Get a free sample of Fecal Occult Testing Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Get a free sample of Fecal Occult Testing Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Fecal Occult Testing Market Analysis

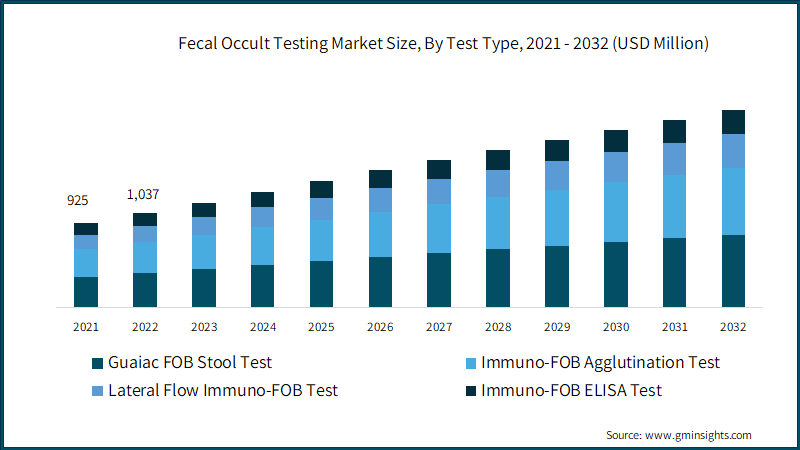

The fecal occult testing market by test type is categorized into guaiac FOB stool test, immuno-FOB agglutination test, lateral flow immuno-FOB test, and immuno-FOB ELISA test. The guaiac FOB stool test segment garnered USD 381.3 million revenue size in the year 2022. Its established reputation in medical practice, affordability, ongoing refinements, and historical integration into colorectal cancer screening programs have collectively propelled its prominence. Additionally, the test's familiarity among healthcare professionals, cost-effectiveness, and improvements over time have instilled trust in its effectiveness. Moreover, this dominance is a result of its alignment with historical screening practices, which have further solidified its position as a cornerstone in fecal occult testing.

Based on end-use, the fecal occult testing market is segmented into hospitals, diagnostic centers, and others. The diagnostic centers segment accounted for over 46% revenue share in the year 2022 and is anticipated to witness highest growth during the forecast period. The specialization of diagnostic centers in providing precise diagnostic services has cultivated a reputation for reliability, positioning them as trusted hubs for fecal occult testing and other medical assessments. Their incorporation of advanced technologies and skilled healthcare professionals elevates the accuracy of fecal occult testing results, establishing confidence among patients and healthcare providers, and consequently driving demand for their services.

In addition, their strategic locations in urban and suburban areas bolster accessibility, resulting in increased utilization and market dominance. Therefore, the diagnostic centers' market dominance stems from their specialized focus, technological prowess, convenience, and widespread accessibility, making them pivotal drivers of both market expansion and efficacy in the realm of fecal occult testing.

U.S. fecal occult testing market accounted for USD 353.1 million revenue size in 2022 and is predicted to witness substantial market growth over the analysis timeline. The U.S. dominance in the market is primarily attributed to its highly advanced and well-established healthcare infrastructure, coupled with the increased prevalence of colorectal cancer. For instance, according to the United States Cancer Statistics (USCS), in 2020, the country reported 126,240 new cases of colorectal cancer, and tragically, 51,869 individuals succumbed to this disease. Therefore, this increased incidence of colorectal cancer highlights the critical significance of advocating for the wider adoption of fecal occult tests in U.S.

Furthermore, the nation's concentration of cancer research institutions and proactive education and awareness campaigns further amplify the adoption of these screenings. Ultimately, the U.S.'s leadership in healthcare infrastructure, awareness efforts, advanced technologies, and cancer prevention strategies has positioned it as the market leader, significantly propelling the market trends and efficacy.

How is the fecal occult testing industry driven by guaiac FOB stool test?

The guaiac FOB stool test segment garnered USD 381.3 million in the fecal occult testing industry in 2022 on account of its established reputation in medical practice and historical integration into colorectal cancer screening programs.

How big is the fecal occult testing market?

Fecal occult testing industry size reached USD 1 billion in 2022 and will witness 7.3% CAGR through 2032 due to the rising incidence of rectal and colon cancer worldwide.

What factors are influencing the fecal occult testing market in the U.S.?

U.S. fecal occult testing industry crossed USD 353.1 million in 2022 and is projected to expand significantly through 2032 owing to the highly advanced and well-established healthcare infrastructure in the region.

Who are the key fecal occult testing industry players?

HUMASIS.COM, CTK Biotech, Inc., Biopanda Reagents Ltd, Biohit Oyj, CERTEST BIOTEC, Cenogenics Corporation, Alfa Scientific Designs, Inc., Siemens Healthcare GmbH, Jant Pharmacal Corporation., Quidel Corporation, and Wondfo are some of the fecal occult testing companies worldwide.