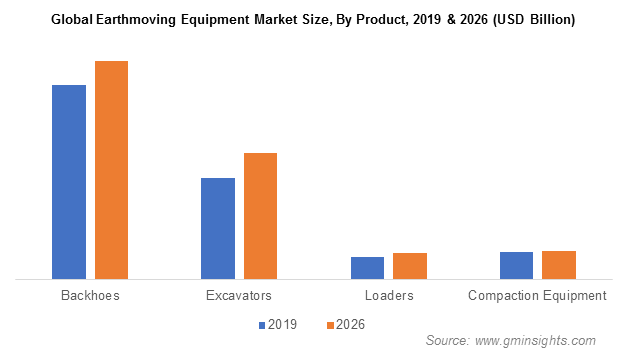

Earthmoving Equipment Market size worth $91 Bn by 2026

Published Date: August 2023

Earthmoving Equipment Market size is set to be over USD 91 billion by 2026, according to a new research report by Global Market Insights Inc.

Increasing number of rental equipment providers across the globe will drive the earthmoving equipment industry growth. High costs associated with the purchase of new earthmoving equipments are encouraging small construction contractors to shift toward rented machines. Rental providers are investing in technologically advanced equipment to cater to growing customer demands.

Increasing penetration of internet and smart devices is creating high demand for robust telecom infrastructure. Rising concerns related to safety and security are encouraging telecom operators to shift toward underground cables. The ability of this equipment to work with a wide range of additional attachments is increasing their adoption in the telecom sector, thereby contributing to the earthmoving equipment market demand through 2026.

Get more details on this report - Request Free Sample PDF

Analyst view: “The earthmoving equipment market is expected to witness an increase in adoption of low-emission electric vehicles owing to stringent emission regulations established by several government authorities across the globe.”

High maintenance and repair costs associated with earthmoving equipment will challenge the industry growth. These machines are deployed in harsh working environments for long hours, causing frequent wear and tear. Frequent oil changes and replacement of critical parts contribute to the high cost of maintaining the earthmoving equipment. Increasing fuel prices coupled with low fuel efficiency also add to the operating costs, further impacting the industry in 2020. However, market players are launching zero-emission, electric models of earthmoving equipment to support the industry outlook.

Rapid spread of the COVID-19 pandemic in several countries is adversely impacting the market growth trends. Factors, such as economic downfall, rising prices of steel, and shortage of labor, are restricting the earthmoving equipment market revenue. The production capability of equipment manufacturers is hampered due to disruptions in global supply chains. Restrictions on international trade have also caused a decline in the shipments. The market is forecast to grow at a steady rate with the reduction of the pandemic impact.

Browse key industry insights spread across 160 pages with 111 market data tables & 21 figures & charts from the report, “Earthmoving Equipment Market Size By Product (Excavators, Loaders, Backhoe, Compaction Equipment), By Application (Construction, Underground Mining, Surface Mining), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020-2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/earthmoving-equipment-market

Increasing demand for wheel loaders on construction sites

According to this report, the loaders are anticipated to witness high demand in construction and earthmoving projects. The loaders market segment valued at over USD 4.5 billion in 2019. The ability of wheel loaders to lift and load loosely packed materials such as dirt, sand, and wood on construction and mining sites is driving their market representation. The increasing importance of these machines in large construction projects will further fuel the earthmoving equipment market demand.

Growing awareness and stringent regulations related to toxic emissions from heavy earthmoving equipment are encouraging a shift toward electric machines. In response to the amplifying market trend, manufacturers are launching new models of electric wheel loaders. For instance, in January 2019, Volvo Construction Equipment announced its plans to launch two new models of compact electric wheel loaders. The new models, L20 and L28 offer reduced energy costs, low noise levels, and zero emissions.

Positive outlook of the underground mining sector driving the industry revenues

The underground mining application held more than 3.5% market share in 2019 and is anticipated to witness substantial growth over 2020-2026. Positive outlook of the mining industry is accountable for the rapid growth in demand for earthmoving equipment. Increasing private sector investments in underground mining projects are further providing new opportunities for the market.

Increasing demand for earthmoving equipment due to rapid development of commercial infrastructure in North America

North America earthmoving equipment market is anticipated to reach USD 17 billion by 2026 fueled by the rapid development of large commercial buildings and public infrastructure in countries including the U.S. and Canada. Additionally, increasing private sector and government investments in infrastructure development are driving the market revenues. For instance, the Canadian government has planned to invest over USD 80 billion in modern infrastructure development through its ‘Invest in Canada’ program.

Leading players in the earthmoving equipment market are focusing on strategic new product launches and acquisitions to grow their market penetration. For instance, in April 2017, JCB launched its new compaction equipment, the JCB116 Soil Compactor. The equipment is integrated with patented fuel saving technologies and provides optimum responsiveness at low engine speeds. Other prominent strategies adopted by manufacturers include strategic partnerships and collaborations.

Key players in the industry include Kobelco Construction Machinery Co., Komatsu Ltd., Hitachi Construction Machinery, Bobcat, Caterpillar, Terex Corporation, and Sany Group.

Preeti Wadhwani, Prasenjit Saha