Submarine Combat Systems Market Size worth over $8bn by 2026

Published Date: March 2020

Submarine Combat Systems Market size is set to surpass USD 8 billion by 2026, according to a new research report by Global Market Insights Inc.

The increasing demand for modern warfare submarines to provide precise missile barrage for underwater, surface, and land-based targets is expected to be a major driver, accelerating growth in the market size. Furthermore, increasing military concerns and geopolitical conflicts across the globe will positively support the market share.

Growth in the submarine combat systems market can be attributed to upgrading of technologies in submarine fleets that is enhancing the market share and offering potential opportunities for advancement in weapon systems. Government regulatory bodies are setting multiple guidelines, programs, and regulations for enhancing crew & vessel safety in submarines.

The increasing military expenditure in developed & developing countries to strengthen their naval capabilities is support the adoption of submarine combat systems. For instance, in March 2019, the U.S. Department of defense declared plans to fund over USD 22.95 billion for military intelligence program that is aligned to support the defense strategy of nation, propelling the market revenue.

Key players in the market are engaged in strategic contracts with defense organizations for the development of their conventional naval defense systems. For instance, in December 2019, General Dynamics Mission Systems signed a strategic contract with countries including the UK’s Royal Navy and the U.S. Navy worth USD 299.9 million. The contract was signed to provide maintenance and modernization of ballistic-missile submarine fire control systems over the next four years.

Get more details on this report - Request Free Sample PDF

Increasing use of electronic warfare will remain an important trend for the submarine combat systems market growth

The electronic warfare weapon segment is anticipated to witness over 9% gains till 2026 due to its ability to provide automatic intercept that includes classification, detection, localization, and identification for both communication and radar signals. These systems enhance the operational capability of submarine combat systems.

The government organizations are signing strategic agreements with major players in the market for deploying electronic warfare systems that will help to detect the enemy radar in the marine sector.

For instance, in February 2019, Lockheed Martin Corporation signed a strategic agreement with the U.S. Navy worth USD 20 million for one year. According to the contract, Lockheed Martin will design, develop, and upgrade electronic warfare systems for the U.S. naval submarines, further strengthening the share of submarine combat systems. The contracts are also expected to extend with additional funding of USD 970.1 million over next 10 years.

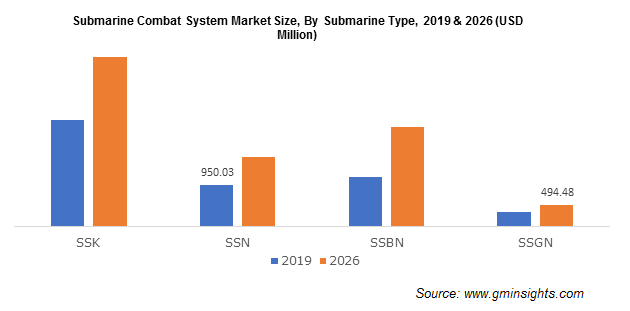

Browse key industry insights spread across 200 pages with 178 market data tables & 20 figures & charts from the report, “Submarine Combat Systems Market Size By Submarine Type (SSK [Diesel Electric Submarine], SSN [Nuclear-Powered Submarine], SSBN [Nuclear-Powered Ballistic Missile Submarine], SSGN [Nuclear-Powered Guided Missile Submarine]), By Weapon System (Electronic Warfare, Torpedoes, Ballistic Missiles, Cruise Missiles, Mines), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/submarine-combat-system-market

Collaboration among key participants and government organizations for the procurement of submarines

Participants dealing in the submarine combat systems market are engaged in offering products with enhanced capabilities by entering strategic partnerships and contracts with defense organizations. The upgrading of technologies in submarine combat systems is further enhancing market share. Key players are engaged in the enhancement of submarine combat systems and are expected to strengthen the defense sector of their country.

The market is forecast to witness an intense competition owing to adoption of several strategies, such as mergers & acquisitions, new product developments, and portfolio diversification, by competitors to gain a high visibility in the market.

Rising demand for SSK submarines in Russia

The market share in the Russia is set to grow on account of several major factors that include territorial disputes, increasing defense capability and industrial growth across the region. The demand for cruise missiles is driving the market share of SSK submarines. Submarine combat system manufacturing companies in the country are prepared to transform their nation with the help of rising naval budgets.

Russia is also enhancing the capability of SSK submarines for multipurpose applications including anti-submarine and anti-surface warfare, strikes against land-based objectives, area surveillance, offensive minelaying and blockade. For instance, in September 2019, the Russian Navy became the first European nation to field hypersonic cruise missile and is expected to have the first mover advantage, minimizing the threats from the neighboring regions.

Rising military expenditure in the Middle East & Africa

The Middle East & Africa submarine combat systems market is expected to grow at a CAGR of over 3% during the forecast period led by increasing defense budget and geopolitical tensions in the Middle East region.

The defense spending is expected to reach USD 100 billion in 2019, further supporting the market growth. Major market share of submarine combat system in Middle East and Africa is captured by Iran, Israel, Turkey, and Egypt due to high number of submarines present within these countries.

Market leaders operating in the market are focusing on strategic collaborations for the support & development of advanced weapon systems. The wide use of torpedoes with enhanced capabilities in submarines will drive the industry size.

For instance, in June 2018, Lockheed Martin Corporation signed a contract with the U.S. Naval Sea Systems Command worth USD 65 million to continue maintaining the MK48 Torpedoes. This contract will enable the company to continue providing maintenance & engineering services in support of MK 48 torpedoes, enhancing the market share.

Prominent companies operating in the market include Lockheed Martin Corporation, Atlas Elektronik GmbH, Thales Group, Saab AB, Raytheon Company, BAE Systems Plc, Kongsberg, Naval Group, Leonardo S.p.A, HAVELSAN Inc., Safran, General Dynamics, and ThyssenKrupp Marine Systems.

Ankita Bhutani, Preeti Wadhwani