Global Rear Spoiler Market Size to reach $5bn by 2024

Published Date: September 2019

Rear Spoiler Market size is predicted to reach USD 5 billion by 2024; according to a new research report by Global Market Insights Inc.

Proliferating automotive production along with increasing focus of automobile manufacturers to improve the aesthetics and performance of their product portfolio are driving the rear spoiler market share over the study period. The improved vehicle stability at higher speed coupled with the availability of downforce while driving is further expanding the market.

Industry participants are continuously focusing on improving the performance parameters of the spoilers with reduced weight and increased downforce. Manufacturers are opting for advanced materials including reinforced fiberglass, and carbon fiber among others to manufacture spoilers, thereby contributing significantly towards overall vehicle weight reduction. Additionally, manufacturers are also focusing on innovative spoiler systems for increasing their vehicle appeal. For instance, in 2017, Porsche launched its new Panamera Saloon Turbo with hidden retractable rear spoiler with rising and extending operations.

Get more details on this report - Request Free Sample PDF

Based on technology the rear spoiler market share is segmented into blow molding, injection molding and reaction injection molding. Reaction injection molding segment will hold a considerable market share over the forecast timeframe owing to its low-cost molds and capability to produce large lightweight parts without higher mold pressure and large presses. The technology allows to mold highly detailed and complex parts including rear spoiler with ease at low equipment and tooling costs. Additionally, it enables to mold rear spoilers with varying wall thicknesses into the unchanged molded part.

Rear spoiler market based on material is categorized into ABS plastics, fiberglass, carbon fiber and sheet metal. The fiberglass will witness a significant growth over the projected time owing to its light weight coupled with high strength. The fiberglass offers an enhanced design flexibility and possibilities to the manufacturers with very few restrictions. The anti-corrosive and non-conductive properties along with lower operating costs are further proliferating the market share.

Browse key industry insights spread across 435 pages with 700 market data tables & 15 figures & charts from the report, “Rear Spoiler Market Size By Technology (Blow Molding, Injection Molding, Reaction Injection Molding), By Material (ABS Plastic, Fiberglass, Carbon Fiber, Sheet Metal), By Fuel [ICE (Internal Combustion Engine), BEV (Battery Electric Technology), Others (Hybrid)], By Vehicle (Hatchback, MPV (Multi-Purpose Technology), SUV (Sports Utility Technology), By End-Use (OEM, Aftermarket) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2017 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/rear-spoiler-market

The ICE will account for a significant share in the rear spoiler market. This can be attributed to the rising automotive sales globally based on such engine configuration. Moreover, the incorporation of spoilers plays a major role in improving efficiency and improve vehicle stability at higher speeds. Moreover, industry players are offering spoiler as a standard fitment on their vehicles. For instance, in 2019, Kia launched its Seltos SUV with integrated rear spoiler.

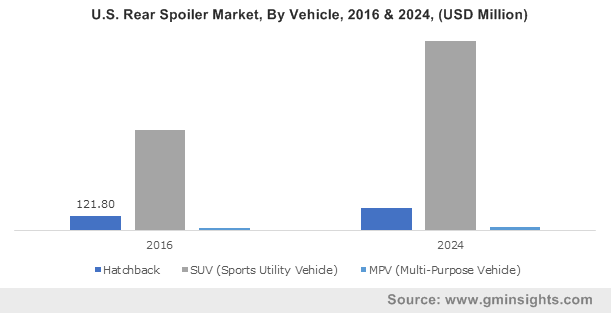

The hatchback vehicles will hold a substantial size of rear spoiler market owing to enhanced performance and increased popularity of hatchbacks. The manufacturers are continuously improving the hatchbacks in terms of performance and aerodynamic design. Additionally, the increasing sales of premium hatchbacks will surge the market size in the forecast timeframe. For instance, in 2018, the sales of premium hatchbacks in India has increased by 13.83% from 363,548 units in 2017 to 408,526 units in 2018.

The OEM will showcase a significant growth in the rear spoiler market revenue over the study timeframe. This can be attributed to the fitment of rear spoilers in vehicles during the production. Moreover, OEMs are focusing on differentiating their product portfolio with improved performance and aesthetics for ensuring improved sales amidst strong competition. Moreover, the OEM designed rear spoilers offers cost effective, enhanced performance levels synchronized with the original vehicle designs.

Latin America will witness a substantial growth in the rear spoiler market share over the forecast timeframe owing to increasing sales of compact SUVs across the region. For instance, in 2017, the top three selling passenger vehicles in Latin America were compact SUVs. The Hyundai Creta sales got almost 10 times accounting for 50,140 units and Jeep Compass sales reached 46,615 with a hike of around 9 times as compared to the previous year.

Industry participants in the market share include Magna International Inc., Plastic Opium, Mercedes-AMG GmbH, Polytec Group, Mitsubishi, Albar Industries Inc., SMP Automotive, Inac Corporation, DAR Spoilers, and Changzhou Huawei. The industry players are adopting multiple strategies to enhance their market share. For instance, in 2018, Mercedes-AMG revealed its new 2020 Mercedes-AMG GT with advanced new wing spoiler manufactured with carbon-fiber.

The rear spoiler market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in units and revenue in USD million from 2013 to 2024, for the following segments:

By Technology

- Blow molding

- Injection molding

- Reaction injection molding

By Material

- ABS plastic

- Fiberglass

- Carbon fiber

- Sheet metal

By Fuel

- ICE (Internal Combustion Engine)

- BEV (Battery Electric Vehicle)

- Others (Hybrid)

By Vehicle

- Hatchback

- SUV (Sports Utility Vehicle)

- MPV (Multi-Purpose Vehicle)

By End-Use

- OEM

- Aftermarket

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Taiwan

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Kiran Pulidindi, Sayan Mukherjee