Summary

Table of Content

Aircraft Soft Goods Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aircraft Soft Goods Market Size

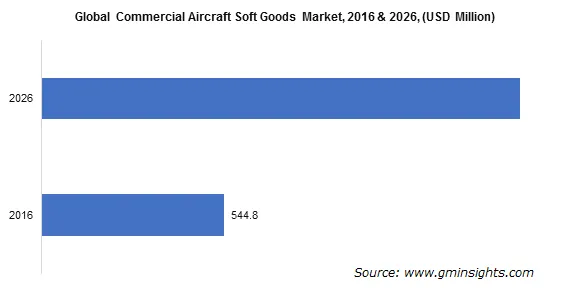

Aircraft Soft Goods Market size surpassed USD 650 million in 2019 and is estimated to grow at over 2% CAGR between 2020 and 2026. Rapidly increasing air passengers’ traffic across the globe is likely to be key driving factor for the market growth.

The expansion of regional air connectivity and air travel routes is positively influencing the industry demand. Moreover, aircraft manufacturers and airliners are focusing on enhancing the customer experience by providing high level of comfort and service. These trends have created need for the development of cabin interiors with comfortable aircraft seats offering reclining and lumbar support.

To get key market trends

To get key market trends

The temporary closure of manufacturing facilities and challenges associated with COVID-19 pandemic will limit the aircraft soft goods market growth in near future. Sudden drop in air travel passengers along with decline in aircraft fleet in service has resulted in reduction of revenue in 2020. However, the industry will gain momentum with increasing air travel demand due to expected stability in tourism sector worldwide.

Aircraft Soft Goods Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 683.5 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 2.5% |

| Market Size in 2026 | 693.9 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Aircraft Soft Goods Market Analysis

Learn more about the key segments shaping this market

In 2019, commercial aircraft held over 85% share in the aircraft soft goods market owing to rising deliveries of narrow-body aircrafts across the world. Emerging countries are experiencing a surge in demand for short to medium haul travel. Rising usage of low-cost carriers coupled with expanding routes offered by airliners are expected to provide a significant boost in the market size. Moreover, airliners are focusing on increasing their flight seating capacities and enhancing level of seating comfort, influencing the industry demand.

Seat covers will register growth of around 2.6% during the forecast period impelled by increasing concerns towards aesthetics, comfort, and hygiene of aircraft seats. Such trends will propel the usage of soft and stain resistant seats covers, that results in significant fuel saving of an aircraft as compared to leather seat covers. Apart from this, government regulations focusing on usage of biodegradable and eco-friendly seat covers will fuel the market growth.

Wool/nylon blend fabric accounted for 70% aircraft soft goods market share on account of properties including, excellent wear resistance, good durability, and superior insulating characteristics. Manufacturers are developing new products that combine properties of wool and nylon fabric to enhance the aesthetics of aircraft interior.

OEM segment is anticipated to dominate the aircraft soft goods market over the coming years led by growing number of commercial aircraft deliveries across the globe. Increasing air travel demand coupled with rising low-cost airliners in the Asia Pacific region will support the segment growth.

Learn more about the key segments shaping this market

In 2019, North America aircraft soft goods market dominated around 45% revenue share. Proliferating commercial airline industry with rising air travel demand in the U.S. will boost the industey growth. Stringent government regulations towards aircraft maintenance and repair activities will create need for refurbishment & repair of interior components of an aircraft will drive the market demand.

Aircraft Soft Goods Market Share

Aircraft soft goods industry is highly competitive with presence of large number of manufacturers and suppliers across the world. Some of the key manufacturers are

- Aerofloor

- Aerofoam Industries

- Aircraft Interior Products

- Botany Weaving Mill

- DESSO Aviation

- E-Leather

- Fellfab Limited

Industry players use variety of strategies including acquisitions & mergers, product development, diversification, etc. to remain competitive. For instance, in 2018, Fellfab Corporation merged with Custom Products, Inc. to enhance their market share. Similarly, Aerofloor Limited introduced a new sheepskin range that regulates body temperature and provides comfort in long flights, is a good example for product innovation.

The aircraft soft goods market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2016 to 2026, for the following segments:

Market by Aircraft

- Commercial

- Regional

- Business

- Helicopters

Market by Product

- Carpets

- Seat covers

- Curtains

- Others

Market by Materials

- Wool/nylon blend fabric

- Natural leather

- Synthetic leather

- Polyester fabric

Market by End-user

- OEM

- Aftermarket

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Russia

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- Qatar

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What was the size of the global aircraft soft goods market in 2019?

The market size of aircraft soft goods surpassed USD 650 million in 2019.

What is the expected growth rate for aircraft soft goods industry share during the forecast timespan?

The industry share of aircraft soft goods is estimated to grow at over 2% CAGR between 2020 and 2026.

How has North America fared in the aircraft soft goods market?

According to the analysts at GMI, North America dominated around 45% market revenue share in 2019.

What are the estimates for seat covers segment in the aircraft soft goods industry?

Seat covers will register growth of around 2.6% during the forecast period, impelled by increasing concerns towards aesthetics, comfort, and hygiene of aircraft seats.

Which are the prominent aircraft soft goods manufacturers across the globe?

Some of the key manufacturers are Aerofloor, Aerofoam Industries, Aircraft Interior Products, Botany Weaving Mill., DESSO Aviation, E-Leather, and Fellfab Limited. Product design.

Aircraft Soft Goods Market Scope

Related Reports