Solid-State Lighting Market Size worth over $85bn by 2024

Published Date: September 2019

Solid-State Lighting Market size is set to surpass USD 85 billion by 2024; according to a new research report by Global Market Insights Inc.

Global LED lamps market revenue should surpass USD 25 billion by the end of the forecast period pertaining to stringent regulations banning the use of inefficient lamps or restricting their usage for general lighting. These devices allow convenient installation, improved efficiency over conventional bulbs, long life, prevent fixture modifications, and easy replacement. Growing demand for decorative lamps in residential applications such as statues, gardens, fountains & pools along with growing infrastructure projects such as flyovers and roadways should promote solid-state lighting market growth.

Global LED-based solid-state lighting market size from indoor hospital applications exceeded USD 4 billion in 2017 on account of significant expansion of healthcare institutions in China and India. These products help reduce patient apprehensiveness in entrance halls, avoids sharp contrasts in hospital corridors to prevent patient discomfort, and maintains optimum light conditions in exam rooms. Rising government efforts to modernize hospital lighting and substantial technological advancements are likely to accelerate market growth.

Get more details on this report - Request Free Sample PDF

Global LED based solid-state lighting industry demand from mining applications should cross USD 25 billion by 2024 owing to significant industrial expansion and infrastructure development in Brazil, China, India and Indonesia. These products offer safer work conditions, consistent light output, reduced downtime, high reliability, and resistance to harsh conditions which makes them well-suited to underground lighting applications. Rising exploration & drilling activities and increased adoption of automation technologies should further trigger market growth.

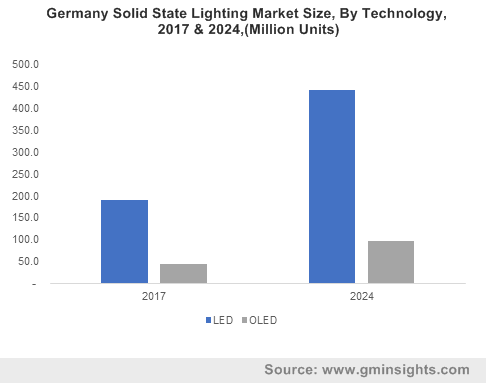

Browse key industry insights spread across 555 pages with 1,284 market data tables and 34 figures & charts from the report, “Solid-State Lighting Market Size By Technology (LED {By Product [Lamps, Luminaires], By Installation [New, Retrofit], By Application [Indoor (Residential, Commercial (Office, Malls, Hospitals), Industrial (Mining, Automotive, Construction), Outdoor (Highway & Roadway, Architectural, Public)}, OLED {By Application [Industrial, Residential, Commercial, Automotive, Hospital, Architectural]}) Industry Analysis Report, Regional Outlook (U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Poland, Denmark, Netherlands, China, India, Japan, South Korea, Australia, Malaysia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE), Application Potential, Price Trend, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/solid-state-lighting-market

U.S. OLED solid-state lighting market demand from hospitality applications witnessed a consumption of over 7.25 million units in 2017 and should rise significantly by 2024 owing to the country’s substantial tourism sector and reputation as a major financial hub. These products reduce electricity costs, maintenance requirements, provide long life, and allow installation in hard-to-reach places. Growing adoption of smartphone applications for booking hotel rooms, digital innovation and rising global consumer purchasing power should further promote market growth.

UK LED retrofit market size surpassed USD 735 million in 2017 and is likely to grow significantly in the predicted timeframe pertaining to growing demand from automotive sector and presence of various lighting manufacturers in the region. These devices are compatible with existing fixtures, produce less waste, require lesser upfront investment and low maintenance. Growing urbanization and initiation of smart city projects is likely to boost market size.

India LED-based solid-state lighting market from office applications surpassed USD 185 million in 2017 and should further by 2024 on account of growing replacement of sodium vapor & incandescent lamps with LEDs. These products allow glare-free lighting of rooms and workstations which supports fatigue-free & concentrated work, improves energy efficiency and productivity. Improving living standards, government efforts to deploy e-governance solutions & smart lighting, and significant urbanization should stimulate market growth.

General Electric, Samsung Electronics, Eaton, Mitsubishi Electric, OSRAM and Philips Lighting Holding are among the key industry participants in the market. Various manufacturers are adopting strategic acquisitions to expand their product portfolio and achieve market growth in the specialty lighting, industrial & professional sectors.

The solid-state lighting market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Units and revenue in USD from 2013 to 2024, for the following segments:

By Product

- LED

- By product

- Lamps

- Luminaires

- By installation

- New installation

- Retrofit

- By application

- Indoor lighting

- Residential

- Commercial

- Office

- Malls

- Hospitals

- Industrial

- Mining

- Automotive

- Construction

- Outdoor

- Highway & roadway

- Architectural

- Public places

- Indoor lighting

- By product

- OLED

- By application

- Industrial

- Residential

- Commercial

- Automotive

- Hospitality

- Architectural

- By application

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Denmark

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Thailand

- Latin America (LATAM)

- Brazil

- Argentina

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

Kunal Ahuja, Kritika Mamtani