Used Construction Equipment Market size worth $142 Bn by 2026

Published Date: October 2020

Used Construction Equipment Market size is set to be over USD 142 billion by 2026, according to a new research report by Global Market Insights Inc.

Increasing demand for affordable equipment to complete construction projects is likely to drive the used construction equipment industry growth. High initial investments associated with purchasing new equipment are encouraging construction contractors to switch to used machines. The availability of premium and certified equipment through OEMs, such as Volvo and Caterpillar, Inc., is augmenting the market demand.

The proliferation of rental construction equipment providers in several countries across the globe is posing a challenge to the industry. Rental companies offer a wide variety of construction equipment at affordable rates. Renting the machines also assists building contractors to forego the costs of equipment maintenance and repair, hampering market revenues. The industry growth is also hampered by several barriers to entry for new players such as high capital costs and stringent regulations related to used construction equipment.

Get more details on this report - Request Free Sample PDF

Analyst view: “The used construction equipment market is expected to grow steadily over the forecast period owing to the high cost of new equipment and capital crunch faced by construction contractors. Enhanced customer services offered by used equipment players will also contribute to the market growth.”

The rapid spread of the COVID-19 pandemic is impacting the global economy on a large-scale. Economic indicators, such as GDP, employment rate, and consumer disposable income, have witnessed a sharp decline in 2020. These indicators have increased financial uncertainties and the shortage of cash flow for market leaders in the construction industry. Companies are increasingly focusing on purchasing low-cost used construction equipment to reduce their operating expenses. Market analysis and trends in the COVID-19 scenario forecast steady growth in the market during the fourth quarter of 2020 and 2021.

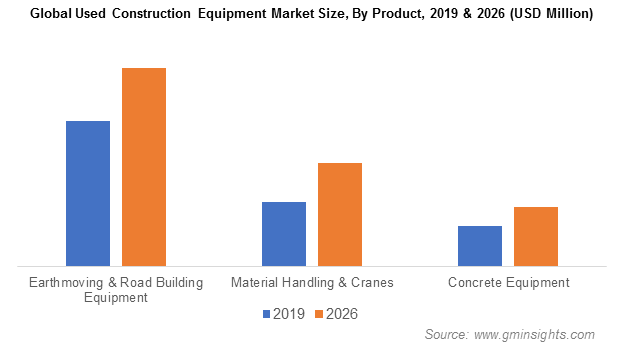

Browse key industry insights spread across 200 pages with 219 market data tables & 24 figures & charts from the report, “Used Construction Equipment Market Size By Product (Earthmoving & Road Building Equipment [Backhoes, Excavators, Loaders, Compaction Equipment], Material Handling & Cranes [Storage & Handling Equipment, Engineered Systems, Industrial Trucks, Bulk Material Handling Equipment], Concrete Equipment [Concrete Pumps, Crushers, Transit Mixers, Asphalt Pavers, Batching Plants]), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020-2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/used-construction-equipment-market

Growing demand for used material handling equipment in large construction projects

The material handling & cranes segment is anticipated to grow at over 7% CAGR through 2026 owing to the increasing demand in large construction & utility distribution projects. The increasing adoption of cranes and bulk material handling equipment in the construction of large commercial buildings and will improve used construction equipment market statistics.

Several benefits offered by industrial trucks, such as large load carrying capacity and enhanced mobility are expected to increase their market demand. These trucks are capable of hauling heavy loads and equipment across construction sites. Market players are offering a wide variety of used industrial trucks at affordable costs, in-line with the growing trend of used equipments in the market. For instance, in August 2020, Daimler AG launched a new used equipment business in collaboration with Bharat Benz to offer used industrial trucks in India.

A positive outlook of the North American construction industry driving market revenues

The North America used construction equipment market valued at over USD 18 billion in 2019. Increasing population shift toward urban locations due to an increase in employment opportunities is creating a demand for robust commercial and residential infrastructures in the region. Shifting focus of construction contractors toward reducing their capital investments is fueling the regional market outlook.

Increasing government investments in the development of residential and public infrastructures will further support the market demand. As per the Canadian Federal Budget of 2018 – 2019, the government invested USD 15.5 billion in building rehabilitation and development of public transport infrastructure. The increasing government focus on the development of robust road and rail networks in Canada is providing several opportunities for the used construction equipment market. Rising demand for sophisticated apartments and office buildings in populated cities including New York and Toronto is supporting the North America market share.

Leading companies are adopting merger & acquisition strategies to expand their business operations and core competencies in the market. For instance, in May 2017, Ritchie Bros. acquired Iron Planet, an online marketplace for sales and auction of used construction equipment, for approximately USD 758.5 million. The acquisition aided the company to expand its customer base and leverage Iron Planet’s online customer acquisition techniques to increase revenues.

Key players in the used construction equipment market include Hitachi Construction Machinery, Terex Group, Komatsu Ltd., Volvo CE, Deere & Company, Ritchie Bros., Equippo AG, Caterpillar, Inc., HKL Baumschine, Arabian Jerusalem Equipment Trading Company LLC, Infra Bazaar, Machinery Trader, Shriram Automall India Limited (SAMIL), and Ais Construction Equipment Service Corporation.

Preeti Wadhwani, Prasenjit Saha