Network Traffic Analytics Market size worth $4.5 billion by 2026

Published Date: August 2020

Network Traffic Analytics Market size is set to surpass USD 4.5 billion by 2026, according to a new research report by Global Market Insights Inc.

Surging advancements in networking infrastructure is expected to drive the industry growth. Factors including digitization, increase in the standard of living, and rise in disposable income have amplified the demand for advanced networking solutions and services. Strategic initiatives by government authorities for commercialization of 5G network are also supporting market demand.

Growing IoT and BYOD penetration to support industry growth

The network traffic analytics market growth is attributed to growing demand for Bring Your Own Device (BYOD) trend due to recent COVID-19 outbreak. Rising demand for work from home trend is also extending BYOD usage in various industries including healthcare, Amanufacturing, and education. This expansion of BYOD is resulting in rising market demand for traffic analytics solutions to manage huge traffic over the wireless network.

Get more details on this report - Request Free Sample PDF

The increasing number of IoT devices is another prominent factor, supporting the market trends. The high network traffic generated from several IoT devices makes network management and capacity planning more difficult. These devices are also a target for malicious attackers; therefore, network traffic analytics solutions are used by many enterprises to handle the huge traffic generated by several connected devices.

Browse key industry insights spread across 300 pages with 441 market data tables and 30 figures & charts from the report, “Network Traffic Analytics Market Size By Component (Solutions [Network Traffic Monitoring, Network Visibility, Network Performance, Network Security, Network Capacity Planning], Services [Integration and Deployment Service, Consulting Service, Training and Support Service, Managed Service]), By Deployment Model (On-premise, Cloud), By End-use (Service Providers [Cloud Service Provider, Telecommunication Service Provider, Internet Service Provider, Managed Service Provider], Enterprise [BFSI, IT & Telecom, Healthcare, Education, Retail, Energy and Utilities]), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/network-traffic-analytics-market

Managed service to witness exponential growth due to increasing cyberthreats to enterprise network infrastructure

The managed service segment is projected to grow at over 20% CAGR during 2020 to 2026 driven by rising market demand to outsource enterprise network management across SMEs and large organizations. Threats and vulnerabilities in enterprise networks are increasing rapidly, making it a complex task for organizations to maintain data security and privacy. Managed services provide a security infrastructure that offers ongoing monitoring and incident management capabilities. These services are adopted by enterprises of all types and sizes to keep their networking infrastructure flexible and secured at cost-effective prices.

On-premise deployment model held the highest market share

The on-premise deployment held more than 70% network traffic analytics market share in 2019 owing to the capability of an on-premise network traffic analytics solution to provide more control over resources for mission-critical workloads. As on-premise deployment models are based within the enterprise, they offer more control and data protection. Furthermore, they also help in reducing latency, thereby maintaining peak performance. The major factor driving market demand for on-premise models is increasing adoption of network analytics solutions across BFSI, telecom, healthcare, and government sectors.

Rise in number of mobile devices to support the market growth across the IT & telecom industry

The IT & telecom industry will witness a rapid adoption of network traffic analytics solutions at a CAGR of over 20% through 2026. IT & telecom enterprises are witnessing high demand for network analytics solutions propelled by rise in the number of mobile devices and internet usage rates. Network planning is an important function for telecom operators to meet customers’ expectations; hence, network analytics is helping telecom operators to effectively manage their network traffic and plan their services as per customers’ requirements.

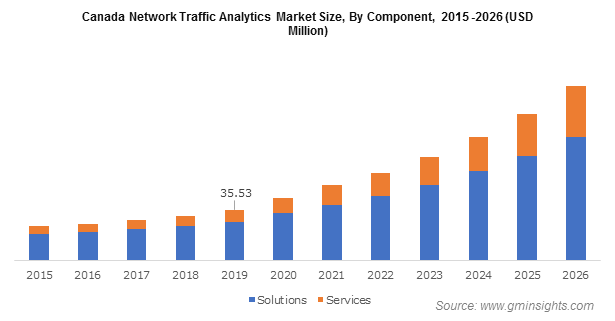

North America to dominate the network traffic analytics market

North America held a market share of over 40% in 2019 impelled by availability of advanced network infrastructure across enterprises in the region. As the availability of software and advanced infrastructure increased, the region also witnessed many cyberattacks on the network, leading to early adoption of network traffic analytics solutions. The presence of telecom providers, such as Verizon and AT&T, who employ network traffic analytics solutions in the region is also supporting the market growth. The high broadband penetration in the region is also a prime factor fueling the demand for network analytics solutions.

Strategic partnership is the major strategy adopted by key market players

Companies operating in the network traffic analytics market are emphasizing on strategic partnerships with analytics solution providers to integrate network traffic analytics into their telecommunication solutions. For instance, in July 2018, IBM partnered with NETSCOUT to integrate NETSCOUT’s network analytics solutions into its telecommunication analytics portfolio. This partnership helped the company to make use of network data to achieve customer safety & satisfaction and reduce churn rate.

Some of the key players operating in the network traffic analytics market include Accenture plc, Allot Ltd., Ascom Holding AG, Cisco Systems, Inc., Flowmon Networks, Fortinet, Genie Networks Ltd., Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks, Inc., Kentik, Microsoft Corporation, Netmon, Inc., Netreo, Inc., Nokia Networks, NortonLifeLock Inc., Palo Alto Networks, Inc., Plixer, LLC, SolarWinds, Inc., and Zenoss, Inc.

Preeti Wadhwani, Smriti Loomba