive maintenance. They expand globally through strategic partnerships, technology collaborations, and smart factory solutions.

- Robert Bosch, Honeywell International, and Cisco Systems are at the forefront of merging IoT, cloud computing, and AI analytics into industrial processes. Their initiatives prioritize seamless connectivity, real-time oversight, and heightened operational efficiency. Additionally, they champion sustainable practices, advocating energy optimization, waste minimization, and eco-friendly manufacturing solutions.

- Schneider Electric, Microsoft, and Mitsubishi Electric are advancing Industry 4.0 through cloud platforms, digital twins, and smart automation. They focus on operational resilience, supply chain visibility, and predictive maintenance while expanding globally via partnerships and acquisitions.

- Oracle, Siemens, and Bosch are leveraging AI, advanced analytics, and IoT to drive digital transformation. Their focus includes energy-efficient technologies, modular automation, and flexible manufacturing to boost sustainability and competitiveness globally.

Industry 4.0 Industry News

- In January 2025, Siemens unveiled the Siemens Industrial Copilot for Operations at CES 2025. This innovation integrates Industrial AI with the Industrial Edge ecosystem, enabling secure real-time decision-making, boosting productivity, and minimizing downtime.

- In January 2025, GE Vernova announced plans to invest nearly USD 600 million in U.S. facilities over two years, including USD 15 million for Generative AI at its Niskayuna, NY, Advanced Research Center and almost USD 100 million to enhance electrification and carbon efforts.

- In November 2024, Emerson's 20th issue of Innovations in Automation magazine showcased the Boundless Automation vision. It focuses on safety, sustainability, and profitability through an open, secure architecture connecting field, edge, and cloud computing via a unified data fabric.

- In October 2024, Honeywell and Google Cloud announced a collaboration to enhance industrial operations by integrating Google Cloud's Gemini on Vertex AI with Honeywell Forge's data. This partnership aims to deliver enterprise-wide actionable insights by connecting AI agents with assets, people, and processes.

The industry 4.0 market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Bn) from 2022 to 2035, for the following segments:

Market, By Component

- Hardware

- Software

- Services

Market, By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

Market, By Organization Size

- Large enterprises

- Small and medium-sized enterprises (SMEs)

Market, By Technology

- Internet of things (IoT)

- Digital twin

- Big data and AI analytics

- Cybersecurity

- Cloud computing

- Robotics and automation

- Augmented reality (AR)

- Others

Market, By End Use

- Manufacturing

- Automotive

- Healthcare

- Aerospace and defense

- Energy and utilities

- Food and beverages

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for the IoT segment during the forecast period?

The IoT segment held a 28% market share in 2025 and is expected to grow at a CAGR of 24.1% during the forecast period, driven by its integration in smart manufacturing and industrial automation.

Which region leads the industry 4.0 sector?

The U.S. leads the North American market, with a projected growth rate of 30.4% from 2026 to 2035. This growth is supported by advanced digital infrastructure, industrial IoT adoption, and a focus on automation and smart manufacturing.

Who are the key players in the industry 4.0 industry?

Key players include Cisco Systems, Emerson Electric, General Electric, Honeywell International, Microsoft, Mitsubishi Electric, Oracle, Robert Bosch, Schneider Electric, and Siemens.

What are the upcoming trends in the industry 4.0 market?

Key trends include AI-driven predictive maintenance, generative AI–based automation, edge computing for low-latency operations, collaborative robots (cobots), and the integration of robotics with digital twins to improve operational efficiency.

What was the valuation of the cloud-based segment in 2025?

The cloud-based segment accounted for 48% of the market share in 2025 and is set to expand at the fastest rate of 24.3% till 2035, driven by scalability and integration capabilities.

What is the market size of the industry 4.0 in 2025?

The market size was USD 149.2 billion in 2025, with a CAGR of 24% expected through 2035. The growth is driven by the adoption of connected IoT devices, national Industry 4.0 policies, and advancements in smart manufacturing technologies.

How much revenue did the hardware segment generate in 2025?

The hardware segment generated approximately 54% of the market share in 2025 and is expected to grow at a CAGR of 22.1% from 2026 to 2035.

What is the expected size of the industry 4.0 industry in 2026?

The market size is projected to reach USD 172.5 billion in 2026.

What is the projected value of the industry 4.0 market by 2035?

The market is poised to reach USD 1.2 trillion by 2035, fueled by advancements in AI, edge computing, and robotics, along with increasing investments in smart factory solutions.

Industry 4.0 Market Scope

Related Reports