Truck Loader Crane Market size worth $2.5 Bn by 2027

Published Date: May 2021

Truck Loader Crane Market size is expected to be over USD 2.5 billion by 2027, according to a new research report by Global Market Insights Inc.

The growing e-commerce and manufacturing sectors across the globe are driving the expansion of the 3PL industry, providing new opportunities to the truck loader crane industry. The increasing utilization of truck loader cranes in warehouse and logistics facilities for loading and unloading activities of heavy goods and bulky cargos is supporting the market growth. The positive outlook of the manufacturing sector in Asian countries including China and India is likely to fuel the market demand.

The high maintenance costs associated with truck loader cranes impact the operational expenditure of the end-use industries, hampering the truck loader crane market growth. The unexpected failure of machinery may affect the company’s operations and productivity. The lack of back-up machines in small companies forces them to halt work upon machine failure. Companies use several methods for forecasting the lifecycle of these machines to avoid sudden failures. To mitigate the impact of this industry challenge, end-users in the market deploy techniques such as life-to-date cost analysis and period-cost-based analysis.

Get more details on this report - Request Free Sample PDF

Market factors, such as lower production and increased uncertainty caused by the rapid spread of the COVID-19 pandemic, negatively impacted the truck loader crane market in 2020. The health crisis forced plant closures and impacted the distribution channel of industry players, resulting into a decline in market revenues. For instance, in August 2020, Manitex International, Inc., based in Illinois, U.S. reported net revenues of USD 37.1 million in the second quarter of 2020, compared to USD 57.4 million in the previous year.

Analyst view: “The demand for truck loader cranes is driven by their growing applications in logistics, manufacturing, and forestry industries. Shifting consumer preference toward renting these high-cost machines will support the growth of rental applications.”

High demand for big-duty cranes due to robust design and lifting capacity

The big-duty segment held over 35% of the truck loader crane market share in 2020 propelled by rising adoption in high weightlifting & handling operations in construction, mining, and energy applications. Their sturdy design enables them to operate efficiently in harsh outdoor environments, further spurring the market expansion. Rising construction projects and infrastructure transformation activities are continuously driving the market trends.

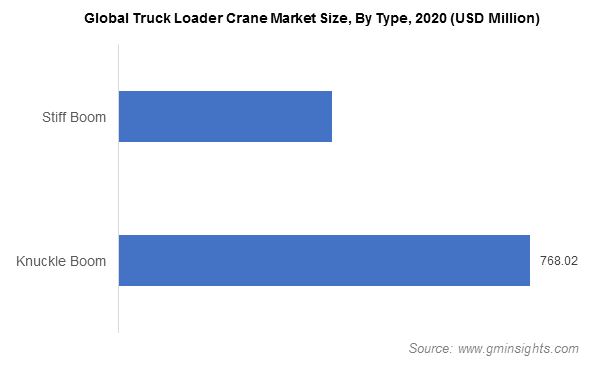

Browse key industry insights spread across 345 pages with 374 market data tables & 32 figures & charts from the report, “Truck Loader Crane Market Size By Product (Small-duty [Up to 6 Metric Tons], Medium-duty [7 to 20 Metric Tons], Big-duty [21 to 80 Metric Tons], Heavy-duty [Above 80 metric tons]), By Type (Knuckle Boom, Stiff Boom), By Sales (New Sales, Aftermarket), By End-use (Rental, Construction, Mining, Oil & Gas, Energy, Forestry, Logistics), COVID19 Impact Analysis, Regional Outlook, Application Potential, Price Trend, Competitive Market Share & Forecast, 2021 – 2027” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/truck-loader-crane-market

Enhanced stability of stiff boom cranes driving the market revenues

The stiff boom segment is projected to witness around 7% CAGR till 2027. In 2020, over 6,000 units of stiff boom truck loader cranes were sold globally. These cranes are witnessing an increasing market representation as they can suspend heavy loads in the air for a long time with little or no drift. All the moving parts in these cranes are concealed inside the machine, ensuring protection of these critical parts against physical damages during operation.

Increasing demand for versatile cranes from the forestry application

Forestry application accounted for more than 2% of the truck loader crane market share in 2020. Players are offering high-performance truck loader cranes for forestry applications. For instance, HIAB offers forestry cranes that are durable vehicles with solid construction and smart solutions that deliver superior safety and operational efficiency.

Increasing construction sector investments in Asia Pacific will enhance the market demand

The Asia Pacific truck loader cranes market is set to observe a CAGR of above 7.5% from 2021 to 2027 driven by increasing government policies & initiatives that support the infrastructure development in Asian countries. For instance, ‘One Belt, One Road (OBOR)’ project by the Government of China, is developed to accelerate the infrastructure development & construction in the country. The project is expected to be completed by 2049, accelerating the adoption of truck loader cranes in China.

Companies are focusing on expansion of their business operations as a part of their strategic outlook. For instance, in November 2019, Manitex International Inc. announced the development of its Italian operations with the establishment of PM and Oil & Steel businesses as a separate division. The new division is responsible for sales, spare parts & services, engineering, manufacturing, and other commercial operations for truck loader cranes. The move was aimed at enhancing the performance and results of PM and Oil & Steel businesses.

Some of the major companies in the truck loader cranes market include Hiab, Palfinger AG, Tadano Ltd., Fassi Gru S.p.A., EFFER S.R.L., Amco Veba, Hyva Crane, F.lli Ferrari, and PM OIL & STEEL.

Preeti Wadhwani, Prasenjit Saha