Get a free sample of Analytical Instrumentation Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Get a free sample of Analytical Instrumentation Market

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Analytical Instrumentation Market Analysis

Based on product, the market is classified into molecular analysis instruments, spectroscopy instruments, chromatography instruments, electrochemical analysis instruments, particle counters and analyzers, and other products. The molecular analysis instruments segment is expected to drive business growth and expand at a CAGR of 6.9%, reaching over USD 39.5 billion by 2034.

- A key driver is the growing adoption of high-throughput and precision-based techniques in research and diagnostics. Innovations such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and mass spectrometry are reshaping applications in genomics, proteomics, and metabolomics. These advancements enhance analytical accuracy and speed, making molecular analysis indispensable in fields such as personalized medicine, drug discovery, and clinical diagnostics.

- The rise in chronic diseases and infectious outbreaks, including those requiring rapid diagnostics, further bolsters the demand for molecular analysis instruments. These tools are critical in detecting and understanding complex biomarkers, aiding in early disease diagnosis and targeted therapies.

- Additionally, the expansion of biotechnology and pharmaceutical industries globally, particularly in emerging economies, is creating a substantial need for robust molecular analysis systems to support rigorous quality control and research activities, further driving the market dominance of this segment.

Based on technology, the analytical instrumentation market is classified into spectroscopy, chromatography, particle analysis, polymerase chain reaction, and other technologies. The spectroscopy segment held a market share of 29.8% in 2024 and was valued at over USD 17.9 billion.

- One primary driver is the increasing demand for precise and accurate analytical techniques in research and development (R&D). Spectroscopic techniques, such as UV-Vis, infrared (IR), nuclear magnetic resonance (NMR), and mass spectrometry (MS), offer non-destructive methods for analyzing chemical and molecular structures, which is critical for industries like pharmaceuticals, biotechnology, and materials science. The growing need for quality control in drug development and manufacturing, along with stringent regulatory requirements, has significantly increased the demand for spectroscopy tools in the pharmaceutical and biotechnology sectors.

- Technological innovations also play a significant role in driving the spectroscopy segment. The integration of artificial intelligence (AI) and machine learning (ML) with spectroscopic systems is enhancing data analysis, making it faster and more accurate. Additionally, improvements in sensor technologies and the development of new spectroscopic techniques are expanding the scope of applications. The increasing trend toward automation and digitization in laboratories and production lines is another driver, as spectroscopy instruments are integral to modern lab setups and automated systems. These factors, coupled with the rising focus on personalized medicine and health diagnostics, ensure strong growth prospects for the spectroscopy segment in the market.

Based on application, the market is classified into clinical research and clinical diagnostics. The clinical research segment dominated the analytical instrumentation market in 2024, with a value of USD 33.4 billion.

- This segmental growth is fueled by several factors, including advancements in drug development, rising healthcare demands, and an increasing need for precision in clinical trials. The global emphasis on personalized medicine and biotechnology has significantly driven the adoption of advanced analytical instruments, which play a pivotal role in accurately evaluating new therapies and treatments. Cutting-edge techniques such as mass spectrometry, chromatography, and high-resolution imaging are indispensable for analyzing complex biological samples and ensuring reliable, high-quality data throughout clinical trials.

- Furthermore, regulatory requirements for clinical trials, particularly those from agencies like the FDA, mandate the use of validated and standardized analytical instrumentation to ensure data integrity and compliance. The increasing complexity of clinical studies, especially in areas such as genomics, proteomics, and microbiomics, further propels the adoption of these tools, thus driving segmental growth.

Based on end use, the market is segmented into pharmaceutical & biotechnology industry, research and academic institutes, diagnostic centers, and other end users. The pharmaceutical & biotechnology industry segment held a dominant market share in 2024 and was valued at over USD 28.1 billion.

- The pharmaceutical and biotechnology industry segment plays a pivotal role in driving the analytical instrumentation market, owing to its growing reliance on precision and advanced technologies for research, development, and production processes. In 2023, this segment demonstrated significant dominance, attributed to several critical factors. The escalating prevalence of chronic and infectious diseases worldwide has intensified the need for innovative drug discovery and development, propelling investments in analytical tools like mass spectrometers, chromatography systems, and molecular spectroscopy devices.

- Additionally, the global focus on personalized medicine has heightened the demand for cutting-edge analytical techniques to ensure precise molecular analysis, biomarker discovery, and pharmacokinetics studies. The surge in biopharmaceuticals, including monoclonal antibodies, vaccines, and cell and gene therapies, has further catalyzed the adoption of advanced analytical instruments to comply with stringent quality control and regulatory requirements. Furthermore, increasing R&D expenditures in both pharmaceutical giants and biotechnology startups have fostered a competitive landscape, necessitating the integration of state-of-the-art instrumentation for faster, more reliable results.

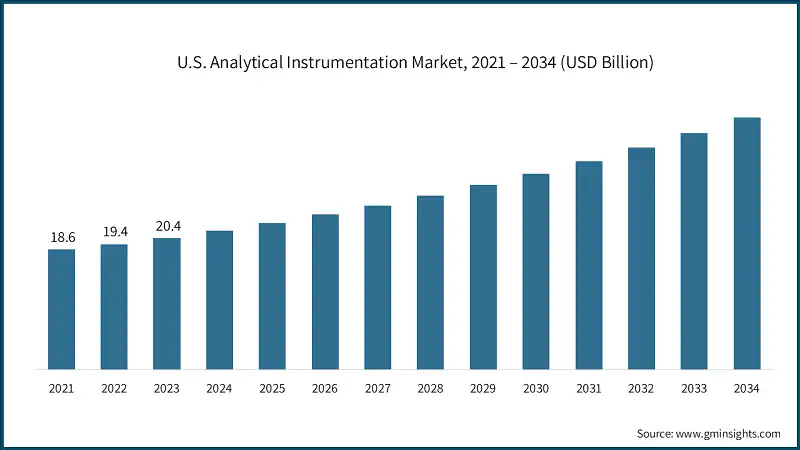

U.S. analytical instrumentation market accounted for USD 21.5 billion market revenue in 2024 and is anticipated to grow at a CAGR of 6.2% between 2025 to 2034 period.

- The U.S. market is primarily driven by the significant growth in the pharmaceutical and biotechnology industries. The increasing demand for precise analytical tools in drug development, quality control, and clinical trials has led to a surge in the adoption of instruments like mass spectrometers, HPLC systems, and chromatography devices. Additionally, the growing focus on personalized medicine and biomarker discovery has further accelerated the need for sophisticated diagnostic and analytical tools in both clinical and research settings.

- Another key driver is the heightened emphasis on environmental monitoring and safety standards. Regulatory bodies such as the EPA and FDA have implemented stricter guidelines for environmental testing, food safety, and product quality, pushing industries to adopt advanced analytical instruments. The rising demand for instruments that monitor air and water quality and ensure compliance with regulations continues to fuel market growth in the U.S.

UK analytical instrumentation market is projected to grow remarkably in the coming years.

- Increasing environmental concerns and the growing emphasis on sustainability are key drivers. Regulatory frameworks, including stringent regulations for air and water quality monitoring, are propelling demand for analytical instruments that monitor pollutants and ensure compliance. The UK's commitment to reducing carbon emissions and improving environmental sustainability is creating demand for tools that can analyze environmental factors in real-time.

- Moreover, government support and funding initiatives, such as research grants and development programs, play a crucial role in boosting the adoption of analytical instrumentation. Programs like the UK Government Industrial Strategy Challenge Fund and investment in research institutions help mitigate financial barriers and support the advancement of precision instrumentation across sectors.

Japan holds a dominant position in the Asia Pacific analytical instrumentation market.

- Japan has long been a global leader in technological innovation, particularly in industries like electronics, robotics, and precision instruments. In analytical instrumentation, advancements such as miniaturization, automation, and AI integration are driving demand. The rise of AI-enabled instruments for real-time data analysis and precision monitoring is particularly important for sectors like pharmaceuticals, healthcare, and environmental testing.

- Further, the country is home to a strong pharmaceutical and biotechnology sector, which is a major driver for analytical instrumentation. Instruments like mass spectrometers, HPLC systems, and chromatographs are essential for drug discovery, clinical trials, and quality control. The increasing focus on personalized medicine and cutting-edge biotechnology research further fuels the need for advanced analytical tools in both clinical and research environments.

How much is the U.S. analytical instrumentation industry worth?

The U.S. analytical instrumentation market generated USD 21.5 billion in revenue in 2024 and is anticipated to grow at a 6.2% CAGR from 2025 to 2034, driven by the expanding pharmaceutical and biotechnology industries.

What is the growth outlook for the molecular analysis instruments segment?

The molecular analysis instruments segment is expected to grow at a 6.9% CAGR, reaching over USD 39.5 billion by 2034, fueled by the adoption of high-throughput and precision-based techniques in research and diagnostics.

How big is the analytical instrumentation market?

The global analytical instrumentation industry was valued at USD 60 billion in 2024 and is projected to grow at a 6.5% CAGR from 2025 to 2034, driven by technological advancements and rising demand for quality control in manufacturing.

Who are some of the prominent players in the analytical instrumentation industry?

Key players in the industry include Agilent, Avantor, BIO-RAD, BRUKER, Danaher, Eppendorf, HITACHI, Illumina, Malvern Panalytical, Metrohm, METTLER TOLEDO, and Revvity (PerkinElmer).