Summary

Table of Content

Built-in Kitchen Appliances Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Built-in Kitchen Appliances Market Size

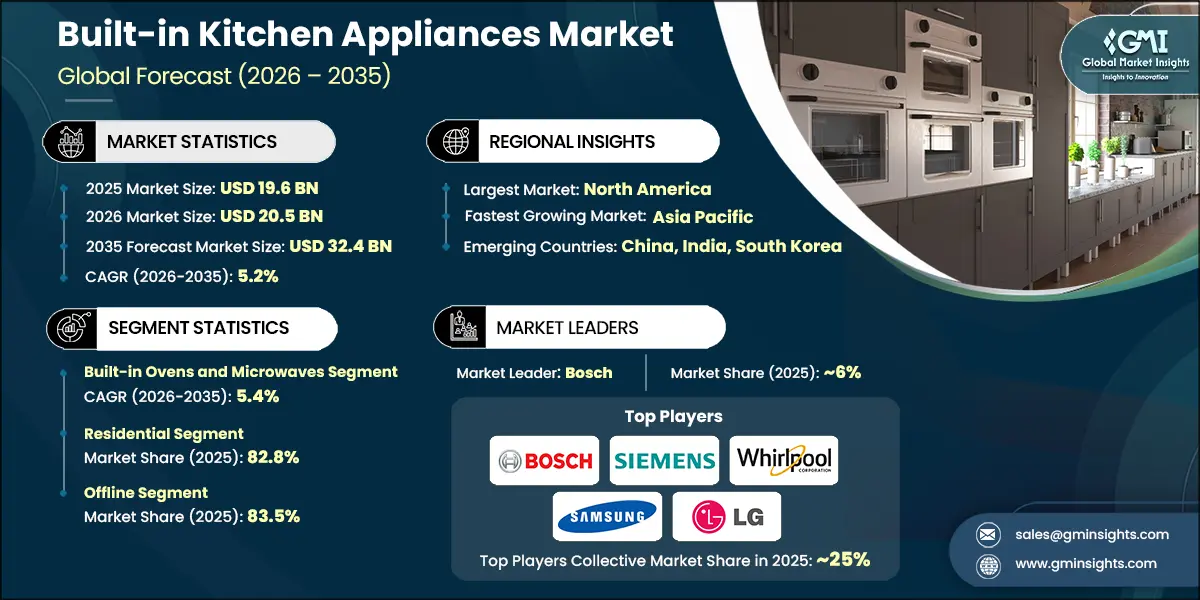

The global built-in kitchen appliances market size was estimated at USD 19.6 billion in 2025. The market is expected to grow from USD 20.5 billion in 2026 to USD 32.4 billion in 2035, at a CAGR of 5.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- Rapid urbanization is creating new living spaces, especially in cities and metropolitan regions, and therefore, optimizing space through the design of these living spaces is important. Therefore, the rapid urbanization of cities has increased the development of modular kitchen units that are designed to provide a modern look while also giving the user the most practical and efficient way to use their kitchen.

- Users are now integrating built-in products, e.g., oven, dishwasher, refrigerator into their modular kitchen units. The use of built-in kitchen appliances saves space and provides a more complete appearance when integrated with the overall modular kitchen unit. As cities grow and housing becomes smaller, as the population of people in urban living conditions grows, it is predicted that there will be continued demand for built-in kitchen appliances.

- An increasing number of individuals are transitioning towards premium products because of an increase in disposable income and a change in consumer behaviour towards premium built-in kitchen appliances. To align with the user's and family's vision of modern-home and upscale living standards, these consumers are starting to look for high-quality excellent products that offer innovation, style, and performance. These consumers are now focusing on modular kitchens with modern features, innovation, and high performance as a source for upgrading their homes.

- The emergence of global lifestyle trends and a heightened interest in the aesthetic appeal of sophisticated home interiors are pushing consumers to purchase premium appliances. Other factors driving this trend are the expansion of financing options available to buyers, as well as the increasing penetration of e-commerce platforms, allowing easier access for a larger segment of the consumer base.

- In addition, the growing acceptance of smart technology for home appliances is having a major impact on the built-in appliance market. More and more consumers are choosing appliances that integrate into their smart home ecosystem and that offer convenience and energy savings.

- Built-in appliances that include features associated with the Internet of Things (IoT), voice-activated control, and remote monitoring are among the most desired products, providing users with greater control and monitoring of their appliance's operation through smartphones or voice assistants, enhancing their user experience. Additionally, the increasing focus on energy efficiency and sustainability creates the opportunity for the development of smart appliances that offer improved performance and use much less energy compared to similar products. As the trend towards smart homes continues to increase, the demand for connected built-in appliances will grow substantially in future years.

Built-in Kitchen Appliances Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 19.6 Billion |

| Market Size in 2026 | USD 20.5 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.2% |

| Market Size in 2035 | USD 32.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Urbanization and modular kitchen adoption | Rapid urbanization and rising preference for modular kitchens are driving demand for built-in appliances, as consumers seek space-saving and aesthetically integrated solutions. |

| Premiumization and lifestyle upgrades | Increasing disposable income and aspirational living trends are pushing consumers toward premium, sleek, and technologically advanced built-in appliances. |

| Smart home integration | The surge in smart home ecosystems is boosting demand for connected built-in appliances with IoT features, voice control, and energy efficiency. |

| Pitfalls & Challenges | Impact |

| High initial cost and installation complexity | Built-in appliances require significant upfront investment and professional installation, limiting adoption among price-sensitive consumers. |

| Limited retrofit options | Existing kitchens often lack the infrastructure for built-in appliances, making retrofitting difficult and costly, which slows penetration in older homes. |

| Opportunities: | Impact |

| Growth in residential construction and renovation | Booming real estate and home renovation projects create strong opportunities for built-in appliance manufacturers to target new homeowners and remodelers. |

| Sustainability and energy efficiency focus | Consumers increasingly prefer eco-friendly, energy-efficient appliances, opening avenues for brands to differentiate through green certifications and smart energy-saving features. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of ~6% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Built-in Kitchen Appliances Market Trends

- The growing preference for integrated and space-efficient solutions is significantly driving the demand for modular kitchens. Consumers are increasingly opting for built-in appliances that seamlessly integrate with modern kitchen designs, offering both functionality and aesthetic appeal. These appliances not only save space but also enhance the overall visual harmony of the kitchen, making them a popular choice among urban households. The trend reflects a shift towards maximizing utility while maintaining a sleek and organized kitchen environment.

- There is a notable shift in consumer preferences toward premium and aesthetically appealing kitchen appliances. High-end appliances with minimalist designs, stainless steel finishes, and glass elements are gaining traction, catering to the aspirations of modern lifestyles. These appliances are designed to complement contemporary interiors, offering a sophisticated and luxurious look. The demand for such products is particularly strong among consumers who prioritize style and quality, reflecting a broader trend of premiumization in the built-in appliances market.

- The adoption of smart and connected appliances is becoming increasingly mainstream, particularly in urban markets. Built-in ovens, refrigerators, and dishwashers equipped with Internet of Things (IoT) technology are transforming the way consumers interact with their kitchens. Features such as app-based controls, voice command compatibility, and energy monitoring systems are enhancing convenience and efficiency. These appliances not only simplify daily tasks but also align with the growing demand for technologically advanced and user-friendly solutions. As smart home ecosystems expand, the integration of connected appliances is expected to further accelerate.

- With sustainability becoming a key priority for consumers, the demand for eco-friendly and energy-efficient appliances is on the rise. Built-in appliances that feature energy-saving certifications and are made from recyclable materials are gaining popularity. These products appeal to environmentally conscious consumers who seek to reduce their carbon footprint while maintaining high performance. Manufacturers are increasingly focusing on developing appliances that align with green living principles, addressing both regulatory requirements and consumer expectations for sustainable solutions.

- The expansion of e-commerce platforms and omnichannel retail models is reshaping the distribution landscape for built-in appliances. Online platforms are providing consumers with greater accessibility, offering a wide range of products, customization options, and virtual kitchen planning tools. Hybrid retail models, which combine online and offline experiences, are further enhancing customer engagement by allowing them to visualize and personalize their kitchen designs. This shift toward digital and omnichannel strategies is enabling manufacturers and retailers to reach a broader audience while meeting the evolving needs of tech-savvy consumers.

- Manufacturers are increasingly focusing on compact and multi-functional designs to cater to the needs of smaller urban homes. Appliances that combine multiple functions, such as an oven with a microwave or a refrigerator with a freezer, are gaining popularity for their ability to maximize space utilization. These innovative designs are particularly appealing to urban consumers who face space constraints but do not want to compromise on functionality. By offering versatile and space-saving solutions, manufacturers are addressing the challenges of modern living while enhancing the overall user experience.

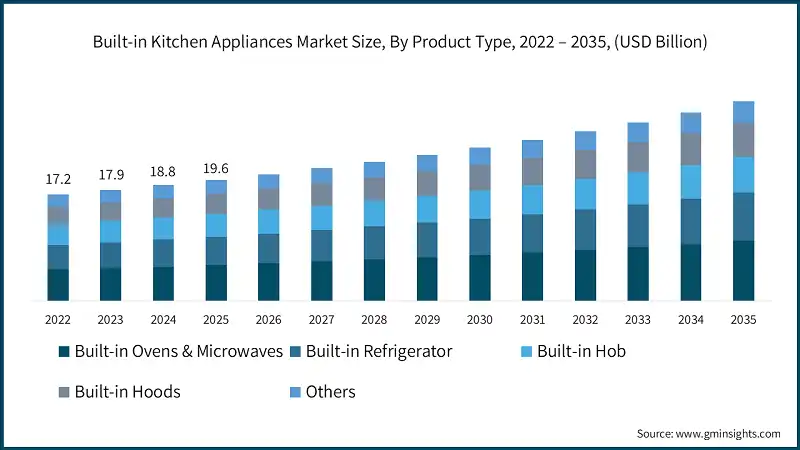

Built-in Kitchen Appliances Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is categorized into built-in ovens and microwaves, built-in refrigerators, built-in hobs, built-in hoods and others. The built-in ovens and microwaves segment accounted for revenue of around USD 5 billion in 2025 and is anticipated to grow at a CAGR of 5.4% from 2026 to 2035.

- Built-in ovens and microwaves have emerged as the dominant segment in the premium kitchen appliance market, primarily due to their seamless integration with modular kitchen designs. These appliances are designed to save space while offering advanced functionalities such as convection cooking, smart controls, and energy efficiency. Their ability to blend effortlessly with modern kitchen aesthetics has made them a preferred choice among urban households.

- Additionally, the rising consumer focus on convenience and visual appeal in kitchen spaces has further propelled their adoption. Manufacturers are increasingly incorporating innovative features, such as voice control and app-based monitoring, to cater to tech-savvy consumers. This trend aligns with the growing demand for smart home solutions, reinforcing the dominance of built-in microwaves and ovens in the premium segment.

Learn more about the key segments shaping this market

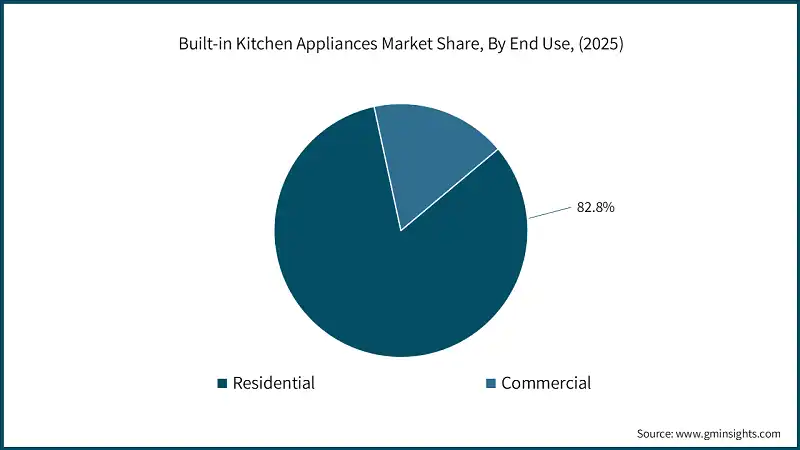

Based on end use, of built-in kitchen appliances market consists of residential and commercial. The residential segment emerged as leader and held 82.8% of the total market share in 2025 and is anticipated to grow at a CAGR of 5.3% from 2026 to 2035.

- Residential kitchens represent the largest application segment for built-in kitchen appliances, driven by rapid urbanization and evolving consumer lifestyles. As urban areas become more densely populated, homeowners are prioritizing space optimization and streamlined designs.

- Built-in appliances, with their compact and integrated nature, address these needs effectively, offering a sleek and clutter-free kitchen environment. The increasing number of home renovation projects and new housing developments has further fueled the demand for these appliances.

- Consumers are also drawn to the long-term value and enhanced functionality provided by built-in solutions, which often include features like multi-functionality and energy-saving capabilities. Moreover, the rising trend of open-plan kitchens, which emphasize aesthetics and functionality, has contributed to the growing popularity of built-in appliances in residential applications.

Based on distribution channel, built-in kitchen appliances market consists of online and offline. The offline segment emerged as leader and held 83.5% of the total market share in 2025 and is anticipated to grow at a CAGR of 5% from 2026 to 2035.

- Offline distribution channels continue to dominate the built-in kitchen appliance market because consumers prefer experiential buying for high-value products. Physical showrooms and exclusive brand outlets allow customers to see, touch, and test appliances before purchase, which is critical for items like built-in ovens, hobs, and dishwashers that require precise fit and finish. Retailers also provide personalized consultations and installation support, making offline channels a trusted choice for premium buyers.

- Large-format stores, specialty kitchen studios, and dealer networks play a key role in driving offline sales, especially in markets where kitchen remodeling and new construction projects are prevalent.

- These channels often bundle appliances with modular kitchen packages, offering end-to-end solutions that online platforms cannot fully replicate. The ability to negotiate pricing, access financing options, and receive immediate after-sales service further strengthens the dominance of offline distribution in this segment.

Looking for region specific data?

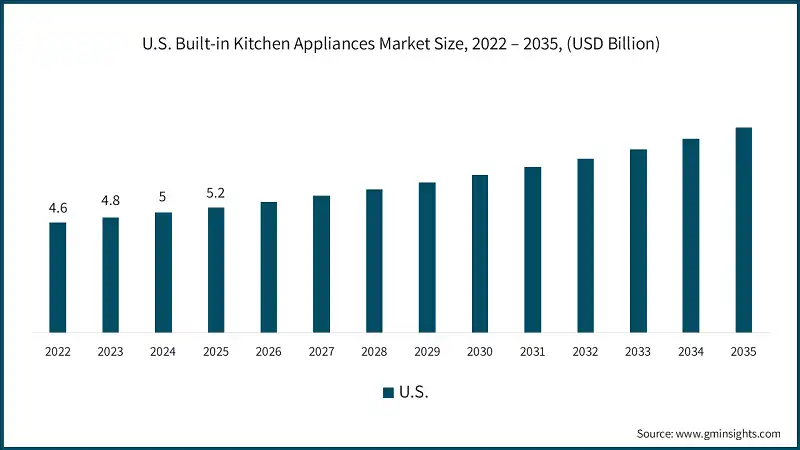

North America Built-in Kitchen Appliances Market

The U.S. dominates an overall North America market and valued at USD 5.2 billion in 2025 and is estimated to grow at a CAGR of 5.1% from 2026 to 2035.

- Built-in kitchen appliances dominate the U.S. market due to strong consumer preference for premium, integrated solutions that complement modern home designs. High disposable incomes and the popularity of open-concept kitchens have accelerated adoption of built-in ovens, microwaves, and dishwashers. These appliances are viewed as lifestyle upgrades, offering convenience and aesthetics.

- The U.S. market also benefits from advanced smart-home penetration, making connected built-in appliances a natural fit. Online retail and omnichannel strategies further strengthen dominance, as consumers increasingly rely on virtual kitchen planners and customization options before purchase.

Europe Built-in Kitchen Appliances Market

In the European market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- Germany’s dominance in built-in appliances stems from its strong cultural emphasis on precision engineering and minimalist design. German households prioritize space optimization and energy efficiency, making built-in ovens, hobs, and dishwashers essential in modern kitchens. Sustainability regulations and eco-conscious consumer behavior reinforce this trend.

- Premium brands thrive in Germany, as buyers value durability and smart features integrated with home automation systems. The market also benefits from a robust renovation culture, where homeowners upgrade kitchens with high-end built-in solutions to align with modern aesthetics and green standards.

Asia Pacific Built-in Kitchen Appliances Market

In the Asia Pacific market, the China held 42.4% market share in 2025 and is anticipated to grow at a CAGR of 5.5% from 2026 to 2035.

- China’s built-in appliance market is dominated by rapid urbanization and the surge in modular kitchen installations in urban apartments. Rising disposable incomes and aspirational lifestyles have fueled demand for sleek, space-saving appliances such as built-in ovens and hobs. Domestic brands and global players compete aggressively, offering affordable yet stylish options.

- Smart technology adoption is accelerating in China, with IoT-enabled appliances gaining traction among tech-savvy consumers. E-commerce platforms dominate distribution, leveraging virtual demos and influencer marketing to drive sales in both tier-1 and tier-2 cities.

Middle East and Africa Built-in Kitchen Appliances Market

In the Middle East and Africa market, Saudi Arabia held 18% market share in 2025 promising growth from 2026 to 2035.

- In Saudi Arabia, built-in appliances dominate luxury and premium kitchen segments, driven by high-income households and a strong preference for modern, integrated designs. Large residential projects and upscale villas often feature fully fitted kitchens with built-in ovens, hobs, and refrigerators as standard.

- The market is also influenced by Western lifestyle trends and hospitality sector growth, where built-in appliances are considered a mark of sophistication. Online channels and exclusive showrooms cater to affluent buyers seeking customization and high-end finishes.

Built-in Kitchen Appliances Market Share

- In 2025, the prominent manufacturers in market are collectively held the market share of ~25%.

- Bosch’s competitive edge lies in its engineering excellence and energy efficiency leadership. Known for German precision, Bosch offers appliances that combine durability, sleek design, and advanced technology. Its strong focus on sustainability and smart-home integration positions it as a top choice for eco-conscious and tech-savvy consumers globally.

- Siemens differentiates itself through premium innovation and connectivity. Its built-in appliances feature cutting-edge smart controls, automation, and elegant aesthetics tailored for modern kitchens. Siemens leverages its strong brand reputation in Europe and advanced R&D to dominate the high-end segment.

- Whirlpool’s edge is its global reach and affordability in premium functionality. It offers a wide range of built-in appliances that balance performance, reliability, and cost-effectiveness. Whirlpool’s strong distribution network and emphasis on user-friendly designs make it a preferred brand for mid-to-premium households worldwide.

Built-in Kitchen Appliances Market Companies

Major players operating in the built-in kitchen appliances industry include:

- Bosch

- Electrolux

- Elica

- Faber

- Gaggenau

- Haier

- Hindware

- IFB

- KitchenAid

- LG

- Miele

- Panasonic

- Samsung

- Siemens

- Whirlpool

Samsung stands out for technology integration and smart-home compatibility. Its built-in appliances feature IoT connectivity, AI-driven cooking assistance, and sleek modern designs. Samsung’s ability to combine innovation with lifestyle appeal gives it a strong foothold among tech-savvy consumers seeking convenience and style.

LG’s competitive edge lies in design innovation and energy efficiency, coupled with smart features like app-based controls and voice integration. LG focuses on compact, multifunctional built-in appliances that cater to urban living trends, making it a leader in both premium and space-saving solutions.

Built-in Kitchen Appliances Industry News

- In September 2025, At IFA 2025, Siemens introduced its new Matte Black “Matt Edition” built-in oven and hob line, featuring AI-powered food recognition and integrated downdraft extraction and launched the world’s first “Steam Drawer” built-in unit.

- In February 2025, Samsung presented its Bespoke AI-built-in appliances wall ovens, induction ranges, and AI Family Hub fridges at KBIS 2025, featuring Bixby voice control, Knox cybersecurity, SmartThings integration, and 7-32″ touchscreens.

- In February 2025, LG, At KBIS 2025, rebranded its Signature Kitchen Suite as “SKS,” unveiling luxury built-in appliances like a 36″ cook-zone-free induction pro range with AI-driven cooking, built-in camera, steam technology, and flush-fit dishwasher in luxury kitchen spaces.

The built-in kitchen appliances market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2022 to 2035, for the following segments:

Market, By Product type

- Built-in ovens & microwaves

- Built-in refrigerator

- Built-in hob

- Built-in hoods

- Others

Market, By Price Range

- Low

- Medium

- High

Market, By End Use

- Residential

- Commercial

- HoReCa

- Bars & pubs

- Others (offices, etc.)

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the built-in kitchen appliances market?

Major players include Bosch, Siemens, Whirlpool, Samsung, LG, Electrolux, Haier, Miele, Panasonic, Gaggenau, KitchenAid, IFB, Elica, Faber, and Hindware.

Which end-use segment dominates the built-in kitchen appliances market?

The residential segment dominated the market with an 82.8% share in 2025, driven by urban housing growth, home renovation activities, and rising consumer preference for integrated kitchen solutions.

Which distribution channel leads the market?

Offline distribution channels led the market with an 83.5% share in 2025, as consumers prefer physical showrooms for high-value purchases that require personalized consultation and professional installation.

Which product type segment generated the highest revenue in 2025?

The built-in ovens and microwaves segment generated approximately USD 5 billion in revenue in 2025, supported by seamless integration with modular kitchens and growing demand for smart and multifunctional cooking appliances.

What will be the market value of the market in 2026?

The market is projected to reach USD 20.5 billion in 2026, reflecting steady growth driven by rising disposable incomes and increasing penetration of modern kitchen designs.

What is the projected value of the built-in kitchen appliances market by 2035?

The market is expected to reach USD 32.4 billion by 2035, growing at a CAGR of 5.2% from 2026 to 2035, supported by premiumization trends, smart-home integration, and expansion of residential construction.

What is the market size of the built-in kitchen appliances market in 2025?

The global market for built-in kitchen appliances was valued at USD 19.6 billion in 2025, driven by rapid urbanization, and growing demand for space-efficient and aesthetically integrated appliances.

Built-in Kitchen Appliances Market Scope

Related Reports