Medical Devices Vigilance Market size to exceed $91.5 Bn by 2025

Published Date: February 2019

Medical Devices Vigilance Market size is set to exceed USD 91.5 billion by 2025; according to a new research report by Global Market Insights.

Demand for medical devices vigilance systems is increasing over recent years owing to surge in the number of adverse events reported related to medical devices. High adoption of medical device vigilance system to ensure safety of patients, healthcare professionals and other users will positively impact business growth. Furthermore, strict government regulations for manufacturers to develop safe and highly efficient devices will favour medical devices vigilance industry growth.

Focus of companies on improvising existing medical devices vigilance software will increase its adoption. Growing R&D investments by key industry players to develop technologically advanced vigilance systems will further augment business growth. Availability of vigilance software and increasing awareness among patients will boost business growth. Patient access to adverse event reporting that further enables exporting of files, publishing regulatory reports as well as handling daily medical device vigilance requirements should favor medical devices vigilance market growth. However, failure of certain manufacturing companies to ensure product safety may impede the medical devices vigilance business growth during the forthcoming years.

Get more details on this report - Request Free Sample PDF

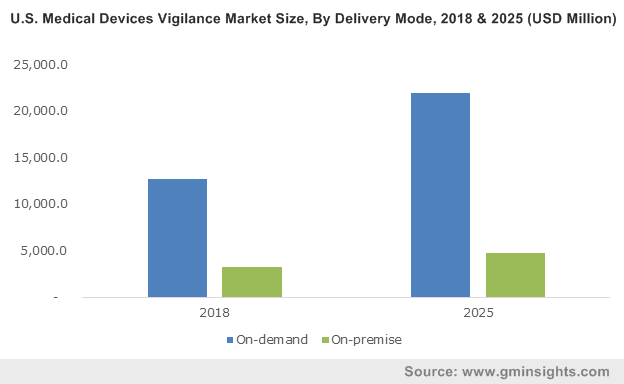

On-demand delivery mode segment dominated the medical devices vigilance market with 80.2% revenue share in 2018 and is estimated to witness similar trend over the forecast period. Segmental growth is attributed to growing focus of companies on development of cloud-based software system to ensure quality of medical devices. For instance, AssurX Cloud QMS developed by AssurX offers quick, secure and reliable quality management software solution over the internet.

Therapeutic application segment held significant revenue in 2018 and is estimated to show fastest CAGR of 8.9% over the analysis years. Growing demand to ensure safety of therapeutic medical devices exerting local effects such as wound covering, tissue cutting or supporting open clogged arteries will surge adoption of medical devices vigilance system thereby driving segmental growth.

Clinical research organizations (CROs) segment was valued at USD 6.1 billion in 2018 and is projected to grow considerably over the estimated timeframe. CROs offer real-time and accurate safety management of medical devices in all phases of development, including pre- and post-market studies. Ability of CROs to communicate directly with manufacturers, physicians, regulatory authorities and clients to ensure full control at every stage of the project will upsurge segmental growth in foreseeable future.

Browse key industry insights spread across 145 pages with 194 market data tables & 8 figures & charts from the report, “Medical Devices Vigilance Market Size By Delivery Mode (On-demand, On-premise), By Application (Diagnostic, Therapeutic, Surgical, Research), By End-user (Clinical Research Organizations [CROs], Original Equipment Manufacturers [OEMs], Business Process Outsourcing [BPO]), Industry Analysis Report, Regional Outlook, Application Potential, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/medical-devices-vigilance-market

U.S. medical devices vigilance market dominated the North America region with more than 89% revenue share in 2018 and is projected to witness similar growth in the foreseeable future. High growth can be attributed to the rising number of medical device adverse events reported in the country. As per the FDA, more than 1 million adverse events related to medical devices were reported in the U.S. in 2015. Such factors will increase adoption of medical device vigilance systems thereby augmenting business growth.

UK medical devices vigilance market is anticipated to witness fastest CAGR of 9.5% over the analysis timeframe. In line with the UK medical device regulations, MHRA strictly investigates any complaints about products with or without CE mark, examines manufacturing facilities in case of breach of regulations as well as investigates results of vigilance reports. Favorable regulatory policies in the country will further spur the market size.

Some of the key industry players operational in the medical devices vigilance market include AssurX, Oracle, AB-Cube, Sparta Systems, Xybion, Sarjen Systems, ZEINCRO, MDI Consultants, INTEL, Omnify Software and Numerix. Industry players focus their efforts on new software development and strategic initiatives including collaborations, acquisitions, partnerships that help them in strengthening market position. For instance, AB-Cube introduced SafetyEasy MD, a medical device vigilance software dedicated to the management of medical devices adverse events thereby, broadening company’s customer base and strengthening its market position.

Medical devices vigilance market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2014 to 2025, for the following segments:

Medical Devices Vigilance Market, By Delivery Mode (USD Million)

- On-demand or cloud based (SaaS)

- On-premise

Medical Devices Vigilance Market, By Application (USD Million)

- Diagnostic

- Therapeutic

- Surgical

- Research

- Others

Medical Devices Vigilance Market, By End-user (USD million)

- Clinical Research Organizations (CROs)

- Original Equipment Manufacturers (OEMs)

- Business Process Outsourcing (BPO)

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Poland

- Asia Pacific

- Japan

- India

- China

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East Asia & Africa

- Saudi Arabia

- South Africa

- UAE

Sumant Ugalmugle, Rupali Swain