Micro Data Center Market worth over $15bn by 2026

Published Date: September 2020

Micro Data Center Market size is set to surpass USD 15 billion by 2026, according to a new research report by Global Market Insights Inc.

Businesses are incorporating IoT into their processes and systems that generate huge amounts of data from globally distributed sources. According to Cisco Global Cloud Index (GCI) study, the annual global data center IP traffic is projected to reach 15.3 ZB by the end of 2020, showcasing an increase of 4.7 ZB per year in 2015. This will lead to increasing demand for micro data centers to handle the traffic generated by IoT and need for low-latency access for data storage and processing. The small size of these facilities ranging from 19-inch rack to a 40-foot container allows organizations to solve low-latency challenge in a cost-effective way.

Market leaders are developing innovative & customized solutions to reduce deployment time of micro data centers

Micro data centers are pre-designed with a complete physical infrastructure solution, such as power, cooling, monitoring, and racks, that help businesses to quickly deploy a computing solution. These facilities eliminate the requirement to integrate, design, specify, and procure large number of disparate components compared to traditional data centers. In addition, manufacturers operating in the micro data center market are introducing infrastructure solutions to enable organizations quickly and easily deploy edge computing. In August 2019, Tripp Lite, a power and connectivity solution provider, introduced EdgeReady Micro Data Centers (MDCs) that can be deployed quickly and reliably. The data center integrates PDU, UPS, rack enclosure, security, and cabling with easy customization options.

The COVID-19 pandemic will positively influence the micro data center market demand, as it has led to increased usage of online services amongst consumers and businesses, driving the need for a physical infrastructure that supports edge computing. The imposed stay-at-home mandates are surging data consumption and stressing the performance and bandwidth limits of current digital infrastructure. In March 2020, the EU government requested Netflix and YouTube to reduce video quality and scale back their network utilization due to the coronavirus pandemic. The demand for edge solutions is encouraging companies to invest in micro data centers for enabling businesses to quickly connect with customers and scale in the rapidly growing edge market.

The usage of lithium-ion UPS to improve operational efficiency is propelling the micro data center market revenue

Get more details on this report - Request Free Sample PDF

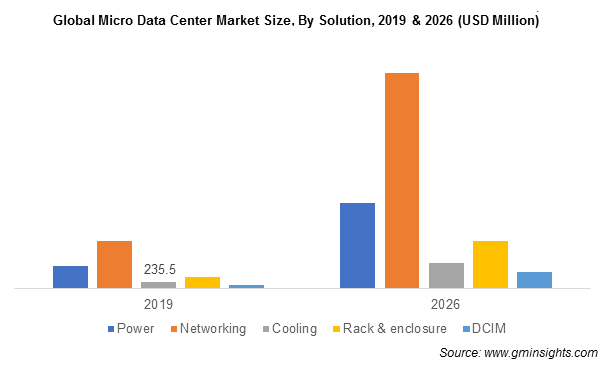

The solution segment will showcase growth of around 25% till 2026 owing to the increasing technological innovations to develop cost-effective and energy-efficient micro data center solutions. Advancements in the UPS technology delivering cost-effective protection for distributed IT have enabled enterprises to increase availability and reduce operating costs. In March 2020, Vertiv Group Corp. announced to offer lithium-ion batteries in its single-phase UPS for edge deployment in North American market. The integration of UPS with lithium-ion batteries provides increased runtime and reduced maintenance requirements for micro edge data centers in the market.

Browse key industry insights spread across 360 pages with 416 market data tables and 30 figures & charts from the report, “Micro Data Center Market Size, By Component (Solution [Power, Networking, Cooling, Rack & Enclosure {Upto 24U, 24U to 40U, Above 40U}, DCIM], Service [Installation & Integration, Maintenance & Support, Consulting]), By Application (BFSI, Colocation, Energy, Government, Healthcare, Industrial, IT & Telecom), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/micro-data-center-market

Advent of 5G will propel the demand of micro data centers in IT & telecommunication industry

Rise in penetration of the 5G technology by leading telecom providers is boosting the data center industry growth. In May 2020, Tele2 AB, a European telecom service provider, launched 5G network for its customers in Stockholm, Gothenburg, and Malmö in Sweden. The network will offer service at over 1 Gbps through 80 MHz bandwidth on the C-band. With the proliferation of 5G systems, companies are investing in data center upgrades to improve network quality and internet bandwidth. The development of edge computing using micro data centers enables telecom companies to manage connectivity challenges to power 5G technology, propelling the micro data center market expansion.

Adoption of data analytics among retailers in North America will drive the market expansion

The North America micro data center market accounted for over 40% revenue share in 2019 led by rising adoption of innovative technologies and digitization in the retail industry. The retailers are leveraging the big data and demand forecasting powered by machine learning to improve customer, logistics, & manufacturing management processes and improve their market position. For instance, ALDO Group, a Canadian retailer, is using big data analytics to predict emerging trends and target the right customers in order to increase sales. The rise in the adoption of analytics solutions will encourage retail stores to deploy micro data center for more powerful edge compute capabilities.

Product launch strategy by major players will fuel the micro data center market growth

The demand for fast & secure data access among customers is encouraging market players, such as Schneider Electric SE, Hewlett Packard Enterprise, Hitachi, Ltd., Huawei Technologies Co., Ltd., Vertiv Group Corp., and Dell Inc., to increase their investments in micro data centers. In October 2019, Schneider Electric SE launched its EcoStruxure micro data center in a 6U wall mount model that is 60% less intrusive, support deployment of distributed IT networks in small edge applications. The data center includes remote monitoring, UPS, cooling, and physical security for providing fast and customized way to deploy and manage edge computing solutions in several environments.

Preeti Wadhwani, Saloni Gankar