Global Monoethylene Glycol (MEG) Market Size worth $40bn by 2024

Published Date: August 2019

Monoethylene Glycol Market size will reach USD 40 billion by 2024; according to a new research report by Global Market Insights Inc.

Development within several end-use industries such as automotive, textile, packaging, paints & coatings and various others due to the economic upsurge and growing spending capability of consumers is projected to swell the monoethylene glycol market size over the forecast timeframe. Mounting consumption of plastics in packaging of food & beverage, cosmetics, pharmaceutical and numerous other end-use industries is the major driving influence on the product market size in the near future. The product is utilized widely for the manufacturing of polyester fiber & resins and PET materials. Moreover, surging demand of polyester fiber materials, specifically in Asia Pacific, will likely boost the market size, due to its excellent mechanical and chemical attributes in forecast spell.

Fluctuations in the raw material costs owing to the instability in the crude oil prices may prove to become the main obstructing aspect for the monoethylene glycol industry size in the forecast time period. This is due to the use of crude oil in the manufacturing of ethylene, as it is a key component in the production of MEG. However, the reduction in unrefined oil prices since 2008 to 2014 created generous opportunities for the product market in future. In addition, the products budding consumption in aerospace industries for its application in producing anti-icers and deicers for aircrafts will certainly expand the monoethylene glycol (MEG) market size by 2024.

Get more details on this report - Request Free Sample PDF

Monoethylene glycol based on its grades is segregated into antifreeze, polyester, low conductivity and industrial. Amid the present grades, polyester will register more than USD 30 million by 2024 in the entire segment and will propel at a considerable rate during the forecast period. The cause for this predominant share is its widespread application in packaging, textile, oil & gas and numerous other end-use sectors owing to its it has superior strength, moisture barrier and various other properties.

Browse key industry insights spread across 260 pages with 418 market data tables & 27 figures & charts from the report, “Monoethylene Glycol Market Size By Grade (Polyester, Industrial, Antifreeze), By Application (Polyester Fiber, PET, Antifreeze & Coolants, Chemical Intermediates), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2017 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/monoethylene-glycol-meg-market

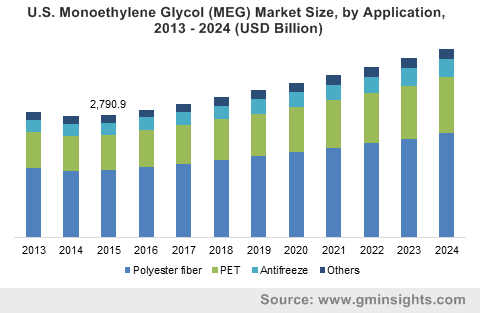

The product application segment involves antifreeze & coolants, PET, chemical intermediates and polyester fiber. MEG’s other significant usage comprises of latex paints, leather processing, asphalt emulsions, humectants, water based adhesive, etc. Nevertheless, polyethylene terephthalate (PET) and polyester fiber will jointly seize over 70% share in the overall market size escalating at a considerable rate in the coming years.

Based on the regions, Asia Pacific is anticipated to register a substantial industry share in the total monoethylene glycol market size preceded by India and China during the forecast timespan. However, Europe and North America is projected to witness a slacken growth due to the existence of stern government regulations concerning the production of MEG. Following this, the product manufacture has drifted to emerging economies that include Latin America, Asia Pacific and Middle East & Africa, which will notably impact the product dispersion in these geographies.

The foremost manufacturers in the product market includes Reliance, AkzoNobel, Dow Chemicals, SABIC, MEGlobal, LyondellBasell Industries, Mitsubishi, Royal Dutch Shell and Sinopec.

The monoethylene glycol (MEG) market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2013 to 2024, for the following segments:

Grade by Application

- Polyester grade

- PET

- Polyester fiber

- Others

- Industrial grade

- Chemical intermediates

- Others

- Antifreeze grade

- Antifreeze & coolants

- Others

- Others

- Chemical intermediates

- Polyester fiber

- Others

By Application

- Polyester fiber

- PET

- Antifreeze & coolants

- Chemical intermediates

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- South Korea

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Kiran Pulidindi, Soumalya Chakraborty