Get a free sample of Fault Detection and Classification Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Get a free sample of Fault Detection and Classification Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Fault Detection and Classification Market Analysis

In the fault detection & classification market, cloud-based solutions are a pivotal trend. The shift toward cloud-based solutions in the fault detection and classification (FDC) market was driven by the desire for greater flexibility and accessibility. Cloud-based FDC systems offer several advantages including scalability to accommodate varying data volumes, remote monitoring capabilities that allow real-time analysis from anywhere, and cost-effectiveness by reducing the need for extensive on-premises hardware infrastructure. Additionally, cloud-based FDC solutions facilitate easy data sharing and collaboration among teams, making it simpler for organizations to implement & maintain these systems while harnessing the benefits of advanced analytics and data insights for improved fault detection & process optimization.

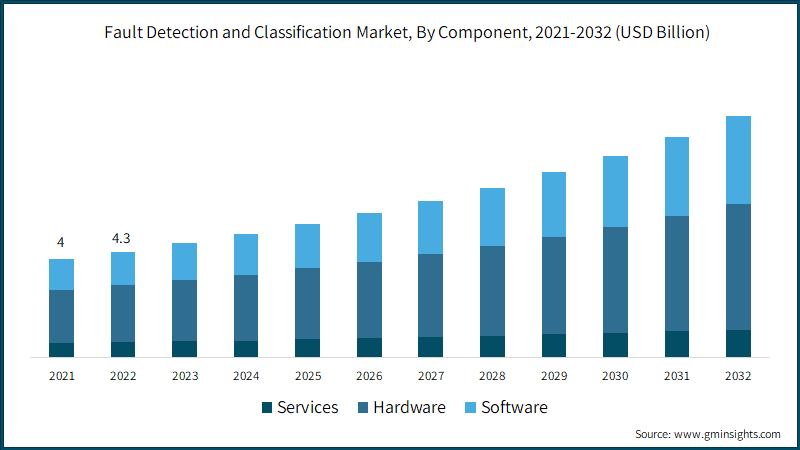

Based on component, the fault detection and classification market is segmented into hardware, software, and services. The hardware segment dominated the market with over 50% revenue share in 2022 and is expected to grow at a lucrative pace till 2032. The automotive industry's notable growth in the fault detection & classification (FDC) market can be attributed to its increasing reliance on automation, precision manufacturing, and quality assurance.

Automotive manufacturers are leveraging FDC systems to enhance production efficiency, minimize defects, and ensure product consistency. These systems enable real-time monitoring of manufacturing processes, leading to reduced downtime and improved product quality. As vehicle complexity rises, FDC technology assists in identifying and addressing faults in intricate automotive components & systems, aligning with the industry's commitment to deliver safe and reliable vehicles. This growth is driven by a demand for streamlined operations and higher quality standards.

Based on end use industry, the fault detection and classification market is segmented into automotive, electronics & semiconductors, metal & machinery, aerospace & defense, food & packaging, and energy & utility. The automotive segment is expected to grow at a CAGR of over 10% through 2032. The growth of hardware in the fault detection & classification market is attributed to a confluence of drivers. As industries increasingly recognize the importance of real-time data collection, there is a growing demand for more robust sensors, advanced data acquisition devices, and high-performance computing hardware to support FDC systems. The proliferation of IoT technologies necessitates hardware components for seamless integration of sensors into manufacturing equipment. As FDC systems become more sophisticated, there is a need for specialized hardware to handle complex data processing tasks, enabling accurate and efficient fault detection and classification.

Asia Pacific held a significant fault detection and classification market share of over 35% in 2022. The region's expanding manufacturing sector, driven by industrialization & increased automation, demands robust FDC solutions to enhance production efficiency and product quality. Moreover, heightened competition pushes companies to adopt advanced technologies including FDC to stay competitive.

Additionally, government initiatives and investments in Industry 4.0 technologies, coupled with a growing awareness of the benefits of FDC systems, are fueling adoption. Asia Pacific's dynamic economic landscape and the need for operational excellence further contribute to market growth. The Chinese government invests USD 1 billion in the development of a new Industrial Internet of Things (IoT) platform. The platform will be used to collect and analyze data from industrial sensors and machines, including data on faults and defects.

Why is fault detection and classification hardware gaining traction?

The hardware component segment held over 50% of the fault detection and classification market share in 2022 and is expected to expand through 2032 owing to rising reliance on automation, precision manufacturing, and quality assurance

How big is the fault detection and classification industry?

Market size for fault detection and classification reached USD 4.3 billion in 2022 and is estimated to witness over 8.7% CAGR from 2023 to 2032 due to the increasing focus on quality control

Who are the leading fault detection and classification business players?

Cognex Corporation, KILI TECHNOLOGY, MobiDev, Amazon Web Services, Inc., Applied Materials, Inc., Microsoft, CIM Environmental Pty Ltd., Qualitas Technologies, einnoSys Technologies Inc., INFICON and OMRON Corporation are some of the major fault detection and classification firms

What is the size of the APAC fault detection and classification market?

Asia Pacific held over 35% share of the fault detection and classification industry in 2022 due to the expanding manufacturing sector, driven by increasing rate of industrialization and automation