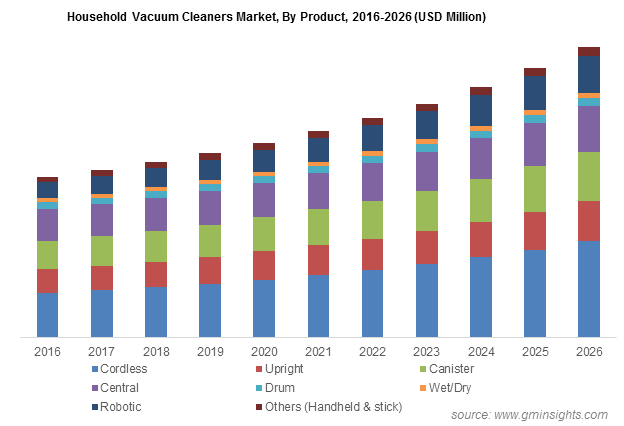

Household Vacuum Cleaners Market Size worth $30bn by 2026

Published Date: February 2025

Household Vacuum Cleaners Market size is set to reach USD 30 billion by 2026, according to a new research report by Global Market Insights Inc.

The increasing adoption of AI and machine vision technologies in electric home appliances is driving the market growth. These technologies aid cleaning devices to autonomously detect dust & dirt particles and other obstacles reliably & effectively.

The increasing trend of dual working population in North America and Asia Pacific is creating a huge demand for automated household vacuum cleaners to save efforts & time in cleaning. Additionally, the rapidly growing e-commerce industry across the globe is providing ample opportunities to market players to introduce their new products to customers across the globe.

The major factor hindering the household vacuum cleaners market is the lack of awareness in rural areas of Asia Pacific and Latin America. Consumers in these regions prefer to clean homes manually, restricting the adoption of household vacuum cleaners.

Moreover, low battery life of cordless vacuum cleaners is limiting its market demand. Companies are developing new household vacuum cleaners with long battery life and less power consuming motors. Additionally, the companies are complying with government energy regulations to reduce the overall environmental footprints, aiding market growth.

Get more details on this report - Request Free Sample PDF

The increasing consumer demand for automated home appliance will support the adoption of robotic vacuums

The robotic vacuum cleaner segment held around 9% of the market share in 2018 owing to increasing consumer demand for smart home appliances integrated with advanced features, such as automatic self-charging, room mapping, and laser vision.

Companies are developing vacuum cleaners with novel technologies including security cameras, navigation, UV sterilization, and intercom systems to improve device performance. For instance, in September 2019, Roborock announced the launch of its new S5 Max robotic vacuum cleaner. The new device allows users to select from a range of customization options including suction power, water flow, scheduled cleaning, room cleaning sequence, etc.

Robotic household vacuum cleaners are primarily witnessing high demand in North American and European countries due to increase in consumer purchasing power and the changing lifestyle and busy work schedules of urban population. Consumers in the region are replacing their old cleaning devices with these vacuums to save time & efforts for cleaning, attributing to industry trend.

Browse key industry insights spread across 204 pages with 220 market data tables & 30 figures & charts from the report, “Household Vacuum Cleaners Market Size By Product (Cordless/Stick, Upright, Canister, Central, Drum, Wet/Dry, Robotic), By Sales Channel (Offline, Online), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/household-vacuum-cleaners-market

Proliferation of the organized retail sector across the globe is driving the industry growth

The offline sales channel segment held over 55% of the market share in 2019. The retail industry is witnessing growth in several countries including Brazil, Germany, and the U.S. owing to entry of several new local as well as global players in the market.

Shopping malls and departmental stores are offering a wide variety of brands to maintain their product portfolio. The availability of extensive product warranty in offline sales channels is attracting new consumers to buy new products from retail channels over e-commerce websites. Consumers prefer offline shopping over online sales channels due to availability of product testing before purchasing, enhancing the market share of offline sales channel segment.

Increasing demand for energy-efficient & automated home appliances across Europe will drive the household vacuum cleaners market revenue

The growing focus of consumers on adopting advanced appliances for effective & convenient cleaning is creating a huge demand for these devices in European countries including the UK, Germany, and France.

The European Commission (EC) has developed new energy labels on an energy efficiency scale ranging from most efficient (A+++) to least efficient (G) for electric home appliances. According to the EC, the utilization of energy-efficient household vacuum cleaners will aid Europe to save up to 20 TWh of electricity per year by the end of 2020.

The growing consumer spending on smart home infrastructure development is creating the demand for connected vacuum cleaning systems. Market leaders operating in the region are introducing new robotic cleaners to cater to consumer demands. For instance, In March 2018, the company announced the launch of its new range of robotic household vacuum cleaners, Pure i9. The device is programmable through a mobile app, allowing consumers to schedule cleaning times and find information on the cleaning status.

The presence of several large & small household vacuum cleaners market companies and the low product differentiation have resulted in price reduction of these appliances. Leading companies in this market are making large investments in product innovation strategies and constantly integrating new product features to gain an enhanced market share.

For instance, in February 2019, iRobot Corporation announced the launch of its new Roomba i7 smart vacuum cleaner. The device is integrated with smart mapping technology and aids operators to direct the device to clean specific rooms by voice through smartphone applications, supporting the market trend.

Leading players in the market are introducing advanced cordless cleaning devices with powerful battery technology to deliver reliable performance to customers, attributing to the market size expansion.

Key players in the market include Dyson, Panasonic Corporation, Samsung Group, Stanley Black & Decker, TTI Floor Care, Oreck Corporation, Bissell, Inc., Phillips, Shark, and Vax Ltd.

Preeti Wadhwani, Prasenjit Saha