Summary

Table of Content

Aesthetic Medicine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aesthetic Medicine Market Size

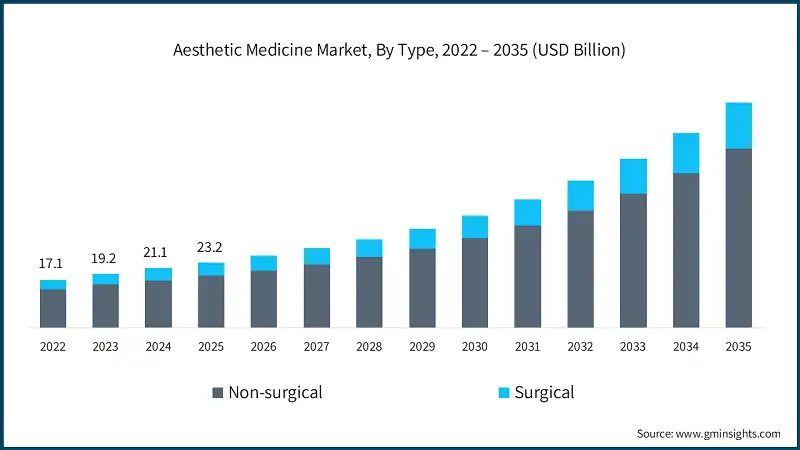

The global aesthetic medicine market was valued at USD 23.2 billion in 2025 and is projected to grow from USD 25.6 billion in 2026 to USD 80.2 billion by 2035, expanding at a CAGR of 13.5%, according to the latest report published by Global Market Insights Inc. This substantial growth is driven by numerous factors such as the increasing awareness regarding aesthetic procedures, technological advancements associated with medical aesthetic devices, rising prevalence of obesity, and increasing adoption of non-invasive procedures.

To get key market trends

Aesthetic medicine is a part of healthcare that focuses on improving physical appearance through non-invasive or minimally invasive procedures. It seeks to address cosmetic issues like skin texture, wrinkles, pigmentation, body contouring, and hair restoration without major surgery. Common treatments include Botox, dermal fillers, chemical peels, laser therapy, and non-surgical fat reduction. Leading companies in the digital pathology field are Sisram Medical Ltd, Boston Scientific Corporation, Merz Pharma, Johnson & Johnson, and Bausch Health. These companies are expanding in the aesthetic medicine market by broadening their product lines, investing in research and development for new treatments, making strategic acquisitions, and growing their global presence through targeted marketing and entering emerging markets.

Aesthetic Medicine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 23.2 Billion |

| Market Size in 2026 | USD 25.6 Billion |

| Forecast Period 2026 - 2035 CAGR | 13.5% |

| Market Size in 2035 | USD 80.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing awareness regarding aesthetic procedures | Fuels demand for cosmetic treatments, encouraging more individuals to seek aesthetic enhancements and boosting market growth. |

| Technological advancements associated with medical aesthetic devices | Enables development of safer, more effective, and innovative solutions, improving patient outcomes and expanding treatment options. |

| Rising prevalence of obesity | Drives demand for body contouring and weight management procedures through liposuction devices, creating opportunities for aesthetic device manufacturers. |

| Increasing adoption of non-invasive procedures | Accelerates preference for minimally invasive treatments, reducing recovery time and attracting a broader patient base. |

| Pitfalls & Challenges | Impact |

| High cost associated with aesthetic procedures | Limits accessibility for price-sensitive consumers, potentially slowing market penetration in emerging economies. |

| Lack of reimbursement and stringent regulatory scenario | Creates financial and compliance barriers for providers, delaying adoption and innovation in the aesthetic industry. |

| Opportunities: | Impact |

| Integration of AI and digital technologies | Adoption of AI-driven diagnostics, treatment planning, and personalized aesthetic solutions enhances efficiency and patient satisfaction. |

| Market Leaders (2025) | |

| Market Leaders |

9.5% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

The market grew from USD 17.1 billion in 2022 to USD 21.1 billion in 2024. Greater awareness of aesthetic procedures drives growth in this market, as more people look for minimally invasive and surgical options to enhance their appearance and boost their confidence. According to the International Society of Aesthetic Plastic Surgery (ISAPS) 2024 report, around 38 million procedures took place worldwide, including 17.4 million surgical and 20.5 million non-surgical treatments, marking a 42.5% increase over the last four years. Popular surgical procedures, like eyelid surgery (2.1 million), liposuction (2.08 million), and breast augmentation (1.65 million), highlight the growing demand for cosmetic enhancements. This trend reflects greater social acceptance, technological progress, and improved accessibility, all of which contribute to the market's growth.

Additionally, the rising prevalence of obesity is becoming one of the most influential drivers of growth in the aesthetic medicine market, as millions of individuals seek effective solutions to improve body shape and appearance beyond traditional weight-loss methods. Obesity not only poses serious health risks but also impacts self-esteem and body image, prompting a surge in demand for procedures such as liposuction, tummy tucks, body contouring, and non-invasive fat reduction treatments.

According to the World Health Organization (WHO), more than 1 billion people worldwide were living with obesity in 2024, and obesity was linked to 3.7 million deaths globally; WHO warns that without stronger action, the number of people affected could double by 2030, potentially costing the world USD 3 trillion annually. As obesity rates climb, aesthetic clinics and device manufacturers are innovating with advanced technologies such as laser-assisted lipolysis, cryolipolysis, and radiofrequency-based treatments to meet growing consumer demand for safe, minimally invasive options. This alarming trend is fueling demand for aesthetic solutions that complement lifestyle changes, driving innovation and expansion in the global aesthetic medicine market.

Aesthetic Medicine, is a field of medicine that improves physical appreance using the combined techniques of surgical and non-surgical procedures to help to enhance the cosmetic value. The purpose of aesthetic medicine is to correct various issues such as wrinkles, scars, fat accumulation, skin laxity, cellulite, unwanted hair, and hyperpigmentation. This is accomplished using a variety of different methods both non-invasive and minimally invasive procedures as well as surgical procedures performed by trained medical professionals such as dermatologists, plastic surgeons, cosmetic surgeons and other appropriately qualified medical practitioners.

Aesthetic Medicine Market Trends

- Technological advancements in medical aesthetic devices are one of the most powerful drivers fueling the growth of the market. These innovations have transformed traditional cosmetic procedures into highly precise, safe, and minimally invasive treatments, meeting the growing consumer demand for effective solutions.

- One major area of progress is laser and light-based technologies, which have evolved to offer enhanced precision and versatility. Modern systems use optimized wavelengths and pulse durations to target specific skin concerns such as pigmentation, vascular lesions, and hair removal, while minimizing damage to surrounding tissue. For example, PicoWay by Apax Partners offer dual-wavelength devices with 1064-nm and 532-nm wavelengths, allowing for versatility in treating different skin concerns and tattoo colors.

- The significant advances being made in energy-based devices that use RF and ultrasound to stimulate collagen formation and tighten skin through non-surgical means are particularly noteworthy. The RF energy delivery systems have been developed to be compatible with microneedling and fractional systems to increase the penetration and effectiveness of the treatments. Ultrasound energy systems allow for deeper tissue targeting and are therefore ideally suited for lifting and contouring body areas.

- Cryolipolysis and non-invasive liposuction methods are rapidly becoming a major advancement in fat reduction. These methods rely on delivering controlled cooling or heating to the area to destroy fat cells while not causing damage to healthy surrounding tissue. The cooling method provides noticeable fat loss with little or no downtime for the patient. As manufacturers continue to integrate AI and smart sensors into their products, these technological advances will continue to impact the rapid growth of the market.

Aesthetic Medicine Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is bifurcated into non-surgical, and surgical. The surgical procedures segment was valued at USD 4.7 billion in 2025 and is expected to reach USD 16.6 billion by 2035.

- Surgical procedures deliver comprehensive solutions for a wide range of aesthetic concerns, including facial rejuvenation, body contouring, breast augmentation, and rhinoplasty. These treatments offer notable and durable improvements in appearance, which makes them attractive to people looking for transformative outcomes.

- According to the International Society of Aesthetic Plastic Surgery (ISAPS), surgical aesthetic procedures grew by 5.5% in 2023, with more than 15.8 million procedures performed globally.

- Modern healthcare facilities are equipped with advanced technologies and staffed by skilled professionals proficient in sophisticated surgical techniques, ensuring precise and safe outcomes while minimizing risks.

- Additionally, as patients invest more in sophisticated procedures like facelifts, liposuction, abdominoplasty, and breast augmentation to achieve their aesthetic goals, rising affluence and increased awareness have fueled demand for complex surgical interventions, driving segmental growth throughout the forecast period.

Based on products, the aesthetic medicine market is divided into energy-based, and non energy-based products. The energy-based segment accounted for USD 5.6 billion in 2025.

- Energy-based products provide non-invasive or minimally invasive treatments with high precision and little downtime. These devices address a variety of aesthetic issues, such as skin rejuvenation, hair removal, tattoo removal, and body contouring, using cutting-edge technologies like lasers, intense pulsed light (IPL), radiofrequency (RF), and ultrasound.

- Laser-based aesthetic devices have proven efficacy in treating pigmentation, vascular lesions, and unwanted tattoos, as well as performing hair removal. According to the Aesthetic Society, tattoo removal procedures increased by 8% in 2022 compared to 2021, with 23,012 procedures performed. Similarly, hair removal procedures saw a 14% increase in 2022, highlighting the growing demand for laser-based treatments. These trends underscore the role of energy-based technologies in meeting consumer preferences for quick, reliable, and less invasive solutions.

- This market is further strengthened by radiofrequency and ultrasound technologies, which provide non-surgical skin tightening and lifting procedures. While ultrasound-based systems reach deeper layers to contour the face and body, radiofrequency devices increase the production of collagen, improving the firmness and elasticity of the skin.

- Therefore, market for aesthetic medicine is anticipated to grow significantly due to ongoing innovation and rising consumer confidence in non-invasive technologies and energy-based devices.

Based on gender, the aesthetic medicine market is segmented into male, and female. The female segment held a market share of 84.6% in the year 2025.

- The female segment represents a dominant share of the market, driven by increasing demand for procedures that enhance appearance and boost confidence. Women are more likely to opt for both surgical and non-surgical treatments, influenced by rising beauty standards and greater awareness of available options. This demographic shows strong preference for body contouring, facial rejuvenation, and breast enhancement procedures, which offer transformative and long-lasting results.

- Surgical interventions remain particularly popular among women, with breast augmentation and liposuction leading the way. According to the International Society of Aesthetic Plastic Surgery (ISAPS) 2024 report, breast augmentation accounted for approximately 1.65 million procedures globally, while liposuction reached 2.08 million procedures, underscoring the high demand for body-shaping solutions.

- Non-surgical treatments also play a significant role in the female segment, as women increasingly choose minimally invasive options such as dermal fillers, botulinum toxin injections, and skin tightening technologies. These treatments offer quick results with minimal downtime.

- Overall, the female segment continues to drive substantial revenue within the aesthetic medicine market. Rising disposable income, cultural acceptance, and technological advancements in treatment safety and efficacy are fueling this trend.

Learn more about the key segments shaping this market

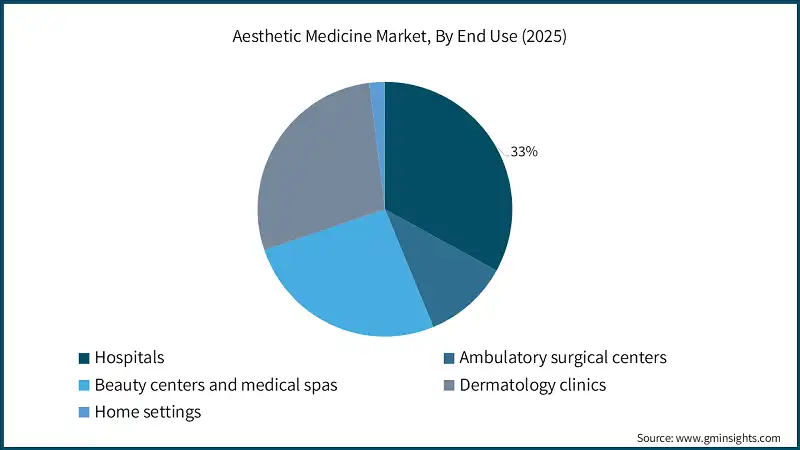

Based on end use, the aesthetic medicine market is segmented into hospitals, ambulatory surgical centers, beauty centers and medical spas, dermatology clinics, and home settings. The hospitals segment held a market size of USD 7.7 billion in the year 2025.

- Hospitals constitute a significant segment within the aesthetic medicine market, functioning as comprehensive centers for advanced treatments and consultations. Hospitals are equipped with advanced aesthetic devices, offering a wide range of treatment options. Patients can access multiple treatments in one location, including surgery, medical consultations, and aesthetic procedures.

- Hospitals often have specialized dermatologists, plastic surgeons, and aesthetic practitioners who are skilled in using devices.

- Furthermore, the increasing number of hospitals creates substantial demand for these devices to perform aesthetic procedures. For instance, there are 6,120 hospitals in the U.S. in 2024. This growing number drives adoption trends for aesthetic devices.

- Overall, hospitals play a pivotal role in shaping the aesthetic medicine industry by combining advanced technology, specialized expertise, and comprehensive care. Their ability to deliver multiple treatments within a single location, coupled with rising patient confidence and infrastructure development, ensures that this segment will further help market to grow.

Looking for region specific data?

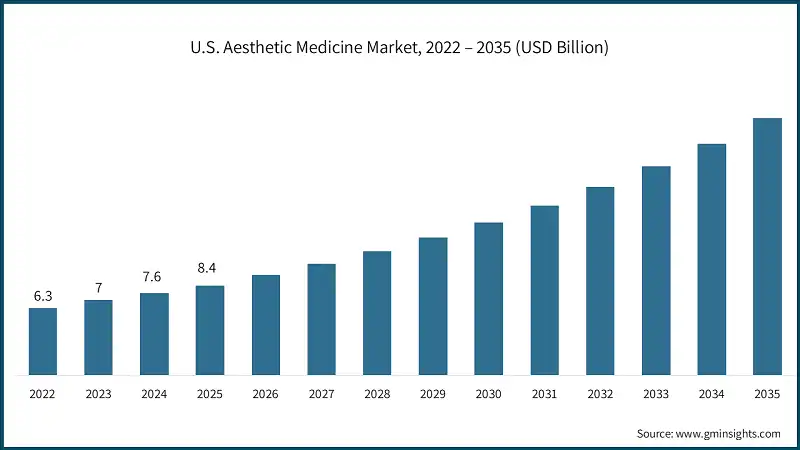

North America Aesthetic Medicine Market North America dominated the global market with a market share of 39.5% in 2025. Europe market accounted for USD 6.8 billion in 2025 and is anticipated to show lucrative growth over the forecast period. Germany aesthetic medicine market is projected to experience steady growth between 2026 and 2035. The Asia Pacific region is projected to be valued at USD 5.1 billion in 2025. Japan aesthetic medicine market is poised to witness lucrative growth between 2026 – 2035. The aesthetic medicine market in Saudi Arabia is expected to experience significant and promising growth from 2026 to 2035. Few of the prominent players operating in the aesthetic medicine industry include: Boston Scientific Corporation, a global leader in medical technology, has been expanding its portfolio through strategic acquisitions and innovation, primarily focusing on minimally invasive solutions. The company’s emphasis on R&D and integration of acquired technologies positions it to deliver safe, effective, and cutting-edge solutions for aesthetic treatments. Bausch Health Companies Inc., through its global aesthetics division Solta Medical, is a prominent player in the aesthetic medicine market. Solta Medical offers innovative non-invasive skin tightening and resurfacing technologies, with Thermage FLX being one of its flagship products. With over 5 million Thermage treatments performed globally, Bausch Health continues to focus on expanding its reach and advancing proven technologies for facial and body rejuvenation. Sisram Medical Ltd, a global leader in energy-based aesthetic solutions, is driving innovation through AI-powered platforms and personalized treatment offerings. By combining global R&D with localized strategies, Sisram is capitalizing on the rising demand for non-invasive procedures and personalized aesthetics, positioning itself as a frontrunner in the evolving aesthetic medicine landscape.Europe Aesthetic Medicine Market

Asia Pacific Aesthetic Medicine Market

Latin America Aesthetic Medicine Market

Middle East and Africa Aesthetic Medicine Market

Aesthetic Medicine Market Share

Aesthetic Medicine Market Companies

Aesthetic Medicine Market News:

The aesthetic medicine market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2022 – 2035 for the following segments:

Market, By Type

- Surgical procedures

- Non-surgical procedures

Market, By Product

- Energy-based

- Laser-based aesthetic device

- Radiofrequency (RF)-based aesthetic device

- Light-based aesthetic device

- Ultrasound aesthetic device

- Other energy-based products

- Non-energy-based

- Botulinum toxin

- Dermal fillers

- Implants

- Facial implants

- Breast implants

- Other implants

- Other non-energy-based products

Market, By Gender

- Male

- 18 years and below

- 19-34 years

- 35-50 years

- 51-64 years

- 65 years and above

- Female

- 18 years and below

- 19-34 years

- 35-50 years

- 51-64 years

- 65 years and above

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Beauty centers and medical spas

- Dermatology clinics

- Home settings

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the global aesthetic medicine market?

Prominent players include Apax Partners, Boston Scientific Corporation, Bausch Health Companies Inc., El.En. S.p.A, GC Aesthetics plc, Huadong Medicine Co., Ltd, Johnson & Johnson, Merz Pharma, and Sciton, Inc.

What was the valuation of the surgical procedures segment in 2025?

The surgical procedures segment was valued at USD 4.7 billion in 2025 and is anticipated to grow to USD 16.6 billion by 2035.

What was the market size of the aesthetic medicine market in 2025?

The market size was valued at USD 23.2 billion in 2025, with a CAGR of 13.5% projected through 2035, driven by increasing awareness of aesthetic procedures, technological advancements, and rising adoption of non-invasive treatments.

How much revenue did the energy-based products segment generate in 2025?

The energy-based products segment accounted for USD 5.6 billion in 2025.

What was the market share of the female segment?

The female segment held a dominant market share of 84.6% in 2025.

What are the key trends in the global aesthetic medicine market?

Key trends include advancements in laser and light-based technologies, increasing demand for non-invasive procedures, and the development of highly precise and safe medical aesthetic devices.

What was the market size of the hospitals segment?

The hospitals segment recorded a market size of USD 7.7 billion in 2025.

Which region led the global aesthetic medicine market in 2025?

North America dominated the market with a 39.5% share in 2025, driven by advanced healthcare infrastructure and high adoption of aesthetic procedures.

What is the projected value of the global aesthetic medicine market by 2035?

The market is expected to reach USD 80.2 billion by 2035, fueled by innovations in medical aesthetic devices and growing consumer demand for minimally invasive solutions.

Aesthetic Medicine Market Scope

Related Reports