Port Equipment Market Size to exceed $9 Bn by 2025

Published Date: July 2019

Port Equipment Market size is anticipated to exceed USD 9 billion by 2025; according to a new research report by Global Market Insights Inc.

Growing maritime trade activities along with increasing container shipments across the globe are positively influencing the port equipment market share over the forecast timeframe. Free trade agreements in conjunction with supporting trade partnerships between emerging economies will augment the industry size over the study timeframe. According to UNCTAD, the international seaborne trade will witness over 3.5% compounded growth annually from 2018 to 2023.

Increasing cargo traffic coupled with port capacity expansion is fostering the demand for advanced cargo handling equipment. For instance, in August 2018, the Port of Rotterdam recorded 10.78 million TEU cargo volume with an increase of over 6% as compared in 2017. Further, development of port infrastructure for catering the growing trade activities will strengthen the port equipment market revenue over the study timeframe.

Get more details on this report - Request Free Sample PDF

Growing adoption of alternative fuel powered port equipment is attributed towards their lower operating costs and reduced environmental impact. Port authorities are focusing to replace their existing cranes with hybrid equipment providing significant fuel savings and lower greenhouse gas emissions. For instance, in November 2016, the Georgia Ports Authority (GPA) completed the third phase of replacing diesel powered gantry cranes with hybrid cranes at the Port of Savannah.

Adoption of automated technologies for fast and efficient cargo transfer is significantly contributing towards reduction of overall cycle times, further supporting the industry expansion. Automated Guided Vehicles (AGVs) and Automated Stacking Cranes (ASCs) offering enhanced capabilities for automated cargo movement at dock yards are gaining higher visibility. For instance, in February 2019, APM Terminals planned to use automated straddle carries US West Coast marine terminals to handle increasing cargo volume.

Availability of customized ship to shore solutions offering enhanced efficiency and management of traffic during container handling is providing positive outlook for the port equipment market share. Supporting initiatives and policies proposed by government bodies are accelerating the development of port infrastructure. For instance, in March 2015, Government of India approved the Sagarmala Project for enhancing the capacities at major ports and developing integrated ports.

Browse key industry insights spread across 400 pages with 495 market data tables & 14 figures & charts from the report, “Port Equipment Market Size By Equipment (Cranes{Ship to Shore Cranes, Yard Crane}, Forklifts Trucks, Terminal Tractors, Ship Loaders, Automated Guided Vehicles, Straddle Carriers, Reach Stacker, Tugboat), By Application (Ship Handling, Container Handling, Bulk Handling), By Type (Diesel, Electric, Hybrid), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, Italy, France, Spain, China, India, Japan, South Korea, Australia, New Zealand, Brazil, Mexico, Argentina, Saudi Arabia, UAE, Qatar, South Africa), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/port-equipment-market

Cranes will hold substantial share in port equipment market owing to their increasing application for container handling. High performance cranes possessing lower self-weight and center of gravity are prominently enhancing the operational productivity with reduced downtime. Moreover, lower lifecycle costs, accurate spreader positioning and robust structure offered by modern cranes are significantly propelling the industry size.

Ship handling segment will witness significant growth over the forecast timeframe owing to the expansion of cargo handling facilities. Growing requirement for efficient ship handling with higher accessibility and operational efficiency will prominently escalate the segment share. Utilization of simulation software for vessel handling are positively contributing towards improving ship handling efficiency.

Adoption of new generation diesel engines with ultra-low-sulfur diesel fuel is providing better fuel efficiency and improved reliability. Port equipment operators are increasingly adopting diesel forklifts featuring enhanced power output and load carrying capabilities. Multiple benefits including higher torque, improved engine life and superior performance are prominently escalating the diesel port equipment market size over the forecast timeframe.

Europe will showcase substantial growth in the port equipment market owing to the increasing seaborne trade activities and cargo transportation. Development and expansion of port infrastructure is providing potential opportunities for the increased product penetration. Strong presence of manufacturers providing innovative range of solutions will further augment the industry share. Moreover, shifting preference of port administrators to deploy automated port equipment will significantly contribute towards regional growth.

Key manufacturers in market are Konecranes, Kalmar, Liebherr, ABB, Prosertek Group S.L., Famur Famak, CVS Ferrari, Shanghai Zhenhua Heavy Industries, Lonking Holdings Limited and American Crane & Equipment. Industry participants are focusing to develop alternative fuel powered port equipment for gaining a competitive edge. For instance, in March 2019, Hyster-Yale Group announced the development of hydrogen fuel cell powered reach stacker for the Port of Valencia under European Horizon 2020 program.

The port equipment market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in units and revenue in USD million from 2013 to 2025, for the following segments:

Port Equipment Market by Equipment

- Cranes

- Ship to Shore Cranes

- Yard Crane

- Others

- Forklift trucks

- Terminal Tractors

- Ship loaders

- Automated guided vehicles

- Straddle Carriers

- Reach Stacker

- Tugboat

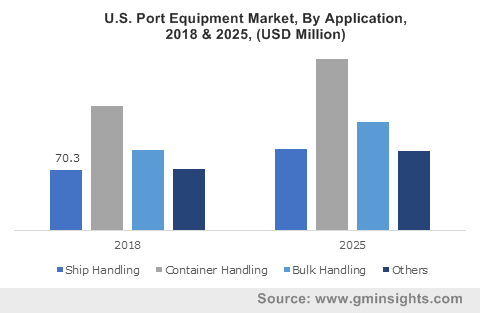

By Application

- Ship handling

- Container handling

- Bulk handling

- Others

By Type

- Diesel

- Electric

- Hybrid

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Italy

- France

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa