Network Telemetry Market size worth over $2.5bn by 2026

Published Date: May 2020

Network Telemetry Market size is set to surpass USD 2.5 billion by 2026, according to a new research report by Global Market Insights Inc.

Network telemetry enables real-time transfer and collection of data related to the network health to a centralized location for storage and analysis using network devices such as switches, routers, and firewalls. It helps enterprises with better accuracy, scalability, coverage, and auto-correct network performance, allowing network infrastructures to fix their issues quickly.

Rising number of cyberattacks will boost the market growth

The increase in cybercrimes around the globe is supporting the network telemetry market demand. The different forms of cybercrimes, such as phishing, hacking, online identity theft, and ransomware attack, are increasing rapidly, leading to business interruptions and financial losses around the world.

In 2017, the federal civilian agencies in the U.S. reported over 35,277 cybersecurity incidents, which included web-based attacks, phishing attacks, and loss or threat of computing equipment. Network telemetry helps in providing in-depth visibility related to network security that allows enterprises to reduce the chances of cyberattacks.

Get more details on this report - Request Free Sample PDF

Professional services dominated the network telemetry market revenue in 2019

The professional services segment accounted for a market share of over 70% in 2019 due to increase in demand for quick remote assistance in case of any network failure across enterprises. Professional services help enterprises in improving delivery time by reducing the network downtime.

Rapid development in telecom infrastructure has resulted in the growing demand for professional services that help in training & consulting, deployment & integration, and support & maintenance of network telemetry solutions. Consulting services provide guidelines for the implementation of network telemetry solutions to improve cellular connectivity across the target area.

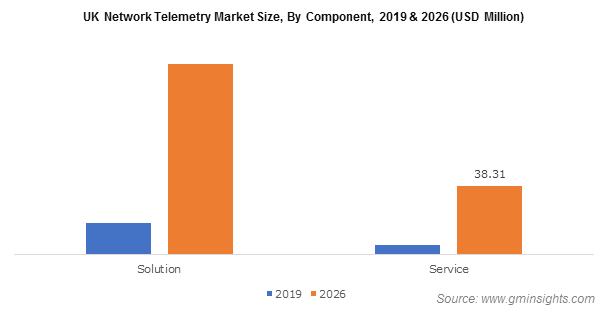

Browse key industry insights spread across 170 pages with 251 market data tables & 16 figures & charts from the report, “Network Telemetry Market Size By Component (Solution, Service [Professional Service, Managed Service]), By Deployment Model (On-premise, Cloud, Hybrid), By Organization Size (SMEs, Large Enterprises), By Application (Telecom Service Providers (TSPs), Cloud Service Providers (CSPs), Managed Service Providers (MSPs)), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 - 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/network-telemetry-market

Organizations prefer cloud-deployment model owing to their reliability and cost-effectiveness

The cloud deployment model in the network telemetry market is expected to witness over 30% growth during the forecast period led by rising adoption of cloud computing solutions. Enterprises are embracing public cloud deployment models as service providers make resources, such as virtual machines and applications, available to customers over the internet.

The cloud deployment model eliminates the need for organizations to invest & maintain their on-premise IT resources and enables scalability to meet workload & user demands. The improved accessibility and reduction in storage complexities offered by cloud-based network telemetry solutions are influencing the market growth.

SMEs to adopt network telemetry solutions to reduce the total cost of ownership

SMEs are predicted to register around 30% gains in the network telemetry market through 2026 due to growing penetration of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) across SMEs. These technologies reduce CAPEX and OPEX related to the network infrastructure among telecom operators and IT-enabled service providers.

Enterprises can significantly reduce their investments in procuring hardware networking components by virtualizing their essential network functions on limited dedicated hardware. This offers unprecedented agility and optimized network scalability to organizations. The growing demand to reduce the total cost of ownership for the maintenance and management of network infrastructure across SMEs will drive the market share.

Telecom service providers are adopting network telemetry solutions on a large-scale

The telecom service providers segment will observe a CAGR of over 32% from 2020 to 2026. This can be attributed to growing demand for real-time network monitoring and predictive operations across telecom companies. The increasing demand to predict network service quality and react quickly to improve the service will support the adoption of network telemetry across telecom service providers.

Telemetry solutions help telecom service providers to monitor the performance of the network components proactively. It also helps telecom operators to improve the network infrastructure by identifying the degradation of networking components.

Asia Pacific is expected to grow at the highest CAGR during the forecast timeline

The Asia Pacific network telemetry market is expected to grow at a CAGR of over 35% during the forecast timeline due to growing investments in IT infrastructure. For instance, in December 2017, the Chinese government planned to invest around USD 170 billion in the IT infrastructure for three years. This investment accelerated the adoption of advanced networking solutions in the country, further driving the regional market growth.

Market players are emphasizing on new product development to gain a competitive advantage over other industry players

Companies operating in the industry are focusing on integrating Artificial Intelligence (AI) technology in their network telemetry solutions to gain a competitive advantage over their market competitors. For instance, in June 2019, Kaloom, a leading data center networking software provider introduced an AI-based network telemetry solution, flowEye to help data centers in achieving high-performance by offering improved monitoring, troubleshooting, and analytics capabilities. This launch helped the company to offer innovative network solutions to support the changing market demand of companies operating in the data center industry.

Major companies in the network telemetry market are Anuta Networks International LLC, Apcela, Arista Networks, Barefoot Networks, Cisco Systems, Inc., Google LLC, Juniper Networks, Kaloom, Marvell Technology Group, Mellanox Technologies Ltd., NetAcquire Corporation, Pluribus Networks, SevOne, Inc., Trimble, Inc., VOLANSYS Technologies, Waystream AB, and Xilinx, Inc.

Preeti Wadhwani, Smriti Loomba