VSAT Market size worth over $18 Bn by 2026

Published Date: August 2020

VSAT market size is set to surpass USD 18 billion by 2026; according to a new research report by Global Market Insights Inc.

The rise in adoption of information technologies such as cloud computing, artificial intelligence and other internet based platforms will fuel the demand for a high speed and reliable telecommunication network, generating market opportunities for VSAT systems. According to the Global Digital Report, in July 2020, there were over four billion people using the internet worldwide. This number is expected to increase with the rapidly growing penetration of internet-enabled devices.

The VSAT market will experience a moderate dip in 2020 and exhibit an accelerated growth rate post 2020 in light of the COVID-19 pandemic. Limited manufacturing, logistics and research and development capabilities due to nationwide lockdown will disrupt the market for short term. Opening of market and trade polices with new rules and regulations will serve as a revival stage of industry.

Get more details on this report - Request Free Sample PDF

Increasing number of aircrafts at global level to support K, Ka segment growth

Aircraft communications happen on 12.5GHz to 18GHz frequency which is supported by K, Ka segment. Increasing air traffic across the globe due to increasing disposable income and introduction of low cost carrier will allow the segment to grow at CAGR of more than 7% between 2020 and 2026. For instance, there are more than 24,000 commercial aircrafts across the globe with year on year growth of more than 5%.

Economical installation process and low operational cost to support new VSAT market players

Time Division Multiplexing (TDM) is expected to witness of over 7% CAGR through 2026 due to engagement of new industry players posing requirement of VSAT communication for limited timeframe in a 24 hour cycle. TDM refers to a multiplexing technique where a total available bandwidth is allocated to a single user for a particular timeframe. Each signal is allocated a time slot which is then passed on to another user on its completion. By this approach even new enterprise who cannot afford establishment of complete infrastructure can get access to personalized VSAT network.

Browse key industry insights spread across 250 pages with 376 market data tables & 25 figures & charts from the report “Very Small Aperture Terminal (VSAT) Market Size By Band (C, Ku, K, Ka, P, L, S), By Terminal (Single Channel Per Carrier (SCPC), Time Division Multiplexing (TDM), Time Division Multiple Access (TDMA)), By Application (Video Broadcasting, Data transfer, Private Network, Voice Communication), By Network Architecture (Star Network, Point To Point, Meshed Network), By Platform (Airborne, Naval, Land), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020-2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/very-small-aperture-terminal-vsat-market

Increasing rate of cyber-attacks and data piracy to generate demand for private networks

The private networks segment captured more than 13% VSAT market share in 2019 and is expected to witness 7% growth rate between 2020 to 2026. Increasing digitization across the globe and growing adoption of remote working model has generated the demand of private networks at enterprise level. Rising cyber threats and data piracy attacks have forced these organizations to ensure utmost safety during operations, further supporting demand for private networks.

Introduction of new telecommunication technologies augmenting meshed network segment growth

The meshed network valued over USD 4 billion in 2019 and is predicted to reach USD 8 billion by 2026. The segment growth is propelled by significant number of commercial satellites launches to strengthen global communication network. Ongoing project developments in 5G internet services in multiple countries will present potential growth prospects. For instance, in January 2020, China launched its first private 5G low orbit broad band satellite from Jiuquan Satellite Launch Center.

Increasing logistics network through waterways to support naval market

Gradual globalization, liberation of trade policies across the globe and increasing manufacturing capacities within Asia Pacific countries has spurred marine logistics. On an average there are more than 50,000 ships globally using VSAT network to ensure communications. Continuous rise in number of ships will also generate the demand of VSAT market.

Increasing political and border disputes in oceans, allowing nations to increase their marine fleet capacity or marine upgradation contracts practiced by range of military bodies also plays a major role in governing market statistics. For instance, in May 2020, Navantia, Spain established a joint venture with Harland & Wolff Ireland to pitch the manufacturing of three logistics ships to support Royal Navy’s new Queen Elizabeth-class aircraft carriers.

Versatile services provided by industry players operating in North America to spur market competitiveness

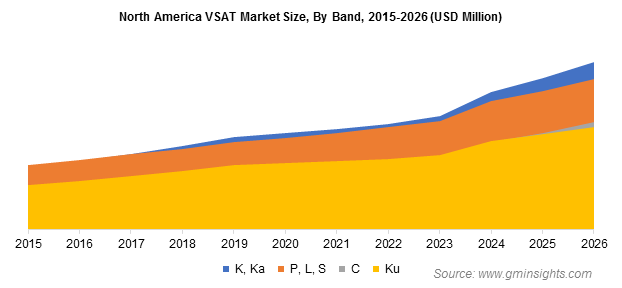

The North America VSAT market is projected to witness 9% CAGR during 2020 to 2026. North America is one of the largest markets in terms of marine trade. Industry players are engaged in providing custom plans to their marine customers to engage in long term contracts, supporting healthy market environment.

Heterogeneous Network (HetNet) services and introduction of 5G to open new market verticals

Major industry players operating in the VSAT market encompass L3Harris, Cobham, Hughes Network System, KVH Industries, Honeywell, Thales Group, General Dynamics, Orbit Communication System, Inmarsat, Singtel, Viasat, Gilet Satellite networks, X2NSat and ST Engineering. Innovative solutions such as Heterogeneous Network (HetNet) where the service provider offers an intelligent blend of microwave, GEO, MEO or LTE wireless connectivity combination managed under single service level agreement are expected to further support market competitiveness.

Commercialization of Fifth Generation (5G) mobile phone networks are opening new growth opportunities for service providers and VSAT manufactures. These technology has demonstrated capabilities to provide more bandwidth, improving their scope of application in naval and land verticals.