Enteral Feeding Tube Market worth over $3bn by 2026

Published Date: October 2020

Enteral Feeding Tube Market size is set to exceed USD 3 billion by 2026, according to a new research report by Global Market Insights Inc.

Rising incidences of premature births and pediatric diseases will impel the market revenue. As per the statistics by the World Health Organization (WHO), globally, an estimated 15 million, that is more than 1 in every 10 babies, are born premature every year. Increase in number of pre-term births in developing economies with constantly improving healthcare expenditure, infrastructure and patient awareness will increase the demand for enteral feeding tubes. In addition, prevalence of pediatric diseases also increases the need for enteral feeding tube. Enteral feeding is one of the most followed practices for providing nutrition to infants, children, and adolescents as they find difficulty in swallowing food on their own.

Increase in number of cancer cases across the globe will propel the market growth

Growing cases of cancer disorders across the globe will drive the enteral feeding tube market demand. Cancer is one of the most prevalent disorders in developing countries such as China, Brazil, and India. There has been a significant increase in number of cancer patients throughout the world over these years. In addition, patients suffering with cancer require safer mode of nutrition delivery to avoid sepsis or infections. Therefore, the demand has significantly increased for enteral feeding tubes. Moreover, nutrition delivery with enteral feeding tube aids to combat the weight loss and malnutrition in cancer patients, offering relief from nutrition impact symptoms and improving quality of life.

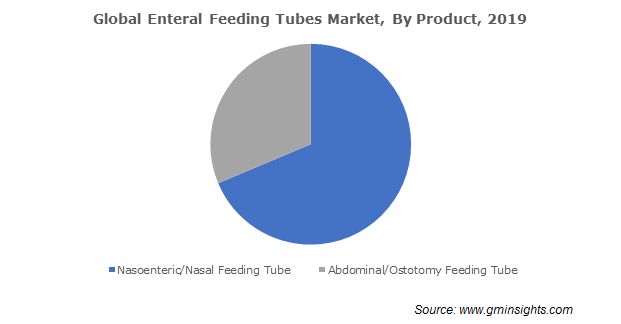

Rise in demand for abdominal feeding tube

Get more details on this report - Request Free Sample PDF

The abdominal enteral feeding tube market size was around USD 629.8 million in 2019 owing to benefits such as increasing demand for long-term patient care as well as patient comfort. Additionally, these tubes allow direct nutrition and do not interfere with oral breathing and thus, increasingly adopted by the physicians to address enteral feeding. Moreover, the demand for abdominal tube has augmented because of minimal chances of nasal passage irritation in patients with partially blocked nasal airways.

Growing number of central nervous system and mental health disorders

The central nervous system & mental health segment value was over USD 717.9 million in 2019 due to the rising prevalence of neurological and mental health disorders associated with swallowing disorders. In addition, as per the recently published article, around 40% of all patients suffering with central nervous system disorder develop dysphagia, thereby requiring nutritional support. Moreover, patients with severe mental health disorders such as depression and anxiety need an adequate dietary intake of supplements. Attributing to this factor, the adoption for nutritional support through enteral feeding tubes has increased.

Browse key industry insights spread across 200 pages with 491 market data tables & 22 figures & charts from the report, ”Enteral Feeding Tube Market Size By Product (Nasoenteric/Nasal Feeding Tube {Nasogastric Tube, Nasojejunal Tube}, Abdominal/Ostotomy Feeding Tube {Gastrostomy Tube, Jejunostomy/Jejunal Tube, Gastrojejunal (GJ) or Transjejunal Tube}), By Disease Condition (Cancer {Head and Neck Cancer, Gastrointestinal Cancer}, Central Nervous System (CNS) & Mental Health, Non-malignant Gastrointestinal (GI) Disorders), By Patient (Adult, Pediatric), By Tube Type (Short-Term Feeding Tube, Long-Term Feeding Tube, Temporary Feeding Tube), By Tube Placement (Without Surgery, Surgical Placement, Endoscopic Placement), By End-use (Home Care, Hospitals), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/enteral-feeding-tubes-market

Increase in preference of long-term feeding will drive the product adoption

The long-term feeding segment revenue was more than USD 642 million in 2019 attributed to the growing number of patients suffering from chronic diseases such as chronic lung disease, irritable bowel disease and cancer. Furthermore, long term feeding is required in patients suffering with malnutrition to fulfill continuous and adequate supplementation of nutrients. Moreover, patients in geriatric population and physical disabilities or movement disorders also require prolonged enteral feeding.

Increase in prevalence of chronic diseases and surgeries will boost the enteral feeding tube market expansion

The adult segment held size crossed USD 1,193 million in 2019. The larger share of the segment can be credited to the increasing prevalence of chronic diseases such as diabetes, neurological disorders, cancers, and inflammatory bowel syndrome in the geriatric population. In addition, higher number of surgical interventions in adult population pool has increased the demand for enteral tubes to meet the necessary nutritional requirements of the patient. Moreover, special high protein diabetes-specific formulas are administered through enteral feeding tube to the diabetic patients in adult population.

Growing preference for endoscopic placement will fuel the market growth

The endoscopic placement segment is projected to grow at 5.9% CAGR during the forecast timeframe. The method for tube placement has evolved with development of new enteral feeding tubes and endoscopic technology. Additionally, nutritional administration through endoscopic tube placement allows the transfer of fluids and medications directly into stomach with very minimal chances of risks and reduces the chances of gastro esophageal reflux. Moreover, endoscopic tube placement is increasingly preferred by patients suffering from swallowing disorders.

Increasing adoption of enteral feeding tube in Japan

Japan enteral feeding tube market valuation surpassed USD 133 million in 2019 led by increasing affordability, rise in healthcare expenditure, growing geriatric population and increase in awareness towards the safe enteral feeding products. According to the World Health Organization (WHO), Japan has the highest percentage of old age population. This factor in-turn augments the demand for enteral feeding in the region. In addition, Japan has developed nutritional teams focusing on home enteral nutrition patients, positively impacting the market growth trends. Moreover, higher number of critical patients suffering with COVID-19 in the ongoing pandemic has augmented the demand for enteral feeding tubes in the region.

Growing preference of home care will boost the industry growth

The home care segment valued at USD 1,014 million in 2019 on account of rising costs of hospital stays leading patients to prefer and adopt home enteral nutrition. Additionally, developed countries have established nutritional teams that are engaged in taking care of patients that need nutritional support for long period of time. Therefore, these factors have encouraged the population to adopt home enteral nutrition. Moreover, the favorable reimbursement policies by the government authorities for home enteral nutrition have led to increased adoption of enteral feeding tube.

Companies focusing on innovative products to expand customer base and operations

Major players operating in the market include Abbott, Applied Medical Technology, Inc., Avanos, B. Braun, Boston Scientific, C.R. Bard, Cardinal Health, Conmed, Cook Medical and Fresenius Kabi.

These players are proposing strategic acquisitions, mergers, colorations, and partnerships in order to launch new products and strengthen their industrial position. For instance, in June 2020, Applied Medical Technology, Inc. announced the expansion of G-Jet product offering physicians and patients a comprehensive selection of enteral feeding tubes. The strategic move will assist the company in expansion of their product portfolio, thereby increasing customer base.

Sumant Ugalmugle, Rupali Swain