Summary

Table of Content

AI Server Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

AI Server Market Size

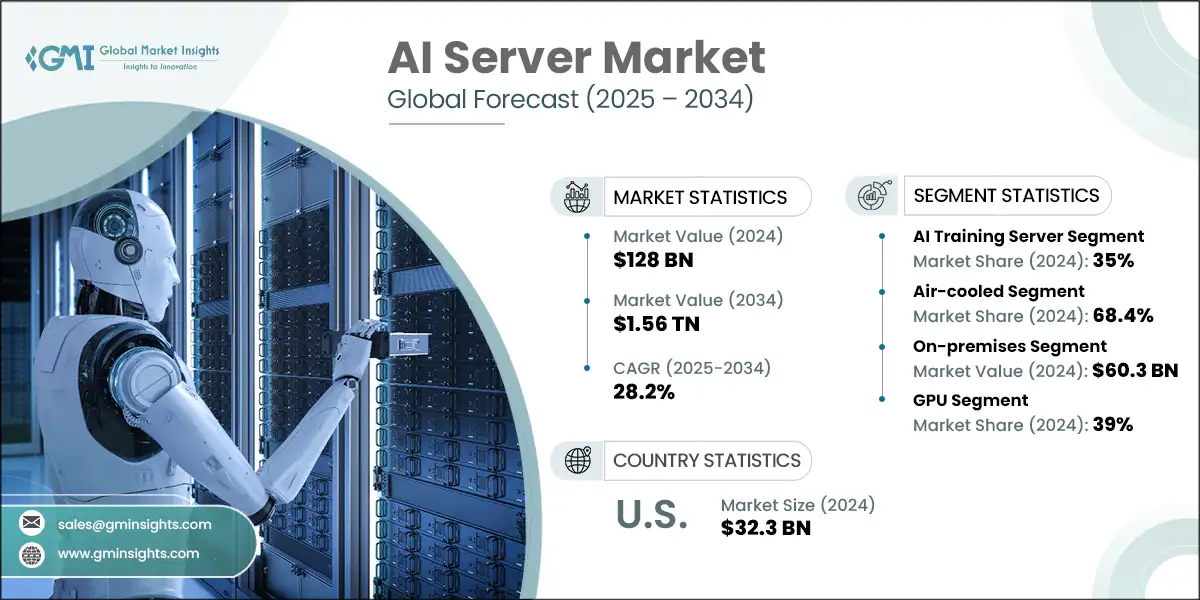

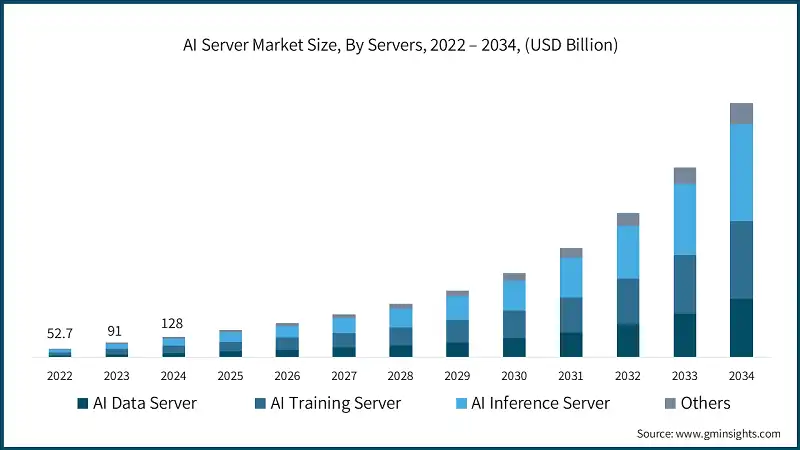

A comprehensive report by Global Market Insights Inc. projects the global AI server market was valued at USD 128 billion in 2024. The market is expected to grow from USD 167.2 billion in 2025 to USD 1.56 trillion in 2034, at a CAGR of 28.2%.

To get key market trends

- The AI server market is experiencing significant growth due to increasing acceptance across many sectors, the need for sturdy servers to support these complex algorithms and applications is also increasing. This is evident by KX, which introduced its KDB.AI Server Edition-a scalable high-performance vector database tailored for contextual search and time-oriented generative AI-in the last week of November 2023. The product can be deployed using Docker into cloud, on-premises, or hybrid environments, while going through streamlined setup processes that allow the corporations to use their AI capabilities.

- This launch will further bolster the artificial intelligence server market by delivering a compelling performance offering to meet the evolving needs of tech-savvy consumers. The product can be deployed using Docker into cloud, on-premises, or hybrid environments, while going through streamlined setup processes that allow the corporations to use their AI capabilities. This launch will further strengthen the market by delivering a compelling performance offering to meet the evolving needs of tech-savvy consumers.

- The AI server market experienced significant growth before and after the COVID-19 pandemic. In 2021, the pandemic accelerated digitization, leading to explosive growth in the broader AI market. Major memory manufacturers like Samsung, SK Hynix, and Micron intensified development of high-bandwidth memory (HBM) products to meet the rising demand from AI applications—HBM is becoming more widely used in GPUs and high-performance AI servers. Similarly, the growth after COVID-19 remained strong, though it stabilized compared to the immediate post-pandemic surge.

- North America is leading in AI server adoption due to a mature technology ecosystem, along with broad use of AI in industry including healthcare, finance, and autonomous vehicles. North America has a large presence of cloud service providers and AI chipmakers, underlining an expected sustained demand. There are several government initiatives to rapid AI based innovation and finance significant investment in AI oriented R&D. There is a clear shift to edge AI infrastructure and hybrid AI oriented deployments especially around data intensive applications.

- The Asia-Pacific region is developing as a fast-paced AI server market, fueled by rapid digitization, large-scale industrial automation, and smart city applications. China, Japan, South Korea, and India have been shifting their economy heavily toward artificial intelligence and building their AI ecosystem and infrastructure to support AI innovations across manufacturing, logistics, and public sectors. Server demand is rising in urban and rural areas due to the expansion of cloud business and AI-as-a-service. The Asia-Pacific region is also capitalizing on its semiconductor manufacturing with large capacities, leading to additional AI hardware sourcing opportunities.

AI Server Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 128 Billion |

| Forecast Period 2025 - 2034 CAGR | 28.2% |

| Market Size in 2034 | USD 1.56 Trillion |

| Key Market Trends | |

| Drivers | Impact |

| Explosive enterprise AI adoption and proven return on investment | Explosive enterprise AI adoption drives demand for powerful AI servers to handle complex workloads and deliver ROI. |

| Massive cloud infrastructure expansion and investment. | Massive cloud expansion fuels AI server growth as providers scale infrastructure to support AI services. |

| Edge computing growth and real-time processing demands | Edge computing growth increases need for decentralized AI servers for low-latency, real-time processing. |

| High-performance computing requirements for AI workloads | High-performance computing (HPC) demands push advancements in AI server capabilities for faster, efficient AI training and inference. |

| Pitfalls & Challenges | Impact |

| Astronomical infrastructure costs and power consumption | High upfront investment in AI servers and data centers limits adoption, especially for SMEs. |

| Critical skills shortage and technical complexity | Lack of expertise in AI deployment and server optimization slows market growth. |

| Opportunities: | Impact |

| Custom AI Solutions for Enterprises | Growing AI adoption creates demand for tailored server configurations to meet specific industry needs |

| Hyperscale Data Center Expansion | Cloud providers investing in AI infrastructure drive bulk orders for high-performance AI servers. |

| Market Leaders (2024) | |

| Market Leaders |

31% market share |

| Top Players |

Collective market share in 2024 is 40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Mexico, China, Brazil, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

AI Server Market Trends

- Increasing investments in AI catalyzes the emergence of AI, thereby spurring demand for high-performing AI servers. The government will fund AI supercomputing centers and innovation hubs, and enterprises will fund with the goal to expand AI infrastructure by improving automation, analytics, and customer engagement. Growing investments in AI will spur innovation in the architecture of AI servers, improving performance and efficiency for all sectors.

- In September 2024, Lenovo constructed a new research and development laboratory in Bangalore and commenced the manufacture of premium AI server systems at their factory in Puducherry. The factory will assemble AI and GPU servers, over 60 percent of which will be sold overseas within the Asia Pacific region.

- The rising adoption of edge AI computing is another key trend in AI server market. The workloads are now being situated closer to data generation sources as organizations seek to enhance real-time processing and reduce their dependency on centralized cloud infrastructure. Thus, resulting in an increased demand for AI servers specialized for edge deployment. These feature compact designs, energy efficient and powerful AI accelerators. Autonomous vehicles, smart manufacturing, and healthcare industries are leading in the application of edge AI technology.

- In November 2024 Vecow Co., Ltd. introduced the next-gen edge AI server platforms. It is powered by Intel Xeon D Series, Intel Xeon Scalable processors, and AMD EPYC processors. These servers are designed especially for the embedded and industrial markets, enabling efficient data processing at the edge to reduce latency and boost operational efficiency.

- Cloud and hybrid AI server deployment is one of the prominent trends in the AI server market. Organizations are adopting agile and elastic cloud options, which could easily be scaled up or down in line with fluctuating workload needs. Hybrid clouds are also gaining much importance as they serve both the on-premises and off-premises workload by balancing security and access to data.

- Some key features include support for autonomous vehicles, where real-time AI inference ensures reduced latency for tasks like object detection. In industrial automation, Vecow’s edge AI servers enhance predictive maintenance and process optimization. The 2U form factor of the RMS-4000/3000 series is ideal for space-constrained environments.

AI Server Market Analysis

Learn more about the key segments shaping this market

Based on servers, the AI server market is divided into AI data servers, AI training servers, AI inference servers and others. The AI training server segment dominated the market accounting for around 35% in 2024 and is expected to grow at a CAGR of over 26% from 2025 to 2034.

- AI training servers continue to evolve as the demand for deep learning, generative AI and large language models increases across industries. These servers are optimized for high performance and AI based capacities and use GPUs or custom AI chips capable of managing multidimensional model training. Organizations and research institutions are pouring an enormous amount of money into AI training servers for their innovations in natural language processing, computer vision and autonomous systems.

- In November 2024, HPE announced multiple new AI supercomputer products configured for machine learning (ML) training, which included the Cray EX4252 with AMD 5th Gen EPYC processors and an EX154n with 224 Nvidia Blackwell GPUs. HPE also produced the Slingshot Interconnect 400 for faster networking and the E2000 storage system for substantially improved I/O throughput. HPE incorporated the ProLiant Compute XD680 (Intel Gaudi 3) and XD685 (Nvidia H200, Blackwell, AMD MI325Xs) with liquid cooling and server-based Cray Supercomputing Software to improve training of ML workloads.

- AI inference servers are also emerging, as real-time decision-making becomes front and center to many of today's modern applications including autonomous vehicles, fraud detection, and intelligent customer communications. AI inference servers are optimized for runway pre-trained models with low latency and high throughput. The trend is toward deploying inference servers at the edge and in data centers to meet the need for instant responses and localized AI execution.

Learn more about the key segments shaping this market

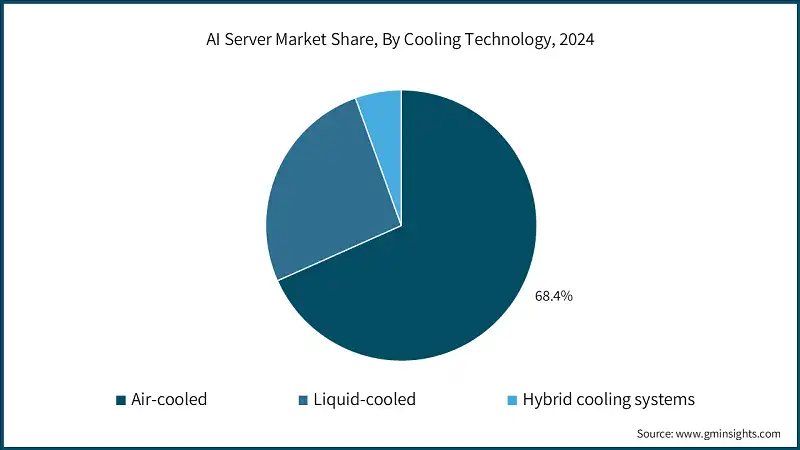

Based on cooling technology, the AI server market is categorized into Air-cooled, Liquid-cooled, and Hybrid cooling systems. Air-cooled segment dominates the market with 68.4% share in 2024, and the segment is expected to grow at a CAGR of over 27% between 2025 & 2034.

- Air-cooled systems remain widely adopted due to their simplicity, cost-effectiveness, and ease of maintenance. These systems are evolving based on technologies involving airflow design, heatsink designs, and fan designs hoping to support more dense AI workloads. Vendors focus on making thermal management more efficient to maintain performance in edge and enterprise deployments which, by design, have less margin than the data center.

- In April 2025, for example, MiTAC announced the release of Open Compute Project (OCP) compliant servers that incorporate new liquid- and air-cooling technologies that are more efficient than previous generations for AI and high-performance computing (HPC) purposes. These servers were designed to mitigate rising power and thermal challenges faced in data centers as they scale, to provide modern AI infrastructure new options to handle today's performance and scale at a fraction of the energy cost.

- Liquid cooled systems are gaining considerable traction in AI server deployments across the industry where thermal loads, computational density, etc. are becoming commonplace. Additionally, this technology provides superior heat dissipation which allows systems to exercise previously unobtainable sustained performance for AI training and inference. Many players in the market are investing heavily direct-to-chip and immersion cooling technologies for hyperscale and high-performance computing.

Based on deployment, the artificial intelligence server market is divided into on-premises, cloud-based, and hybrid. The on-premises segment dominates the market and was valued at USD 60.3 billion in 2024.

- On-premises AI servers are gaining traction among enterprises seeking greater control over data security and infrastructure. This deployment is favored by industries with sensitive data, such as healthcare, finance, and defense. Organizations prefer on-premises setups for low-latency processing and compliance with data residency regulations. Customization and integration with legacy systems further support their adoption.

- On-premises solutions demonstrate 55-65% cost advantages for large-scale deployments, though they require substantial upfront capital investments and specialized expertise for management and maintenance. The break-even analysis for on-premises versus cloud deployment typically occurs at 17% server utilization over one year, with Lambda's analysis showing 66.3% savings over a 1-year total cost of ownership compared to AWS options.

- Cloud-based AI servers are increasingly adopted due to their scalability, flexibility, and ease of access to high-performance computing. Organizations are leveraging cloud platforms to quickly deploy AI workloads without investing heavily in infrastructure. For instance, In June 2025, NVIDIA announced the creation of Europe's first industrial AI cloud, a Germany-based "AI factory" equipped with 10,000 GPUs, including DGX B200 systems and RTX PRO Servers. This initiative aims to revolutionize manufacturing by accelerating AI-driven applications such as digital twins, robotics, and engineering simulations for European industrial leaders.

Based on hardware, the artificial intelligence (AI) server market is divided into GPU, ASIC, FPGA and others. The GPU segment dominates the market with 39% share in 2024, and the segment is expected to grow at a CAGR of over 26% from 2025 to 2034.

- GPUs utilize many processing units to perform complex calculations faster and with greater accuracy for AI systems. As more companies begin to adopt AI, they will require more GPU servers to harness their ability to consume a lot of data very quickly, which is critical for quickly building and deploying AI systems. Companies such as AOS are creating new advanced GPU components that provide reliable power delivery, ensuring stability and optimal performance.

- For example, in January 2025 Alpha and Omega Semiconductor (AOS) launched a cutting-edge power management system for Nvidia Blackwell GPUs in AI servers. The system saves energy, leading to reliable operation of the system. It allows operation of powerful applications, reducing the energy consumed by new GPU systems.

- Field-Programmable Gate Arrays (FPGA) move through an essential space in AI server hardware ecosystems, simultaneously realizing reconfigurable computing to uniquely occupy space between programmable general-purpose processors and customized Application-Specific Integrated Circuits (ASIC) implementation efficiency. Because FPGAs do not only provide a means of encoding "custom" logic circuits specific to AI algorithms, but they also allow for the reconfiguration of the logic circuit for other applications when reallocation is needed.

Looking for region specific data?

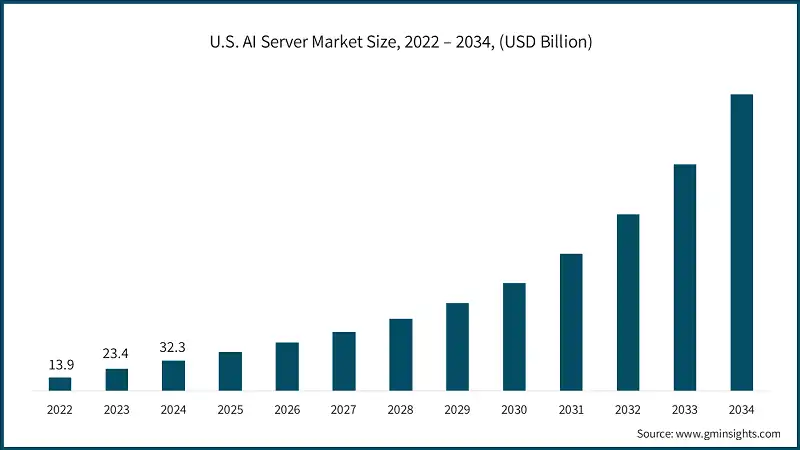

The US dominated the North America AI server market with around 80% market share and revenue of USD 32.3 billion in 2024.

- A key trend in the US AI server market is the rapid adoption of AI powered robotics and automation to enhance manufacturing efficiency and precision. Manufacturers of high-performance AI servers are not only experiencing significantly increased demand now, but they are also rushing to deploy robots and other autonomous systems into their product to speed up assembly, minimize the mistakes, and decrease labor costs. This trend in manufacturing is largely driven by the need to improve speed and scale to manufacture the next gen of AI servers that can require complex configurations of GPUs, other accelerators, and liquid cooling systems, among other things.

- For example, as of June 2023, NVIDIA has partnered with Foxconn to deploy humanoid robots at Foxconn’s new Houston factory, which is scheduled to manufacture NVIDIA’s AI servers by Q1 2026. These humanoid robots will be trained on the many intricate assembly tasks that characterize the advanced server hardware needed to manufacture AI servers, an important milestone in AI-powered smart manufacturing. The impact of the use of humanoid robots not only improves efficiencies in production, but are signifying the importance of North America, and especially the Texas market, in leading the development of next-gen AI infrastructure, supporting the region as an important regional community in the global supply to AI solutions.

- Canada is a significant and growing market for AI server infrastructure driven by strong government support for AI R&D, a well-established technology ecosystem, and increasing enterprise deployments of AI technologies across industries. Canada's government has also heavily invested in AI research efforts such as the Pan-Canadian Artificial Intelligence Strategy, putting Canada at the forefront of AI research and development with increased investment from major Canadian institutions and companies in AI infrastructure to support their research and commercial applications.

Germany AI server market will grow tremendously between 2025-2034.

- Germany is the largest European market propelled by its strong industrial foundation, the level of government investment into AI R&D, and the high usage of AI in its manufacturing, automotive and other dominant sectors. Germany's policy on AI best practice is characterized by a strong commitment to infrastructure and R&D investment in AI, and major German firms such as Siemens, BMW and SAP are all investing heavily into AI capability to keep their positions in the international market.

- Similarly, the UK AI server market is developing from the country’s post-Brexit approach to technology policy which has a tech strategy based around digital sovereignty and domestically developed AI capabilities but still maintaining a close working relationship with foreign tech suppliers and collaborators. According to the US International Trade Administration, “the UK AI market is worth over USD 20.4 billion and is expected to grow to USD 971 billion by 2035." Much of that growth will only be catalyzed via direct partnering with the data center industry and its collective capacity to provide the secure, scalable and sustainable computing underpinnings required to meet the ambitions of government in AI.

- France is one of the most important and growing AI server markets in Europe due to strong government support for artificial intelligence development, investments in research and development and uptake of artificial intelligence technology across industries including aerospace, automotive, and financial. Italy is a developing, growing artificial intelligence (AI) server market in Europe driven by government action to encourage digital change, increased recognition of the strategic importance of artificial intelligence across industries and increased public and private investment in technology infrastructure.

The AI server market in China will experience strong growth during 2025-2034.

- Asia-Pacific contributes more than 31% of the market, making it the fastest growth region with a projected CAGR of 30%. China is the world's largest market for AI servers, strategically significant, with large government investment in AI R&D, a location of global tech giants, and governmental policies that advocate for the deployment of AI as a priority because of technology's importance to economic and strategic competitiveness. Chinese firms such as ByteDance, Tencent, Ali Baba, and Baidu have been large purchasers of AI infrastructure, with market share falling from about 25% in 2020 to around 15% in 2024 because of U.S. export restrictions on advanced AI chips.

- On a similar trajectory is India's artificial intelligence server market, supported by India's role as a center of global technology service for the world as well as significant government expenditure on digital infrastructure, and increasing acceptance of AI's potential to facilitate economic growth and social development. In April 2025, India launched its first fully designed artificial intelligence (AI) server from VVDN Technologies a hardware manufacturing firm based in Manesar, Haryana.

- Australia is an emerging and strategically significant AI server market, which is being driven by government programs for digital transformation, increasing enterprise adoption of AI technology, and large investment in technology infrastructure, both public and private sectors. Amazon's commitment to spending USD 13.1 billion on Australian data center infrastructure between 2025 and 2029 indicates the high growth prospects and international confidence in the economy of Australia.

The AI server market in Brazil will experience significant growth between 2025 & 2034.

- Latin America holds a 5% share of the market in 2024 with a CAGR of 25%. The market is emerging in Latin America and is becoming a larger AI investment server market, driven by greater awareness of AI's strategic value for economic growth, an evolving government support for digitalization, and increased investments in technology infrastructure more broadly in the region.

- Brazil is leading this movement, as the National Plan for AI (2024) allots $4 billion USD for AI infrastructure and development in Brazil, including prior efforts, such as the Brazilian AI Strategy (EBIA), to be seen as a competitive player in the global AI landscape. Important to this shift, and to recognize about investment in knowledge, was Microsoft's announcement in September 2025 that it plans to invest 14.7 billion Reais (approx. $3 billion USD) over three years for cloud and AI infrastructure in Brazil, which includes major AI training programs to develop AI capability for 5 million Brazilians to utilize advanced AI technologies.

- Mexico is also an emerging AI server market and regionally, it is a significant market for AI servers; dimensions of this importance are through the encouragement of entities for digital transformation by the government, expanded enterprise use of AI technologies, and Mexico's role in leading global manufacturing while being a gateway to North America. The government of Mexico has come up with programs to facilitate the adoption of AI and digital transformation, and large Mexican businesses and foreign businesses operating in Mexico are investing in AI capabilities to enhance manufacturing, logistics and other strategic sectors.

The AI server market in UAE is expected to experience high growth between 2025 & 2034.

- The Middle East & Africa region is among the fastest-growing markets for AI servers backed up by digital economy initiatives and national AI strategies, especially in the Gulf states. AI is coming on stream in a variety of industries, including smart governance, oil & gas, and fintech, which is pushing demand for secure and scalable server solutions. Development of cloud-enabled infrastructure is accelerating in much of the region, creating a demand for AI applications in healthcare and education. Technologically advanced cities such as Dubai and Riyadh are driving AI adoption and increasing the demand for AI servers on the edge and in data centers.

- United Arab Emirates is a very advanced and rapidly growing AI server market in the MEA region which is being driven by excellent government support for AI development, enormous investments in technology infrastructure, and the country serves as a regional technology and business hub. The government of UAE has prioritized AI as a national priority by taking initiatives such as the UAE AI Strategy 2031 and investing substantially in AI research and development, while large UAE corporations and multinationals are investing in the UAE are spending massively to get their AI capabilities established.

- Saudi Arabia is among the fastest-growing AI server markets in the MEA region and one of the most active, mainly due to the Vision 2030 strategy, enormous government funding to add technology infrastructure, digital transformation, and economic diversification initiatives. Saudi Arabia has prioritized AI development as a central part of its national transformation strategy. While developing various aspects of AI into the Saudi economy, the government has invested heavily in research, technology uptake, and AI infrastructure development. Leading Saudi organizations and international firms are investing heavily in AI capability to support the country in its economic diversification initiative.

AI Server Market Share

The top 7 companies in the market are Nvidia, Super Micro Computer, Hewlett Packard Enterprise, Dell, IBM, Fujitsu, and Microsoft. These companies hold around 40% of the market share in 2024.

- Nvidia secures leadership in the AI server market by vertically integrating its GPU based platforms, Blackwell and Rubin, and locks up its manufacturing capacity through a pre-booking process to secure supply and limit competition. The company has introduced NVLink Fusion, which allows third party chips to be integrated into its ecosystem, thus expanding the adoption of its platforms.

- Supermicro is focused on building hardware infrastructure that is high performance and scalable for workloads optimized for AI. The company sells HGX based GPU servers that use the fastest NVLink/NVSwitch interconnects and utilize its largest LLM training and inference throughput at scale. The SuperCluster of all flash rack-level turnkey systems supports Generative AI, while all flash petascale storage servers using NVIDIA Grace CPU accelerate AI and data pipelines.

- HPE’s approach emphasizes AI Factory solutions, describing integrated, modular AI infrastructure for private cloud, hybrid, and edge deployments. HPE partners with Nvidia for pre-configured ProLiant servers using RTX PRO 6000 Blackwell, as well as its scalable XD690 systems to accelerate generative, agentic, and physical AI. For both offerings, HPE couples its OpsRamp SaaS for unified monitoring and optimization on all HPE hardware as well as current training statuses where applicable and education programs with its global channel partners and systems integrator network.

- Dell has an overall AI Factory framework, which fits hardware, services, data governance and ecosystem together. Dell works closely with Nvidia and Intel/AMD and provides AI ready data centers, PCs, and scalable object storage appliances. Dell also emphasizes automated hybrid-cloud orchestration, zero trust, and AI life cycles with its AI Factory and AI Data Platform.

AI Server Market Companies

Major players operating in the AI server industry include:

- Amazon Web Services

- Dell

- Fujitsu

- Hewlett Packard Enterprise

- Huawei

- IBM

- Microsoft

- NVIDIA

- Super Micro Computer

- Several companies are shaping the AI server market with notable initiatives. For example, NVIDIA has debuted its DGX platform with a custom-built platform with customer experiences appropriate for AI research and enterprise AI development. Dell Technologies and HPE have introduced AI-ready servers that support complete end-to-end AI workflows. In the telecom sector, for example, Ericsson has established AI servers to automate network management and improve delivery of services. These learning and operational advancements illustrate the market moving to intelligent and adaptive server ecosystems for next generation AI innovations.

- Similarly, IBM’s AI server strategy is based in enterprise-grade hybrid cloud environments integrated with the watsonx platform. The company believes in creating scalable, trustworthy AI infrastructure that enables the best governance, explainability, and risk management tools. IBM's AI server offers promote workload-optimized servers that support generative AI and traditional machine learning and analytics from regulated industries.

- Fujitsu’s AI server strategy is rooted in creating and leveraging unique hardware, green computing and industry-specific solutions. Fujitsu offers edge-to-core platforms optimized for key industries such as telecom, science and government and builds upon partnerships with Supermicro and AMD. Fujitsu is committed to sustainability through initiatives such as liquid cooling and the use of green energy appliances in their data centers. The company's FugakuNEXT project, which includes proprietary 2nm processors, will support, through sustainability investments, the next generation of the Fugaku supercomputer.

AI Server Industry News

- In May 2025, Dell and NVIDIA strengthened their partnership with "Dell AI Factory," introducing cutting-edge AI solutions that enhance accelerated computing and data processing. These integrated systems optimize AI deployment pipelines—from development to production enabling enterprises to achieve faster insights, streamlined workflows, and scalable AI infrastructure.

- In March 2025, South Korean AI chip startup FuriosaAI declined an acquisition offer of $800M from Meta and decided to pursue independence instead to continue advancing AI inference semiconductors, including its brand new RNGD chip, which was developed as a competing alternative to NVIDIA. Given the current state of successful Series C funding, the decision illustrates belief in the company's independence for long term growth potential in the AI server market, where there is a growing demand for alternative AI accelerators.

- In December 2024, Asus moved forward with its AI solutions. They are now connecting AI applications with servers to support improvements in digital healthcare. The AI server market in Taiwan is shifting. Companies like Asus are focusing on AI to boost patient care and make medical processes smoother.

- In June 2024, Foxconn announced to produce AI servers at its facilities in India. The announcement is in line with the company’s strategy of significant expansion of operations in India and diversification of its manufacturing capabilities.

- In June 2024 Advantech has launched the AIR-520 Edge AI Server which utilizes Phison’s aiDAPTIV+ technology in its pursuit to accelerate genAI applications. The solution integrates an AMD EPYC 7003 CPU with NVIDIA RTX GPU cards, SQ ai100 AI SSDs, and an Edge AI SDK that facilitates LLM (large language model) fine tuning and hardware-level data protection.

The AI server market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue and volume ($ Bn & Units) from 2021 to 2034, for the following segments:

Market, By Servers

- AI data

- AI training

- AI inference

- Others

Market, By Hardware

- GPU

- ASIC

- FPGA

- Others

Market, By Deployment

- On-premises

- Cloud-based

- Hybrid

Market, By Cooling Technology

- Air-cooled

- Passive air cooling

- Active air cooling

- Precision air conditioning

- Containment solutions

- Liquid-cooled

- Direct-to-chip

- Immersion cooling

- Single-phase

- Two-phase

- Hybrid cooling systems

Market, By Application

- IT & telecommunication

- Transportation and automotive

- BFSI

- Retail and e-commerce

- Healthcare and pharmaceutical

- Industrial Automation

- Others

Market, By End use

- OEM

- Cloud Service Provider (CSP)

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the AI server industry?

Key players include Amazon Web Services, Dell, Fujitsu, Google, Hewlett Packard Enterprise, Huawei, IBM, Microsoft, NVIDIA, and Super Micro Computer.

Which region leads the AI server sector?

North America leads the market, with the US accounting for 80% of the regional revenue, generating USD 32.3 billion in 2024.

What are the upcoming trends in the AI server market?

Key trends include growing AI infrastructure investment, edge AI adoption, cloud/hybrid deployments, advanced server architectures, and rising demand from sectors like autonomous vehicles, smart manufacturing, and healthcare.

What is the growth outlook for the GPU segment from 2025 to 2034?

The GPU segment held a 39% market share in 2024 and is likely to showcase around 26% CAGR up to 2034.

What was the valuation of the air-cooled segment in 2024?

The air-cooled segment dominated the market with a 68.4% share in 2024 and is set to expand at a CAGR of over 27% between 2025 and 2034.

What was the market share of the AI training server segment in 2024?

The AI training server segment accounted for approximately 35% of the market in 2024 and is expected to witness over 26% CAGR till 2034.

What is the projected value of the AI server market by 2034?

The market is poised to reach USD 1.56 trillion by 2034, fueled by advancements in AI infrastructure, edge computing, and hybrid cloud deployments.

What is the market size of the AI server in 2024?

The market size was USD 128 billion in 2024, with a CAGR of 28.2% expected through 2034. The growth is driven by increasing adoption across sectors and the need for robust servers to support complex AI algorithms and applications.

AI Server Market Scope

Related Reports