Electronic Logging Device (ELD) Market Size to hit $16bn by 2025

Published Date: May 2019

(ELD) Electronic Logging Device Market size is set to exceed USD 16 billion by 2025; according to a new research report by Global Market Insights Inc.

The electronic logging device market is anticipated to grow in the future due to stringent government regulations to integrate these devices in countries such as the U.S. and European countries. The U.S. came up with the ELD mandate rule, which came into effect in December 2017, while Europe made the digital tachographs mandatory for commercial vehicles with GVWR more than 3.5 tons since 2006. The growing need to increase the operational efficiency in fleet management services is pushing the implementation of these devices in several commercial vehicles.

The devices are primarily used to measure the driving hours or the hours of service. Moreover, the electronic logging device (ELD) market is becoming more inclined toward extra smart features, such as vehicle tracking & monitoring, measuring driver performance, location details, power, and fuel status, which are becoming important features offered by these devices. Owing to the regulations for the deployment of these devices across several regions, fleet management providers are partnering with manufacturers for the implementation of such systems. Hunter Express, a freight transport company, partnered with a leading ELD provider, Omnitracs for the implementation of these devices for regulatory compliance. Such partnerships will influence the ELD market growth.

Get more details on this report - Request Free Sample PDF

Asia Pacific is witnessing rapid growth in the use of commercial vehicles particularly in the light commercial vehicles and is expected to have considerable potential for the (ELD) electronic logging device market growth. There has been a significant rise in the trucking industry of the region. The BRIC countries are supposed to positively influence industry growth due to the increased sales volume of trucks. For instance, in China, the buyers are granted a truck scrappage subsidy due to which the trucking industry in the region is flourishing, contributing to the ELD market growth. Moreover, explosive growth in production and industrialization is expected to keep the demand high. The countries, such as India, will have a growing demand for commercial vehicles owing to the presence of large middle-class population and the boost in economic developments, boosting the electronic logging device market growth.

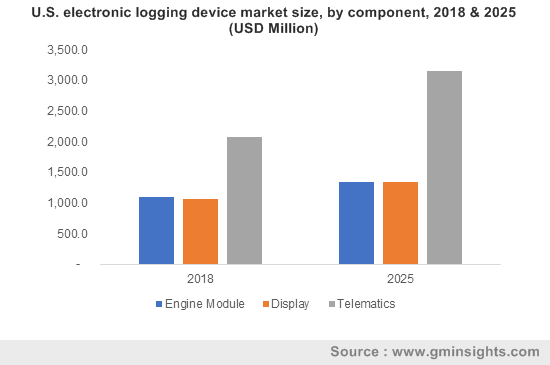

Browse key industry insights spread across 160 pages with 155 market data tables & 25 figures & charts from the report, “Electronic Logging Device Market Size By Component (Engine Module, Display, Telematics), By Form Factor (Embedded, Integrated), By Vehicle Type (Truck, Bus, LCV), Industry Analysis Report, Regional Outlook, Application Development Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/electronic-logging-device-market

The increased digitization and the use of telematics technology are fueling the growth of the electronic logging device (ELD) market. The challenges arising due to the driver shortage will require fewer commercial vehicles to transport a greater number of goods. The developed countries, especially the U.S., beholds a high adoption of IT technology and software solutions in the transportation sector, leading to a high demand for telematics in commercial vehicles. The capabilities to monitor the driving style, wear of components, fuel efficiency, and protect materials are increasing the overall useful life of commercial vehicles. The connected vehicle trends, especially in the developed countries, can improve the route & efficiency management for commercial vehicles, creating several opportunities for the electronic logging device market growth.

Keeptruckin, Omnitracs, and AT&T are some of the major companies in the (ELD) electronic logging device market. The companies also provide software platforms and apps for the fleet management industry. These platforms allow smartphones and other devices to be used as ELDs. The developments in software solutions and the launch of low-cost devices are expected to drive the adoption of the augmenting electronic logging device market. New product and platform developments are among the growing trends in the electronic logging device market. Keeptruckin has developed a platform, which provides features such as fuel tax reporting, fleet safety and coaching, vehicle diagnostics functions, driver workflow, and messaging functions.

The major factor challenging the growth of the electronic logging device (ELD) market is the cost associated with these devices, especially with the embedded systems. Moreover, the limit on hours of service enforced by the ELD mandate law in the U.S.is facing resistance from the truck drivers. The mandate allows a maximum of 11 hours of driving in consecutive 14 hours block. However, most of the drivers need to wait for around three hours at shipping docks, which reduces the time from 14 hours block. The drivers are paid based on distance and not hourly basis, which has been a major problem for drivers. Additionally, switching from paper logs to electronic devices can be a difficult process for some fleet management companies, limiting the industry growth.

The (ELD) electronic logging device market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue in USD from 2015 to 2025, for the following segment:

Electronic Logging Device (ELD) Market, By Component

- Engine Module

- Display

- Telematics

Electronic Logging Device (ELD) Market, By Form Factor

- Embedded

- Integrated

Electronic Logging Device (ELD) Market, Vehicle Type

- Truck

- Bus

- LCV

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa (MEA)

- Saudi Arabia

Preeti Wadhwani, Prasenjit Saha