Organic Ice Cream Market size to exceed $1.2bn by 2025

Published Date: May 2019

Organic Ice Cream Market size is estimated to surpass USD 1.2 billion by 2025; according to a new research report by Global Market Insights Inc.

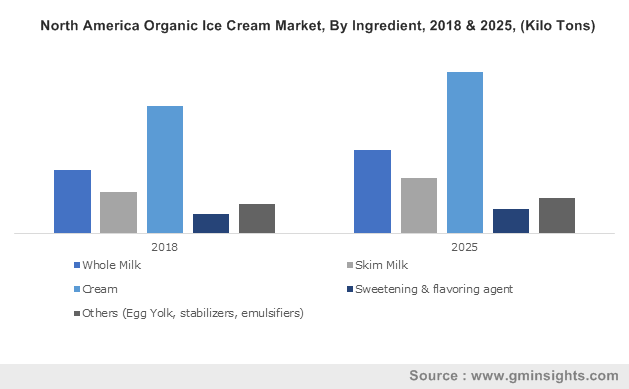

Strong outlook with availability in versatile flavors including chocolate, vanilla, coffee, butter pecan, mint chocolate chip, strawberry and black raspberry are among key factors driving the organic ice cream market growth. Significant demand for novel flavors has urged the manufacturers to develop non-dairy products comprising of skimmed milk, whole milk, cream, sweetening & flavoring ingredients. Increasing number of disease incidences will positively influence the demand for naturally sourced food, thereby supporting the industry expansion.

Shifting focus towards health, fitness and balanced diet patterns coupled with growing nutritious food demand will propel the organic ice cream market growth. Surging consumer preference for natural based food products containing essential vitamins, minerals, and omega 3 fatty acids provides a positive outlook for the product demand. Growing demand for vanilla, chocolate and strawberry products from children and young populace will further supplement the product demand.

Get more details on this report - Request Free Sample PDF

Growing prevalence of lactose intolerance among the adult population has led to an increase in the consumption of probiotic organic ice cream having neutral pH content that proves to be helpful in maintaining balanced digestion and intestinal microbiota. Rising number of certified organic farms across the developed countries including the U.S., Germany, Italy, etc. is another factor supporting the industry growth. Regulatory standards and policies provided by government bodies such as FAO, WHO, and FSSAI will fuel the industry expansion. However, increasing cost of raw material costs with changing agricultural trends may hinder the product price trend.

Browse key industry insights spread across 530 pages with 810 market data tables & 15 charts & figures from the report, “Organic Ice Cream Market Size By Product (Artisanal, Impulse, Take Home), By Ingredient (Whole Milk, Skimmed Milk, Cream, Sweetening & Flavoring Agent), By Flavor (Vanilla, Chocolate, Butter Pecan, Strawberry, Coffee, Black Raspberry, Mint Chocolate Chip), By Distribution Channel (On Trade, Hypermarket & Supermarket, Food & Drink Specialists, Convenience Stores), By Packaging (Paper & Board, Rigid Plastics, Flexible Packaging), Industry Analysis Report, Regional Outlook (U.S, Canada, Germany, UK, France, Italy, Denmark, Sweden, Ireland, Finland, Russia, Norway, China, India, Japan, South Korea, New Zealand, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/organic-ice-cream-market

Artisanal segment will witness CAGR at over 4% in terms of revenue up to 2025. Majority of the health-conscious customers are highly persuaded towards artisanal ice creams due to presence of low level of sugar and added preservatives. Surging demand for the product owing to increase in demand for home-made ice creams consisting high-quality fresh ingredients such as cream, whole milk, egg, and natural sweetening & flavoring agents will propel the organic ice cream market size.

Whole milk as an ingredient is projected to surpass USD 300 million by 2025.It is more delicious and contains a higher number of calories compared to the skimmed milk hence is widely used in preparation of yogurts, cheese and ice cream. The product reduces the risk of chronic disease, improves the bone strength and serves as an appetite suppressant, hence is highly recommended for children and body builders.

Vanilla holds over 25% of the global organic ice cream market share in 2018. Key properties including presence of low-calorie content and high availability of antioxidants along with strong ability to enhance the flavor have stimulated the product scope in a wide variety of food and beverage applications. Additionally, it offers several health benefits including presence of anti-aging properties, stimulation of hormonal secretion and prevention of cancer, depression and heart diseases will boost the industry growth.

On trade is expected to be the fastest growing distribution channel in the global organic ice cream market up to 2025. Growing prominence of on trade distribution channels such as restaurants, bars, ice cream parlors, and hotels will provide a strong outlook for industry expansion. Increasing disposable incomes among the consumers in the developing countries including India, Brazil, Indonesia, Mexico etc. along with growing trend regarding consumption of after meal dessert will proliferate the market size.

Rigid plastics segment will witness CAGR at around 4.5% in terms of revenue up to 2025. Growing consumer preference for ready-to-use and on-the-go products, which need a healthy functioning and convenient packaging will promulgate the market growth. Additionally, key factors including cost effectives, attractive labeling printing options and high impact strength compared to other packaging alternatives will substantially contribute towards the segment growth.

North America organic ice cream market accounted for over 40% of the market share in 2018. Factors including the craving to indulge in ice cream and rise in small-sized packaging demand for snacking options will drive the growth for the product across the region. Surging prevalence of cardiovascular diseases and obesity coupled with soaring diabetes problems among the adult populace will enhance the regional demand.

Asia Pacific organic ice cream market will witness CAGR over 3.5% from 2019 to 2025. Increasing consumer spending on premium health products coupled with rising demand for natural taste preference will proliferate the regional industry growth. Rapid rise in the number of super markets and convenience stores across countries including China, India, Japan, Malaysia, Indonesia etc. owing to increasing disposable incomes will provide lucrative opportunities for the regional growth.

Global industry share is highly fragmented with presence of regional and multinational players. The key industry players in the market include Clover Stornetta Farms, Inc., Yeo Valley Family Farms, Straus Family Creamery, Crystal Creamery, Boulder Ice Cream, Oregon Ice Cream, and Blue Marble Ice Cream. The manufacturers are involved in new product launches, R&D investments, mergers & acquisitions and production capacity expansions for gaining competitive share. For instance, in February 2019, Unilever announced to launch its first vegan ice-cream brand that Magnum Dairy Free in New Zealand to cater the growing demand for non-dairy ice cream from the Asia Pacific market.

Organic Ice Cream market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Kilo Tons & revenue in USD Million from 2013 to 2025, for the following segments:

Organic Ice Cream Market, By Product

- Artisanal

- Impulse

- Take home

Organic Ice Cream Market, By Ingredient

- Whole Milk

- Skim Milk

- Cream

- Sweetening & flavoring agent

- Others (Egg Yolk, stabilizers, emulsifiers)

Organic Ice Cream Market, By Flavor

- Vanilla

- Chocolate

- Butter Pecan

- Strawberry

- Coffee

- Black raspberry

- Mint Chocolate Chip

- Others (Chocolate raspberry, Coconut almond, Vanilla Fudge Ripple)

Organic Ice Cream Market, By Distribution

- On trade

- Hypermarkets & supermarkets

- Food & drink specialists

- Convenience stores

- Others

Organic Ice Cream Market, By Packaging

- Paper & board

- Rigid plastics

- Flexible packaging

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Denmark

- Sweden

- Ireland

- Finland

- Russia

- Norway

- Asia Pacific

- China

- India

- Japan

- Australia

- New Zealand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Kunal Ahuja, Amit Rawat