Neopentyl Glycol Market Size to exceed $1.5bn by 2025

Published Date: September 2019

Neopentyl Glycol Market size is estimated to exceed USD 1.5 billion by 2025; according to a new research report by Global Market Insights Inc.

Rising demand for powder coatings applications in automotive, aerospace, electronics and construction industry is expected to boost the neopentyl glycol market size in forecasted time frame. Strong application scope in powder coating resins as an alternative to conventional resins with low VOC emission and enhanced durability supporting product demand. Factors such as low processing cost, improved environmental performance and low energy consumption will create positive business outlook for industry participants.

Stringent government regulations pertaining to chemical processing and VOC emission standards is escalating the demand for neopentyl glycol. Companies are continuously striving to improve the standards for the product to meet and exceed the existing laws and regulations to gain competitive advantage and larger market share. Increasing demand as chemical intermediate in polyesters, paints, adhesives, synthetic lubricants, alkyd resins, and polycarbonate resins manufacturing fueling neopentyl glycol demand over the projected timeframe.

Get more details on this report - Request Free Sample PDF

Easy availability and low processing cost will fuel neopentyl glycol market development. It is processed by the catalytic synthesis of formaldehyde and iso-butyraldehyde. Companies are expected to lower their production cost and invest in new technologies to obtain high yield, therefore enhancing profitability to gain competitive edge. For instance, Jiangsu Kaimao Chemical Technology Co., Ltd. has developed one-step synthesis of the product, which is a cost-effective method to produce neopentyl glycol with high stability and purity.

Housing subsidies along with socio-economic development by the regional government will positively impact the architectural and decorative sector. key manufacturers such as Jotun, PPG, and Asian Paints are focused on incorporation of strategies such as expanding production capacity and establishing supply chain agreements, thus creating lucrative business opportunities for industry participants. However, availability of cheaper alternatives, such as ethylene glycol, that are comparatively easy to handle, store, and transport pose a challenge to the neopentyl market growth.

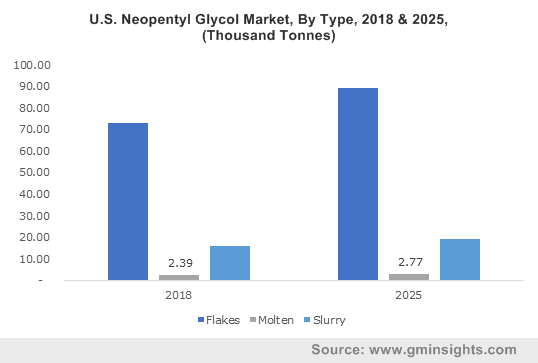

Browse key industry insights spread across 350 pages with 380 market data tables & 17 figures & charts from the report, “Neopentyl Glycol Market Size By Type (Flakes, Molten, Slurry), By Application (Automotive Parts/Insulation, Construction Insulation, Furniture/Footwear, Plasticizers, Electronic Products, Fibers, Automotive/Construction Additives, Lubricants, Pharmaceuticals, Agrochemicals, Dyes), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, Italy, France, Spain, UK, Poland, China, India, Japan, South Korea, Australia, Thailand, Malaysia, Indonesia, Brazil, Argentina, Mexico, Saudi Arabia, UAE, South Africa), Application Development Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/neopentyl-glycol-market

Neopentyl glycol flakes market hold the highest revenue share and is expected to witness over 7% CAGR up to 2025. Flakes form of neopentyl glycol is extensively used in polyesters to produce powder coatings, coil coatings, stoving enamels, gel coats and reinforced plastics and in esters for the production of synthetic lubricants. Easy handling, storage and transport of the flake type of product will support enhanced product sales for manufacturers. However, these flakes can form cake when stored for long duration and hence impurities are added to the product which may hamper the quality of the product.

Automotive parts/insulation holds the highest share by application and is expected to generate over USD 300 million by 2025. Rising vehicles production coupled with stringent carbon emission regulations has pushed the automotive and transportation component manufacturers to adopt powder coatings and polyester resins used to produce fabrics, greases, and other insulation containing neopentyl glycol compounds. Increasing demand for environmentally friendly and electric vehicles owing to consumer awareness regarding depleting fossil fuel resources and increasing the cost of energy will support the business growth.

Asia Pacific led by China, India and Japan holds the highest share in neopentyl glycol market accounting to over 50% in 2018 by volume. Robust growth in construction, automotive, and electronics industries will fuel product demand. Rising consumer expenditure level, rapid infrastructural development, and stable economy in China, India, Malaysia, and Thailand will influence the market share. Favourable government regulations & policies for promoting the efficient usage of highly eco-friendly plasticizers, paints & coatings will support product penetration across the region. In addition, a significant availability of low-cost raw materials along with changing macroeconomic scenario in the region will further drive the overall industry expansion.

Neopentyl Glycol market is highly consolidated due to the presence of companies including BASF, Eastman Chemicals, LG Chem, Mitsubishi Gas Chemical, OXEA, Perstorp AB, and Wanhua Chemical Group. Major industry participants are adopting strategies including mergers and acquisitions, initiatives to capture a higher market share include geographical expansions, production capacity expansion and R&D investments. For instance, in December 2017, BASF and SINOPEC announced the manufacturing capacity expansion in China and Asia Pacific regions. The company’s products including neopentyl glycol and other products will be doubled from 40,000 MT to 80,000 MT by 2020.

The neopentyl glycol market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in thousand tonnes & revenue in USD million from 2013 to 2025, for the following segments:

By Type

- Flakes

- Molten

- Slurry

By Application

- Automotive parts/ insulation

- Construction insulation

- Furniture/footwear

- Plasticizers

- Electronic products

- Fiber

- Automotive/ construction additives

- Lubricants

- Pharmaceuticals

- Agrochemicals

- Dyes

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- France

- Spain

- UK

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Malaysia

- Indonesia

- Latin America

- Brazil

- Argentina

- Mexico

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Kunal Ahuja, Amit Rawat