Summary

Table of Content

Bolt-on Industrial Traction Battery Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bolt-on Industrial Traction Battery Market Size

The global bolt-on industrial traction battery market was estimated at USD 3.1 billion in 2024 and is expected to reach USD 11.6 billion by 2034, growing at a CAGR of 13.3% from 2025 to 2034. Improvements in energy density, charging speed, and efficiency have increased the industrial applicability of lithium-ion batteries. For instance, the U.S. Department of Energy has reported that the cost of lithium-ion batteries has declined by almost 89% since 2010, increasing their accessibility for industrial usage.

To get key market trends

As industries, from forklifts to automated guided vehicles (AGVs), increasingly adopt electric vehicles (EVs), the demand for dependable, long-lasting batteries surges. For illustration, the U.S. Bureau of Labor Statistics highlights that the material handling equipment market, including forklifts, is projected to grow significantly, further driving battery demand.

Bolt-on Industrial Traction Battery Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.1 Billion |

| Forecast Period 2025 – 2034 CAGR | 13.3% |

| Market Size in 2034 | USD 11.6 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Development in solid state batteries is on the rise due to high energy densities and safety features. This development is mainly due to the focus in the industry to increase energy density and charge times. The developed technologies are necessary due to the increased need in a variety of industrial sectors.

Investments in infrastructure, especially in charging stations and in smart grids, strengthen the utilization of battery-powered industrial tools. For reference, the U.S. Department of Energy has budgeted more than USD 7.5 billion on EV charging infrastructure as part legislations supporting the shift towards battery-operated devices. Several companies are now establishing vital partnerships and alliances to increase market share in this developing industry.

Bolt-on Industrial Traction Battery Market Trends

To reduce the overall carbon impact, businesses are shifting towards more sustainable practices and products. This transition is enhanced with government regulations and incentives. For instance, the U.S. government will dedicate USD 2.8 billion in funding battery manufacturing and recycling facilities with the hopes of green tech adoption under the Bipartisan Infrastructure Law.

As forklifts, automated guided vehicles (AGVs), and other industrial EVs become more popular, the demand for appropriate traction batteries is also increasing. This shift shows the importance of advanced traction batteries as the most electric vehicles increasing in popularity.

The adoption of commercial EVs (trucks, buses, etc.) is increasing, implying a demand for batteries with increased power capacity. Bolt-on traction batteries allow for added capacity without having to re-engineer the vehicle. With an increasing number of businesses adopting EVs (especially for logistics or delivery) bolt-on batteries will allow for increased range without needing to completely change out the existing fleet vehicles.

Bolt-on Industrial Traction Battery Market Analysis

Learn more about the key segments shaping this market

- The global bolt-on industrial traction battery industry was valued at USD 2.1 billion, USD 2.6 billion, and USD 3.1 billion in 2022, 2023, and 2024, respectively. Based on chemistry, the industry can be categorized into lead acid, lithium-ion, nickel based and others.

- The lithium ion battery segment is expected to reach USD 7.5 billion by 2034. Lithium-ion batteries have greater energy density, making them more practical for technologies that require high energy capacity, long operating hours, and less frequent charging. Government subsidies and incentives for utilizing electric vehicles and eco-friendly technologies enhance the appeal of the lithium-ion batteries.

- Increase in governmental subsidies and incentives allows fleet operators to seek economically friendly options including lead acid batteries to extend the range and performance of existing systems. In industries where cost remains the most important factor, lead-acid batteries are the preferred option. Bolt on lead acid enables effortless attachment in material handling equipment, forklifts, and warehouse devices to increase operation time economically without excessive alteration.

- Heavy machinery such as electric buses and trucks, as well as other advanced accessories, require instantaneous charge and discharge rates, and greater load capacities, which is made possible with NMC and NCA nickel based batteries that have higher power density when compared to lead acid and other lithium ion batteries. Nickelbased batteries are frequently used in hybrid vehicles like buses and trucks, where they are used alongside lithium and other chemistry batteries for their enhanced power output.

Learn more about the key segments shaping this market

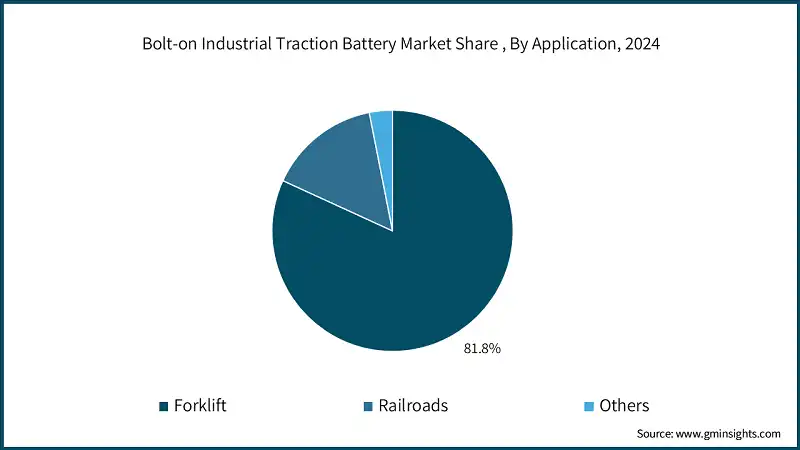

- Based on the application, the bolt-on industrial traction battery industry is trifurcated into forklift, railroads and others. The forklift segment held a major market share of 81.8% in 2024 while growing at a positive CAGR through 2034. Forklifts are widely used in warehouses, distribution centers, and manufacturing facilities, and their electrification is an ongoing trend driven by efficiency, sustainability, and regulatory concerns.

- The use of bolt-on traction batteries offers a cost-effective way to extend operational capacity without replacing the entire system. As companies look to reduce their carbon footprint and operating costs, there’s a growing shift towards electric forklifts. Bolt-on batteries enable companies with existing electric forklifts to increase range or enhance performance without purchasing new equipment.

- Many railroads are moving from diesel-powered to electric trains. However, electrification can be costly and complex, so hybrid solutions or bolt-on battery systems can be used to complement existing diesel or electric systems, improving efficiency and extending range.

- Moreover, New advancements in lithium-ion and nickel-based battery technologies are leading to batteries with higher energy densities, which is essential for large, heavy-duty rail applications. These improvements make bolt-on batteries more viable and attractive.

Looking for region specific data?

- The U.S. bolt-on industrial traction battery market size reached USD 246.4 million, USD 283 million, and USD 322 million in 2022, 2023, and 2024. U.S. federal and state governments are offering financial incentives, grants, and subsidies to promote electrification in industrial applications. These incentives support the adoption of bolt-on industrial batteries, especially in material handling and electric vehicle fleets. Stricter emissions regulations are driving companies to retrofit their fleets with more sustainable solutions. Bolt-on batteries can offer a way to meet environmental standards without fully replacing existing equipment.

- Europe offers financial incentives and subsidies to encourage electrification, including funding for battery solutions in material handling, electric vehicle fleets, and industrial machinery. These programs incentivize the adoption of bolt-on traction batteries. The rise of automation in warehouses, logistics, and manufacturing is driving demand for electric-powered automated systems (e.g., AGVs, robotic forklifts). Bolt-on batteries offer a way to scale energy storage and performance for these systems without costly new equipment.

- Countries in the APAC region are introducing subsidies and tax incentives for companies adopting electric solutions and reducing emissions. Bolt-on industrial batteries benefit from these policies, especially in material handling and electric vehicle fleets. The region benefits from strong R&D and battery manufacturing ecosystems, driving advancements in battery efficiency and integration. As a result, Asia Pacific companies are well-positioned to scale bolt-on industrial battery solutions.

- The Chinese government has stringent air quality standards in major cities, pushing industries toward electric alternatives. Bolt-on solutions help meet these standards in sectors like rail transport and electric vehicles.

Bolt-on Industrial Traction Battery Market Share

Leading manufacturers consisting of BYD Co., Ltd., EXIDE INDUSTRIES, LG Energy Solution, Panasonic Corporation and ENERSYS holds over 15% of the market share. Larger companies with significant market share can leverage economies of scale to reduce production costs and improve battery performance. As a result, they can offer more affordable and better-performing bolt-on battery solutions, which can accelerate adoption in industries such as material handling (forklifts) and rail transport.

Companies with significant market share often form strategic alliances and local partnerships to provide localized solutions. These collaborations can involve working with local distributors, technology providers, and service providers, allowing the company to effectively address market demands in a cost-effective manner and support bolt-on battery installations in different industries.

Bolt-on Industrial Traction Battery Market Companies

- BYD is a dominant player in the bolt-on industrial traction battery industry, particularly in the lithium iron phosphate (LFP) battery segment. Their batteries are widely used in electric vehicles, material handling equipment (e.g., forklifts), and rail transport. BYD has a strong market presence in China and is expanding into North America and Europe.

- LG Energy Solution is a global leader in lithium-ion batteries and a major supplier for industries like material handling, rail transport, and electric vehicles. They provide bolt-on industrial traction batteries that are known for their high energy density and long lifespan. The company reported sales of USD 17.48 billion in 2024.

- Exide Industries is a major player in the lead-acid and lithium-ion battery markets, with strong applications in material handling equipment (such as forklifts) and industrial energy storage. The company has a long-established reputation in industrial batteries and continues to innovate in the lithium-ion space.

- Panasonic Corporation is a significant player in the bolt-on industrial traction battery market, particularly in lithium-ion and nickel-based chemistries. Panasonic has extensive experience in the battery market, with products widely used in material handling equipment, rail transport, and electric vehicles. The company spent over USD 3.27 billion for research & development.

- EnerSys is a major player in both lead-acid and lithium-ion industrial batteries. The company provides bolt-on industrial traction battery solutions for forklifts, AGVs (Automated Guided Vehicles), and other industrial applications. EnerSys has a strong presence in North America, Europe, and Asia-Pacific.

Some of the major key players operating across the bolt-on industrial traction battery market are:

- Amara Raja Batteries

- Aliant Battery

- BYD

- Camel Group

- EXIDE INDUSTRIES

- ecovolta

- ENERSYS

- Farasis Energy

- Guoxuan High-tech Power Energy

- HOPPECKE Batteries

- Hitachi Energy

- LG Energy

- Mutlu Corporation

- MIDAC

- Panasonic Corporation

- Samsung

- Sunwoda Electronic

- Toshiba Corporation

Bolt-on Industrial Traction Battery Industry News

- In February 2025, BYD has expanded its offerings of bolt-on lithium-ion batteries for electric forklifts and other material handling equipment. The company is now focusing on providing cost-effective, high-energy density solutions for warehouses and logistics companies globally. BYD's LFP (lithium iron phosphate) battery technology is now the core of their expansion into Europe, where forklift fleets are undergoing rapid electrification. The company's growth in the industrial sector will significantly impact the market share of existing players, as the company is now poised to dominate in regions like North America and Europe.

- In January 2025, LG Energy Solution and Siemens Mobility have entered into a partnership to provide bolt-on lithium-ion battery solutions for rail electrification projects in Europe and North America. The collaboration will focus on creating hybrid rail systems that combine traditional rail power sources with onboard battery storage, improving energy efficiency and reducing emissions. This battery system can be retrofitted to existing non-electrified rail lines, allowing for electric trains without costly infrastructure investments.

- In December 2024, Enersys, a leader in industrial batteries, has introduced a new series of bolt-on lithium-ion batteries designed specifically for material handling and automated guided vehicles (AGVs). The new range is optimized for high-demand environments such as warehouses, distribution centers, and e-commerce operations. The batteries feature improved battery management systems (BMS), faster charging times, and longer operational hours.

- In November 2024, Panasonic has signed a strategic partnership with Sunwoda, a leading Chinese lithium-ion battery manufacturer, to jointly develop and supply bolt-on industrial traction batteries. These batteries will be used for material handling, automated systems, and rail transport applications. The partnership aims to enhance battery production capabilities and improve battery performance for the Asia-Pacific and Europe markets.

The bolt-on industrial traction battery market research report includes in-depth coverage of the industry with estimates & forecast in terms of “USD Million” from 2021 to 2034 for the following segments:

Market, By Chemistry

- Lead acid

- Lithium-ion

- Nickel based

- Others

Market, By Application

- Forklift

- Railroad

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of World

Frequently Asked Question(FAQ) :

How much is the U.S. bolt-on industrial traction battery market worth in 2024?

The U.S. bolt-on industrial traction battery market was worth over USD 322 million in 2024.

How big is the bolt-on industrial traction battery market?

The bolt-on industrial traction battery market was valued at USD 3.1 billion in 2024 and is expected to reach around USD 11.6 billion by 2034, growing at 13.3% CAGR through 2034.

What will be the size of lithium ion battery segment in the bolt-on industrial traction battery industry?

The lithium ion battery segment is anticipated to cross USD 7.5 billion by 2034.

Who are the key players in bolt-on industrial traction battery market?

Some of the major players in the bolt-on industrial traction battery industry include Amara Raja Batteries, Aliant Battery, BYD, Camel Group, EXIDE INDUSTRIES, ecovolta, ENERSYS, Farasis Energy, Guoxuan High-tech Power Energy, HOPPECKE Batteries.

Bolt-on Industrial Traction Battery Market Scope

Related Reports